- Home

- »

- Alcohol & Tobacco

- »

-

UK Roll-Your-Own Tobacco Products Market, Industry Report, 2030GVR Report cover

![UK Roll-Your-Own Tobacco Products Market Size, Share & Trends Report]()

UK Roll-Your-Own Tobacco Products Market Size, Share & Trends Analysis Report By Product (RYO Tobacco, Rolling Paper & Cigarette Tubes), By Distribution Channel (Offline, Online), And Segment Forecasts, 2024 - 2030

- Report ID: GVR-4-68040-234-6

- Number of Report Pages: 75

- Format: PDF, Horizon Databook

- Historical Range: 2018 - 2023

- Forecast Period: 2024 - 2030

- Industry: Consumer Goods

Market Size & Trends

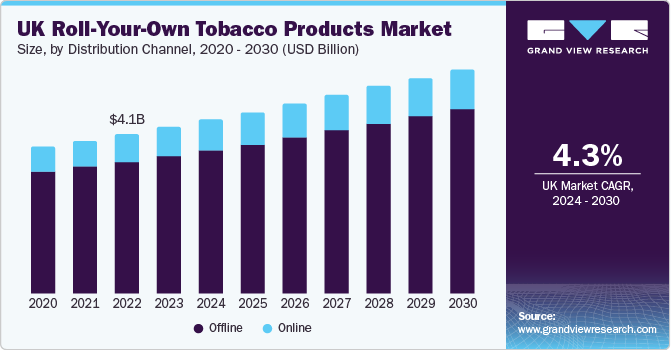

The UK roll-your-own tobacco products market size was estimated at USD 4.32 billion in 2023 and is expected to grow at a CAGR of 4.3% from 2024 to 2030.The notable rise in tobacco product usage among millennials is responsible for the market's progress. The main factors propelling the market expansion over the projection period are the growing preference for handmade cigarettes over factory-made ones because of their lower cost and the growing acceptance of RYO tobacco.

The UK market accounted for a share of 13.3% of the global roll-your-own tobacco products market in 2023. The market for roll-your-own tobacco products is expanding primarily because to the fast-rising tobacco consumption of both women and teenagers. Due to the fact that millennials and other income groups experiencing financial hardships choose handcrafted cigarettes. The consumption of roll-your-own tobacco products has been rising in industrialized economies. Growing cigarette usage among celebrities and an increase in cigarette manufacturer advertisements are expected to drive up adolescent interest in the product, leading to higher market shares for roll-your-own tobacco products.

Over the coming years, consumers' price concern is probably going to have an effect on how the UK tobacco market develops. The implementation of legislation like "Track and Trace" has resulted in increased taxes and fees, which in turn have raised the price of tobacco products. This situation is forcing smokers to switch to more affordable tobacco products or to other possibilities, such rolling their own tobacco products. Selling RYO tobacco products through online distribution channels can help producers fulfill this goal by allowing them to sell directly to consumers and boost their profit margin. Two UK-based tobacco businesses, British American Tobacco and Imperial Brands, are among the top four global tobacco companies.

These businesses control 80% of the nation's tobacco market. Sales of premium brands have been declining in the UK's factory-made cigarette market, while sales of ROY cigarettes and other roll-your-own tobacco products have been steadily increasing. In the nation, RYO tobacco cigarettes are becoming more and more well-liked as an affordable substitute for factory-made models.

The primary factors driving the expansion of the market for roll-your-own tobacco products are the lower cost and lower health risk of RTO tobacco. The belief that handcrafted cigarettes are less dangerous than factory-produced cigarettes is another reason propelling the expansion of the market for roll-your-own tobacco products. Due to traditional cigarettes' cheaper pricing in many countries, RYO tobacco is more popular among smokers.

The availability of diverse filters, such as flavor-infused biodegradable filters, draws in more customers, which will support the increase in the market share of roll-your-own tobacco products throughout the projection period. The expansion of the roll-your-own tobacco product business in the UK is mostly being driven by aggressive ads and increased online promotion.

Market Characteristics

Due to their enormous customer bases, well-known brands, and extensive distribution networks, these businesses are predicted to rule the market. Organizations have been employing several tactics, including mergers and acquisitions and the introduction of new products, in order to maintain a competitive edge.

Only a few primary avenues remain for tobacco companies to spur development in a dwindling cigarette market, aside from developing innovative products: mergers and acquisitions, expansions, and the launch of non-combustible nicotine delivery systems. These are a few tactics used by businesses to continue generating income.

In order to forge solid foundations and hold onto clients, the industry's leading companies have been making some crucial strategic choices. In order to increase their customer base and obtain a competitive edge over rivals, businesses have started launching novel and eco-friendly products.

Due to the numerous domestic and foreign businesses vying for market share, the roll-your-own tobacco products market in the UK is quite dynamic.The industry is largely controlled by local businesses. Several businesses are the owners of well-known brands for fine-cut tobacco, filters, and rolling papers. The fact that roll-your-own tobacco products are more affordable than alternatives like cigarettes is a crucial factor in the growing demand for them.

Product Insights

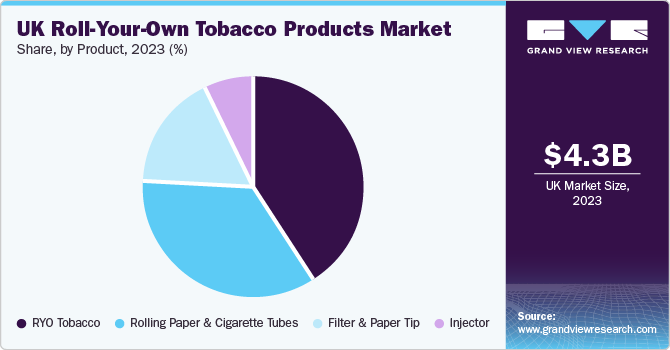

The RYO tobacco category accounted for a revenue share of 41.2% in 2023. The notion that rolling cigarettes is a way to reduce smoking or avoid the dangerous chemicals found in regularly filtered cigarettes made for commercial purposes is the reason for the growing popularity of roll-your-own tobacco. Because rolling your own tobacco is more natural, many smokers believe it to be less hazardous.

The demand for filter & paper tips is expected to grow at a CAGR of 5.0% from 2024 to 2030. Customers who would rather roll their tobacco but would like the option of filtered smoke should definitely consider filter tips. They're composed of asbestos, phenol-formaldehyde resins, paper or activated charcoal, and cellulose acetate fibre. The process of esterifying bleached cotton or wood pulp with acetic acid yields cellulose acetate. Smokers are employing filters more frequently in an effort to reduce their exposure to tar and other hazardous substances.

Distribution Channel Insights

The offline distribution channel dominated the UK market, having accounted for a revenue share of nearly 83% in 2023. Under rigorous guidelines, smoke shops or retail stores are the main venues for the selling of roll-your-own tobacco. Although there is strict regulation around online sales of these drugs, the number of transactions on these platforms is much lower than through conventional distribution channels.

The online sales of roll-your-own tobacco products in the UK are expected to grow at a CAGR of 4.9% from 2024 to 2030. Increasing taxes and rising costs on account of the introduction of regulations such as “Track and Trace” are boosting the prices of tobacco products. This scenario is pushing cigarette smokers to shift to economy-priced tobacco products or to choose alternative options, such as roll-your-own tobacco products. This purpose can be achieved by selling RYO tobacco products through online distribution channels, in which manufacturers can directly sell to the customers and increase their profit margin.

Key UK Roll-Your-Own Tobacco Products Company Insights

The competition in the UK roll-your-own tobacco products industry is made up of well-established players as well as small & medium players. The challenges for market players depend on various factors such as R&D capabilities, product portfolio, geographic presence, and key growth strategies adopted by them. Some of the key growth strategies carried out by these players are collaborations, product launches & developments, business expansions, mergers & acquisitions, partnerships & agreements, and R&D investments.

Key UK Roll-Your-Own Tobacco Products Companies:

- Imperial Brands

- British American Tobacco

- Scandinavian Tobacco Group A/S

- Altria Group, Inc.

- Philip Morris International

- HBI International

- Curved Papers, Inc.

- Karma Filter Tips

- Shine Brands

- Japan Tobacco International

Recent Developments

-

In January 2023, The Canadian cannabis company, Cronos Group was acquired by Philip Morris International (PMI) as part of a plan to increase the number of lower-risk products in its lineup. PMI intends to create products derived from cannabis that are suitable for both medical and recreational usage.

-

In May 2022, Altria Group declared that it had purchased the Dutch e-cigarette company, Kaai, as its tactic to extend its presence in the reduced-risk products sector.

UK Roll-Your-Own Tobacco Products Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 4.52 billion

Revenue forecast in 2030

USD 5.83 billion

Growth rate

CAGR of 4.3% from 2024 to 2030

Actuals

2018 - 2023

Forecast period

2024 - 2030

Quantitative units

Revenue in USD million and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product, distribution channel

Country scope

UK

Key companies profiled

Imperial Brands; British American Tobacco; Scandinavian Tobacco Group A/S; Altria Group, Inc.; Philip Morris International; HBI International; Curved Papers, Inc.; Karma Filter Tips; Shine Brands; Japan Tobacco International

Customization scope

Free report customization (equivalent to up to 8 analysts' working days) with purchase. Addition or alteration to country, regional, and segment scope.

Pricing and purchase options

Avail of customized purchase options to meet your exact research needs. Explore purchase options

UK Roll-Your-Own Tobacco Products Market Report Segmentation

This report forecasts revenue growth at country level and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the UK roll-your-own tobacco products market report based on product and distribution channel:

-

Product Outlook (Revenue, USD Million, 2018 - 2030)

-

RYO Tobacco

-

Rolling Paper & Cigarette Tubes

-

Injector

-

Filter & Paper Tip

-

-

Distribution Channel Outlook (Revenue, USD Million, 2018 - 2030)

-

Offline

-

Online

-

Frequently Asked Questions About This Report

b. The UK roll-your-own tobacco products market size was estimated at USD 4.32 billion in 2023 and is expected to reach USD 4.52 billion in 2024.

b. The UK roll-your-own tobacco products market is expected to grow at a compound annual growth rate of 4.3% from 2024 to 2030 to reach USD 5.83 billion by 2030.

b. RYO tobacco dominated the UK roll-your-own tobacco products market with a share of 41.2% in 2023. This is attributable to the growing population of smokers in the country, coupled with consumer perception of rolled tobacco being chemical-free as compared to traditional cigarettes.

b. Some key players operating in the UK roll-your-own tobacco products market include Imperial Brands, British American Tobacco, Scandinavian Tobacco Group A/S, Altria Group, Inc., Philip Morris International, HBI International, Curved Papers, Inc., Karma Filter Tips, Shine Brands, and Japan Tobacco International.

b. Key factors that are driving the market growth include growing tobacco usage among millennials and the increasing consumer preferences towards handmade cigarettes over their factory-made counterparts.

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."