- Home

- »

- Medical Devices

- »

-

UK Ligation Devices Market Size, Industry Report, 2033GVR Report cover

![UK Ligation Devices Market Size, Share & Trends Report]()

UK Ligation Devices Market (2025 - 2033) Size, Share & Trends Analysis Report By Product (Appliers, Accessories), By Application (Gastrointestinal & Abdominal, Urological), By Procedure (Minimally Invasive Surgery, Open Surgery), By End-use, And Segment Forecasts

- Report ID: GVR-4-68040-665-7

- Number of Report Pages: 125

- Format: PDF

- Historical Range: 2021 - 2024

- Forecast Period: 2025 - 2033

- Industry: Healthcare

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

UK Ligation Devices Market Size & Trends

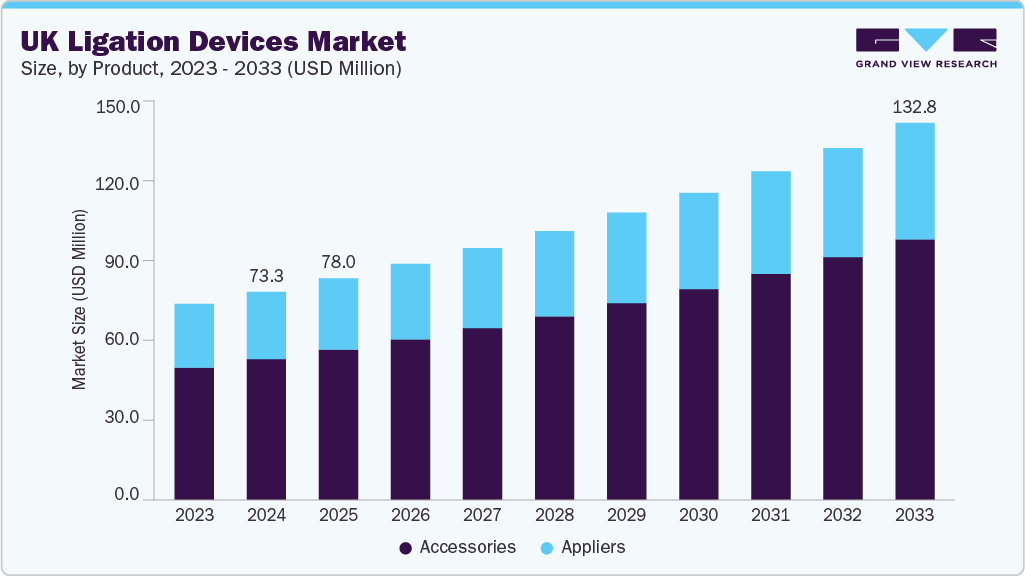

The UK ligation devices market size was estimated at USD 73.25 million in 2024 and is projected to reach a value of USD 132.78 million in 2033 and growing at a CAGR of 6.9% from 2025 to 2033. This market growth is driven by the increasing prevalence of chronic diseases, such as cardiovascular diseases and cancer, which require more surgical procedures, significantly increasing the demand for ligation devices. Technological advancements in surgical techniques, including minimally invasive surgeries (MIS), coupled with the rising geriatric population in the UK, which is more vulnerable to age-related health issues requiring surgical interventions, and government initiatives also contributes to market growth.

The growth of the UK ligation devices market is significantly influenced by the adoption of minimally invasive surgical (MIS) techniques across healthcare facilities. Surgeons in the UK are increasingly transitioning from traditional open procedures toward MIS methods such as laparoscopy and robotic-assisted surgery due to their clinical benefits, including reduced trauma, shorter hospital stays, and quicker recovery times. This procedural shift has enhanced the demand for advanced ligation devices that offer precision, reliability, and compatibility with MIS equipment. Devices such as endoscopic clip appliers are witnessing significant demand as they provide enhanced visibility and control within confined anatomical spaces. Furthermore, NHS modernization efforts and ongoing investments in surgical infrastructure have improved access to advanced surgical technologies. The continuous refinement of surgical protocols and training programs is also ensuring that surgeons are proficient in the use of these devices, further boosting their utilization.

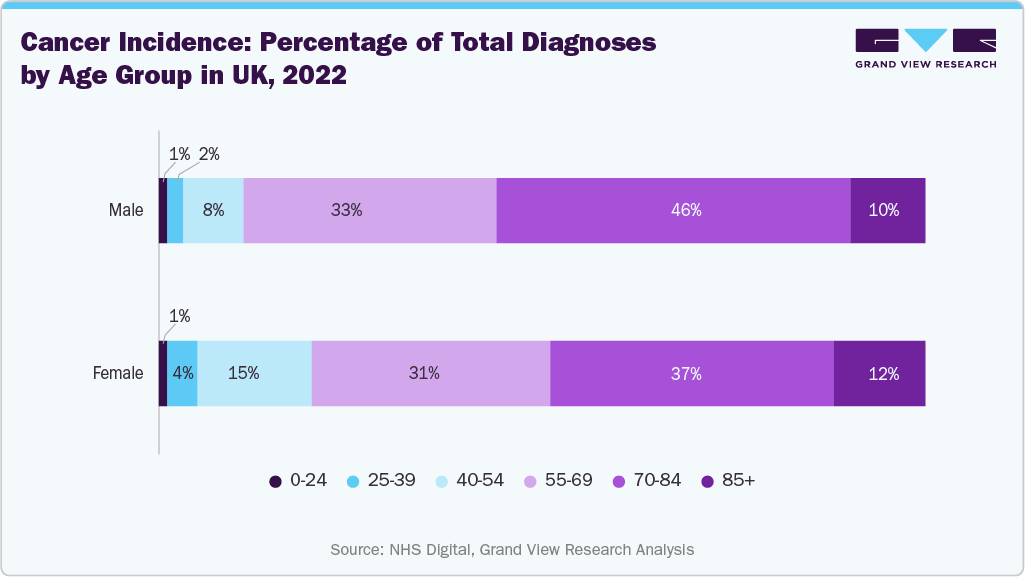

The aging population in the country is also one of the major factors driving the growth of the ligation devices market, as older adults usually experience a higher incidence of chronic and degenerative conditions that require surgical intervention. According to the Centre for Ageing Better 2025, around 19% of the total population or 11 million people in England are aged 65 years or above and around 38% of the total population or 22 million people are aged 50 years or above. Moreover, according to the same source, by 2065, around 26% of the population will be aged 65 years or above and around 46% of the population will be aged 50 years and above. With the growing proportion of individuals aged 65 and older, there is an increased demand for surgeries related to cardiovascular disease, cancer, gastrointestinal disorders, and urological complications, many of which necessitate reliable vessel ligation. Elderly patients often require minimally invasive or precisely controlled procedures to reduce surgical risks and recovery times, further fueling the need for advanced ligation devices that offer safety, and efficiency.

The increasing prevalence of chronic diseases, particularly cancer, further contributes to market growth. As cancer diagnosis rates continue to climb due to aging demographics and improved screening programs, the volume of oncological surgeries is also growing, directly driving the utilization of advanced ligation tools. The need for reliable, efficient, and safe hemostatic control during complex cancer surgeries increases the importance of technologically advanced ligation systems. As the UK healthcare system places increased emphasis on early intervention and surgical treatment of cancer, the demand for high-performance ligation devices is expected to witness significant growth.

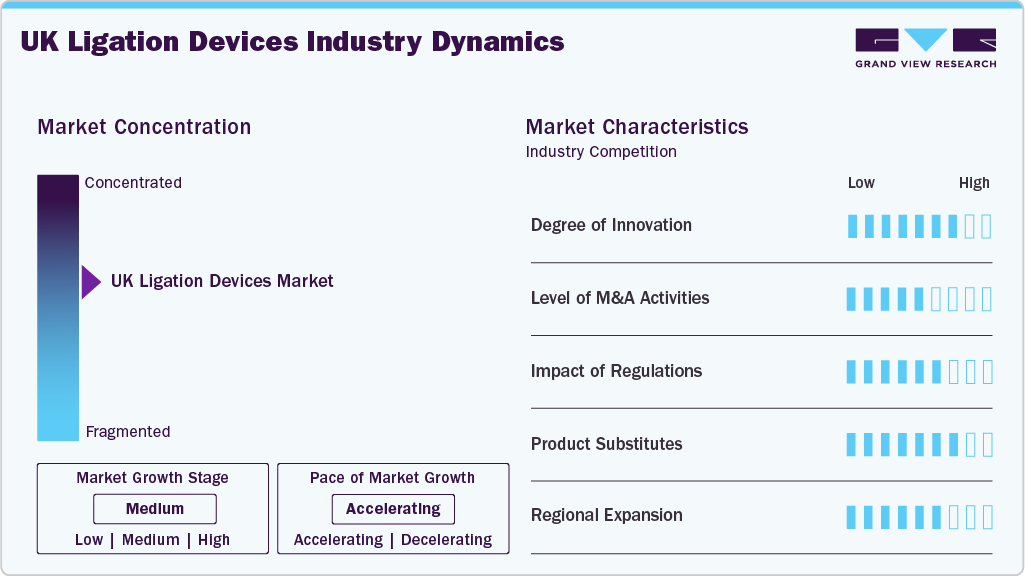

Market Concentration & Characteristics

The US ligation devices market is characterized by increasing surgical volumes and a growing geriatric population. Furthermore, government initiatives and investments in healthcare infrastructure, including the expansion of surgical facilities and the adoption of advanced medical technologies, also contributes to the market growth. The growing preference for minimally invasive procedures, driven by benefits such as reduced recovery time and less scarring, is also a major factor fueling the demand for advanced ligation devices in the UK.

The UK ligation devices industry indicates a moderate degree of innovation, primarily driven by the focus on improving existing device features, such as enhanced precision, ease of use, and biocompatibility. Key areas of innovation include developing advanced materials for ligating clips and sutures, which lead to better tissue handling and fewer complications. In addition, the increasing focus on minimally invasive surgical techniques influences the design of ligation devices to be smaller, more flexible, and compatible with laparoscopic and robotic-assisted procedures.

The UK litigation devices industry has a mix of established players and smaller, specialized firms. M&A activity in this sector could be driven by companies seeking to expand their product portfolios, gain access to new technologies, or increase their market share. Furthermore, M&A can provide benefits such as economies of scale, improved operational efficiencies, and access to new distribution channels.

The UK ligation devices industry is significantly influenced by regulatory frameworks established by the Medicines and Healthcare products Regulatory Agency (MHRA). The MHRA's stringent oversight, aligned with European Union regulations requires strict pre-market approval processes, including comprehensive clinical trials and adherence to the Medical Device Regulations 2002 (SI 2002 No. 618), which implements the EU Medical Devices Directive (93/42/EEC). These regulations ensure device safety and efficacy, influencing market entry timelines and associated costs. Furthermore, the MHRA's post-market surveillance activities, including vigilance reporting and incident investigations, impact product lifecycle management and can lead to device recalls or modifications, affecting market dynamics. The regulatory landscape creates a competitive environment where manufacturers need to prioritize compliance, quality, and robust clinical evidence to gain and maintain market access, thereby influencing product innovation and the overall availability of ligation devices in the UK.

The threat of substitute products in the UK ligation devices industry is a significant consideration, primarily driven by the availability of alternative surgical techniques and technologies. The primary substitutes include advanced energy devices such as ultrasonic and radiofrequency surgical systems, which offer advantages such as reduced thermal spread, potentially leading to less tissue damage and faster patient recovery times. These devices are increasingly adopted in various surgical specialties, including general surgery, gynecology, and urology, where ligation devices are traditionally used. The availability of these substitutes, coupled with the ongoing pressure to reduce healthcare costs within the National Health Service (NHS), intensifies the competitive pressure on ligation device manufacturers.

The UK ligation devices industry is witnessing significant regional expansion. The National Health Service (NHS) plays a significant role, with regional variations in healthcare funding and infrastructure influencing device adoption rates. Regions with higher investment in minimally invasive surgery (MIS) are witnessing increased demand for advanced ligation devices, particularly in specialties such as gynecology, and urology. Furthermore, the presence of specialized surgical centers and teaching hospitals in specific regions contributes to the rise of advanced device usage. The expansion is also influenced by the strategic initiatives of major medical device manufacturers, who are focusing their sales and marketing efforts on regions with favorable reimbursement policies.

Product Insights

The accessories segment accounted for the largest revenue share in 2024, owing to the rise in procedure-specific demand for secure vessel occlusion and tissue management during laparoscopic and robotic-assisted surgeries. NHS trusts and private surgical centers increasingly favor reusable and precision-engineered clip systems, especially titanium and polymer-based ligation clips, for their reliability in critical surgeries such as laparoscopic cholecystectomy and gynecological procedures. The consistent need for clip removers in revision surgeries and post-operative interventions further fuels the segment growth.

The appliers segment is expected to witness the fastest growth over the forecast period. Appliers, particularly those compatible with polymer and titanium clips, are witnessing increased demand as surgical teams emphasize quick clip deployment and user-friendly handling during complex procedures such as laparoscopic cholecystectomy and bowel resection. The availability of reusable appliers designed for multiple sterilization cycles is also witnessing demand in cost-conscious facilities. In addition, the preference for modular appliers that allow interchangeability between clip sizes is expanding due to their operational flexibility during various surgical interventions.

Application Insights

The gastrointestinal and abdominal segment accounted for the largest market share in 2024, owing to the increasing adoption of minimally invasive laparoscopic surgeries for colorectal, bariatric, and gastrointestinal cancer interventions. The rising incidence of conditions such as diverticulitis, gastrointestinal perforations, and peptic ulcers has increased the clinical need for effective tissue ligation and vessel sealing tools during abdominal procedures. NHS hospitals are increasingly equipping their surgical departments with advanced clip appliers and endoloops to streamline gastrointestinal resections, especially amid rising referrals for colorectal cancers linked to national bowel screening programs. Additionally, the growing expertise among UK surgeons in advanced laparoscopic and robotic-assisted gastrointestinal procedures is further fueling segment growth.

The urological application segment is expected to witness the fastest growth over the forecast period. The NHS's emphasis on shorter hospital stays and reduced postoperative complications has enhanced the adoption of laparoscopic and robotic-assisted urological procedures, which frequently utilize ligation devices for vessel sealing and tissue management. Additionally, the aging male population in the UK has led to a higher incidence of BPH-related interventions, boosting procedural volumes where ligation clips and bands are standard. Urology-focused centers across the UK are also integrating advanced reusable appliers and laparoscopic clip applicators into standard protocols, further fueling the growth of segment.

Procedure Insights

The minimally invasive surgeries (MIS) dominated the market in 2024 owing to its several clinical advantages. The technological advancements in MIS, including the development of smaller, more precise instruments and improved imaging technologies, have made these procedures safer and more effective, encouraging their adoption by surgeons. Furthermore, the growing emphasis on patient outcomes, including reduced pain, shorter hospital stays, and faster recovery times, is increasing the value of minimally invasive surgeries.

The open surgery segment is expected to witness significant growth during the forecast period, driven by the increasing technological advancements in ligation devices, which have improved patient outcomes in open surgeries. The prevalence of these procedures, influenced by factors such as the aging population, the incidence of related diseases, and evolving surgical guidelines, directly impacts the market for open ligation devices. Moreover, the cost-effectiveness of open surgery, especially when considering the total cost of care, including equipment, training, and potential complications, can influence its adoption.

End-use Insights

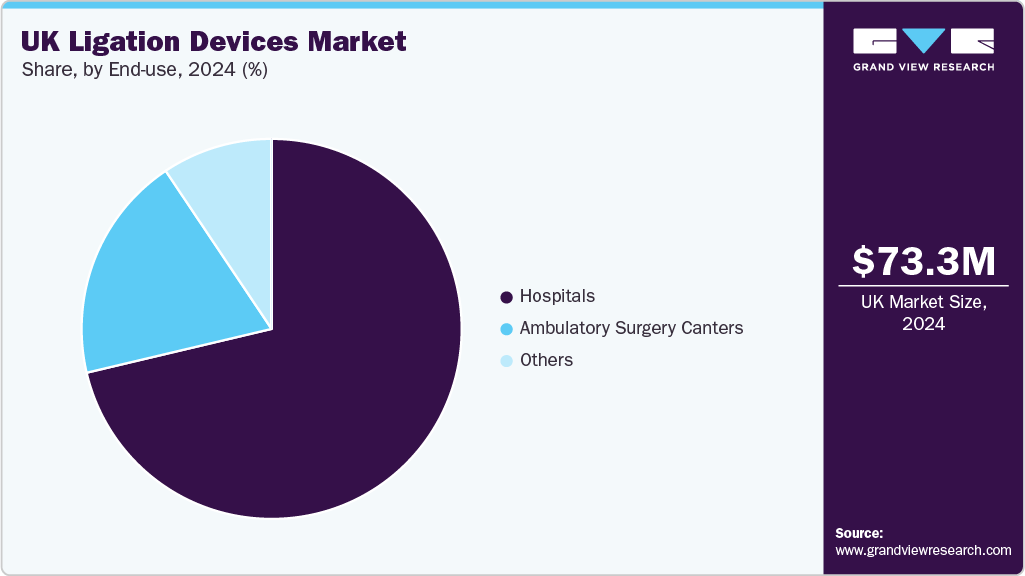

The hospital segment accounted for the largest market share in 2024. This can be attributed to the procedural shifts toward minimally invasive surgeries within NHS and private hospital settings. Hospitals across the UK have significantly increased the adoption of laparoscopic and robotic surgeries for general, gynecologic, and colorectal procedures, which require reliable vessel sealing and ligation tools. Moreover, high-volume surgical centers such as tertiary hospitals and university-affiliated facilities increasingly standardize the use of automated clip appliers and ligation devices to reduce variation in surgical outcomes. This reliance on technologically advanced ligation solutions is directly contributing to the expansion of hospitals in the market.

The growth of ambulatory surgery centers (ASCs) is driven by the increasing surgical preference shift towards outpatient healthcare settings owing to their enhanced patient outcomes and procedural cost efficiency. Moreover, the increasing number of ambulatory surgical sensors coupled with a shorter waiting period in these facilities compared to hospitals and other settings is increasing the patient preference towards these facilities, thereby fueling the segment growth.

Key UK Ligation Devices Company Insights

Leading market players include Grena Ltd, Welfare Medical Ltd, and Medtronic plc. These companies have utilized their technological expertise to enhance their presence in this growing market. Their strategies emphasize the development of effective solutions, improved accessibility, and ensuring widespread adoption of their advanced products.

Key UK Ligation Devices Companies:

- Welfare Medical Ltd

- Grena Ltd

- Medtronic

- Fannin Ltd

- BioSpectrum Ltd

- Teleflex

- LocaMed Ltd

- Johnson & Johnson (Ethicon)

- B. Braun Melsungen

- Boston Scientific Corporation

Recent Developments

-

In February 2025, Teleflex announced plans to separate into two publicly traded companies by mid-2026, splitting its Urology, Acute Care, and OEM businesses into a new independent entity, NewCo, while RemainCo will focus on Vascular Access, Interventional, and Surgical businesses. Both companies are expected to improve operational focus, financial performance, and innovation capacity post-separation.

-

In November 2024, Medtronic acquired Netherlands-based Fortimedix Surgical to enhance its surgical and endoscopy portfolio. Fortimedix specializes in proprietary articulating instruments designed for flexible, robust navigation in endoscopic, minimally invasive, and robotic surgeries, including single-port and multi-port soft tissue robotics.

UK Ligation Devices Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 78.00 million

Revenue forecast in 2033

USD 132.78 million

Growth rate

CAGR of 6.9% from 2025 to 2033

Actual data

2021 - 2024

Forecast period

2025 - 2033

Quantitative units

Revenue in USD million, and CAGR from 2025 to 2033

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product, application, procedure, end-use

Regional scope

UK

Key companies profiled

Welfare Medical Ltd; Grena Ltd; Medtronic; Fannin Ltd; BioSpectrum Ltd; Teleflex; LocaMed Ltd; Johnson & Johnson (Ethicon); B. Braun Melsungen; Boston Scientific Corporation

Customization scope

Free report customization (equivalent to 8 analysts working days) with purchase. Addition or alteration to segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

UK Ligation Devices Market Report Segmentation

This report forecasts revenue growth at country levels and analyzes the latest industry trends in each of the sub-segments from 2021 to 2033. For this study, Grand View Research has segmented the UK ligation devices market report based on product, application, procedure, and end-use:

-

Product Outlook (Revenue, USD Million, 2021 - 2033)

-

Appliers

-

Disposable

-

Reusable

-

-

Accessories

-

Clips

-

Clip Remover

-

-

-

Application Outlook (Revenue, USD Million, 2021 - 2033)

-

Gastrointestinal and Abdominal Surgery

-

Gynecological Surgery

-

Cardiothoracic Surgery

-

Urological Surgery

-

Other

-

-

Procedure Outlook (Revenue, USD Million, 2021 - 2033)

-

Minimally Invasive Surgery (MIS)

-

Laparoscopic

-

Robotic Assisted

-

Others

-

-

Open surgery

-

-

End-use Outlook (Revenue, USD Million, 2021 - 2033)

-

Hospitals

-

Ambulatory Surgical Centers (ASCs)

-

Others

-

Frequently Asked Questions About This Report

b. The UK ligation devices market size was valued at USD 73.25 million in 2024 and is expected to reach a value of USD 78.00 million in 2025.

b. The UK ligation devices market is expected to grow at a compound annual growth rate of 6.88% from 2025 to 2030 to reach USD 132.78 million by 2030.

b. The accessories segment accounted for the largest revenue share in 2024, owing to the rise in procedure-specific demand for secure vessel occlusion and tissue management during laparoscopic and robotic-assisted surgeries.

b. Some key players operating in the UK ligation devices market include Welfare Medical Ltd; Grena Ltd; Medtronic; Fannin Ltd; BioSpectrum Ltd; Teleflex; LocaMed Ltd; Johnson & Johnson (Ethicon); B. Braun Melsungen; Boston Scientific Corporation

b. Key factors driving the growth of the UK ligation devices market include the increasing prevalence of chronic diseases, such as cardiovascular diseases and cancer. Technological advancements in surgical techniques, including minimally invasive surgeries (MIS), coupled with the rising geriatric population in the UK, and government initiatives, also contribute to market growth

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.