- Home

- »

- Homecare & Decor

- »

-

Candle Market Size, Share & Growth, Industry Report, 2030GVR Report cover

![Candle Market Size, Share & Trends Report]()

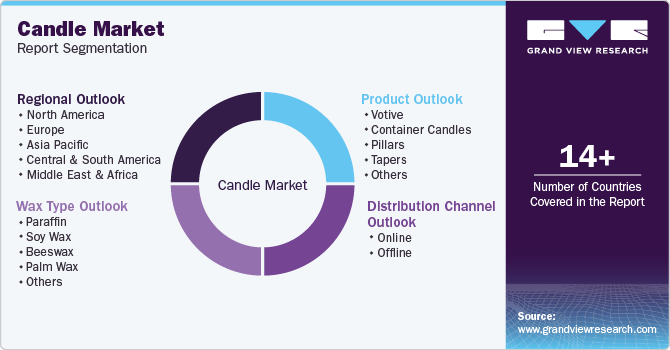

Candle Market (2025 - 2030 ) Size, Share & Trends Analysis Report By Product (Votive, Container Candle, Pillars, Tapers), By Wax Type (Paraffin, Soy Wax, Beeswax, Palm Wax), By Distribution Channel (Online, Offline), By Region, And Segment Forecasts

- Report ID: GVR-3-68038-351-5

- Number of Report Pages: 110

- Format: PDF

- Historical Range: 2018 - 2024

- Forecast Period: 2025 - 2030

- Industry: Consumer Goods

- Report Summary

- Table of Contents

- Interactive Charts

- Methodology

- Download FREE Sample

-

Download Sample Report

Candle Market Summary

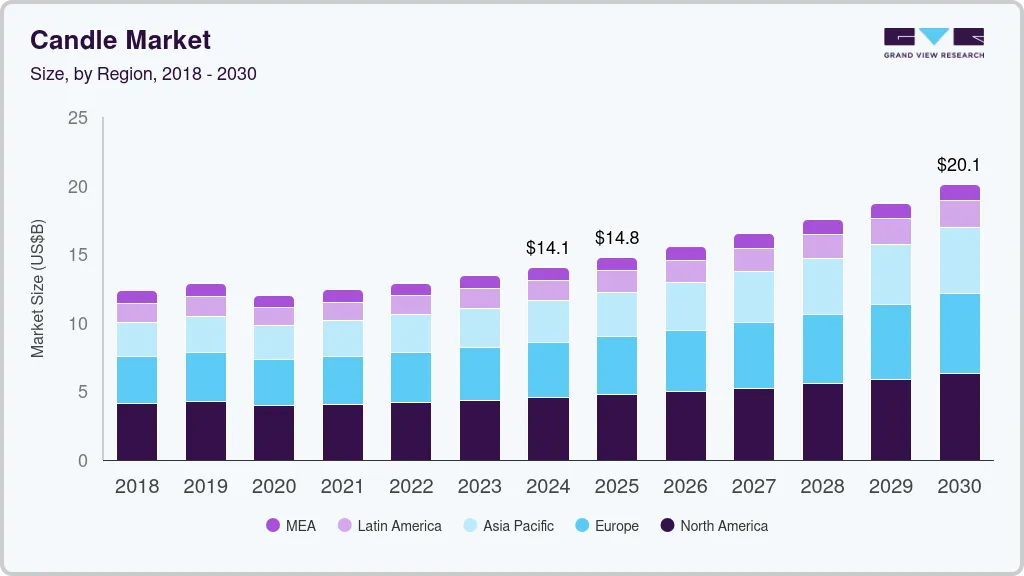

The global candle market size was valued at USD 14.06 billion in 2024 and is projected to reach USD 20.10 billion by 2030, growing at a CAGR of 6.4% from 2025 to 2030. With rising awareness about self-care and mental well-being, consumers are increasingly spending on home renovations and redecorations, seeking to create cozy environments.

Key Market Trends & Insights

- North America candle market accounted for a revenue share of around 32% in 2024.

- The candle market in the U.S. held a dominant share of 75 % in 2024.

- By product, votive candles accounted for a share of about 26% of the global industry in 2024.

- By wax type, paraffin candles accounted for a share of about 30% of the global industry in 2024.

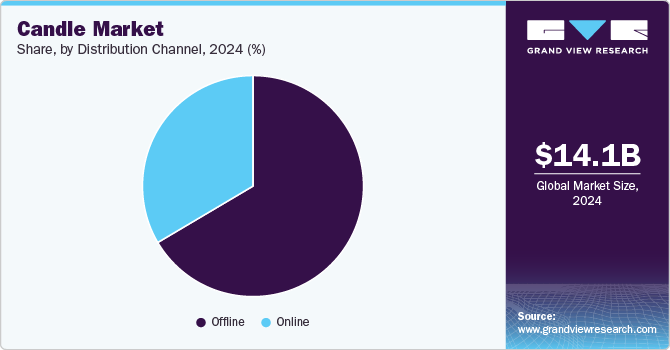

- By distribution channel, demand through the online channel is projected to grow with a cagr of 7.3% during the forecast period from 2025 to 2030.

Market Size & Forecast

- 2024 Market Size: USD 14.06 Billion

- 2030 Projected Market Size: USD 20.10 Billion

- CAGR (2025-2030): 6.4%

- North America: Largest market in 2024

A significant driver in the candle industry is the growing preference for online shopping, entertainment at home, and self-care rituals. According to The Dubrovnik Times, many people incorporated candles into their self-care routines in 2021, with specific aromas proven to improve mood. Additionally, the candle industry has seen a rise in commercial applications, with spas and massage centers using candles with essential oils to enhance relaxation and create soothing atmospheres.

The industry has become integral to personal wellness routines, fueled by a rising interest in home fragrances and self-care. Scented candles are no longer just lighting sources; they play a crucial role in creating calming atmospheres for relaxation and emotional well-being. As more people recognize the psychological benefits of certain fragrances, such as reducing stress and improving mood, the demand for candles with sophisticated blends continues to grow. This trend underscores the candle industry’s expanding role in enhancing mental health and wellness.

The COVID-19 pandemic catalyzed a significant surge in candle sales globally, reflecting a growing demand for comfort and wellness products within the home fragrance industry. With lockdowns and work-from-home arrangements becoming prevalent, candles became a simple yet effective way to enhance living spaces and promote relaxation. A January 2022 Vogue blog highlighted the dramatic increase in home fragrance sales during the pandemic, as candles transitioned from occasional purchases to everyday wellness essentials, cementing their importance within the industry.

Candles have also emerged as a popular gift choice, further driving growth in the candle industry. Their versatility and universal appeal make them suitable for various occasions, from holidays to birthdays and anniversaries. Scented candles are thoughtful and gender-neutral, complementing diverse home décor styles while creating an ambience. Their mood-enhancing properties, ranging from promoting relaxation to boosting productivity, make them highly desirable gifts. As consumer interest in thoughtful, wellness-oriented presents grows, candles continue to strengthen their position in the market.

Seasonal demand, particularly during the holiday quarter, is another key driver in the market. Retailers like Bath & Body Works capitalize on this trend by launching collections of seasonal candles, soaps, and room fragrances priced between USD 2 and USD 30. This period accounts for 38-40% of their annual sales, underscoring the importance of holiday gifting within the candle industry. Products such as their three-wick seasonal candles, featuring scents like “Merry Cookie,” are designed to evoke holiday memories and appeal to a wide audience. This highlights how both gifting and seasonal interest are essential to shaping consumer demand within the industry.

Product Insights

Votive candles accounted for a share of about 26% of the global industry in 2024. The rising popularity of votive candles is due to their ability to create a cozy and intimate atmosphere. Consumers are increasingly looking for affordable ways to enhance their living spaces, and votive candles offer an elegant yet subtle lighting solution. Their small size makes them suitable for decorating small spaces, such as shelves, side tables, or dining settings. At the same time, their ability to fit into holders adds a layer of safety and elegance. Additionally, votive candles often come in a variety of scents and designs, allowing consumers to personalize their environments with minimal investment.

Demand for tapered candles is expected to grow at a CAGR of 8.1% from 2025 to 2030. Taper candles are favored for their ceremonial and symbolic significance. They are commonly used in religious ceremonies, rituals, and celebrations where light represents unity, hope, or spirituality. Their long, upright form and steady burn make them particularly suited for such occasions, where they often serve as focal points in traditional setups.

Wax Type Insights

Paraffin candles accounted for a share of about 30% of the global industry in 2024. One of the primary reasons for the increasing demand for paraffin wax is its affordability. Compared to other candle waxes like soy or beeswax, paraffin is significantly cheaper, making it an economical option for mass production. This affordability allows manufacturers to produce a wide range of candles at competitive prices, catering to both budget-conscious consumers and luxury markets. Furthermore, the global abundance of petroleum ensures a consistent and reliable supply of paraffin wax, reducing production bottlenecks and ensuring market stability.

Demand for beeswax candles is expected to increase at a CAGR of 7.5% from 2025 to 2030. Beeswax is a renewable and biodegradable material derived naturally from honeycomb structures created by bees. As consumers increasingly gravitate toward products with minimal environmental impact, beeswax candles have gained popularity for their sustainable production process. The use of a natural resource free from synthetic additives appeals to environmentally aware buyers looking to support eco-friendly practices.

Distribution Channel Insights

Demand through the online channel is projected to grow with a CAGR of 7.3% during the forecast period from 2025 to 2030. E-commerce platforms use algorithms and data-driven insights to offer personalized shopping experiences. Based on browsing and purchasing history, online retailers can recommend products, fragrances, and styles that align with individual preferences. This tailored approach enhances customer satisfaction and encourages repeat purchases, making online channels an increasingly attractive option for candle buyers.

Sales of candles through the offline channel accounted for a share of about 66% in 2024. Offline stores offer personalized customer service that enhances the shopping experience. Store employees can guide customers through product selections, recommend fragrances, and provide information about the materials or benefits of specific candles. This level of interaction builds trust and loyalty, making offline shopping a preferred choice for consumers seeking a more engaging and tailored experience. Specialty candle shops and boutique retailers, in particular, capitalize on this by curating unique collections and offering expert advice.

Regional Insights

North America candle market accounted for a revenue share of around 32% in 2024. Increased candle demand in North America is attributed to the growing focus on home décor. As consumers spend more time at home, there is a heightened emphasis on creating aesthetically pleasing and comfortable spaces. Candles, with their ability to enhance ambiance, have become a popular choice for adding warmth and style to interiors. Their availability in various sizes, colors, and designs allows consumers to integrate them seamlessly into different décor themes, from minimalist to traditional.

U.S. Candle Market Trends

The candle market in the U.S. held a dominant share of 75 % in 2024. Seasonal and festive demand is a major factor boosting candle sales in the U.S. Candles are a staple in holiday celebrations, such as Christmas, Thanksgiving, and Halloween, where they are used for decoration and gifting. Specialty and themed candles with seasonal fragrances and designs are particularly popular, driving higher sales during festive periods. For instance, in July 2023, Yankee Candle announced the launch of the Daydreaming of Autumn collection, featuring fragrances that capture the essence of fall. The lineup includes scents like Autumn Daydream, Pumpkin Maple Crème Caramel, Spicy Sangria, and more.

Europe Candle Market Trends

The candle market in Europe accounted for a share of about 28% in 2024. Here candles have deep cultural roots and are often associated with warmth, coziness, and tradition. The concept of hygge, originating from Scandinavian culture, emphasizes creating a warm and inviting atmosphere, with candles playing a central role. This cultural association has made candles a staple in many European households, where they are used to create ambiance during long winters and to enhance intimate gatherings.

Asia Pacific Candle Market Trends

The candle market in Asia Pacific is expected to grow at a CAGR of 7.9% from 2025 to 2030. A rising millennial population and increased consumer spending are the major factors propelling the demand for candles here. Additionally, key players are expanding into new locations and product portfolios to spread awareness regarding the brand and the usage of candles. For instance, in January 2022, Diptyque launched a candle collection, which includes three unique courtesy candles and one limited-edition style of the Rose Candle. The company is excessively promoting its products through endorsements and Key Opinion Leaders (KOL) to garner demand from consumers across China due to the rising population and the changing consumer preferences about fashion and home decor.

Key Candle Company Insights

The candle market is fragmented primarily due to the presence of several globally recognized manufacturers as well as regional players. Some prominent companies in this market are Bath & Body Works Direct, Inc., Bridgewater Candle Company, Diptyque S.A.S., Jo Malone London, The Yankee Candle Company, Inc., and NEST Fragrances, LLC, among others. Market players are differentiating through innovative candle designs, eco-friendly materials, and unique scents and expanding their product offerings to cater to evolving consumer preferences for wellness and sustainability.

Key Candle Companies:

The following are the leading companies in the candle market. These companies collectively hold the largest market share and dictate industry trends.

- Bath & Body Works Direct, Inc.

- Better Homes & Gardens

- Bridgewater Candle Company

- Colonial Candle

- Circle E Candles

- Diptyque S.A.S.

- Jo Malone London

- MALIN+GOETZ

- NEST Fragrances, LLC

- The Yankee Candle Company, Inc.

- Conscious Candle Company

- Contract Candles & Diffusers Ltd.

- Ellis Brooklyn

- TRUDON

- Le Labo

Recent Developments

-

In February 2024, Jo Malone London announced the launch of a limited-edition Paddington Collection inspired by the beloved British character, Paddington Bear. The collection features an Orange Marmalade Cologne and four gift sets, capturing the essence of Paddington's favorite treat.

-

In November 2023, Yankee Candle announced the launch of the Bright Lights Collection, a festive lineup designed to enhance the holiday atmosphere. This collection features fragrances such as Holiday Cheer, Magical Bright Lights, Shimmering Christmas Tree, Sparkling Winterberry, and the retail-exclusive Marshmallow Eggnog. Each candle is crafted with natural fiber wicks and a premium soy wax blend infused with essential oils, ensuring a clean and long-lasting burn. The Bright Lights Collection is available for purchase on YankeeCandle.com, at Yankee Candle retail stores, and through major retailers like Target, Kohl's, Walmart, and Meijer. Pricing starts at USD 12.99 for small tumblers and USD 30.99 for large jars.

-

In February 2023, Le Labo announced an expansion of its candle collection with the introduction of AMBROXYDE 17, a scent closely related to their popular ANOTHER 13 fragrance. This new candle features a potent blend of ambroxide, musk, jasmine petals, and moss, offering a distinctive aroma. Ambroxide, a synthetic molecule, serves as a cruelty-free alternative to natural ambergris, aligning with ethical fragrance practices.

Candle Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 14.77 billion

Revenue forecast in 2030

USD 20.10 billion

Growth rate

CAGR of 6.4% from 2025 to 2030

Actual data

2018 - 2024

Forecast period

2025 - 2030

Quantitative units

Volume in million units; revenue in USD million/billion, and CAGR from 2024 to 2030

Report coverage

Volume & revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product, wax type, distribution channel, region

Regional scope

North America; Europe; Asia Pacific; Central & South America; Middle East & Africa

Country scope

U.S; Canada; Mexico; U.K.; Germany; France; Italy; Spain; Japan; China; India; Japan; South Korea; Australia & New Zealand; Brazil; South Africa

Key companies profiled

Bath & Body Works Direct, Inc.; Better Homes & Gardens; Bridgewater Candle Company; Colonial Candle; Circle E Candles; Diptyque S.A.S.; Jo Malone London; MALIN+GOETZ; NEST Fragrances, LLC; The Yankee Candle Company, Inc.; Conscious Candle Company; Contract Candles & Diffusers Ltd.; Ellis Brooklyn; TRUDON; Le Labo.

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Candle Market Report Segmentation

This report forecasts volume & revenue growth at the global, regional and country levels and provides an analysis of the latest industry trends and opportunities in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global candle market report based on product, wax type, distribution channel, and region:

-

Product Outlook (Volume, Million Units; Revenue, USD Billion, 2018 - 2030)

-

Votive

-

Container Candles

-

Pillars

-

Tapers

-

Others

-

-

Wax Type Outlook (Volume, Million Units; Revenue, USD Billion, 2018 - 2030)

-

Paraffin

-

Soy Wax

-

Beeswax

-

Palm Wax

-

Others

-

-

Distribution Channel Outlook (Volume, Million Units; Revenue, USD Billion, 2018 - 2030)

-

Online

-

Offline

-

-

Regional Outlook (Volume, Million Units; Revenue, USD Billion, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

Spain

-

-

Asia Pacific

-

Japan

-

China

-

India

-

Australia & New Zealand

-

South Korea

-

-

Central & South America

-

Brazil

-

-

Middle East & Africa

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global candle market size was estimated at USD 14.06 billion in 2024 and is expected to reach USD 14.77 billion in 2025.

b. The global candle market is expected to grow at a compound annual growth rate of 6.4% from 2025 to 2030 to reach USD 20.10 billion by 2030.

b. North America dominated the candle market, with a share of 32.34% in 2024. This is attributable to increasing product demand during festive seasons such as Easter and Christmas and high demand for the product for family gatherings, fine dining, beauty, and spas.

b. Some key players operating in the candle market include Bath & Body Works Direct, Inc., Better Homes & Gardens, Bridgewater Candle Company, Colonial Candle, Circle E Candles, Diptyque S.A.S., Jo Malone London, MALIN+GOETZ, NEST Fragrances, LLC, The Yankee Candle Company, Inc., Conscious Candle Company, Contract Candles & Diffusers Ltd., Ellis Brooklyn, TRUDON, and Le Labo.

b. Key factors that are driving the market growth include high consumption of candles as aesthetic-appealing product among female millennials for household application, demand form spa and massage centers and restaurants and fine dines are increasingly using the product to create a beautiful and aromatic ambiance for the customers.

b. The U.S. candle market size was estimated at USD 3.42 billion in 2024 and is expected to reach USD 3.56 billion in 2025.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.