- Home

- »

- Homecare & Decor

- »

-

UK Luxury Travel Market Size, Share & Trends, Report 2030GVR Report cover

![UK Luxury Travel Market Size, Share & Trends Report]()

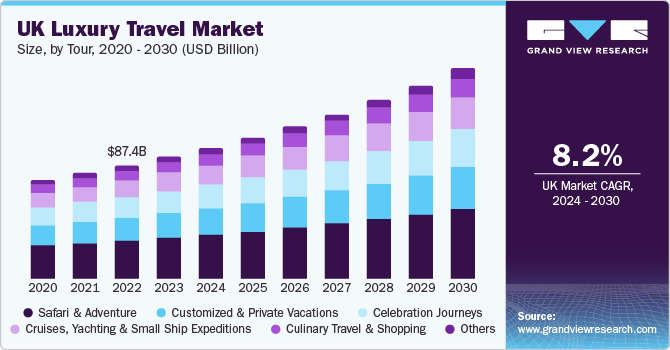

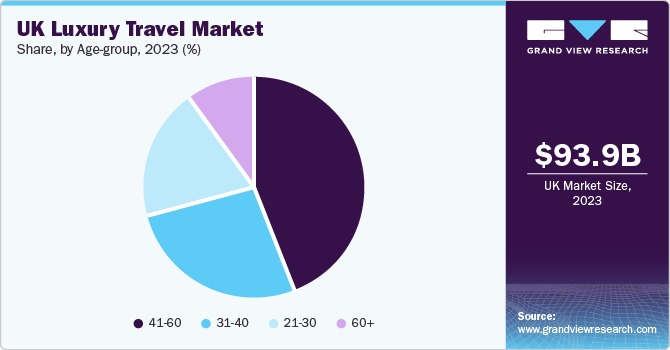

UK Luxury Travel Market Size, Share & Trends Analysis Report By Tour (Customized & Private Vacations, Safari & Adventure), By Age-group (21-30, 31-40, 41-60, & 60+), And Segment Forecasts, 2024 - 2030

- Report ID: GVR-4-68040-203-9

- Number of Report Pages: 80

- Format: PDF, Horizon Databook

- Historical Range: 2018 - 2023

- Forecast Period: 2024 - 2030

- Industry: Consumer Goods

UK Luxury Travel Market Size & Trends

The UK travel market size was estimated at USD 93.88 billion in 2023 and is expected to grow at a compound annual growth rate (CAGR) of 8.2% from 2024 to 2030. Increasing presence of elite travelers in the country. Rising travel connectivity, coupled with rapid penetration of high-speed internet, has made even the most remote places in Europe more accessible to the luxury traveler. According to a report by the Expedia Group Survey in 2022, 6 out 10 travelers are interested in learning about travel options supporting locals. Travelers are seeking destinations that are unique and provide real experiences. This is driving the need to explore new, exotic, and exciting locations across the region, thereby driving the luxury travel market over the forecast period.

A large number of consumers consider cruise tourism as a luxurious, all-inclusive way of traveling. This mode combines various attractions, activities, accommodations, and amenities, which can be compared to, or even considered superior to, those offered on land. According to the Cruise Lines International Association (CLIA), Northern Europe continues to establish itself as an international cruise region and ranks third globally. Post-COVID-19, cruise sailing and yachting have revived at a rapid pace.

A recent study by the top travel trade group UK inbound in August 2022 revealed that couples and empty nesters—adults whose children have left home—from overseas markets are driving the comeback of the U.K.'s inbound tourist industry since the onset of the COVID-19 pandemic. According to Eurostat in July 2022, the U.K. received 1.9 billion tourists in 2022, 88% of those came in July 2019.

The growing desire to escape the stress, hustle-bustle, and routine of everyday life has driven the attraction for travel. High spending power and growing consumer preference for family vacations have propelled the demand for luxury travel. Adventure trips such as camping, and glamping have been proving to be a lucrative business. A wide variety of features is offered by glamping site owners, wherein one is able to charge as much as a luxury hotel would charge per night. Glamping is also referred to as glamorous or luxury camping and has been appealing consumers on account of its nature as it allows consumers to enjoy the best of the outdoors without compromising on everyday comforts.

According to a report by the CBI Ministry of Foreign Affairs in January 2023, the U.K. offers the largest adventure tourism market in Europe, accounting for 19% of the world’s adventure travel tourists. Among British tourists, 40% prefer active vacations. For British teenagers, this share is 45%, and for tourists in their twenties, 54%. Preference for sport-related activities is the main reason to go on a holiday (3.2%), however, is below the European average of 4.4%. British travelers consider their adventure trips less sport related.

Market Concentration & Characteristics

The UK luxury travel market is characterized by moderate degree of innovation, with businesses continuously focusing on differentiating themselves through unique experiences and offerings. This region is mainly attract tourist for its natural beauty and heritage. Increasing need to reconstruct or maintain their old museum, church, and others. Furthermore, cultural destinations incorporating tangible and intangible resources in the tour packages to further push the growing market. Governments and associated tourism organizations have been working on increasing awareness regarding the cultural and heritage aspect of travelers in this region, which is likely to favor the growth of the luxury travel market.

The industry is also characterized by a moderate level of merger and acquisition (M&A) activity by the leading players. Companies in the luxury travel business are also engaging in collaborations and acquisitions in order to expand their presence and strengthen their service portfolio. For instance, in May 2022, Scott Dunn Ltd. a U.K. based luxury tour operator partnered with Nuvei Corporation, a payment platform company based in Canada. As part of the partnership, Nuvei will provide Scott Dunn with a holistic global payment solution. The collaboration was aimed at expanding Scott Dunn’s presence and strengthening its product portfolio.

End-user concentration is a significant factor in the UK luxury travel market. Increasing popularity for trips that include a taste of culture, architecture, & cuisines. Strong cultural traditions that include culinary experiences and heritage experiences also present significant educational and volunteer possibilities for both young and old tourists, which promotes the interchange of ideas across various cultures and generations.

Tour Insights

The luxury safari & adventure travel market held a revenue share of 34.01% in 2023. Safari & adventure trips such as camping, and glamping have been proving to be a lucrative business. A wide variety of features is offered by glamping site owners, wherein one is able to charge as much as a luxury hotel would charge per night. Glamping is also referred to as glamorous or luxury camping and has been appealing consumers on account of its nature as it allows consumers to enjoy the best of the outdoors without compromising on everyday comforts.

Theluxuryculinary travel & shopping market is expected to grow at a CAGR of 9.5% from 2024 to 2030. The growth is attributed to the phenomenon known as “screen tourism or intangible tourism” occurs when a particular cuisine or any merchandise related to any movie/series is portrayed on television, which subsequently draws tourists there. According to a 2019 report on Heritage and the Economics of On-Screen Tourism, visitors to locations used in movies and television shows contributed £140 billion to the U.K. economy with the purchase of merchandise products. This included a sizable number of shows shot at historical locations, including Broadchurch, Downton Abbey, and Harry Potter.

Age-group Insights

The participation of travelers between 41 to 60 years of age accounted to the market share of 43.71% in 2023 owing to high disposable income of this demographic. Most elderly travelers view their travel experiences from a leisure and learning perspective; checking-off a bucket list and continuing to expand their knowledge of the world’s culture and histories. This, combined with their financial means to spend on such trips, has resulted in a large market for luxury travel.

The participation of travelers between 21 to 30 years of age in luxury travel activities is estimated to grow at a CAGR of 8.9%from 2024 to 2030. Social media, and Instagram in particular, have provided a significant boost in hospitality spending for countries that were able to tap into influencer marketing and picture-perfect experiences. Furthermore. most millennial who are adventure travelers have cited exploring new places, relaxation, time with family/friends, and learning about new cultures as the most important part of their travel experiences.

Key UK Luxury Travel Company Insights

Some of the key players operating in the market include Cox & Kings Ltd., Scott Dunn Ltd. and Exodus Travels Limited.

-

Exodus Travels Limited is a privately held tour and travel company that offers transportation services, flights, and accommodations, along with providing tour planning and guidance services. It was founded in 1974 and is headquartered in Surbiton, England. The company offers walking & trekking, wildlife & polar, cycling holidays, cultural holidays, family holidays, winter holidays, and private adventures. It offers over 500 holidays to over 90 countries across the globe.

-

Cox & Kings Ltd., principal services offered by the company are destination management, outbound tourism, business travel, incentive & conference solution, domestic holidays, NRI, trade fairs, foreign exchange, and insurance.

Backroads, Butterfield & Robinson, and Jet2 Holidays are some of the emerging market participants in the UK travel market,

-

Backroads is an adventure travel company. The company offer international travel such hiking, walking, and biking tours.

-

Jet2 Holidays is the third largest Airline in UK. It was formed in 2007 as a subsidiary of Dart Group PLC, and a sister to Jet2.com.

Key UK Luxury Travel Companies:

- Cox & Kings Ltd.

- Scott Dunn Ltd.

- Exodus Travels Limited.

- Backroads

- Butterfield & Robinson

- Jet2 Holidays

- Lindblad Expeditions

- Thomas Cook Group

- Zicasso

- Micato Safaris

UK Luxury Travel Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 101.01 billion

Revenue forecast in 2030

USD 161.68 billion

Growth rate

CAGR of 8.2% from 2024 to 2030

Actuals

2018 - 2023

Forecast period

2024 - 2030

Quantitative units

Revenue in USD billion, and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Tour, age-group

Country scope

UK

Key companies profiled

Cox & Kings Ltd.; Scott Dunn Ltd. ; Exodus Travels Limited.; Backroads; Butterfield & Robinson; Jet2 Holidays; Lindblad Expeditions; Thomas Cook Group; Zicasso; Micato Safaris

Customization scope

Free report customization (equivalent up to 8 analysts’ working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

UK Luxury Travel Market Report Segmentation

This report forecasts revenue growth at regional, and country levels and provides an analysis of the latest trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the UK luxury travel market report based on tour, and age-group:

-

Tour Outlook (Revenue, USD Billion, 2018 - 2030)

-

Customized & Private Vacations

-

Safari & Adventure

-

Cruises, Yachting & Small Ship Expeditions

-

Celebration Journeys

-

Culinary Travel & Shopping

-

Others

-

-

Age-group Outlook (Revenue, USD Billion, 2018 - 2030)

-

21-30

-

31-40

-

41-60

-

60+

-

Frequently Asked Questions About This Report

b. The UK luxury travel market size was estimated at USD 93.88 billion in 2023 and is expected to reach USD 101.01 billion in 2024.

b. The UK luxury travel market is expected to grow at a compound annual growth rate of 8.2% from 2024 to 2030 to reach USD 161.68 million by 2030.

b. Luxury safari & adventure travel dominated the UK luxury travel market with a share of more than 34% in 2023. Safari & adventure trips such as camping, and glamping have been proving to be a lucrative business.

b. Some key players operating in the UK luxury travel market include Cox & Kings Ltd.; Scott Dunn Ltd.; Exodus Travels Limited.; Backroads; Butterfield & Robinson; Jet2 Holidays; Lindblad Expeditions; Thomas Cook Group; Zicasso; Micato Safaris

b. Key factors that are driving the UK luxury travel market growth include the increasing presence of elite travelers in the country. Rising travel connectivity, coupled with rapid penetration of high-speed internet, has made even the most remote places in Europe more accessible to the luxury traveler.

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."