- Home

- »

- Next Generation Technologies

- »

-

Ultrasonic Cleaning Market Size, Industry Report, 2030GVR Report cover

![Ultrasonic Cleaning Market Size, Share & Trends Report]()

Ultrasonic Cleaning Market (2025 - 2030) Size, Share & Trends Analysis Report By Product (Benchtop, Standalone, Multistage), By Industry(Automotive, Healthcare, Food & Beverage, Metal), By Region, And Segment Forecasts

- Report ID: GVR-4-68040-129-7

- Number of Report Pages: 130

- Format: PDF

- Historical Range: 2018 - 2024

- Forecast Period: 2025 - 2030

- Industry: Technology

- Report Summary

- Table of Contents

- Interactive Charts

- Methodology

- Download FREE Sample

-

Download Sample Report

Ultrasonic Cleaning Market Summary

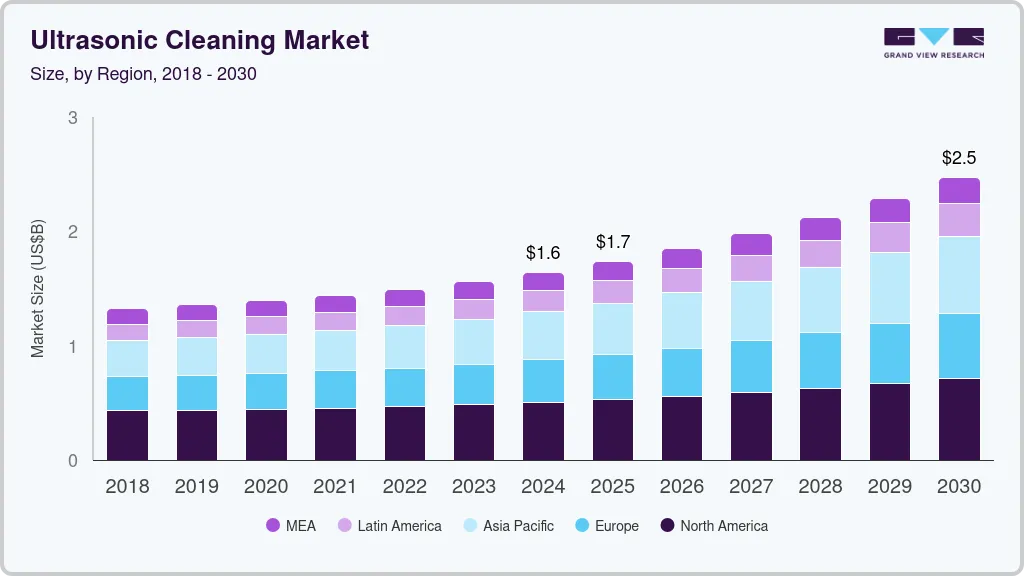

The global ultrasonic cleaning market size was estimated at USD 1,643.4 million in 2024 and is projected to reach USD 2,472.6 million by 2030, growing at a CAGR of 7.3% from 2025 to 2030. This upward trend in the ultrasonic cleaning industry is primarily attributed to the rising demand for precision cleaning within sectors like electronics, healthcare, and automotive manufacturing.

Key Market Trends & Insights

- In terms of region, North America was the largest revenue generating market in 2024.

- Country-wise, India is expected to register the highest CAGR from 2025 to 2030.

- In terms of segment, benchtop accounted for a revenue of USD 808.3 million in 2024.

- Multistage is the most lucrative product segment registering the fastest growth during the forecast period.

Market Size & Forecast

- 2024 Market Size: USD 1,643.4 Million

- 2030 Projected Market Size: USD 2,472.6 Million

- CAGR (2025-2030): 7.3%

- North America: Largest market in 2024

Ultrasonic cleaning has emerged as a favored solution due to its capacity to deliver a comprehensive and consistent cleaning process that effectively removes contaminants, even from intricate and challenging-to-reach areas. This quality has resulted in heightened adoption across industries where cleanliness and product quality are paramount.Ultrasonic cleaning uses high-frequency sound waves to agitate a cleaning solution, creating microscopic bubbles that implode and remove contaminants from surfaces. This method is highly effective for cleaning intricate and delicate parts, making it a preferred choice in various industries. In addition, environmental sustainability is another driving force behind the market growth. Unlike traditional cleaning methods that rely on harsh chemicals, ultrasonic cleaning typically uses environmentally friendly and biodegradable cleaning solutions. This aligns with the growing emphasis on eco-friendly practices and regulatory requirements, making ultrasonic cleaning an attractive choice for businesses aiming to reduce their environmental footprint.

Advancements in ultrasonic cleaning technology are also a major factor driving the growth of the industry over the forecast period. For instance, developing multi-frequency and multi-tank ultrasonic cleaning systems allows for greater versatility in cleaning various materials and contaminants. Furthermore, integrating automation and robotics in ultrasonic cleaning equipment has improved efficiency and reduced business labor costs. Hence, the combination of technological advancements, increasing industrial applications, and the growing awareness of the benefits of ultrasonic cleaning is expected to fuel overall market growth over the forecast period.

The market growth has grabbed the attention of venture capital firms and other medical technology companies, driving further investments in market players. For instance, in March 2023, Getinge, a medical technology company, acquired a U.S.-based ultrasonic cleaning technology manufacturing company named Ultra Clean Systems for USD 16 million. This acquisition was aimed at decontaminating surgical instruments to minimize the risk of contamination.

The market's growth could be hindered by various factors, particularly the high initial costs associated with purchasing and installing ultrasonic cleaning equipment. Furthermore, the ongoing maintenance and repair expenses can also be substantial, contributing to the overall cost of ownership. Moreover, the limited compatibility of ultrasonic cleaning with certain materials and items can limit its market reach, as the intense cleaning action may damage delicate or sensitive objects. Energy consumption and environmental concerns related to chemical usage are additional challenges, while noise pollution and competition from alternative cleaning technologies can further slow market growth.

Product Insights

The benchtop segment accounted for the largest share of 46.6% in 2024. These compact and versatile cleaning devices have become increasingly popular due to their ease of use and cost-effectiveness. They are well-suited for small to medium-sized businesses and laboratories that require efficient cleaning solutions without the space or budget for larger industrial systems. In addition, technological advancements have improved the performance and reliability of benchtop ultrasonic cleaners, making them more attractive to a wider range of industries.

Multistage is expected to grow at the highest CAGR during the forecast period. These systems, consisting of multiple ultrasonic cleaning tanks or stages, allow for a more comprehensive cleaning process. They are particularly attractive to industries with stringent cleanliness standards, such as aerospace and electronics manufacturing. Multistage ultrasonic cleaners provide flexibility to tailor the cleaning process to specific needs, with options for pre-cleaning, ultrasonic cleaning, rinsing, and drying stages.

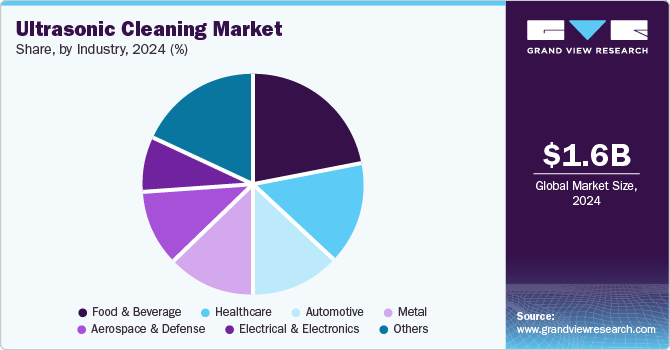

Industry Insights

The food & beverage segment held the largest market in 2024. Ultrasonic cleaning technology offers a safe and efficient method for removing contaminants from processing equipment, utensils, and packaging materials, such as food residues, oils, and pathogens. It helps maintain high levels of hygiene and sanitation, which are critical in food production to ensure product safety and quality. Furthermore, ultrasonic cleaning reduces the need for harsh chemicals and manual labor, aligning with the industry's focus on sustainability and cost-efficiency.

Automotive is expected to register the highest CAGR during the forecast period. The ultrasonic cleaners precisely clean automotive components, such as fuel injectors, engine parts, brake components, and transmission parts. Ultrasonic cleaners are particularly effective in removing stubborn contaminants such as oil, grease, rust, and carbon deposits from intricate surfaces and complex geometries. The automotive industry relies on ultrasonic cleaning to enhance the performance and longevity of critical components, leading to improved vehicle reliability and efficiency. In addition, as the industry shifts towards electric vehicles (EVs), ultrasonic cleaning plays a crucial role in the meticulous cleaning and maintenance of EV battery components, ensuring their optimal performance and safety.

Regional Insights

North America dominated the ultrasonic cleaning market in 2024 with a revenue share of 30.6%.Regional market growth can be projected to increase the adoption of ultrasonic cleaners. Furthermore, prominent market players such as SharperTek, Mettler Electronics Corp., and L&R Manufacturing, among others, are expected to fuel the market’s growth. In addition, stringent regulatory standards in the region, particularly in healthcare and food production, have fostered the adoption of ultrasonic cleaning as it effectively meets hygiene requirements.

U.S. Ultrasonic Cleaning Market Trends

The ultrasonic cleaning market in the U.S. held a dominant position in 2024 due to the increasing demand for precision cleaning in industries such as healthcare, electronics, and automotive. The rising adoption of medical devices and stringent cleanliness regulations in the healthcare sector drive demand for ultrasonic cleaning solutions.

Europe Ultrasonic Cleaning Market Trends

The ultrasonic cleaning industry in Europe is expected to register a moderate CAGR during the forecast period. Countries such as the UK and Germany are major contributors, with a growing need for effective cleaning solutions in pharmaceuticals and high-tech industries. The push for sustainability and strict environmental regulations favors water-based and chemical-free ultrasonic cleaning solutions. In addition, the presence of established manufacturers and investments in R&D for innovative cleaning technologies further enhance ultrasonic cleaning industry opportunities.

Germany ultrasonic cleaning market held a substantial market share in 2024.The country’s dominance in automotive manufacturing, electronics, and precision engineering fuels the demand for ultrasonic cleaning systems. Stricter environmental and workplace safety regulations push industries to adopt non-toxic and efficient cleaning solutions. Germany’s focus on Industry 4.0 and automation in industrial processes is also a key factor contributing to the growth of advanced ultrasonic cleaning technologies.

The ultrasonic cleaning market in the UK is expected to grow at the highest CAGR during the forecast period. The increasing demand for ultrasonic cleaning products in the medical and dental sectors, where hygiene and sterility are paramount, can be attributed to the market’s growth. The country’s robust aerospace and precision engineering industries also contribute to adopting ultrasonic cleaning solutions.

Asia Pacific Ultrasonic Cleaning Market Trends

The ultrasonic cleaning market in Asia Pacific is anticipated to grow at the highest CAGR during the forecast period. The regional market's growth can be attributed to its home to a burgeoning manufacturing industry, encompassing electronics, automotive, precision engineering, and healthcare sectors. Furthermore, the region's adoption of ultrasonic cleaning is propelled by its cost-effectiveness and ability to streamline manufacturing processes, enhancing overall efficiency and productivity. The region has also witnessed rapid industrialization and economic growth, translating into increased investments in advanced cleaning technologies.

India ultrasonic cleaning market is expected to grow at the highest growth rate during the forecast period. This is due to increasing industrialization and the growth of sectors such as healthcare, electronics, and automotive. The rising adoption of medical equipment and laboratory instruments, which require stringent cleaning processes, fuels the demand for ultrasonic cleaners. Government initiatives to boost manufacturing, such as "Make in India," have increased the need for efficient cleaning technologies.

The ultrasonic cleaning market in China held a substantial market share in 2024 owing to the country’s massive electronics, automotive, and manufacturing industries. The growing use of high-tech components and semiconductors, which require precision cleaning, is a major market driver. In addition, the expansion of the medical and pharmaceutical sectors further contributes to market demand, as these industries require high standards of cleanliness.

Key Ultrasonic Cleaning Company Insights

Some key companies in the ultrasonic cleaning industry include SharperTek, Mettler Electronics Corp., and L&R Manufacturing. To improve their market share, industry leaders are involved in various strategic initiatives, such as geographic expansion, partnerships and collaborations, and acquisitions.

-

SharperTek is a manufacturer specializing in ultrasonic cleaning solutions. It offers a range of products designed for various applications, including medical, industrial, and laboratory cleaning. The company’s ultrasonic cleaning solutions utilize high-frequency sound waves to create microscopic cavitation bubbles in a cleaning solution. These bubbles remove contaminants such as oil, grease, dirt, carbon deposits, and biofilms from intricate parts without causing damage.

-

Mettler Electronics Corp. specializes in ultrasonic cleaning technology, particularly through their Cavitator Ultrasonic Cleaners. These cleaners are designed to utilize ultrasonic waves to generate millions of tiny bubbles via a process called cavitation, which effectively cleans and polishes various surfaces.

Key Ultrasonic Cleaning Companies:

The following are the leading companies in the ultrasonic cleaning market. These companies collectively hold the largest market share and dictate industry trends.

- SharperTek

- Mettler Electronics Corp.

- L&R Manufacturing

- Elma Schmidbauer GmbH

- Steelco S.p.A.

- Emerson Electric Co.

- GT Sonic

- Kemet International Limited

- Crest Ultrasonics Corporation

- Ultrasonic LLC

Recent Developments

-

In May 2023, Steelco S.p.A., an ultrasonic cleaner provider, partnered with the International Society of Pharmaceutical Engineering (ISPE). As a result of this partnership, Steelco S.p.A. became a global supplier of sterilization and cleaning solutions for the biopharma and pharma industries.

-

In October 2024, Elma Schmidbauer GmbH launched the Elmasonic Xtra, an innovative solution for the most demanding cleaning tasks. This advanced series delivers exceptional performance and cutting-edge efficiency, setting new benchmarks in professional ultrasonic cleaning.

Ultrasonic Cleaning Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 1.74 billion

Revenue forecast in 2030

USD 2.47 billion

Growth rate

CAGR of 7.3% from 2025 to 2030

Actual data

2018 - 2024

Forecast period

2025 - 2030

Quantitative units

Revenue in USD million/billion and CAGR from 2025 to 2030

Report coverage

Revenue forecast, company market share, competitive landscape, growth factors, and trends

Segments covered

Product, industry, region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; Mexico; Germany; UK; France; China; Japan; India; South Korea; Australia; Brazil; KSA; UAE; South Africa

Key companies profiled

SharperTek; Mettler Electronics Corp.; L&R Manufacturing; Elma Schmidbauer GmbH; Steelco S.p.A.; Emerson Electric Co.; GT Sonic; Kemet International Limited; Crest Ultrasonics Corporation; Ultrasonic LLC

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Ultrasonic Cleaning Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global ultrasonic cleaning market report based on product, industry, and region:

-

Product Outlook (Revenue, USD Million, 2018 - 2030)

-

Benchtop

-

Standalone

-

Multistage

-

-

Industry Outlook (Revenue, USD Million, 2018 - 2030)

-

Automotive

-

Healthcare

-

Food & Beverage

-

Metal

-

Electrical & Electronics

-

Aerospace & Defense

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

-

Asia Pacific

-

China

-

Japan

-

India

-

South Korea

-

Australia

-

-

Latin America

-

Brazil

-

-

Middle East and Africa (MEA)

-

KSA

-

UAE

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global ultrasonic cleaning market size was estimated at USD 1.64 billion in 2024 and is expected to reach USD 1.74 billion in 2025.

b. The global ultrasonic cleaning market is expected to grow at a compound annual growth rate of 7.3% from 2025 to 2030 to reach USD 2.47 billion by 2030.

b. North America dominated the ultrasonic cleaning market with a share of 30.6% in 2024. The regional market growth can be projected to the increasing adoption of ultrasonic cleaners. Furthermore, the presence of prominent market players such as SharperTek, Mettler Electronics Corp., and L&R Manufacturing, among others, in the region are expected to fuel the market’s growth.

b. Some key players operating in the ultrasonic cleaning market include SharperTek, Mettler Electronics Corp., L&R Manufacturing, Elma Schmidbauer GmbH, Steelco S.p.A., Emerson Electric Co., GT Sonic, Kemet International Limited, Crest Ultrasonics Corporation, and Ultrasonic LLC.

b. Key factors that are driving the market growth include improved Efficiency and safety in cleaning of components and eco-friendly cleaning process with biodegradable waste discharge.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.