- Home

- »

- Healthcare IT

- »

-

U.K. And Germany Diet And Nutrition Apps Market Report, 2030GVR Report cover

![U.K. And Germany Diet And Nutrition Apps Market Size, Share & Trends Report]()

U.K. And Germany Diet And Nutrition Apps Market Size, Share & Trends Analysis Report By Type (Weight Loss/Gain Tracking Apps, Calorie Counting Apps, Meal Planning Apps), By Platform, By Devices, And Segment Forecasts, 2022 - 2030

- Report ID: GVR-4-68039-954-6

- Number of Report Pages: 80

- Format: PDF, Horizon Databook

- Historical Range: 2017 - 2020

- Forecast Period: 2022 - 2030

- Industry: Healthcare

Report Overview

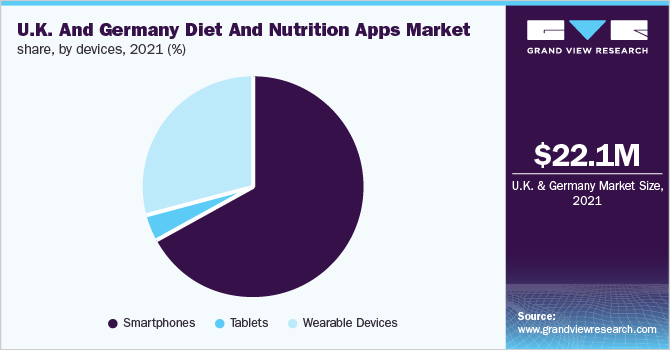

The U.K. and Germany diet and nutrition apps market size was valued at USD 22.1 million in 2021 and is expected to expand at a compound annual growth rate (CAGR) of 19.1% from 2022 to 2030. The COVID-19 pandemic has increased awareness regarding health and wellbeing. Daily active users on diet and nutrition apps increased from 2019 to 2020, as per various research papers. In addition, studios, wellness clubs, and gyms are increasing their online presence, thereby boosting adoption. Diet and nutrition apps utilize machine learning, artificial intelligence, and other technologies to provide personalized programs to customers. These apps are also offering personalized diet charts, no equipment workout routines, and personalized health coaches as well as track footsteps & monitor diet, among others. Such advantages are increasing the growth potential of the market. For instance, MyFitnessPal provides personalized diet and activity tracking to its customers.

Increasing penetration of smartphones and the internet further propel the market growth. As per the report of GSMA, in 2020, 82% of people adopted smartphones in the U.K., and this percentage is projected to increase to 85% by 2025. Only 2% of the population had a 5G connection in 2020. However, the percentage is projected to increase to 42% by 2025. Mobile applications for smartphones have made life easy by making it convenient to perform daily activities.

With the increasing adoption of smartphones and easy availability of technologically advanced devices, innovators have started investing to capitalize on growth opportunities by focusing on delivering quality healthcare and comfort to consumers through various mobile platforms that would help them track their fitness regimes and obtain answers to fitness-related inquiries over the phone, or through several mobile applications. For instance, several apps such as Fitbit, MyFitnessPal, MyNetDiary, Noom, and Fitbit have been launched in the past few years to help individuals track healthy lifestyles and store their healthcare information during their fitness journey.

Growing health consciousness propels market growth. The increasing prevalence of chronic diseases such as diabetes, CVDs, and other lifestyle diseases has forced people to opt for healthy diets. According to the report of the International Diabetes Federation, in 2019, about 9.5 million adults were living with diabetes in Germany. Furthermore, the increasing prevalence of obesity within the region further fuels market growth. These diet and nutrition apps help lose weight by tracking calorie intake and monitoring their day-to-day activities.

Various apps offer meal plans depending on consumer preferences, budget, age, and gender. Various studies also claim that these apps help in maintaining a healthy lifestyle. For instance, a recent study released by NCBI stated that diet & nutrition apps promote healthy eating habits and exercise. These apps positively impact users’ actions, provide knowledge of nutrition & physical activities, and promote self-consciousness.

The sudden outbreak of COVID-19 significantly transformed the perception of people toward a healthy lifestyle. In the early stage of the pandemic, there was a sudden increase in the adoption of diet and nutrition apps. However, this demand decreased by the year 2021, which drastically impacted the market growth. To maintain social distancing, governments of the U.K. and Germany closed gyms and other activity centers, as a result, people were compelled to opt for home gyms and other diet options for maintaining their fitness. This led to a sudden growth in the diet & nutrition apps market, as a large proportion of the population downloaded these apps to maintain their health at home by opting for healthy meal plans.

However, the trend witnessed a decrease in 2021, owing to situations across geographies heading toward normalcy. For instance, according to the data published by SensorTower, the health & fitness apps category witnessed a significant increase in downloads in Europe. However, user adoption was down in 2021 as compared to 2020 but remained significantly high as compared to 2019.

Factors such as the high cost of premium memberships, lack of reimbursement for diet and nutrition apps, and data privacy are expected to hamper the market growth in the forecast period. Some of the most common security vulnerabilities in diet and nutrition apps are poor server-side control, improper storage of data, poor cryptography, improper authentication of users, insecure session handling, and poor binary protection. Thus, the vulnerability of data privacy is projected to pose a big challenge for market growth.

Type Insights

In 2021, the calorie counting segment held the largest revenue share of 55.1%. This can be attributed to a large proportion of companies focusing on introducing innovative technologies to monitor calorie intake that will help maintain a healthy lifestyle. Furthermore, the growing percentage of the obese population further drives the adoption of the app which includes calorie counting technologies.

The others segment, which includes food journaling, food logging, and activity tracking, is estimated to grow at a significant CAGR over the forecast period. Tracking health and food logging through apps & gadgets has gained popularity in the past years, which is resulted in a sudden surge in the number of consumers. With an increasing number of consumers, major technology companies have started investing in the technology, and hence the segment is anticipated to grow at a lucrative rate over the forecast period.

Platform Insights

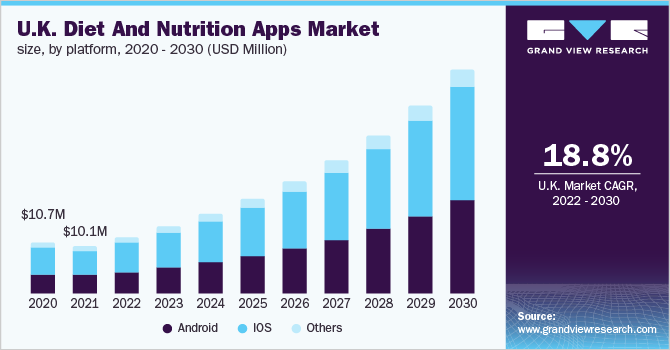

In 2021, the android segment held the largest revenue share of 46.0%. The growth can be attributed to growing downloads of diet and nutrition apps on android phones for tracking calorie intake and nutrients, monitoring physical activities, and gathering diet recipes. Increasing penetration of smartphone users is yet another factor driving the growth.

However, the iOS segment is expected to achieve the fastest CAGR over the forecast period. iOS is a mobile operating system created by Apple Inc. exclusively for its devices. It is the world’s most advanced operating system, and its high adoption rate in the U.K. & Germany is driving the growth of the segment.

For instance, according to data provided by StatCounter for May 2022, the mobile operating system share of iOS users is around 50.3% in the U.K. The diet & nutrition apps designed for iOS devices can provide diet coaching, help in activity tracking, aid in or help in tracking intake of water & macronutrients, monitoring calorie burns, provide diet recipes, and allow streaming of workout classes, motivational and inspirational videos for workouts, stretching, guided meditations, & others. Some of the diet and nutrition apps designed for iOS platforms, i.e., iPhone, iPad, and Apple Watch, are Loose It!, MyFitnessPal, Noom, and Eat This Much.

Device Insights

Based on devices, the market is segmented into smartphones, tablets, and wearables. In 2021, smartphones held the largest revenue share of 67.1%. The growth of this segment is attributed to the increasing penetration of smartphones within the region and the high usage of smartphones and app compatibility. Moreover, smartphones are considered to be a necessity as opposed to tablets, which are usually operated at home or in corporate settings.

However, wearable devices are projected to grow at the fastest CAGR of 20.0%. A wearable fitness device is used for measuring & compiling user activity data and synchronizing it with a suitable fitness application. An increasing number of lifestyle disorders, growing awareness regarding healthy lifestyles, and technological advancements are the key factors propelling segment growth.

Growing adoption of the Internet of Things (IoT) and rising demand for real-time monitoring systems to track fitness activities, calorie burns, & count weight gain or loss are further expected to drive segment growth in the forecast period. Some of the smart wearables that can be used to track healthy lifestyle routines are Apple Watch, Fitbit, Polar Watch, and Garmin.

Key Companies & Market Share Insights

Mergers & acquisitions, major investments in R&D, and the introduction of new features are some of the key factors that will drive the market growth in the forecast period. For instance, in January 2021, Google completed the acquisition of Fitbit, which was announced in November 2019, for USD 2.1 billion. This acquisition was aimed to help the company provide more choices, innovate faster, and make better products.

Similarly, in March 2020, Adidas started offering its users free premium access to its running and training apps as part of its Hometeam initiative, which was launched considering the closure of fitness centers because of the COVID-19 pandemic. Some of the prominent players in the U.K. and Germany diet and nutrition apps market include:

-

Adidas

-

MyNetDiary Inc.

-

FatSecret

-

FitNow, Inc.

-

Eat This Much Inc.

-

Under Armour, Inc.

-

Azumio, Inc.

-

Lifesum AB

-

Fitbit, Inc.

-

MyFitnessPal, Inc.

-

Noom, Inc.

U.K. And Germany Diet And Nutrition Market Report Scope

Report Attribute

Details

The market size value in 2022

USD 26.2 million

The revenue forecast in 2030

USD 105.8 million

Growth rate

CAGR of 19.1 % from 2022 to 2030

The base year for estimation

2021

Actual estimates/Historical data

2017 - 2020

Forecast period

2022 - 2030

Quantitative units

Revenue in USD million and CAGR from 2022 to 2030

Report coverage

Revenue forecast, company share, competitive landscape, growth factors, and trends

Segment Covered

Type, platform, devices

Country scope

U.K., Germany

Key companies profiled

Adidas; MyNetDiary, Inc.; FatSecret; FitNow, Inc.; Eat This Much, Inc.; Under Armour, Inc.; Azumio, Inc.; Lifesum AB; Fitbit, Inc.; MyFitnessPal, Inc.; and Noom, Inc.

15% free customization scope (equivalent to 5 analyst working days)

If you need specific market information, which is not currently within the scope of the report, we will provide it to you as a part of the customization

Customization scope

Free report customization (equivalent to up to 8 analysts' working days) with purchase. Addition or alteration to country, regional, and segment scope.

Pricing and purchase options

Avail of customized purchase options to meet your exact research needs. Explore purchase options

U.K. And Germany Diet And Nutrition Market Segmentation

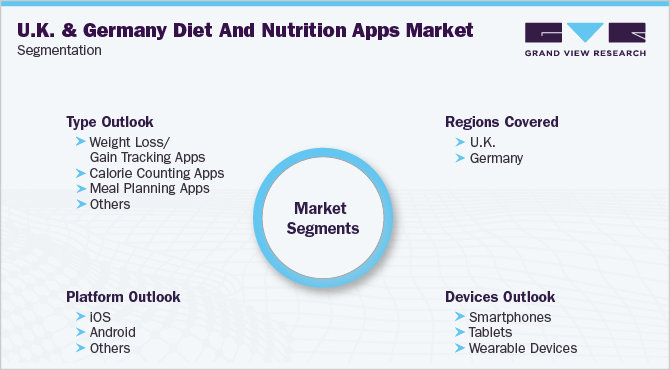

This report forecasts revenue growth at the country level and provides an analysis of the latest industry trends in each of the sub-segments from 2017 to 2030. For this study, Grand View Research, Inc. has segmented the U.K. and Germany diet and nutrition apps report based on type, platform, devices, and country:

-

Type Outlook (Revenue, USD Million, 2017 - 2030)

-

Weight Loss/ Gain Tracking Apps

-

Calorie Counting Apps

-

Meal Planning Apps

-

Others

-

-

Platform Outlook (Revenue, USD Million, 2017 - 2030)

-

iOS

-

Android

-

Others

-

-

Devices Outlook (Revenue, USD Million, 2017 - 2030)

-

Smartphones

-

Tablets

-

Wearable Devices

-

-

Country Outlook (Revenue, USD Million, 2017 - 2030)

-

U.K.

-

Germany

-

Frequently Asked Questions About This Report

b. The UK and Germany Diet and Nutrition Apps market size was estimated at USD 22.1 million in 2021 and is expected to reach USD 26.2 million in 2022.

b. The UK and Germany Diet and Nutrition Apps market is expected to grow at a compound annual growth rate of 19.1% from 2022 to 2030 to reach USD 105.8 million by 2030.

b. In 2021, by type, calorie counting segment held the largest revenue share of 55.1%. This can be attributed to large proportion of companies focusing on introducing innovative technologies to monitor calorie intake that will help in maintaining healthy life style.

b. Some of the major players operating in the UK and Germany Diet and Nutrition Apps market are Adidas, MyNetDiary Inc., FatSecret, FitNow, Inc., Eat This Much Inc., Under Armour, Inc., Azumio, Inc., Lifesum AB, Fitbit, Inc., MyFitnessPal, Inc. and Noom, Inc.

b. Increasing smartphone penetration, rising awareness regarding health & wellness and growing adoption of fitness-related apps, including diet and nutrition apps are some of the major factors driving the UK and Germany Diet and Nutrition Apps market growth

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."