- Home

- »

- Consumer F&B

- »

-

UK Energy Drinks Market Size & Share, Industry Report 2030GVR Report cover

![UK Energy Drinks Market Size, Share & Trends Report]()

UK Energy Drinks Market (2025 - 2030) Size, Share & Trends Analysis Report By Product (Energy Drinks, Energy Shorts), By Type (Organic, Conventional), By Packaging (Bottles, Cans), By Distribution Channel, And Segment Forecasts

- Report ID: GVR-4-68040-597-4

- Number of Report Pages: 90

- Format: PDF

- Historical Range: 2018 - 2024

- Forecast Period: 2025 - 2030

- Industry: Consumer Goods

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

UK Energy Drinks Market Size & Trends

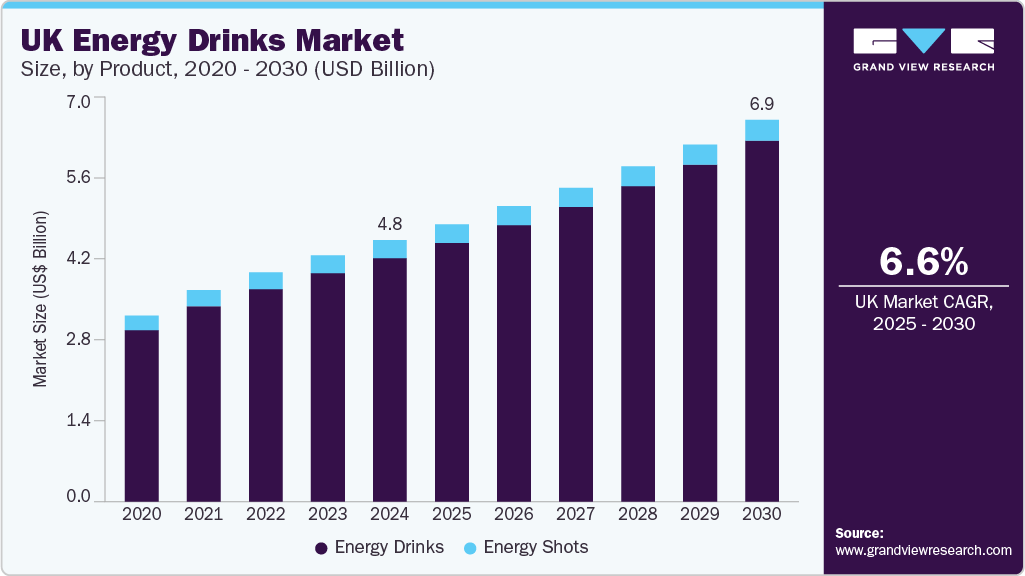

The UK energy drinks market size was estimated at USD 4.79 billion in 2024 and is expected to grow at a CAGR of 6.6% from 2025 to 2030. The growth is attributable to evolving consumer lifestyles and increasing health awareness. Urbanization and rising disposable incomes have led to greater demand for convenient, functional beverages that enhance energy and mental alertness. Consumers, especially younger adults, are gravitating towards sugar-free and natural ingredient-based energy drinks, reflecting a shift towards healthier options. For instance, the launch of vitamin-enriched and no-sugar variants by domestic brands has successfully captured health-conscious segments.

Another key driver is innovation in product offerings and distribution channels. Companies are expanding their portfolios to include energy shots, organic formulations, and beverages with added functional benefits such as electrolytes and adaptogens. The rise of e-commerce and partnerships with fitness centers and wellness outlets has broadened market access, allowing niche brands to reach targeted consumers efficiently. For instance, the introduction of natural energy drinks with nootropics and zero added sugar has resonated well with consumers seeking both energy and wellness benefits.

Regulatory measures also shape market growth, with strict labeling requirements on caffeine content and marketing restrictions targeting minors, ensuring consumer safety and building trust. Sustainability trends are influencing packaging innovations, with eco-friendly materials gaining traction in response to environmental concerns. Despite challenges related to health perceptions of caffeine and sugar, the market’s ability to innovate and meet consumer demands for functional, healthier, and convenient energy solutions underpins its strong growth trajectory through 2030.

Product Insights

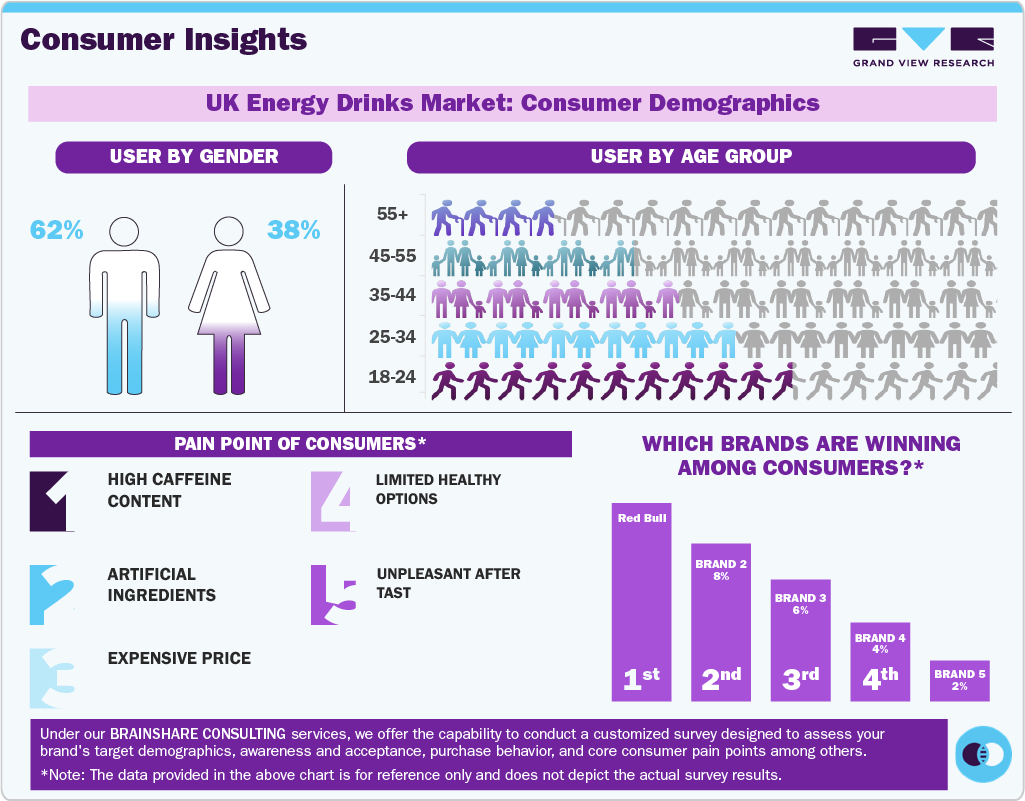

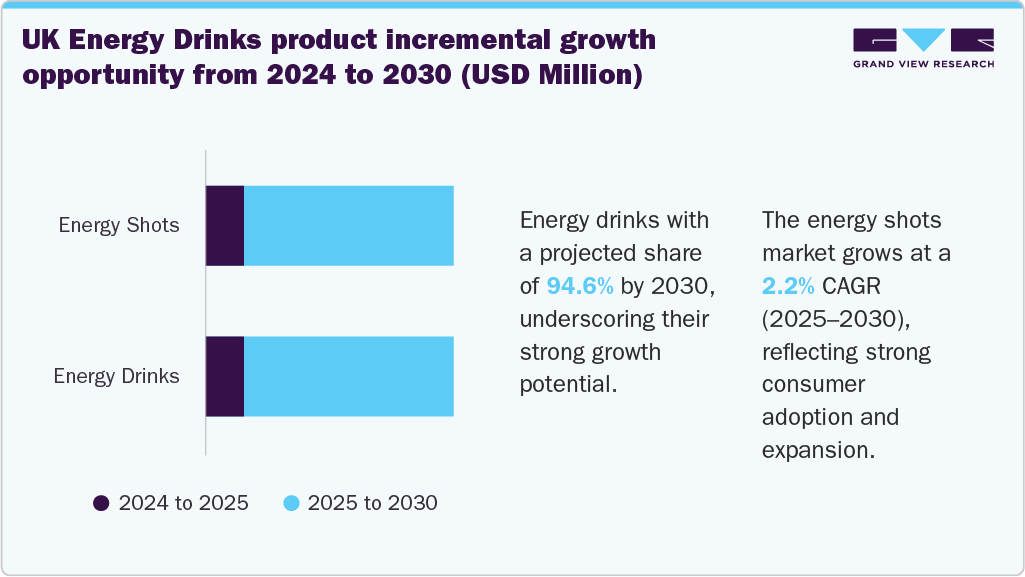

The energy drinks market segment accounted for the largest revenue share of 93.1% in 2024, due to strong consumer demand for convenient, functional beverages that provide quick energy and mental alertness. The large young adult population, especially those aged 18 to 34, drives this demand, seeking products that support busy lifestyles and fitness routines. Innovation plays a key role, with brands expanding sugar-free, vitamin-enriched, and natural ingredient options to meet health-conscious preferences. In addition, strategic marketing through sports and music sponsorships enhances brand visibility and consumer engagement. Despite regulatory measures on caffeine labeling and marketing to minors, the market remains strong, supported by continuous product innovation and growing interest in healthier energy solutions that combine performance with wellness benefits.

The energy shots market segment is projected to grow at a CAGR of 2.2% from 2025 to 2030, due to its niche appeal as a quick, concentrated energy source for busy consumers seeking immediate alertness. Energy shots offer portability and convenience in small packaging, making them suitable for on-the-go consumption. Despite this, energy shots face challenges such as market saturation by dominant brands and consumer preference for lifestyle-oriented, flavorful energy drinks. In addition, energy shots are marketed primarily as pure energy boosters, whereas energy drinks also serve as lifestyle beverages, which limits their broader appeal.

Type Insights

The conventional energy drinks market segment accounted for the largest revenue share of 92.3% in 2024, as these products offer a well-established, immediate energy boost that appeals to a broad consumer base, especially young adults and working professionals. Conventional drinks typically contain higher levels of caffeine and sugar, delivering quick and effective stimulation, which remains popular despite rising health concerns. For instance, iconic brands with strong market presence and high brand awareness, such as Red Bull, continue to dominate due to their consistent product quality and extensive distribution across supermarkets, convenience stores, and online platforms. In addition, conventional energy drinks benefit from aggressive marketing strategies, including sponsorships of sports and music events, which reinforce brand loyalty and consumer trust.

The organic energy drinks market segment is projected to grow at a CAGR of 10.4% from 2025 to 2030, primarily due to increasing consumer demand for healthier, natural beverage options free from artificial ingredients, chemicals, and pesticides. Health-conscious consumers are shifting away from conventional energy drinks, concerned about high sugar content and synthetic additives, and preferring organic products that offer cleaner, minimally processed formulations. For instance, in 2023, Wholesome Organics Co. launched a Clean Energy Shot designed to provide organic energy boosts with added health benefits, appealing to wellness-focused individuals.

Packaging Insights

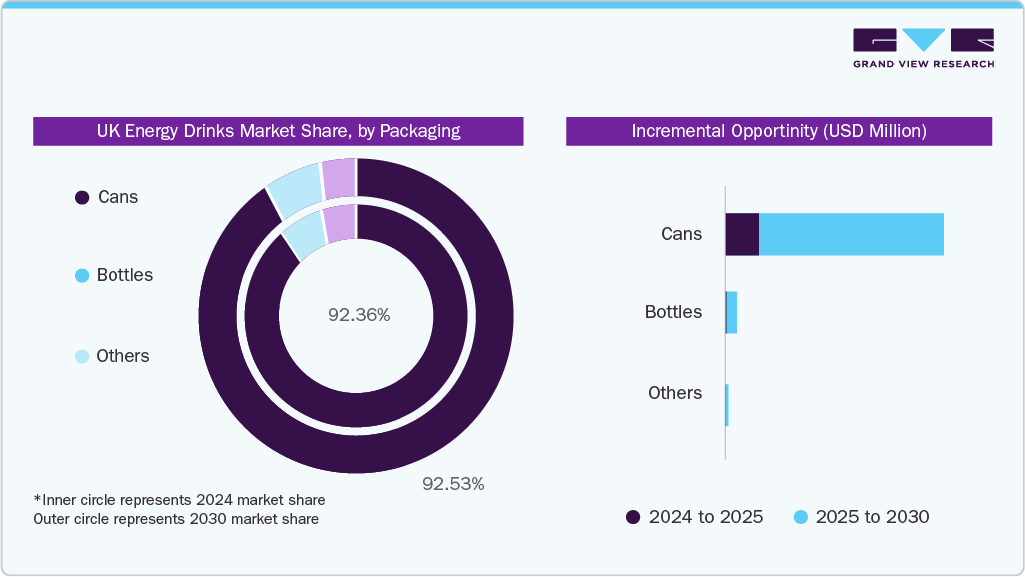

The cans energy drinks market segment accounted for the largest revenue share of 92.3% in 2024, primarily due to its superior convenience, portability, and ability to preserve product quality. Aluminum cans provide excellent protection against light and oxygen, which helps maintain the flavor and carbonation of energy drinks over time, extending shelf life. In addition, cans are lightweight, easy to chill quickly, and highly recyclable, aligning with growing consumer and regulatory demands for sustainable packaging. For instance, leading brands have increasingly adopted sleek, slim-can formats that appeal to younger consumers seeking both style and functionality. The widespread availability of canned energy drinks across supermarkets, convenience stores, and online platforms further supports their dominance.

The bottles energy drink segment is projected to grow at a CAGR of 3.9% from 2025 to 2030, attributed to increasing consumer preference for convenience, portability, and resealable packaging that supports on-the-go lifestyles. Plastic bottles, especially PET, are lightweight, durable, and cost-effective, making them ideal for busy consumers who value ease of use and the ability to consume energy drinks over multiple sittings. Environmental concerns are also driving innovation toward recyclable and lightweight bottle designs, aligning with sustainability trends. While cans dominate due to their preservation qualities, bottles’ functional benefits and expanding distribution through convenience stores and e-commerce platforms support steady growth in this segment.

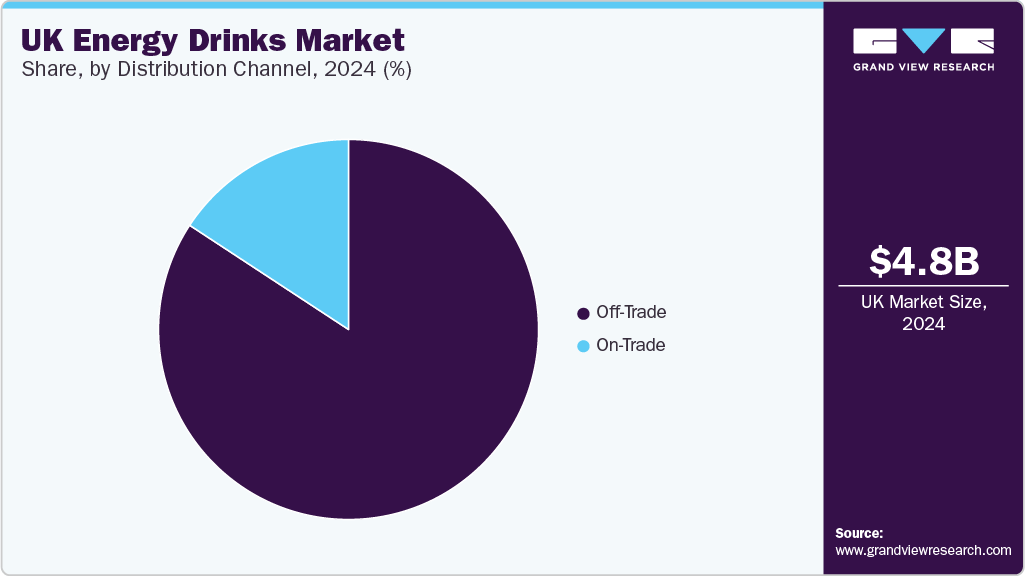

Distribution Channel Insights

The sales of energy drinks through off-trade accounted for a revenue share of around 84.2% in 2024. Off-trade distribution offers consumers widespread accessibility and convenience through supermarkets, convenience stores, and online retailers. These outlets provide a broad product assortment, allowing shoppers to personally inspect packaging, ingredients, and brands before purchase, which builds consumer confidence. The off-trade segment also benefits from competitive pricing, promotions, and multipack offers that encourage bulk buying and repeat purchases. In addition, the growing trend of at-home consumption and the rise of e-commerce platforms have further strengthened off-trade sales.

Energy drinks sales through on-trade are projected to grow at a CAGR of 5.4% from 2025 to 2030, due to increasing consumer demand for energy beverages in social and entertainment venues such as bars, clubs, restaurants, and cafes. These establishments offer immediate consumption experiences and often provide exclusive or craft energy drink options that enhance the appeal of on-trade purchases. In addition, the rising nightlife culture and growing popularity of energy drink mixers with alcoholic beverages contribute to this growth. On-trade venues also serve as platforms for experiential marketing and brand engagement, which are crucial for attracting younger consumers.

Key UK Energy Drinks Company Insights

Key companies in the UK energy drink industry maintain a competitive edge through continuous product innovation, focusing on sugar-free, natural, and functional beverages enriched with vitamins and herbal extracts to meet evolving consumer health preferences. They leverage extensive distribution networks across supermarkets, convenience stores, and online platforms to ensure broad market reach. Strategic marketing efforts, including sports sponsorships and digital campaigns, enhance brand visibility and consumer engagement.

Key UK Energy Drinks Companies:

- Red Bull GmbH

- Suntory Holdings Limited

- PepsiCo, Inc.

- Monster Beverage Corporation

- Lucozade Ribena Suntory Limited

- The Coca-Cola Company

- Amway Corp

- Keurig Dr. Pepper, Inc.

- Vitamin Well AB

- Congo Brands

Recent Developments

-

In September 2024, Nottingham Forest announced Red Bull as their official energy drink partner. The Premier League club entered into a strategic partnership with Red Bull, a leading global energy drink and lifestyle brand, enhancing the club’s commercial portfolio. As part of the deal, Red Bull’s logo was prominently displayed on bottles, bottle carriers, coolers, and ice boxes at The Nigel Doughty Academy, as well as during home and away matches.

UK Energy Drinks Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 5.08 billion

Revenue forecast in 2030

USD 7.00 billion

Growth rate

CAGR of 6.6% from 2025 to 2030

Actuals

2018 - 2024

Forecast period

2025 - 2030

Quantitative units

Revenue in USD million/billion CAGR from 2025 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product, type, packaging, distribution channel

Country scope

UK

Key companies profiled

Red Bull GmbH; Suntory Holdings Limited; PepsiCo, Inc.; Monster Beverage Corporation; Lucozade Ribena Suntory Limited; The Coca-Cola Company; Amway Corp; Keurig Dr. Pepper, Inc.; Vitamin Well AB; Congo Brands

Customization scope

Free report customization (equivalent up to 8 analysts’ working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options.

UK Energy Drinks Market Report Segmentation

This report forecasts revenue growth at the country level and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the UK energy drinks market report based on product, type, packaging, and distribution channel:

-

Product Outlook (Revenue, USD Million, 2018 - 2030)

-

Energy Drinks

-

Energy Shots

-

-

Type Outlook (Revenue, USD Million, 2018 - 2030)

-

Organic

-

Conventional

-

-

Packaging Outlook (Revenue, USD Million, 2018 - 2030)

-

Bottles

-

Cans

-

Others

-

-

Distribution Channel Outlook (Revenue, USD Million, 2018 - 2030)

-

On-Trade

-

Off-Trade

-

Frequently Asked Questions About This Report

b. The UK energy drinks market size was estimated at USD 4.79 billion in 2024 and is expected to reach USD 5.08 billion in 2025.

b. The UK energy drinks market is expected to grow at a compounded growth rate of 6.6% from 2025 to 2030 to reach USD 7.00 billion by 2030.

b. The energy drinks market accounted for a share of 93.1% of the UK revenue in 2024, due to strong consumer demand for convenient, functional beverages that provide quick energy and mental alertness.

b. Some key players operating in the UK energy drinks market include Red Bull GmbH, Monster Beverage Corporation, PepsiCo Inc. and Others.

b. Key factors that are driving the market growth include innovation in product offerings and distribution channels. Companies are expanding their portfolios to include energy shots, organic formulations, and beverages with added functional benefits such as electrolytes and adaptogens.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.