- Home

- »

- Next Generation Technologies

- »

-

U.K. Point Of Sale Software Market Report, 2021-2028GVR Report cover

![U.K. Point Of Sale Software Market Size, Share & Trends Report]()

U.K. Point Of Sale Software Market Size, Share & Trends Analysis Report By Application (Fixed POS, Mobile POS), By Deployment, By Organization Size, By End-user, And Segment Forecasts, 2021 - 2028

- Report ID: GVR-4-68039-620-4

- Number of Report Pages: 57

- Format: PDF, Horizon Databook

- Historical Range: 2016 - 2019

- Forecast Period: 2021 - 2028

- Industry: Technology

Report Overview

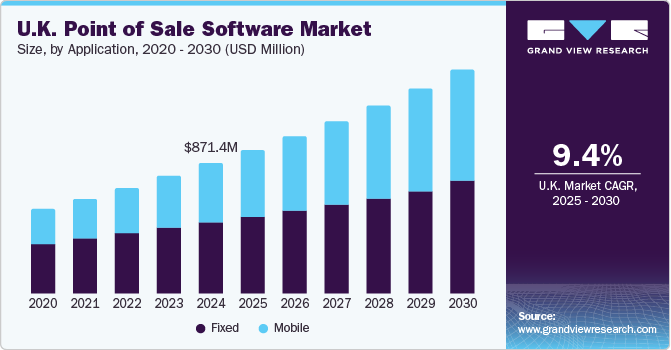

The U.K. point of sale software market size was valued at USD 549.0 million in 2020 and is expected to expand at a compound annual growth rate (CAGR) of 8.1% from 2021 to 2028. The demand for Point-Of-Sale (POS) software can be attributed to the rise in cashless economy, demand for mobile POS terminals, and increasing number of payment applications. The U.K. is rapidly moving toward a cashless economy, furthered by the COVID-19 pandemic. This is expected to increase the usage of payment wallets and budget-friendly mPOS terminals, favoring the market growth. Moreover, mobile and tablet-based POS terminals are more economical for small and medium-sized businesses and the availability of affordable iOS and Android compatible software is driving the adoption of POS software over the forecast period.

A POS system has become a vital tool for many businesses in the U.K. to manage long queues and provide quick payment facilities. Initially, POS terminals with compatibly integrated software facilitated cashless payment transactions. However, upgrades in POS software offer multiple functions such as employee management, loyalty and gift card management, inventory management, everyday sales tracking, and insights on popular products and sales trends.

The add-on POS functions help scale the business competitively and manage multiple location information for a holistic view of sales and other functions. The U.K. restaurant industry has more widely adopted POS solutions to run the business. The average cost of POS software ranges between USD 79 to USD 150 per month while the hardware is a one-time investment starting at nearly USD 799. The cost of software usually increases for retailers as they need multiple functions for a successful business operation. The robust online retail industry in the U.K. and the increased offline retail space has further bolstered the demand for POS terminals and their software.

The country witnessed severe setbacks due to the COVID-19 pandemic, which led to the temporary shutdown of businesses across the retail, restaurant, hospitality, and other industries. While BFSI and healthcare sectors continued to operate amid the pandemic, owing to the necessity of attending patients and keeping the economy running, retail and restaurant industries suffered heavy revenue loss in 2020, which led to a decline in the sales of POS terminals and subsequently impacted the POS software demand during the year. Hence, the industries shifted to using alternative POS solutions such as mPOS and mobile wallets for payment transactions. While restaurants upgraded their software to provide online food sales and delivery, small retailers started promoting their business online and using compatible POS solutions to facilitate sales. This support of POS software in online sales, tracking, and payments helped businesses thrive during the pandemic. With the third wave in action and the looming fourth wave in the U.K., business owners are opting for POS software, which is continuously being upgraded with features to support online sales and transactions without the physical presence of the customer.

Application Insights

The mPOS terminals segment is expected to expand at the highest CAGR of over 10% during the forecast period. The low cost of installation and portability is contributing to the increasing demand for mPOS terminals. The rise in the adoption of mPOS terminals amid the COVID-19 pandemic has resulted in the rapidly growing demand for compatible POS software across industries. Mobile-based POS systems are capable of creating revenue growth channels, thereby attracting retail, restaurant, and other industries to leverage numerous marketing channels for gaining a competitive edge in the market. The POS software application in mPOS is driven by the demand across SMBs, as mPOS provides the flexibility of using tablets or smartphones as a POS with minimal investment in software subscriptions.

The POS software application is segmented into fixed POS terminal and mobile POS terminal. The integration of POS software in fixed POS terminals is often provided by the vendor’s partners. The end users can also select a software vendor of their choice based on the nature of the business. A traditional fixed POS terminal is a set of devices comprising a PC monitor, keyboard, processing unit, cash drawer, pole display, barcode reader, and printer. Large-scale businesses widely adopt these systems as they need a continuous power supply, are complex and require high maintenance. Moreover, large retail, restaurant, and other business are wary of security concerns and handling of terminals by employees. Hence, the adoption of POS software for fixed POS terminals is majorly driven by large-scale businesses.

Deployment Insights

Based on deployment, the U.K. POS software market is segmented into cloud and on-premises. The on-premises deployment type emerged as the largest revenue contributor with a market share of over 57% in 2020. The on-premises deployment POS software is preferred by large enterprises that need to protect large volumes of confidential customer financial and identity information. Although on-premises deployment offers access to data even in offline mode, cloud deployment is an economical option for small-size businesses.

The POS deployment on the cloud helps leverage Software as a Service (SaaS) capability in the existing personal computers, mobiles, and tablets. The inclination toward deploying a POS solution on the cloud is supported by the low cost of installation as there is no need for separate hardware. However, cloud-deployed software can only be used while the system is connected via the internet. A poor internet connection can hinder usage and halt business functions.

Organization Size Insights

Based on organization size, the market is categorized into large enterprises and SMEs. The large enterprises segment contributed the highest revenue share of over 58% and is expected to dominate the market over the forecast period. POS software is used by large enterprises to carry out hassle-free transactions, track sales, and link the data back to an inventory control system, which provides large enterprises insightful information to make critical business decisions.

The SMEs segment is expected to witness high growth over the forecast period. The software for mobile POS (mPOS) terminals is widely adopted by small vendors owing to the low cost of installation and scaling of business without the hassle of installing the complete hardware system. Moreover, a large number of SMEs are encouraged to adopt contactless payment methods amid the COVID-19 pandemic. This trend is expected to have long-term effects in the U.K. as the fourth wave is looming in the country and the change in payment methods has been welcomed by the population.

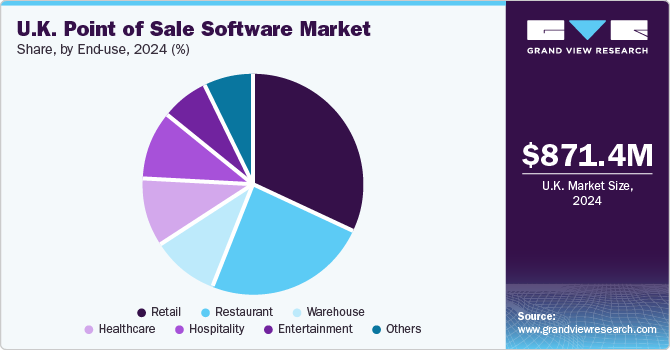

End-user Insights

The end users of POS software solutions identified for the market include retail, restaurants, hospitality, healthcare, entertainment, and others. POS solutions compatible with POS terminals help avoid billing errors and ensure reliability by managing inventory, employees, and other information crucial for business. The healthcare segment is expected to expand at the highest CAGR of over 9% during the forecast period with the influx of patients during the COVID-19 pandemic. POS functions such as storing records of COVID-19-affected patients, managing the list of vaccinated individuals, ensuring smooth payment processes, and scheduling shifts for employees are contributing to the increasing demand for POS software in U.K. hospitals.

With the combination of a traditional POS strategy with a mobile POS strategy, retailers and other end users have more flexibility for leveraging the benefits of a sophisticated retail management solution. POS software provides the capability of using mobile devices to connect with customers, sell anywhere, and run the business smoothly. mPOS software offers several payment alternatives that are outside the control of the major brand card interchange processors such as MasterCard and Visa. However, mobile payment providers are expected to modify the transaction processing structure in the country by capturing a growing share of the payment volume.

Country Insights

The market is expected to expand at a CAGR of 8.1% over the forecast period. Higher disposable incomes and living standards have supported the growth of retail markets, thereby boosting the demand for POS terminals and their software. The most common non-cash payment methods opted by the U.K. consumers include the credit and debit card payment system by the domestic debit card scheme, EFTPOS, and international credit and debit cards schemes such as Diners, MasterCard, Visa, and Amex. The growing usage of these payment methods by the new generation is expected to change the payment landscape in the U.K. and provide a lucrative opportunity for growth over the forecast period.

The growing number of mobile payment technologies based on wallet applications is favorably impacting the market growth. Additionally, Europay, MasterCard, and Visa (EMV) regulations ensure the security of payment using wallets. The payment acceptance is supported by POS software, which is anticipated to positively impact the market growth. However, the negative impact of the COVID-19 pandemic on the retail, restaurant, and service industries slowed down the overall growth of the market.

Key Companies & Market Share Insights

The concentration of U.S.-headquartered POS software vendors is high in the U.K. Companies such as Lightspeed; Square Inc.; Oracle Micros; and TouchBistro are considered among the major players. Other popular vendors in the market comprise Epos Now, PayPal (iZettle), iiko UK & Europe, and Zonal. The industry players have been adopting partnership, product launch, and acquisition strategies to gain a competitive edge over their competitors in the market. For instance, in November 2020, SumUp, a U.K. global payments service company, acquired Goodtill, a POS software company.

The prominent vendors in the U.K. market partner with the payment provider, application integrator, or distributors to increase their revenue and strong product offering. For instance, in January 2020, Vend partnered with Klarna, a global payment provider, to provide more flexibility in payment options. Vend is also a preferred retail POS software vendor of the British Independent Retail Association. Similarly, in March 2021, Enactor Limited, which provides PoS and mPoS retail store software, collaborated with Retail247 Consulting Ltd to leverage its technical expertise in integration, business analysis, and implementation capabilities for delivering curated software within time and budget. Some of the prominent players operating in the U.K. point of sale software market are:

-

Lightspeed

-

Square Inc.

-

PayPal Inc. (iZettle)

-

TouchBistro

-

Oracle

-

NCR Corporation

-

ShopKeep

-

Revel Systems

-

iiko UK & Europe

-

Clover Network Inc.

U.K. Point Of Sale Software Market Report Scope

Report Attribute

Details

Market size value in 2021

USD 606.0 million

Revenue forecast in 2028

USD 1.05 billion

Growth rate

CAGR of 8.1% from 2021 to 2028

Base year for estimation

2020

Historical data

2016 - 2019

Forecast period

2021 - 2028

Quantitative units

Revenue in USD million and CAGR from 2021 to 2028

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Application, deployment, organization size, end-user

Country scope

U.K.

Key companies profiled

Lightspeed; Square Inc.; PayPal Inc. (iZettle); TouchBistro; Oracle; NCR Corporation; ShopKeep; Revel Systems; iiko UK & Europe; Clover Network Inc.

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country and segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Segments Covered in the ReportThis report forecasts revenue growth at the country level and provides an analysis of the latest industry trends in each of the sub-segments from 2016 to 2028. For this study, Grand View Research has segmented the U.K. point of sale software market report based on application, deployment, organization size, and end-user:

-

Application Outlook (Revenue, USD Million, 2016 - 2028)

-

Fixed POS

-

Mobile POS

-

-

Deployment Outlook (Revenue, USD Million, 2016 - 2028)

-

Cloud

-

On-premises

-

-

Organization Size Outlook (Revenue, USD Million, 2016 - 2028)

-

Large Enterprises

-

SMEs

-

-

End-user Outlook (Revenue, USD Million, 2016 - 2028)

-

Restaurant

-

Hospitality

-

Healthcare

-

Retail

-

Entertainment

-

Other

-

Frequently Asked Questions About This Report

b. The U.K. point of sale software market size was valued at USD 549.0 million in 2020 and is expected to reach USD 606.0 million in 2021.

b. The U.K. point of sale software market is expected to grow at a compound annual growth rate of 8.1% from 2021 to 2028 to reach USD 1.05 billion by 2028.

b. The fixed POS terminals segment registered the highest revenue share in 2020 in the U.K. POS software market and is expected to continue dominating the industry over the forecast period.

b. Some key players operating in the U.K. point of sale software market include Lightspeed, Square Inc., Oracle Micros, Epos Now, PayPal (iZettle), iiko UK & Europe, Zonal, and TouchBistro

b. Key factors that are driving the U.K. POS software market growth include the rise in the cashless economy, demand for mobile POS terminals, and an increasing number of payment applications.

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."