U.K. PPE In Construction Market Trends

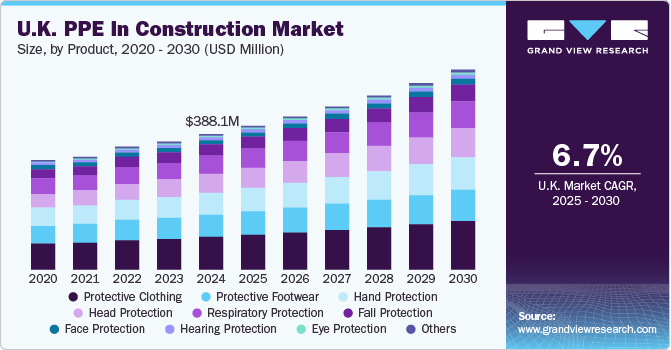

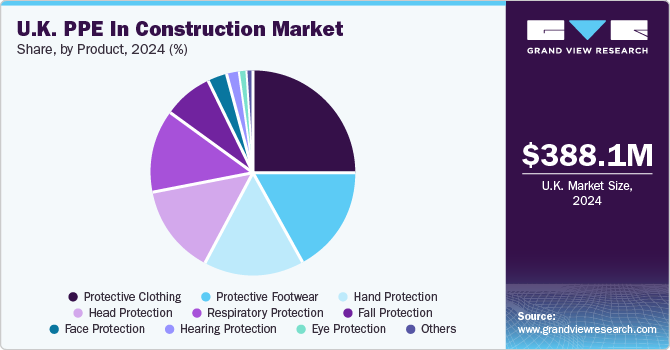

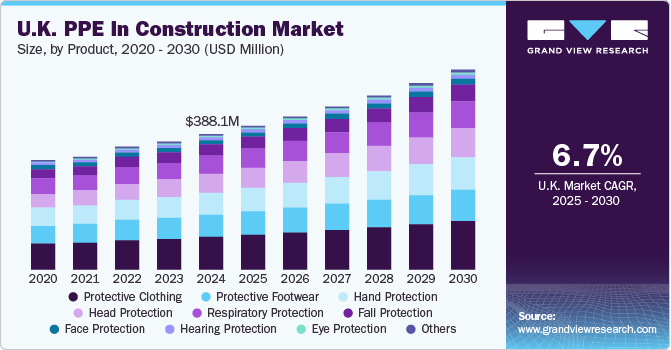

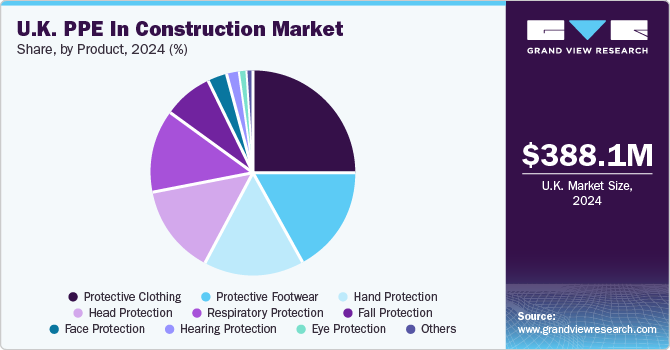

The U.K. PPE in construction market size was valued at USD 388.1 million in 2024 and is projected to grow at a CAGR of 6.7% from 2025 to 2030. Increasing developments in the commercial and residential sectors have led to a steady expansion of the construction industry in the region. Several notable national projects have been launched or completed in recent years, such as the Thames Tideway, Heathrow Airport expansion, The New Hospital Programme, the Palace of Westminster restoration, the High Speed 2 (HS2) tunnel between London and West Midlands, and others. Such projects have necessitated the availability of significant manpower, leading to increased concerns regarding their safety during construction activities. This has led to a substantial growth of the U.K. personal protective equipment (PPE) in construction industry demand.

The Construction Industry Training Board (CITB) published an industry outlook report for 2024-2028, where it stated that there would be a need for around 251,000 additional construction workers by 2028 in the U.K. This demand is expected to be enabled by improvements in the economy, which is expected to strengthen the construction sector. However, the industry also presents several notable risks for workers caused by accidents, including medical expenses, insurance claims, and loss of productivity, which can impact project timelines and create strain on resources. Increasing awareness regarding the importance of worker safety due to stringent regulations is anticipated to drive market expansion. The Health and Safety Executive (HSE) implements safety and health regulations across various industries in the U.K., focusing on the construction vertical. Moreover, the Health and Safety at Work Act (HSWA) 1974 outlines the ‘duty of care’ concept that has compelled construction firms to take all practical steps to ensure worker safety. This involves the provision of worker training that includes proper use of PPE.

Personal protective equipment (PPE) kits have various inherent properties, such as heat and UV tolerance, wear resistance, flexibility, toughness, and durability. Other notable qualities, such as flame retardancy and improved breathability, have made protective equipment a necessary aspect of the construction industry. PPE manufacturing companies in the U.K. are designing and supplying products to several end-use industries based on the amount of protection required for workplace hazards through innovative technologies. Most manufacturers either leverage their proprietary technology or license it from other industry participants to enhance their offerings. The rising importance of high-end materials that exhibit specialty features, including improved heat resistance, lightweight, wear & tear resistance, and enhanced comfort, has been a major incentive for companies to conduct extensive R&D activities. These factors are expected to result in a steady growth of the U.K. PPE in construction industry.

Product Insights

The protective clothing segment emerged with a leading revenue share of 24.5% in the U.K. PPE in construction industry in 2024. These types of PPE are used to protect the worker from heat & flames, offer thermal insulation and waterproofing, and can be used for general purposes. Construction sites are inherently risky environments, with workers exposed to various hazards such as falling objects, heavy machinery, electrical hazards, extreme temperatures, and chemicals. The implementation of stringent safety regulations that require workers to wear protective clothing to prevent injury from hazardous materials and physical harm has created a substantial demand for such products. Moreover, the development of advanced materials and fabrics has led to an increase in demand for more effective protective clothing. For instance, lightweight, breathable, and moisture-wicking fabrics are being incorporated into construction gear, enhancing worker comfort while maintaining protection.

The respiratory protection segment is expected to grow at the highest CAGR from 2025 to 2030 in the U.K. PPE in construction industry. These products protect employees from hazardous gases & vapors, radiological particles, particulates, chemical agents, and biological contaminants that witness substantial emissions during construction activities. Factors such as technological innovations, improvements in respirator performance, and stringent enforcement of workplace safety standards across the U.K. are expected to boost investments and innovations in this segment. Air-purifying respirators are used to protect wearers against vapors and gases that are at lesser atmospheric concentrations than the standard atmospheric concentration. Meanwhile, supplied-air respirators provide high-level respiratory protection and positive pressure to the mask so that leakage is outward. These respirators are light and can be used for longer periods when compared to self-contained breathing apparatus.

Key U.K. PPE In Construction Company Insights

Some major companies involved in the U.K. PPE in construction industry include DuPont, 3M, and Safetec Direct Ltd, among others.

-

DuPont offers a comprehensive range of products designed to protect workers across various industries from workplace hazards. Their PPE products are particularly crucial for sectors such as utilities, manufacturing, and healthcare. Notable offerings include Tyvek protective clothing, Kevlar gloves that meet EN 388 standards, and Nomex heat and flame protection products.

-

3M is a multinational organization involved in the development, manufacturing, and distribution of products in various sectors, including industrial products, worker safety, healthcare, and consumer goods. The company produces more than 60,000 products, ranging from adhesives and abrasives to personal protective equipment (PPE) and medical devices. 3M offers PPE solutions across different categories, including eye protection, fall protection, head & face protection, hearing protection, respiratory protection, and masks & barrier face coverings, among others.

Key U.K. PPE In Construction Companies:

- 3M

- Honeywell International Inc.

- DuPont

- uvex group

- MSA

- ANSELL LTD.

- JSP Ltd.

- Lindström

- DELTA PLUS

- Safetec Direct Ltd

Recent Developments

-

In October 2024, Lindström Group announced the acquisition of Micronclean’s industrial workwear division, which includes customer contracts, textiles, and on-site service personnel in the UK. Micronclean is a textile service firm that offers workwear and cleanroom services in India and the UK. The development is expected to aid Lindström in strengthening its presence in the heavy industry sector.

-

In March 2024, safety equipment manufacturer uvex announced the launch of the ‘uvex profi pure HG’ safety glove, which has been designed to offer workers optimum grip in damp or wet environments. The product uses a novel ‘Hydro Grip’ polymer coating that improves gripping while also maintaining traction. The coating also has waterproof properties and has a cotton fiber lining to ensure wearer comfort for longer periods.

U.K. PPE in Construction Market Report Scope

|

Report Attribute

|

Details

|

|

Market size value in 2025

|

USD 412.4 million

|

|

Revenue forecast in 2030

|

USD 571.4 million

|

|

Growth rate

|

CAGR of 6.7% from 2025 to 2030

|

|

Base year for estimation

|

2024

|

|

Historical data

|

2018 - 2023

|

|

Forecast period

|

2025 - 2030

|

|

Report updated

|

December 2024

|

|

Quantitative units

|

Revenue in USD million and CAGR from 2025 to 2030

|

|

Report coverage

|

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

|

|

Segments covered

|

Product

|

|

Key companies profiled

|

3M; Honeywell International Inc.; DuPont; uvex group; MSA; ANSELL LTD.; JSP Ltd.; Lindström; DELTA PLUS; Safetec Direct Ltd

|

|

Customization scope

|

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

|

|

Pricing and purchase options

|

Avail customized purchase options to meet your exact research needs. Explore purchase options

|

U.K. PPE In Construction Market Report Segmentation

This report forecasts revenue growth at the country level and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the U.K. PPE in construction market report based on product: