- Home

- »

- Pharmaceuticals

- »

-

UK Prescription Weight Loss Medications Market Report 2033GVR Report cover

![UK Prescription Weight Loss Medications Market Size, Share & Trends Report]()

UK Prescription Weight Loss Medications Market (2026 - 2033) Size, Share & Trends Analysis Report By Product (Incretin-Based Therapies For Weight Management), By Route Of Administration (Injectable, Oral), By Prescribing Channel, And Segment Forecasts

- Report ID: GVR-4-68040-837-1

- Number of Report Pages: 150

- Format: PDF

- Historical Range: 2021 - 2024

- Forecast Period: 2026 - 2033

- Industry: Healthcare

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

UK Prescription Weight Loss Medications Market Summary

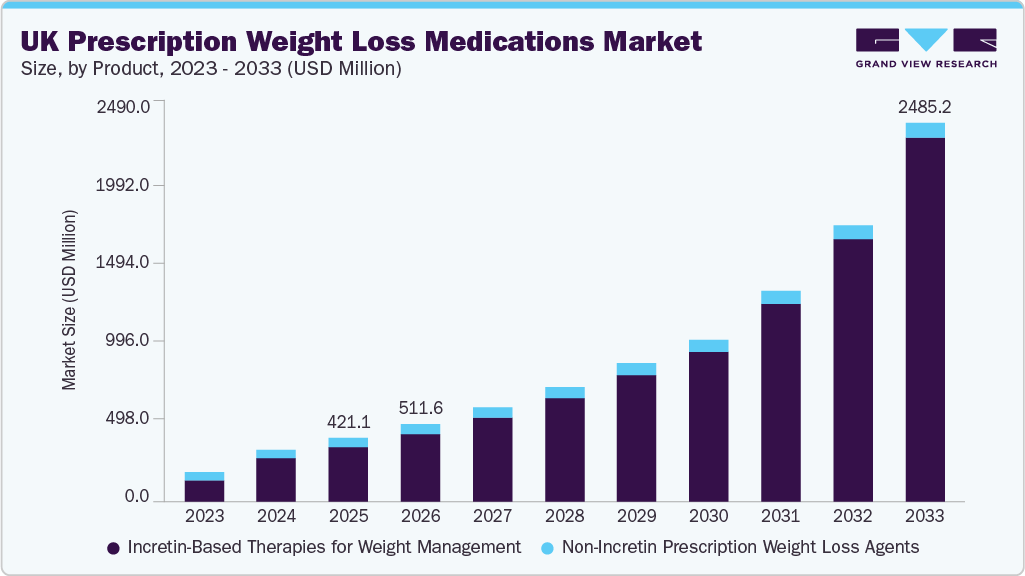

The UK prescription weight loss medications market size was estimated at USD 421.07 million in 2025 and is projected to reach USD 2,485.23 million by 2033, growing at a CAGR of 24.85% from 2026 to 2033. Growth is driven by rising obesity prevalence, increasing clinical adoption of incretin-based therapies, expanding access through private and digital prescribing channels, and growing patient awareness.

Key Market Trends & Insights

- By product, incretin-based therapies for weight management segment dominated the market with a share of 85.54% in 2025.

- By route of administration, injectable weight loss medications segment held the majority share of 83.46% in 2025.

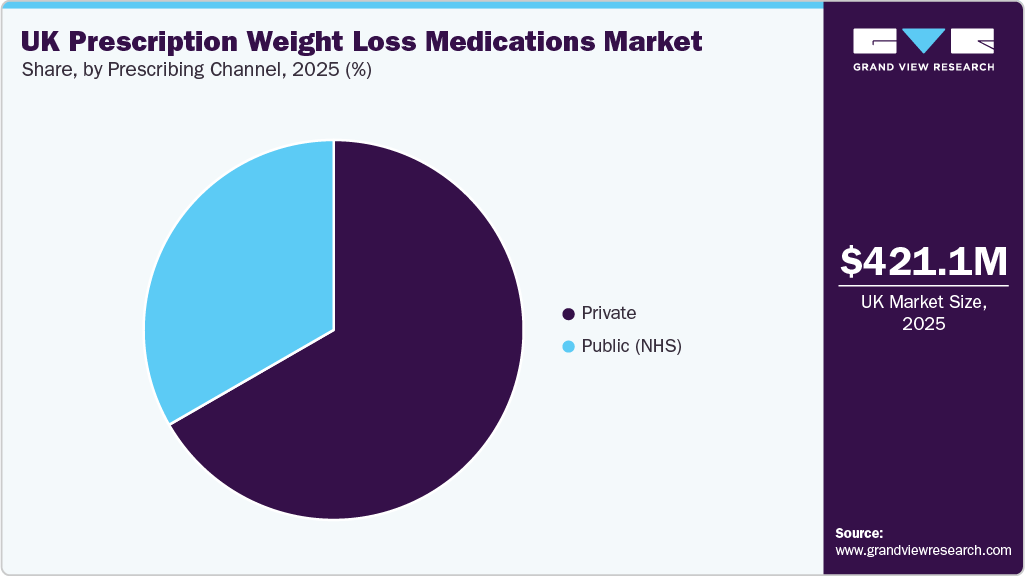

- By prescribing channel, private channel is the largest segment with market share of 66.68% in 2025.

Market Size & Forecast

- 2025 Market Size: USD 421.07 Million

- 2033 Projected Market Size: USD 2,485.23 Million

- CAGR (2026-2033): 24.85%

The UK prescription weight loss medications market is currently influenced by several key factors. The prevalence of obesity and overweight individuals in the country is a significant driver, as data from March 2025 indicate that approximately 64% of adults in England are classified as overweight or obese, with 29% meeting the criteria for obesity (BMI ≥30 kg/m²).This large and persistent portion of the population creates a steady demand for weight-management solutions, particularly prescription-based treatments, as individuals increasingly seek alternatives to lifestyle changes such as diet and exercise. Obesity is often linked to various comorbidities such as type 2 diabetes, cardiovascular disease, and hypertension, further elevating the need for effective pharmacological treatments. As the population dealing with these health issues continues to grow, the demand for prescription weight loss medications is expected to rise, creating a sustainable market base for these treatments.

Another important factor is the shift in the regulatory and public-health environment, which has facilitated the adoption of pharmacological solutions. Notably, in 2023, the National Institute for Health and Care Excellence (NICE) approved Semaglutide (Wegovy) for managing obesity, and in late 2024, it extended approval to Tirzepatide (Mounjaro). These regulatory endorsements have made obesity treatment more accessible under the public healthcare system. As of early 2025, approximately 344,927 patients in England received licensed weight-loss medications under the NHS, marking a significant step toward integrating pharmacological treatments into routine healthcare. This trend is expected to continue as NICE guidelines evolve and more medications are approved for obesity management. The formal recognition of obesity as a medical condition that requires pharmacological intervention is not only improving access but also instilling confidence among patients and healthcare providers in the long-term use of these drugs.

The rapid uptake of effective medications, particularly GLP-1 receptor agonists like Semaglutide and Tirzepatide, has shifted the competitive landscape in the UK. These medications offer significant weight loss results, with clinical trials demonstrating body weight reductions of 15-20% when combined with lifestyle interventions. By 2025, prescribing volumes for GLP-1-based weight-loss medications surpassed those of older treatments, such as Orlistat, indicating a clear preference for these more effective options. However, uptake within the public healthcare system remains limited due to eligibility criteria and phased rollout. Consequently, a large number of patients are turning to private healthcare providers to access these medications. This has led to the growth of the private sector, where demand for weight-loss medications is high, driven by patients who seek effective treatments even when they do not meet NHS eligibility thresholds. This growing private sector represents a significant market opportunity, especially as more individuals opt to pay for faster access to these treatments, reflecting the evolving demand for weight-loss solutions in the UK.

Opportunity Analysis

The UK prescription weight-loss medications market presents several key opportunities that could drive growth in the coming years. One significant gap is the limited access to treatments for individuals with lower-severity obesity (BMI 27-30), which constitutes a large portion of the population at risk for obesity-related health conditions. While the NHS prioritizes patients with more severe obesity or associated comorbidities, individuals without these health issues currently have restricted access to pharmacological interventions. Expanding treatment eligibility to include patients with lower-severity obesity, particularly through more accessible and affordable options such as oral medications, could significantly expand the addressable market. Additionally, increasing patient awareness and education regarding the benefits of prescription weight-loss therapies, especially GLP-1 medications, could help address underutilization, particularly among lower-income or less health-literate groups. This would ensure that a broader segment of the population is aware of and able to benefit from these treatments.

Another important opportunity lies in the development and adoption of oral GLP-1 therapies, which offer a more convenient and less invasive alternative to injectable treatments. As patient preference tends to favor oral medications over injectables due to ease of use and comfort, oral GLP-1 therapies are expected to gain significant traction in both public and private healthcare settings. This shift is likely to be facilitated by general practitioners (GPs), who are more accustomed to prescribing oral therapies, which could lead to increased prescription volumes and faster adoption. Moreover, the introduction of biosimilars as patents for existing GLP-1 drugs expire represents an opportunity to reduce treatment costs, making these medications more accessible to a wider patient base, particularly in the private market. Integrating weight-loss medications into broader chronic disease management, such as for patients with type-2 diabetes and hypertension, could further drive market growth by expanding the scope of weight-loss treatments within existing healthcare pathways. Addressing these unmet needs, such as improving access for patients with lower-severity obesity and leveraging cost-reducing strategies like biosimilars, will be key to the future development of the UK prescription weight-loss medications market.

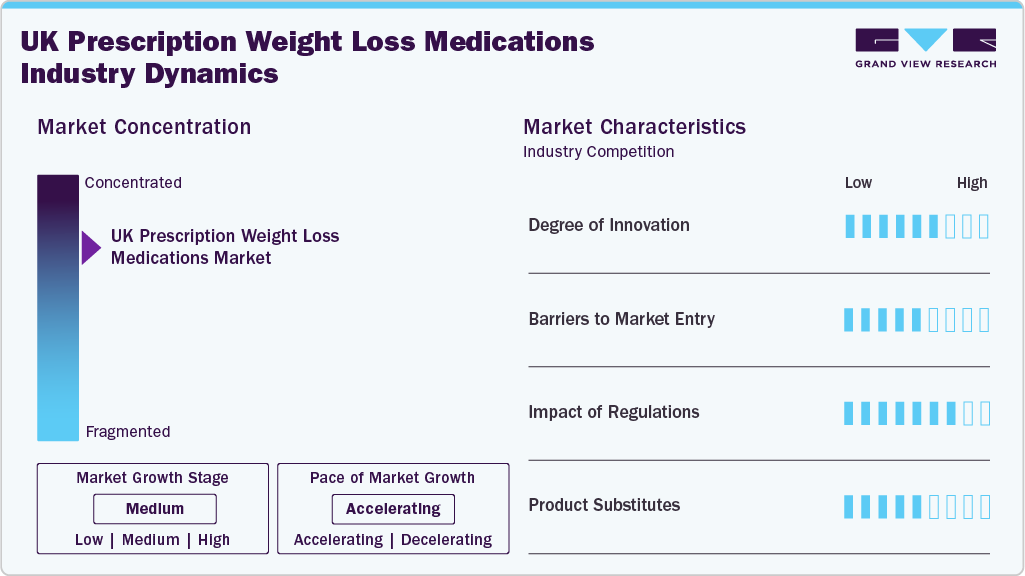

Market Concentration & Characteristics

The UK prescription weight-loss medications market exhibits a moderate level of concentration, with a few key players leading the development and distribution of pharmacological treatments. The market is largely shaped by the availability of GLP-1 therapies, such as Semaglutide and Tirzepatide, which have become pivotal in the treatment of obesity. These medications, approved under the National Institute for Health and Care Excellence (NICE) guidelines, have gained significant traction, particularly in the private healthcare sector. While competition exists in terms of alternative treatments, such as older medications like Orlistat, the entry of newer, more effective therapies has redefined the market landscape. As a result, market concentration is gradually increasing, although there is still room for additional players to introduce innovative treatments and address unmet needs, particularly for patients with lower-severity obesity.

The degree of innovation in the UK prescription weight-loss medications market has been notably high in recent years, driven primarily by the development of GLP-1 receptor agonists. Medications such as Semaglutide and Tirzepatide have revolutionized obesity treatment, offering significantly greater efficacy than previous options. Clinical data indicates that these drugs can reduce body weight by 15-20%, making them more effective than traditional weight-loss medications or lifestyle interventions alone. The introduction of oral formulations for these therapies further enhances accessibility and convenience, representing a significant innovation in treatment delivery. Additionally, ongoing research and development into alternative pharmacological solutions, including potential weight-loss biosimilars, will continue to foster innovation within the market.

Barriers to market entry in the UK prescription weight-loss medications market are substantial, primarily due to the stringent regulatory approval processes and the high costs associated with bringing new treatments to market. Regulatory bodies, including the National Institute for Health and Care Excellence (NICE), require robust clinical data to approve medications for use within the NHS, and this can significantly delay market entry. Furthermore, pharmaceutical companies must invest heavily in research and development to create treatments that meet both safety and efficacy standards. Additionally, the competitive nature of the market, dominated by established players with successful treatments, presents a significant challenge for new entrants seeking to secure a foothold.

Regulations have a significant impact on the UK prescription weight-loss medications market, primarily through the approval process governed by NICE and the Medicines and Healthcare products Regulatory Agency (MHRA). NICE plays a key role in determining which medications are eligible for public reimbursement under the NHS, and this can directly affect market dynamics. The approval of medications like Semaglutide and Tirzepatide has been pivotal in expanding access to prescription weight-loss treatments. However, regulatory guidelines also introduce restrictions, such as eligibility criteria for NHS prescriptions, which limit access for certain patient groups, thereby affecting market growth. Ongoing regulatory shifts, including potential future approvals of oral GLP-1 therapies and biosimilars, will continue to shape the market.

In the UK prescription weight-loss medications market, the primary substitutes to pharmacological treatments are lifestyle interventions such as diet modifications and physical activity. However, for individuals struggling with severe obesity or obesity-related comorbidities, these alternatives often prove insufficient, leading to a higher reliance on prescription medications. Older weight-loss medications, like Orlistat, continue to serve as substitutes, but they are less effective compared to newer therapies such as GLP-1 receptor agonists. The development of non-injectable options, such as oral GLP-1 medications, could further challenge the use of injectable therapies, offering an alternative with fewer barriers to patient adoption.

Product Insights

Incretin-based therapies for weight management segment dominated the market with a share of 85.54% in 2025. These therapies, including semaglutide (Wegovy) and tirzepatide (Zepbound), have become central components in the management of obesity, offering highly effective weight-loss solutions. Clinical studies have shown that these medications can lead to significant weight reductions of up to 15-20%, with tirzepatide, a dual GLP-1 and GIP receptor agonist, demonstrating even greater efficacy, with up to 22.5% weight loss in pivotal trials. As of 2025, these therapies are widely prescribed in both NHS and private healthcare settings, and demand is expected to grow steadily as more patients seek effective solutions for obesity and related metabolic diseases. The introduction of dual- and multi-agonist therapies, such as Retatrutide and CagriSema, which target multiple metabolic pathways, is poised to further expand the effectiveness of weight-loss treatments. These newer therapies have demonstrated even more promising results, with early-stage trials showing weight loss of up to 24.2%. However, the broader adoption of these advanced therapies will depend on regulatory approval and clinical trial outcomes in the coming years.

Non-incretin prescription weight-loss agents are the fastest-growing segment in the UK obesity treatment market, despite the increasing prevalence of incretin-based therapies. These medications, which include lipase inhibitors like Orlistat and centrally acting agents such as Mysimba, provide alternative weight-loss options for patients who may not be suitable candidates for, or prefer not to use, hormonal therapies. Orlistat, a well-established treatment that inhibits fat absorption, continues to appeal to patients due to its lower cost and oral administration, making it accessible for individuals who may not have the financial means to afford more expensive injectable therapies. Additionally, Mysimba, a combination of naltrexone and bupropion, regulates appetite and reduces food intake, offering an effective solution for patients who require oral treatments. While the segment faces competition from more effective therapies, non-incretin agents continue to be vital for specific patient groups who seek non-hormonal alternatives, contributing to their rapid growth in the market. The appeal of these agents is expected to persist as they serve as more affordable and accessible options, particularly in regions or healthcare systems where access to newer, injectable therapies may be limited.

Route Of Administration Insights

Injectable weight loss medications segment held the majority share of 83.46% in 2025, due to their proven efficacy in delivering greater and more consistent weight reduction compared to older oral therapies or lifestyle interventions alone. Medications like semaglutide and tirzepatide have demonstrated substantial improvements in body weight, metabolic health, and long-term disease risk, making them increasingly preferred by clinicians treating obesity. A key study published in May 2025 in The New England Journal of Medicine highlighted the effectiveness of tirzepatide, which achieved 20.2% weight loss compared to 13.7% with semaglutide, while also showing greater reductions in waist circumference. This strong clinical evidence has reshaped expectations around medical weight-loss treatments, driving increased demand across both public and private healthcare systems. With many injectable treatments requiring minimal in-person follow-up and administered once a week, they provide greater convenience than traditional therapies, fitting well into self-managed routines.

Oral weight-loss medications are fastest growing segment in the UK market, driven by increasing demand for convenient and accessible alternatives to injectable therapies. Traditional options, such as orlistat and bupropion-naltrexone, have provided modest benefits, but the growing recognition of obesity as a chronic condition has heightened interest in pharmacological treatments. Oral medications are particularly attractive to patients who are hesitant about injections or those who lack access to specialist services. As more individuals seek medical support earlier in their weight-management journey, oral treatments offer a practical and accessible entry point for a broader patient population. The arrival of next-generation oral incretin therapies, such as high-dose oral semaglutide and new non-peptide GLP-1 receptor agonists, is expected to dramatically enhance the market.

Prescribing Channel Insights

Private channel is the largest segment with market share of 66.68% in 2025, has become a key component of the UK weight-loss medication market as more individuals seek faster, personalized access to treatments. Patients often turn to private clinics when NHS pathways involve long waiting times or when eligibility criteria limit access to newer therapies. These clinics offer more flexible and personalized treatment plans, including extended consultations, clinical assessments, and tailored weight-management strategies, making them particularly attractive for patients looking for quick, effective solutions. The private model allows for a more integrated approach, combining medication with services such as nutritional counseling, behavioral coaching, and regular follow-ups, which helps improve long-term patient adherence.

Public prescribing channel segment is the fastest growing segment in the forcast period. The NHS remains the most influential prescribing channel in the UK prescription weight-loss medications market, driven by its role as the primary healthcare provider for individuals with obesity and related health conditions. With obesity prevalence continuing to rise, GPs and NHS specialists are facing increasing demand for effective weight-loss treatments beyond lifestyle interventions. However, access to advanced therapies is restricted by national policies and commissioning criteria. For example, in March 2023, the National Institute for Health and Care Excellence (NICE) recommended semaglutide for weight management in adults with a BMI of ≥35.0 kg/m² and at least one weight-related comorbidity. These structured eligibility criteria, which include specific BMI reductions for certain ethnic groups, reinforce the NHS's central role in treatment pathways.

Key UK Prescription Weight Loss Medications Company Insights

The UK prescription weight-loss medications market features a diverse group of key players, each contributing to the development and availability of obesity treatments. The major companies involved in this space include Novo Nordisk, Eli Lilly, F. Hoffmann-La Roche, GSK, Sanofi, AstraZeneca, Teva Pharmaceutical Industries, Sandoz, and Viatris. These companies vary in their approaches, with some focusing on incretin-based therapies like GLP-1 receptor agonists, while others are exploring generics, biosimilars, and combination therapies for future market entry.

Key UK Prescription Weight Loss Medications Companies:

- Novo Nordisk

- Eli Lilly

- F. Hoffmann-La Roche

- GSK

- Sanofi

- AstraZeneca

- Teva Pharmaceutical Industries

- Sandoz

- Viatris

Recent Developments

-

In July 2024, the UK regulator MHRA approved a new indication for semaglutide (Wegovy) to reduce the risk of serious cardiovascular events (heart attack, stroke) in overweight or obese adults, making it not only a weight-management drug but also one for cardiovascular risk reduction.

-

In November 2025, AstraZeneca exercised an option to acquire SixPeaks Bio, a weight-loss/obesity-drug startup, for USD 170 million (plus milestone payments), signaling a major push into its obesity drug pipeline.

-

In March 2025, F. Hoffmann-La Roche entered into an exclusive collaboration and licensing agreement with Zealand Pharma to co-develop and co-commercialize its amylin analog petrelintide for overweight/obesity, both as monotherapy and in combination with CT-388.

UK Prescription Weight Loss Medications Market Report Scope

Report Attribute

Details

Market size value in 2026

USD 511.58 million

Revenue forecast in 2033

USD 2,485.23 million

Growth rate

CAGR of 24.85% from 2026 to 2033

Base year for estimation

2025

Historical data

2021 - 2024

Forecast period

2026 - 2033

Quantitative units

Revenue in USD million/billion and CAGR from 2026 to 2033

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product, route of administration, prescribing channel

Key company profiled

Novo Nordisk; Eli Lilly; F. Hoffmann-La Roche; GSK; Sanofi; AstraZeneca; Teva Pharmaceutical Industries; Sandoz; Viatris

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

UK Prescription Weight Loss Medications Market Report Segmentation

This report forecasts revenue growth at country level and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2033. For this study, Grand View Research has segmented the UK prescription weight loss medications market report based on product, route of administration, and prescribing channel:

-

Product Outlook (Revenue, USD Million, 2021 - 2033)

-

Incretin-Based Therapies for Weight Management

-

Approved for Weight Loss

-

Semaglutide (Wegovy)

-

Liraglutide (Saxenda)

-

-

Approved for Other Indications but Used Off-Label for Weight Loss

-

Semaglutide (Ozempic)

-

Tirzepatide (Mounjaro)

-

Dulaglutide (Trulicity)

-

oral semaglutide (Rybelsus)

-

-

Oral GLP-1 & Incretin Therapies (Expected Market Entry)

-

Oral Semaglutide (50 mg obesity dose) - expected 2026-2027

-

Orforglipron (non-peptide oral GLP-1 RA) - expected 2027-2028

-

Amycretin (oral GLP-1 analog) - pipeline (forecast scenario)

-

-

Dual / Multi-Agonists (High-Impact Future Therapies)

-

Tirzepatide (Zepbound) - Injectable (obesity approved US; UK expected)

-

Retatrutide - Injectable (GLP 1/GIP/Glucagon triple agonist)

-

Cagrisema (Cagrilintide + Semaglutide) - Injectable

-

Survodutide (BI 456906) - Injectable (GLP 1/Glucagon dual agonist)

-

Pemvidutide - Injectable (GLP-1/Glucagon)

-

-

-

Non-Incretin Prescription Weight Loss Agents (Approved + generics + centrally acting agents)

-

Lipase Inhibitors (Orlistat)

-

Centrally Acting Agents (Bupropion/Naltrexone (Mysimba) - licensed in EU/UK for WL)

-

-

-

Route Of Administration Outlook (Revenue, USD Million, 2021 - 2033)

-

Injectable Weight Loss Medications

-

Oral Weight Loss Medications

-

-

Prescribing Channel Outlook (Revenue, USD Million, 2021 - 2033)

-

Public (NHS)

-

NHS Primary Care Prescriptions

-

NHS Specialist / Hospital Prescriptions

-

-

Private

-

Private (In-clinic) Prescriptions

-

Digital / Online Prescribing Platforms

-

-

Frequently Asked Questions About This Report

b. The UK prescription weight loss medications market size was estimated at USD 421.07 million in 2025 and is expected to reach USD 511.58 million in 2026.

b. The UK prescription weight loss medications market is expected to grow at a compound annual growth rate of 24.85% from 2026 to 2033 to reach USD 2,485.23 million by 2033.

b. Incretin-based therapies for weight management segment dominated the UK prescription weight loss medications market with a share of 85.54% in 2025. These therapies, including semaglutide (Wegovy) and tirzepatide (Zepbound), have become central components in the management of obesity, offering highly effective weight-loss solutions

b. Some key players operating in the UK prescription weight loss medications market include Novo Nordisk, Eli Lilly, F. Hoffmann-La Roche, GSK, Sanofi, AstraZeneca, Teva Pharmaceutical Industries, Sandoz, Viatris

b. Key factors that are driving the market growth include rising obesity prevalence, increasing clinical adoption of incretin-based therapies, expanding access through private and digital prescribing channels, and growing patient awareness.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.