- Home

- »

- IT Services & Applications

- »

-

U.K. Factoring Services Market Size & Share Report, 2030GVR Report cover

![U.K. Factoring Services Market Size, Share & Trends Report]()

U.K. Factoring Services Market (2023 - 2030) Size, Share & Trends Analysis Report By Type (Recourse, Non-recourse), By Category (Domestic, International), By Financial Institution (Banks, NBFIs), By End-use, And Segment Forecasts

- Report ID: GVR-4-68040-134-0

- Number of Report Pages: 120

- Format: PDF

- Historical Range: 2018 - 2021

- Forecast Period: 2023 - 2030

- Industry: Technology

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Market Size & Trends

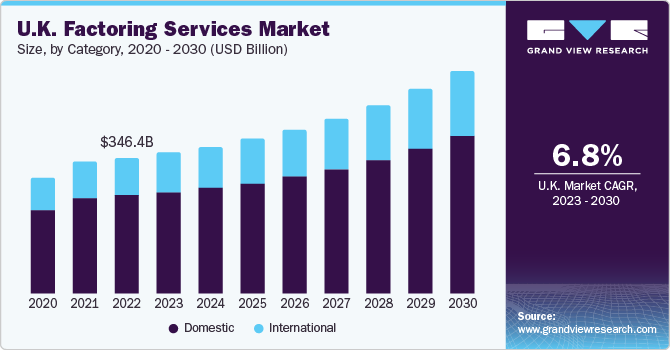

The U.K. factoring services market size was estimated at USD 346.44 billion in 2022 and is anticipated to grow at a compound annual growth rate (CAGR) of 6.8% from 2023 to 2030. The market growth can be attributed to the rising need for alternative financing sources for Micro, Small & Medium Enterprises (MSMEs). Various finance companies are providing flexible factoring services to freelancers and SMEs to assist them in reducing financial pressure caused by delayed payments. Furthermore, the use of cloud-based and artificial intelligence (AI)-based models in factoring services is rising to improve service efficiency. Banks in the region are becoming more user-friendly by providing accessible sites where customer can check their bank balance, submit financing requests, and assign invoices. Such developments are expected to drive the market growth during the forecast period.

Factoring services help firms get working capital loans while also mitigating credit concerns. For instance, in January 2022, Aldermore Bank PLC provided Carlton Hill Holdings, a subsidiary of the Pickard Properties Group, with a USD 20.6 million (GBP 15.3 million) loan, which would be used to refinance an existing loan, raise additional capital, and assist in the development of large student accommodation blocks in Leeds, U.K. The financial partnership would help in bringing cutting-edge design to all the student accommodations built in the city. To remain competitive in the market, fintech and banks have utilized these technologies to offer innovative solutions.

On account of the predicted accuracy of these tools, as well as the absence of human underwriting, significant outsourcing of decision-making capacities is expected. Such developments are expected to drive the market growth during the forecast period. Financial institutions can streamline their operations and optimize their credit collection procedures by automating repetitive and time-consuming backend duties. Furthermore, automation aids in the implementation of resources for value-added projects and the reputation of financial institutions. Moreover, the digitization of accounts receivable operations contributes to lower printing costs and higher profitability for employees.

Many businesses prefer to put accounts receivable solutions on-premises as it gives them complete control over the infrastructure and assets. Furthermore, on-premises deployment provides complete control over company and transaction records. Healthcare and BFSI organizations favor on-premises implementation since they deal with sensitive data connected to income and healthcare. These reasons are predicted to drive automation demand in the market. Organizations, such as Factors Chain International (FCI), the global representative body for financing and factoring of open account trade receivables, provide an exclusive system for cooperation in cross-border factoring.

Currently, FCI has members from around 75 countries and serves more than 80% of the world’s international factoring volume. Other organizations, such as the World Bank, AfreximBank, IDB Invest for the Americas, European Bank for Reconstruction and Development (EBRD), Asia Development Bank (ADB), and the ICC Banking Commission, are instrumental in promoting financing services across the world. These factors would further drive the market growth during the forecast period. The growing use of blockchain technology by banks and non-banking financial companies (NBFCs) is propelling the expansion of the market.

It motivates regional market participants to make more efforts to improve their services to acquire a competitive advantage. Furthermore, the growing acceptance of Distributed Ledger Technology (DLT) among SMEs and major organizations, as well as greater awareness of blockchain DLT applications across industries, is propelling the regional market growth forward. The technology offers multiple advantages, such as transparently delivering and receiving product information and securely storing client information for various purposes. Such features enabled by blockchain technology are expected to boost the adoption of factoring services in non-banking financial institutions (NBFIs) and banks. These factors would further drive the market growth during the forecast period.

Category Insights

The domestic segment accounted for the maximum market share of over 70% in 2022. The segment growth can be attributed to the rapid adoption of the factoring receivable technique in several industry verticals due to its effectiveness. Moreover, the growing importance of electronic invoices has helped consolidate the domestic factoring sector in the region. Domestic factoring offers firms a weekly or monthly review of their sales and payable invoices. Furthermore, the local segment's easy risk coverage and lower cost in comparison to overseas factoring support the segment’s high market share. The international segment is anticipated to register the fastest CAGR of 7.3% from 2023 to 2030.

International factoring services are a must-have for any company involved in international trade, regardless of size or industry. An increase in open account trading has pushed this segment to expand further. Moreover, importers in the region regard factoring as a viable alternative to traditional trade finance methods. Furthermore, increased international trade knowledge and a migration of production facilities from China to other developing economies, such as Mexico, the Philippines, and Vietnam, particularly after the COVID-19 pandemic, are projected to drive the growth of this segment in the years to come.

Type Insights

The recourse segment accounted for the highest share of over 50% in 2022. It is the most typical factoring service in which a company purchases invoices on which a factoring company is unable to collect payments. Several organizations utilize factoring to sell invoices at the lowest possible discount. Furthermore, it provides various advantages, such as immediate cash flow for urgent needs, a lower cost choice for invoice sellers, a speedy approval process, and no responsibility for the client to manage the collection. The advantages of employing recourse factoring services have opened the path for this category to flourish during the forecast period.

The non-recourse segment is anticipated to grow at a CAGR of 7.3% during the forecast period. In non-recourse factoring, the financing company is responsible for the risks of unpaid invoices, which offers protection against bad debts. The non-recourse segment is likely to witness substantial growth over the forecast period owing to the widespread adoption of non-recourse factoring in developing countries. SMEs are likely to be the leading adopters of this financing facility as interest rates for both recourse and non-recourse factoring are almost equal across the world. Moreover, the demand for non-recourse financing is expected to increase as short-term financing offers debt security, employment, and growth opportunities in developing nations.

Financial Institution Insights

The bank segment accounted for the largest market share of over 85% in 2022.Banks are the major financing organizations across the world and are increasingly offering factoring services owing to the adoption of technologies, such as distributed ledgers. Several banks worldwide are developing blockchain technology platforms for meeting the financial needs of their clients. Several banks and financial service companies, including Wells Fargo, JP Morgan, Barclays Plc, and Morgan Stanley are working with blockchain technology vendors to develop creative solutions and lower overall process costs. These advanced technologies enable invoice automation with unique identification for speedy funding, as well as complete transactional security and smart contract capabilities.

Furthermore, it increases payment system efficiency, reduces operational expenses, and provides transparency. These factors would further drive the segment growth during the forecast period. The NBFIs segment is anticipated to grow at a CAGR of 7.8% from 2023 to 2030. NBFIs are focused on developing advanced products and catering to low-income, urban customers in unorganized sectors. Furthermore, NBFIs use advanced technologies and leverage their partnership ecosystems across the value chain of lead generation, credit/loan disbursement, and customer onboarding with the help of AI, machine learning (ML), and blockchain. These technologies enable lenders to measure individual insights and build credit-scoring models. These factors would drive the segment growth during the forecast period.

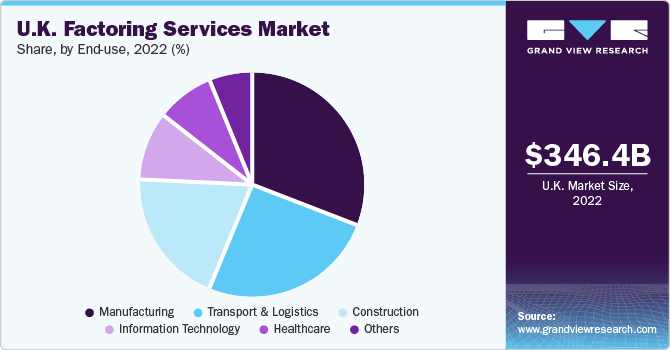

End-use Insights

The manufacturing segment accounted for the highest market share of over 30% in 2022. Factoring services are used by manufacturers to turn their bills receivables into cash to fund operating expenses. Instead of high-interest loans, manufacturers prefer invoice factoring for fast cash payouts without the need for significant and time-consuming documentation. Furthermore, organizations that need fast cash but cannot qualify for traditional funding or series funding turn to invoice factoring to get the needed operating capital and optimize their manufacturing process with enhanced cash flow stability.

Moreover, factoring in the manufacturing industry removes payment-related issues and gives clients immediate access to cash. These factors would further drive the demand for factoring services in the manufacturing sector during the forecast period. The healthcare segment is anticipated to grow at a CAGR of 8.4% during the forecast period. Factoring services are used in a variety of medical industries, including laboratory services, ambulatory services, home health agencies, hospitals, nurse staffing agencies, rehabilitation centers, health centers, medical equipment providers, and medical billing and transcription service providers.

Healthcare service-offering organizations with improper payment and billing systems might be undesirable for the broader healthcare sector. Furthermore, developing complexities in the insurance & bureaucracy layers and leftover medical debts for several weeks are prompting medical corporations & healthcare centers to turn to factoring services to manage the cash flow of healthcare or pharma enterprises. Hospitals and clinics can use these services to acquire quick funds to optimize and streamline their inventory of emergency medical supplies, such as surgical tools, organic chemicals and medicines, and operation technology (OT) supplies.

Key Companies & Market Share Insights

To broaden their product offering, companies utilize a variety of inorganic growth tactics, such as regular mergers, acquisitions, and partnerships. For instance, in April 2022, Eurobank Factors, a subsidiary of Eurobank, announced additional enhancements to its factoring services as well as the debut of new digital reverse factoring services. The bank's advanced digital reverse factoring services are designed to help clients improve their cash flow ratios while also offering a loyalty program with favorable conditions. The new offerings would help the bank increase its customer base in the EMEA region for factoring services. Some of the prominent players in the U.K. factoring services market include:

-

Barclays Plc

-

BNP Paribas

-

HSBC Group

-

eCapital, Inc.

-

Aldermore Bank PLC

-

Bank of Scotland plc.

-

Bibby Financial Services Ltd.

-

Close Brothers Group plc.

-

Danske Bank Group

-

EUROBANK

-

Lloyds Bank plc.

-

Nucleus Commercial Finance

-

Paragon Bank PLC

-

Pulse Cashflow Finance Ltd.

-

Skipton Business Finance Ltd.

U.K. Factoring Services Market Report Scope

Report Attribute

Details

Volume forecast in 2030

USD 568.90 billion

Growth rate

CAGR of 6.8% from 2023 to 2030

Base year for estimation

2022

Historical data

2018 - 2021

Forecast period

2023 - 2030

Quantitative units

Volume in USD billion and CAGR from 2023 to 2030

Report coverage

Volume forecast, company market share, competitive landscape, growth factors, and trends

Segments covered

Category, type, financial institution, end-use

Key companies profiled

Barclays Plc; BNP Paribas; HSBC Group; eCapital Inc.; Aldermore Bank Plc; Bank of Scotland plc.; Bibby Financial Services Ltd; Close Brothers Group plc.; Danske Bank Group; EUROBANK; Lloyds Bank plc.; Nucleus Commercial Finance; Paragon Bank PLC; Pulse Cashflow Finance Ltd.; Skipton Business Finance Ltd.

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

U.K. Factoring Services Market Report Segmentation

This report forecasts factoring volume growth at a country level and provides an analysis of the latest trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the U.K. factoring services market report based on category, type, financial institution, and end-use:

-

Category Outlook (Factoring Volume, USD Billion, 2018 - 2030)

-

Domestic

-

International

-

-

Type Outlook (Factoring Volume, USD Billion, 2018 - 2030)

-

Recourse

-

Non-recourse

-

-

Financial Institution Outlook (Factoring Volume, USD Billion, 2018 - 2030)

-

Banks

-

Non-banking financial Institutions (NBFIs)

-

-

End-use Outlook (Factoring Volume, USD Billion, 2018 - 2030)

-

Manufacturing

-

Transport & Logistics

-

Information Technology

-

Healthcare

-

Construction

-

Others

-

Frequently Asked Questions About This Report

b. The U.K. factoring services market size was estimated at USD 346.44 billion in 2022 and is expected to reach USD 358.71 billion by 2023.

b. The U.K. factoring services market is expected to grow at a compound annual growth rate of 6.8% from 2023 to 2030 to reach USD 568.90 billion by 2030.

b. The domestic segment accounted for a market share of over 70% in 2022 in the U.K. factoring services market. The segment growth can be attributed to the rapid adoption of the factoring receivable technique in several industry verticals due to their effectiveness.

b. The key players operating in the U.K. factoring services market include Barclays Plc, BNP Paribas, HSBC Group, eCapital Inc., Aldermore Bank Plc, Bank of Scotland plc., Bibby Financial Services Ltd, Close Brothers Group plc., Danske Bank Group, EUROBANK, Lloyds Bank plc., Nucleus Commercial Finance, Paragon Bank PLC, Pulse Cashflow Finance Ltd, and Skipton Business Finance Ltd

b. The U.K. factoring services market growth can be attributed to the growing need for alternative financing sources for Micro, Small & Medium Enterprises (MSMEs) and development in the cross-border financing business. Banks in the region are becoming more user-friendly by providing accessible sites where customer can check their bank balance, submit financing requests, and assign invoices.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.