- Home

- »

- Medical Devices

- »

-

UK Oral Care Market Size, Share And Growth Report, 2030GVR Report cover

![UK Oral Care Market Size, Share & Trends Report]()

UK Oral Care Market Size, Share & Trends Analysis Report By Product (Toothbrush, Toothpaste, Mouthwash/rinse, Dental Products, Dental Accessories), By Distributional Channels, By Region, And Segment Forecasts, 2024 - 2030

- Report ID: GVR-4-68040-198-0

- Number of Report Pages: 150

- Format: PDF, Horizon Databook

- Historical Range: 2018 - 2022

- Forecast Period: 2024 - 2030

- Industry: Healthcare

Market Size & Trends

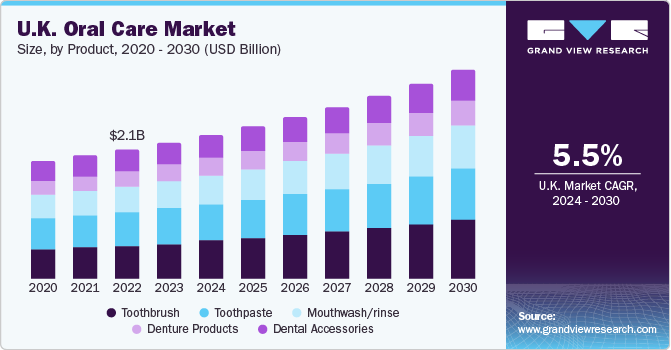

The UK oral care market size was valued at USD 2.3 billion in 2023 and is anticipated to grow at a compound annual growth rate (CAGR) of 5.5 % from 2024 to 2030. This growth is attributed to the rising prevalence of dental conditions, increasing preference for cosmetic dentistry, and the rise in disposable income.

As per the data published by the Public Health England survey, about 27.0% of adults reported untreated tooth decay of an average of two teeth, contributing to the high demand for oral care in the region. In addition, the awareness of oral care among the population isalso a significant driving factor . The UK ranked first for a good oral care regime as per the Sunstar Group survey conducted for oral care awareness worldwide.

Dental conditions such as dental caries and enamel decay are prevalent amongst the young population of the UK. In June 2022, the British Dental Journal reported that around 33.4% of secondary school children with visible dental cavities in their teeth. The prevalence of dental caries among the young population is expected to witness growth in the oral care market over the forecast years.

Moreover, consumers are shifting their choices more towards innovative technology-based oral care products. This phenomenon in turn leverages the market growth. For instance, in July 2023, Parla Limited launched its new product such as probiotic-based mouthwash tablets and floss to fulfill the demand for eco-friendly oral care products.

Market Concentration & Characteristics

The market is characterized by a high degree of merger and acquisition activities undertaken by key players in the country. Several oral care companies expanding their product portfolio, featuring the significance of oral care products and innovation. For instance, in February 2024, Unilever announced the acquisition of the premium haircare K18 brand to expand its geographical existence and company portfolio.

The market is highly influenced by technological innovation and new oral care products. This is due to the increasing preference of consumers for innovative products and the rising importance of oral care. For instance, in November 2023, Kent Brushes launched its SONIK electric toothbrush in the UK market. These toothbrushes are designed to provide deeper cleaning using ultrasonic pulses, high-quality bristles, a super-fast charging facility, and lightweight waterproof designs.

Furthermore, product expansion is significant in this market. Several key players with the focus on regional expansion invest largely in this country. For instance, in August 2022, an Ireland-based oral company, Spotlight Oral Care started offering its oral care products in Europe to expand its company portfolio and gain a large number of consumers.

Product Insights

Based on products, the toothbrush segment dominated the market with a revenue share of about 26.0% in 2023. The development of innovative products such as electric toothbrushes has escalated their use among the population than manual toothbrushes. Moreover, the presence of modernized attributes and higher efficiency of these products results in greater adoption. For instance, in April 2022, Reswirl, UK UK-based company launched the world’s first zero-waste, fully recyclable toothbrush made up of bio-PBS and biodegradable material.

The mouthwash/rinse is anticipated to witness the fastest growth over the forecast period. Increasing awareness about oral care amongst the population and dentists' recommendations to enhance dental care, is likely to fuel the market growth. Moreover, key manufacturers in the oral care market are focusing on the innovative and high efficiency products to improve the oral health and overall experience of consumers. For instance, Clinical Health Technologies Ltd, in November 2020, launched Clinisept+ mouthwash in the market. The product consists of the high amount of hypochlorous in turn provides higher purity, efficacy and safety.

Distribution Channels Insights

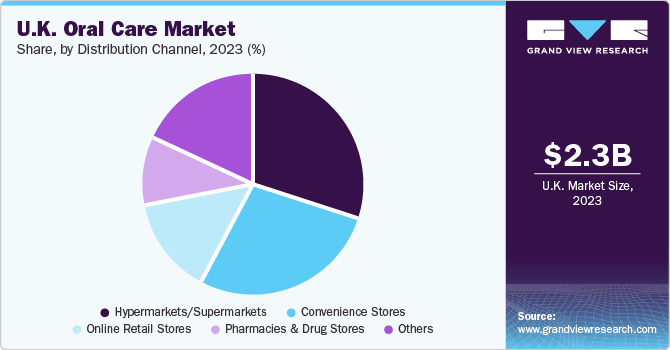

Based on the distribution channels, supermarkets/hypermarkets dominated the market in 2023 owing to the availability of widely spread supermarkets and hypermarkets in the region. Moreover, robust discounts of stores reduce the cost burden of retailers and consumers, in turn leading to market growth. For instance, in October 2023, Tesco, the leading supermarket in the UK offered VAT coverage on kids' toothbrushes, toothpaste, and mouthwash to help young consumers with tooth decay. This strategic move aims to make it affordable for low-income families.

The online retail segment is projected to witness the fastest CAGR over the forecast period. The driving factors of the market growth include the provision of oral care services at home, online selling of oral care products, and huge discounts on home delivery services and products. Moreover, some of the key players of the region run marketing campaigns organized campaign to highlight the company’s oral care offerings. The campaign featured the company’s eco-friendly PowerSmile Whitening Toothpaste and other vegan oral care products.

Key UK Oral Care Company Insights

Some of the prominent key players operating in the oral care market include Unilever, and GLAXOSMITHKLINE PLC, CosmoLab, MIL-UK. PSP-Dental, Cinoll, ElectricTeeth, AHL, Septodont, and CODIBEL, among others. Competition between key players is to get intense over the forecast years as they are focusing on geographical expansion, mergers and acquisitions through collaborations, and marketing campaigns.

Key UK Oral Care Companies:

The following are the leading companies in the UK oral care market. These companies collectively hold the largest market share and dictate industry trends. Financials, strategy maps & products of these UK oral care companies are analyzed to map the supply network.

- GLAXOSMITHKLINE PLC.

- UNILEVER

- DR. FRESH, LLC

- Wisdom Toothbrushes

- Curaprox UK

- Oralieve

- DenTek

- Lush

- UltraDEX

- Waken

- 3M oral care

- Splat Oral Care

- Dentocare

- Oral Health Foundation

- JASON Naturals

Recent Developments

-

In September 2023, Oral care brand, Waken announced the launch of Sonic Electric toothbrush. This toothbrush consists of new-patented technology of “Precision-power” with long-term rechargeable batteries and multiple cleaning ways.

-

In September 2021, GSK launched a sustainable toothbrush named as “Dr Best GreenClean toothbrush. This novel product of the company aims to build the world’s most sustainable toothbrush manufacturer company across the globe.

UK Oral Care Market Report

Report Attribute

Details

Market size value in 2024

USD 2.42 billion

Revenue Forecast in 2030

USD 3.51 billion

Growth rate

CAGR of 5.5% from 2024 to 2030

Historical data

2018 - 2022

Forecast period

2024 - 2030

Quantitative units

Revenue in USD Million and CAGR from 2024 to 2030

Report Coverage

Revenue forecast, company ranking, competitive landscape, growth factors, trends

Segments Covered

Product, distribution channels

Country scope

UK

Key companies profiled

GLAXOSMITHKLINE PLC.; UNILEVER ; DR.FRESH,LLC; Wisdom Toothbrushes; Curaprox UK; Oralieve; DenTek; Lush; UltraDEX; Waken; 3M oral care; Splat Oral Care; Dentocare; Oral Health Foundation; JASON Naturals

Customization scope

Free report customization (equivalent to up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

UK Oral Care Market Report Segmentation

This report forecasts revenue growth at and country level and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the UK oral care market report based on product, distribution channel.

-

Product Outlook (Revenue, USD Million, 2018 - 2030)

-

Toothbrush

-

Manual

-

Electric (Rechargeable)

-

Battery-powered (Non-rechargeable)

-

Others

-

-

Toothpaste

-

Gel

-

Polish

-

Paste

-

Powder

-

-

Mouthwash/rinse

-

Medicated

-

Non-medicated

-

-

Denture Products

-

Cleaners

-

Fixatives

-

Floss

-

Others

-

-

Dental Accessories

-

Cosmetic Whitening Products

-

Fresh Breath Dental Chewing Gum

-

Tongue Scrapers

-

Fresh Breath Strips

-

-

-

Distribution Channels Outlook (Revenue, USD Million, 2018 - 2030)

-

Hypermarkets/Supermarkets

-

Pharmacies and drug stores

-

Convenience Stores

-

Online retail stores

-

Other

-

Frequently Asked Questions About This Report

b. The UK oral care market is estimated at USD 2.3 billion in 2023 and is expected to reach USD 2.4 billion in 2024.

b. The UK oral care market is expected to grow at a CAGR of 5.5% from 2024 to 2030 to reach USD 3.51 billion in 2030.

b. The toothbrush dominated the market with a revenue share of about 26.0% in 2023. The development of innovative products such as electric toothbrushes has escalated their use among the population than manual toothbrushes.

b. Some of the prominent key players operating in the oral care market include Unilever, and GLAXOSMITHKLINE PLC, CosmoLab, MIL-UK. PSP-Dental, Cinoll, ElectricTeeth, AHL, Septodont, and CODIBEL, among others.

b. Key driving factors include rising prevalence of dental conditions, increasing preference for cosmetic dentistry, and the rise in disposable income.

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."