- Home

- »

- Homecare & Decor

- »

-

UK Candle Market Size And Share, Industry Report, 2030GVR Report cover

![UK Candle Market Size, Share & Trends Report]()

UK Candle Market (2024 - 2030) Size, Share & Trends Analysis Report By Product (Votive, Container Candle), By Wax Type (Paraffin, Soy, Beeswax, Palm), By Distribution Channel, And Segment Forecasts

- Report ID: GVR-4-68040-212-4

- Number of Report Pages: 80

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2024 - 2030

- Industry: Consumer Goods

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

UK Candle Market Size & Trends

The UK candle market size was estimated at USD 723.42 million in 2023 and is expected to grow at a compound annual growth rate (CAGR) of 8.3% from 2024 to 2030. The candles of different kinds and brands are widely used across the United Kingdom, by both domestic as well as commercial users. The individual buyers, young consumers, people who have interest in fragrances, mental well-being routines, and regular mind and body health rituals tend to use scented container-based candles, made from premium quality paraffin wax or naturally sources beeswax for that matter. Corporate offices, luxury hotels owned by leading hospitality companies, theme-based restaurants and eateries, clubs, cosy local bakeries, spas, physiology centres, therapy centres, mindfulness clubs and such commercial spaces also use candles for aesthetic appeal as well as their use in developing fragrant atmosphere.

UK candle market accounted for 5.38% share of the global candle market revenue in 2023. After pandemic phase, people have started treating their homes as one of their places to be, where they engage in activities such as self-care, personal hygiene routine, mindfulness activities and more. This coupled with increased awareness about role of mental health in upkeep of overall human health has resulted in rising demand for scented candles which are used for developing pleasant and nurturing atmosphere within the home. The kitchen and cooking industry in UK experienced democratization a few years ago; the similar phenomenon has become part of fragrant candles industry in recent past.

In addition, the enriched aesthetic presentation attained through use of taper candles, scented candles in business spaces has resulted in growing demand patterns for UK candles market. The spas offering relief from body aches, headaches, muscle pains, and other related issues have also been adopting to use of candles to develop helpful atmosphere within their rooms, lobbies and front offices.

Market Concentration & Characteristics

The UK candle market is growing at accelerating pace and the growth stage is identified as high. The market is fragmented mainly due to existence of many market participants, out of which, a few are well established and operating at larger scales, however a few are recently founded and engaging in smaller scale in comparison.

Degree of innovation high in the candle market of UK. Companies in the industry have to cater to constantly changing consumer behaviour through strategies regarding innovation and novelty. The personalised and customised product offerings, use of slow burning waxes, adoption of sustainability practices are some of the solutions that candle companies implement to attain competitive advantage by developing product differentiation through innovation.

The UK candle market is moderately impacted by the regulations. The government body working in the sector of standardization, marking and quality certification of goods has led down rules and requirement regarding the development of candle and associated products as well. One of the basic requirements includes candle shall be clean, free from dirt or foreign materials.

Level of mergers and acquisitions is fairly low in the market. Only few M&A activities have made it to news in last couple of years. However, the partnerships, collaborations, social responsibility activities have been part of the industry. The companies tend to engage in such partnerships to attain advantages such as share technology, collective innovation effort and more.

The threat of substitutes is low as these candles, scented to be precise, are often used with certain purpose, which will not be sufficed, by use of substitutes. However, presence of counterfeit goods is one of the challenges faced by industry. The locally made candles and associated products tend to make it to stores and shops in vicinities in no time and are sold at lower prices than products with brand tags.

Product Insights

The votive candle market in UK accounted for 26.44 % revenue share of the industry in 2023. The votive candles are classically used as votive offering in diverse cultural traditions. Often, in contemporary markets influencers and companies sell these sorts of products for lighting and decoration as well. Individual buyers as well as commercial purchasers use these candles, to cultivate serene décor charms and attain preferred ambience. The votive candles are used by numerous domestic users as well, as they are small is sizes and are designed in such a shape that they burn very slow.

UK Tapers candle market is projected to grow at lucrative growth rate of 9.7% from 2024 to 2030. The taper candles are often made with soy wax, beeswax or coconut wax in order to distribute exceptional value to customers. These candles are naturally used on distinctive occasions such as marriage ceremonies, birthday or anniversary celebrations for eye-catching decorations. The products are featured in various stores with numerous colour variants right from ivory classic to variations in other colours such as red, green and more.

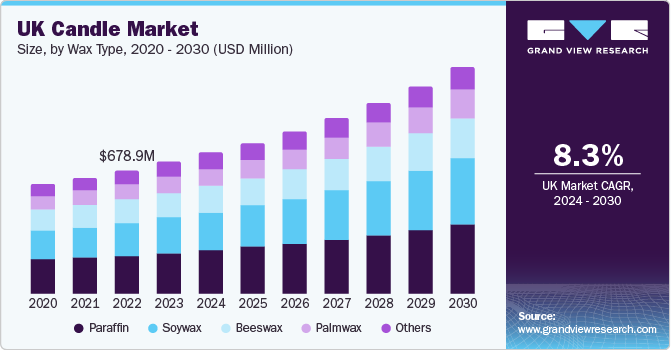

Wax Types Insights

Paraffin candle market in UK held 31.34% share in 2023. As compared to other naturally sourced waxes, such as beeswax, the paraffin-based wax is less in terms of cost of it. As most of the scented candles or luxury candles are made out this, manufacturers commonly prefer the use of paraffin. The paraffin-based candles are characterised by higher capacity to hold fragrances and marketers have been very keen in creating awareness about such facts, which have been encouraging the users to prefer them to other sort of waxes used in candles.

UK beeswax-based candle market is expected to grow at highest CAGR of 9.5% from 2024 to 2030. The beeswax is one of the most naturally made types of wax, which is collected from honeycombs. This wax is developed by honeybees to build their nests while engaging in their routine activities. Of the overall beeswax produced across the world, more than half of it is procured from Asian countries.

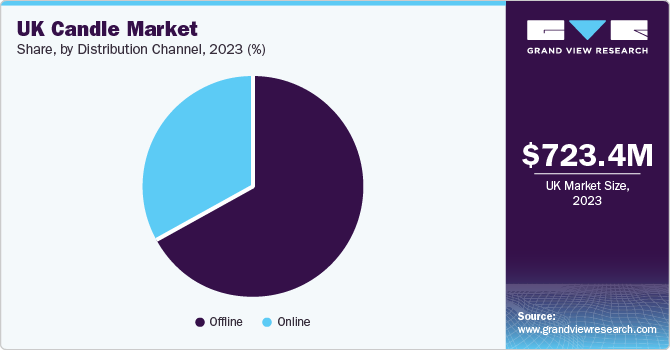

Distribution Channel Insights

The candle sales through offline channels accounted for 66.83% revenue share in 2023. Presence of branded candles and product portfolios offered by international companies in hypermarkets, supermarkets, organised retail company’s stores, local shops and fragrance stores have been resulting in increased visibility and greater revenue generations. The key aspect of the offline shopping of candles that it provides immediate possession and offers opportunity to buyers to examine the products before they buy it.

The sales of candles through online channels have also been playing a vital role in generating lucrative sales; the segment is expected to grow at CAGR of 9.5% from 2024 to 2030. The personalised experience offered by the online websites, range of products available through online distribution and privacy aspect of the online purchases have lured the consumers towards preferring the online shopping experience. Millennials and gen z customers’ group generally choose this alternative.

Key UK Candle Company Insights

The UK candles industry is fragmented and consists of companies from different categories including multinational brands to local start-ups. The presence of these market participants, belonging to different backgrounds, offering range of entirely different products yet in similar market, develops highly competitive marketplace.

- Yankee Candles is one of the largest candle brands in UK. With more than 30 years of experience in retail business, now they have been offering diverse and vast online product portfolio, which features candles, jars, accessories, and related products. Some of their key products include jar candles, votive, wax melts, pillar candles, and dinner candles as well.

Key UK Candle Companies:

- Yankee Candles

- Estée Lauder Companies'

- RACHEL VOSPER

- Aja Botanicals

- True Grace

- POTT Candles

- Cotswold Candle

- Stoneglow Candles

- Shearer Candles

- The Candle Brand

Recent Developments

-

In July 2023, Cheshire-based GBJ Services acquired Pintail, well-established candle and reed diffuser manufacturing business in Flookburgh.

-

In June 2023, the Otherland Candles, luxury range candle products company, was acquired by Curio Brands. The acquisition was undertaken to expand Curio's presence in home fragrance market.

UK Candles Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 772.87 million

Revenue Forecast in 2030

USD 1,246.44 million

Growth rate

CAGR of 8.3% from 2024 to 2030

Actual data

2018 - 2023

Forecast period

2024 - 2030

Quantitative units

Revenue in USD million/billion and CAGR from 2024 to 2030

Report Coverage

Revenue forecast; company ranking; competitive landscape; growth factors; and trends

Segments Covered

Product, wax type, distribution channel

Key companies profiled

Yankee Candles; Estée Lauder Companies'; RACHEL VOSPER; Aja Botanicals; True Grace; POTT Candles; Cotswold Candle; Stoneglow Candles; Shearer Candles; The Candle Brand

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

UK Candle Market Report Segmentation

This report forecasts revenue growth at the country level and offers a scrutiny of the most recent industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the UK Candle market report based on product, wax type and distribution channel:

-

Product Outlook (Revenue; USD Million; 2018 - 2030)

-

Votive

-

Container Candles

-

Pillars

-

Tapers

-

Others

-

-

Wax Type Outlook (Revenue; USD Million; 2018 - 2030)

-

Paraffin

-

Soywax

-

Beeswax

-

Palmwax

-

Others

-

-

Distribution Channel Outlook (Revenue; USD Million; 2018 - 2030)

-

Offline

-

Online

-

Frequently Asked Questions About This Report

b. The UK candle market size was estimated at USD 723.42 million in 2023 and is expected to reach USD 772.87 million in 2024.

b. The UK candle market is expected to grow at a compound annual growth rate of 8.3% from 2024 to 2030 to reach USD 1,246.44 billion by 2030.

b. Votive candles dominated the UK candle market with a share of 26.4% in 2023. Individual buyers as well as commercial purchasers use these candles, to cultivate serene décor charms and attain preferred ambience.

b. Some key players operating in the UK candle include Yankee Candles; Estée Lauder Companies'; RACHEL VOSPER; Aja Botanicals; True Grace; POTT Candles; Cotswold Candle; Stoneglow Candles; Shearer Candles; The Candle Brand

b. The market growth is mainly attributed to factors such as the increasing use of candles in domestic as well as commercial markets across the country, the growing popularity of scented candles, the use of candles in home décor, and the adoption of various types of candles in therapeutic spas

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.