- Home

- »

- Renewable Energy

- »

-

Underground Hydrogen Storage Market Size Report, 2030GVR Report cover

![Underground Hydrogen Storage Market Size, Share & Trends Report]()

Underground Hydrogen Storage Market Size, Share & Trends Analysis Report By Storage Type (Porous Media Storage, Salt Caverns, Engineered Cavities), By Region, And Segment Forecasts, 2024 - 2030

- Report ID: GVR-4-68040-028-6

- Number of Pages: 100

- Format: Electronic (PDF)

- Historical Range: 2018 - 2022

- Industry: Energy & Power

Market Size & Trends

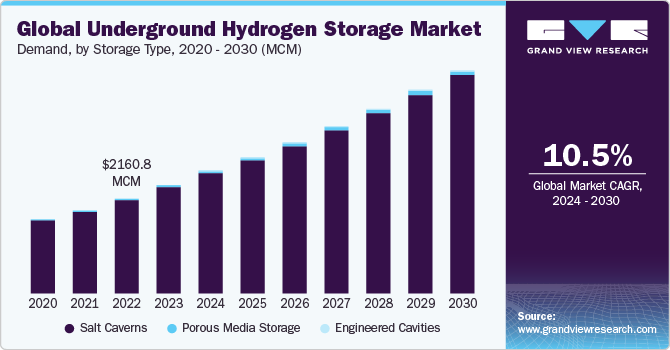

The global underground hydrogen storage market demand was estimated at 2,478.15 MCM in 2023 and is projected to grow at a CAGR of 10.5% from 2024 to 2030. The market growth is primarily attributed to research & development (R&D) in hydrogen technologies and increasing acceptance of alternative forms of energy. Increasing applications of hydrogen across several sectors are expected to further propel the growth. For instance, hydrogen can be used for industrial applications in oil refineries, power generation in stationary fuel cells, as fuel in fuel cell vehicles, and stored as a cryogenic liquid.

Another factor contributing to the increase in hydrogen technologies is the reduced cost of production. In the past, hydrogen was expensive because it had to be produced from natural gas, which required a significant amount of energy. However, advances in electrolysis, a process that uses electricity to split water into hydrogen and oxygen, have made it possible to produce hydrogen from renewable sources such as solar and wind power. This has the potential to make hydrogen a competitive and clean energy source.

There are efforts underway to develop infrastructure for hydrogen fuel cell vehicles including the creation of hydrogen fueling stations. While the deployment of these stations has been slow, several countries have announced plans to significantly increase their number in the coming years. The demand for underground hydrogen storage is expected to increase significantly over the forecast period as the increased demand for hydrogen prompts market players in hydrogen storage technologies.

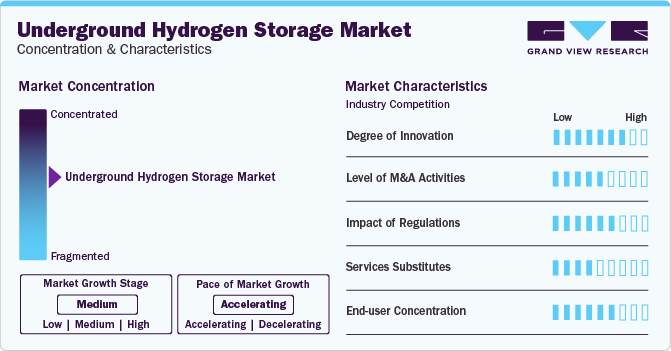

Market Concentration & Characteristics

The underground hydrogen storage market has significant opportunities for growth and development. It offers a safe and efficient way to store large quantities of hydrogen and has the potential to support the growth of hydrogen fuel cells, chemicals, and renewable energy sectors. As the demand for hydrogen increases, there will be increasing demand for underground storage systems to meet this demand.

Another opportunity in the underground hydrogen storage industry is the potential for growth in the renewable energy sector. Renewable energy sources such as wind and solar have become increasingly important sources of electricity but they are often intermittent and unreliable. Hydrogen can be used to store excess renewable energy, allowing it to be used when needed. Underground hydrogen storage offers a solution to this problem as it allows for the safe and efficient storage of large quantities of hydrogen. As the renewable energy sector continues to grow, there will be increasing demand for underground storage systems to support this growth.

Storage Type Insights

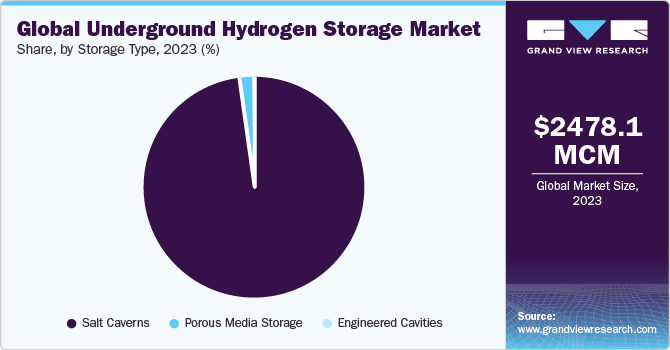

In terms of volume, the salt caverns segment accounted for the largest share of 97.97% in 2023. Salt caverns are salt domes and bedded salts with high deliverability and a short cycle of 10 to 20 days. These caverns are the most expensive among other storage types owing to the new infrastructures and solution mining required by them. Unlike depleted reservoirs, salt caverns require less cushion gas injection of approximately 20%-30%. Increasing investments in the development of salt cavern-based underground hydrogen storage facilities are expected to augment the growth of this segment from 2022 to 2030.

Porous media storage accounted for the second-largest market share in 2023. This storage type consists of limestone, formations, shale, and conglomerates, which ensure high permeability and void fractions for hydrogen storage. It includes gas and depleted fields and aquifers. Porous media storage has been proposed as an effective and sustainable storage type for underground hydrogen to balance renewable energy supply and seasonal demand.

Engineered cavities are underground gas storage facilities such as mine shafts, which have been modified to store hydrogen. Establishing hydrogen storage facilities based on engineered cavities is still in the research and development phase and is expected to have a positive outcome in the near future. A number of pilot projects have been carried out while conceptual designs of these facilities are being prepared to scope their proposed outcome.

Regional Insights

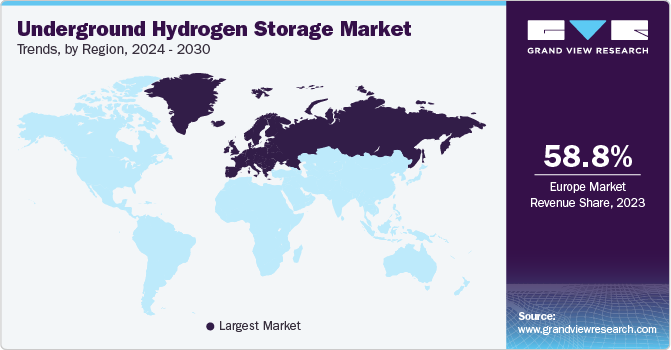

The North America underground hydrogen energy storage market is expected to grow over the forecast period from 2024 to 2030. The expansion of the hydrogen energy storage industry in North America has been underway for several years and the industry has grown at a brisk pace with contributions from each application and technology.

U.S. Underground Hydrogen Storage Market Trends

The U.S. is among the early adopters of clean energy solutions in the world for power generation, manufacturing, and transportation sectors. Continuous R&D in the U.S. is expected to boost demand for underground hydrogen storage. For instance, in March 2023, the National Energy Technology Laboratory (NETL) published research on the potential for hydrogen storage in existing underground gas facilities as part of DOE's Subsurface Hydrogen Assessment, Storage and Technology Acceleration (SHASTA) initiative. The research team characterized the potential for hydrogen storage in existing underground gas storage facilities in the U.S. and assessed the possibility of mixing hydrogen with methane currently contained in the reservoirs.

The U.S. market concentrates on salt formations owing to their high deliverability and cycling rates. Major investments in the development of underground hydrogen facilities have augmented the market growth. For instance, in August 2022, Mitsubishi Power and Magnum Development collaborated to construct a 300 GWh underground hydrogen storage facility in Utah, U.S., which will have two caverns with capacities of 150 GWh. After completion, it will be the world’s largest underground hydrogen facility. In 2022, the production of hydrogen in the U.S. was 12 million metric tons. Large-scale hydrogen production and construction of new hydrogen storage facilities are expected to fuel the growth of the U.S. market.

Europe Underground Hydrogen Storage Market Trends

Europe accounted for the largest volume share of 58.76% in 2023. Europe has been investing heavily in hydrogen energy as an alternate power source. European countries are looking for energy independence and are increasing their domestic underground hydrogen storage capacities. The UK government has been investing heavily in developing its hydrogen generation and storage capabilities. The country plans to become a major player in the emerging hydrogen economy.

The UK underground hydrogen storage market accounted for the largest volume share of 18.76% in Europe in 2023. The UK's commitment to achieving net zero targets and increasing investment in hydrogen infrastructure is likely to play a key role in shaping the dynamics of the underground hydrogen storage industry in the country.

The underground hydrogen storage market in France is expected to grow at the fastest CAGR of 20.8% over the forecast period. France has been a leader in underground hydrogen storage with many active and under-construction underground hydrogen storage sites. The government of France has been promoting the growth of green hydrogen and is investing in different hydrogen generation projects. This has resulted in a higher demand for underground hydrogen storage facilities. For instance, in January 2022, HyPSTER announced the construction of an underground storage of green hydrogen in a saline cavity in France's Ain region. The facility will have an initial storage capacity of 3 tons, which can be expanded to 44 tons.

Asia Pacific Underground Hydrogen Storage Market Trends

The presence of a large number of refineries in China and India is expected to drive the utilization of underground hydrogen storage in the region. Moreover, countries such as Japan and Australia are evaluating greener and cleaner technologies for hydrogen generation, which is further expected to boost the requirement for underground hydrogen facilities in the region over the forecast period.

The Australia underground hydrogen storage market accounted for the largest volume share of 29.83% of Asia Pacific in 2023. The hydrogen storage market in Australia is driven by government initiatives to develop hydrogen infrastructure in the country. After the launch of the Hydrogen Roadmap by the government in 2008, the Australian Association for Hydrogen Energy was set up to dedicatedly work to support the growth of hydrogen infrastructure.

The underground hydrogen storage market in China is also expected to grow at a CAGR of 14.7% during the forecast period. China is undergoing a massive transformation in the hydrogen industry to overcome numerous challenges including pollution and economic disparity between urban and rural populations. Air pollution and increasing sulfur content in the environment are also posing a challenge for the country.

Latin America Underground Hydrogen Storage Market Trends

The Latin America underground hydrogen storage market accounted for a volume share of 0.23% in 2023 in Latin America.Latin America has a relatively low demand for underground hydrogen storage as compared to other regions due to lower investment in green hydrogen technology and low demand from end-use industries. The demand for underground hydrogen storage is concentrated in industrialized countries such as Mexico, Brazil, and Argentina.

Middle East & North Africa Underground Hydrogen Storage Market Trends

The Middle East & North Africa underground hydrogen storage marketaccounted for a volume share of 0.31% in 2023. The demand for underground hydrogen storage facilities in the Middle East and North Africa is expected to grow over the forecast period, owing to countries looking to invest in sustainable technologies and diversify the energy mix away from traditional energy sources such as natural gas and oil. Oil and gas exporting countries such as Saudi Arabia and the UAE have introduced hydrogen strategies to increase hydrogen production and export. These factors are expected to boost the regional market growth.

Key Underground Hydrogen Storage Company Insights

The players operating in this market are continuously engaged in R&D activities in many regions globally. Players are also adopting strategies to increase their reach in diverse geographical areas. The key market players are adopting various organic and inorganic strategies to increase their footprint in the underground hydrogen storage industry.

-

In October 2023, Fluxys Belgium announced the BE-HyStore pilot project for subterranean hydrogen storage in Loenhout, Antwerp. The plant has a special geological structure that allows it to store gas molecules over a kilometer below the surface.

-

In September 2023, ENGIE announced a project for hydrogen production and storage. The HyPSTER project, supported by the European Union and the Clean Hydrogen Partnership, produces and stores hydrogen underground on a large scale. The project consists of two parts, namely storing the gas in a salt cave and producing hydrogen from renewable energy sources using an electrolysis unit. The project is currently in the pilot phase and is expected to commission in 2024.

-

In August 2023, the U.S. Department of Energy awarded USD 1.5 million to hydrogen storage projects in depleted Appalachian gas fields.

-

In January 2023, SSE, an energy company, started the construction of an underground hydrogen storage cavern in East Yorkshire, UK. The project is expected to generate hydrogen using renewable energy in a 35-megawatt electrolyzer stored in a cavern.

The global underground hydrogen storage industry is highly competitive, owing to the presence of major industries, as these companies are fairly concentrated and highly competitive.

Key Underground Hydrogen Storage Companies:

The following are the leading companies in the underground hydrogen storage market. These companies collectively hold the largest market share and dictate industry trends.

- Air Liquide

- Air Products and Chemicals, Inc.

- Engie

- Linde plc

- Texas Brine Company, LLC

- Uniper SE

- WSP

Underground Hydrogen Storage Market Report Scope

Report Attribute

Details

Market demand volume in 2024

2,780.67 MCM

Volume forecast in 2030

5,049.94 MCM

Growth rate

CAGR of 10.5% from 2024 to 2030

Base year for estimation

2023

Historical data

2018 - 2022

Forecast period

2024 - 2030

Quantitative units

Volume in MCM, and CAGR from 2024 to 2030

Report coverage

Volume forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Storage type, region

Regional scope

North America; Europe; Asia Pacific; Latin America; Middle East and Africa

Country scope

U.S.; Canada; Germany; France; UK; China; India; Australia; Japan; Mexico; Brazil; Algeria; Egypt; Libya; UAE

Key companies profiled

Air Liquide; Air Products and Chemicals, Inc.; WSP; Texas Brine Company, LLC; Linde plc; Engie; Uniper SE; NEUMAN & ESSER GROUP; Hychico S.A

Customization scope

Free report customization (equivalent up to 8 analyst’s working days) with purchase. Addition or alteration to country, regional, and segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Underground Hydrogen Storage Market Report Segmentation

This report forecasts volume growth at the global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For the purpose of this study, Grand View Research has segmented the global underground hydrogen storage market report based on storage type, and region:

-

Storage Type Outlook (Volume, MCM, 2018 - 2030)

-

Porous Media Storage

-

Salt Caverns

-

Engineered Cavities

-

-

Regional Outlook (Volume, MCM, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

-

Europe

-

Germany

-

France

-

UK

-

-

Asia Pacific

-

Australia

-

China

-

India

-

Japan

-

-

Latin America

-

Brazil

-

Mexico

-

-

Middle East and Africa

-

Algeria

-

Egypt

-

Libya

-

UAE

-

-

Frequently Asked Questions About This Report

b. The global underground hydrogen storage market size was estimated at 2,478.15 MCM in 2023 and is expected to reach 2,780.67 MCM m in 2024

b. The global underground hydrogen storage market is expected to witness a compound annual growth rate of 10.5% from 2024 to 2030 to reach 5,049.94 MCM by 2030

b. The salt caverns was the largest storage type segment accounting for 97.97% of the total volume in 2023 owing to its strength and suitability for hydrogen storage

b. Some of the key players operating in the underground hydrogen storage market include Air Liquide, Air Products and Chemicals, Inc., WSP, Texas Brine Company, LLC, Linde plc, Engie, Uniper SE

b. Key factors driving the growth of the underground hydrogen storage market include the Increase in the adoption of hydrogen technologies and lack of viable alternatives for hydrogen storage

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."