- Home

- »

- Electronic Devices

- »

-

Unified Communication And Business Headsets Market Report, 2030GVR Report cover

![Unified Communication And Business Headsets Market Size, Share & Trends Report]()

Unified Communication And Business Headsets Market Size, Share & Trends Analysis Report By Product (Earphones, Headphones), By Type (Wired, Wireless), By Price (<50 USD, 50 to 100 USD, >100 USD), By Region, And Segment Forecasts, 2023 - 2030

- Report ID: GVR-2-68038-243-3

- Number of Report Pages: 224

- Format: PDF, Horizon Databook

- Historical Range: 2017 - 2021

- Forecast Period: 2023 - 2030

- Industry: Semiconductors & Electronics

Market Size & Trends

The global unified communication and business headsets market size was valued at USD 3.30 billion in 2022 and is anticipated to grow at a CAGR of 14.2% over the forecast period. The increasing demand for mobility and portability has led to a surge in the adoption of UC-enabled devices that allow multitasking and offer convenience. The Unified Communication (UC) technology offers several advantages to customers owing to its ability to simultaneously establish connections with multiple devices at different locations. Call centers are largely opting for UC and business headsets owing to benefits such as increased productivity levels of employees and efficient communication with clients.

Currently, the demand for unified communications is high and is projected to increase over the forecast period. Customers are gaining substantial benefits from using smart devices, which include various services such as emails, instant messaging, webinars, and desktop sharing on a single platform.

Furthermore, due to the increased telecommuting demand, unified communication is used for business applications. UC-enabled headsets support using personal devices such as tablets, laptops, and smartphones. The headsets enable all employees to opt for work from home to conveniently attend calls, video conferences, and meetings with clients without external disturbances.

Employers are opting for cost-cutting strategies and seeking to reduce the need for office space by adopting work-from-home and BYOD policies. These policies encourage employees to opt for devices that eliminate external disturbances for effective communication over calls and improved efficiency while performing office-related tasks.

The COVID-19 pandemic positively impacted the market. The outbreak and subsequent global restrictions and lockdown measures forced a large-scale shift towards remote work and virtual communication. This sudden transition created a surge in demand for UC headsets as businesses and individuals sought effective tools to facilitate seamless communication and collaboration from home. With the need to maintain business continuity while ensuring the safety of employees, organizations rapidly deployed remote work setups.

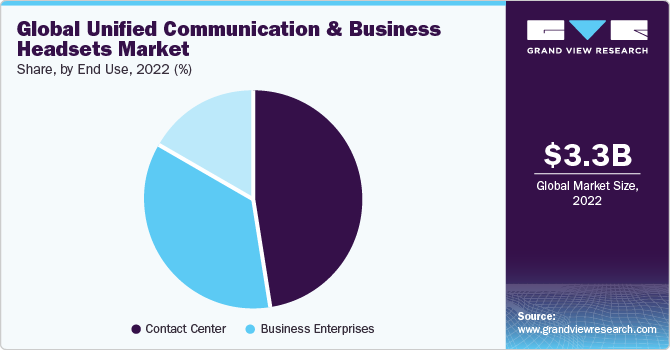

End Use Insights

Based on end use, the market is segmented into contact centers and business enterprises. The contact center segment held the largest revenue share of 56.6% in 2022. Players across various industry verticals such as telecommunication, Banking, Financial Services, and Insurance (BFSI), travel, healthcare, and consumer goods & retail, among others, provide customer-centric services, resulting in demand for contact centers for customer interaction. It is expected to drive the demand for the contact center segment over the forecast period.

The business enterprises segment is expected to grow at the fastest CAGR of 14.6% over the forecast period. The growing need for effective communication and collaboration tool drives the business enterprise segment in the market. UC headsets enable seamless voice and video communication, allowing employees to connect with colleagues, clients, and partners from anywhere. With noise cancellation and superior audio quality, these headsets ensure clear and uninterrupted conversations, even in noisy office environments or during remote work.

Type Insights

Based on the type, the market is segmented into wired and wireless. The wired segment accounted for the largest revenue share of 56.0% in 2022. Wired headsets have lower latency and lag compared to wireless alternatives. This attribute is particularly important for real-time communication, such as voice and video calls, where even slight delays can disrupt the flow of conversation or cause misunderstandings. The low latency of wired headsets ensures immediate and accurate audio transmission, contributing to seamless and efficient communication.

The wireless segment is further segmented into Bluetooth, NFC, Wi-Fi, and others. The wireless segment is expected to grow at the fastest CAGR of 14.7% during the forecast period. The wireless headsets segment is estimated to emerge as the fastest-growing segment owing to benefits such as ease of use offered by these headphones. Headsets used for office purposes are lightweight and enabled with Wi-Fi and Bluetooth connectivity, which allow employees to use headsets while away from office premises. Wireless headsets include an active noise cancellation feature, which benefits employees serving at offices where colleagues surround them and indulge in the same activity.

Regional Insights

North America dominated the market and accounted for the largest revenue share of 29.8% in 2022. It can be attributed to the change in mindset and a shift in the traditional pattern of using desk phones to headphones. The presence of several key players and the growing popularity of BYOD solutions is further expected to drive market growth. It has resulted in the large-scale adoption of headphones across the region.

Asia Pacific is expected to grow at the fastest CAGR of 17.5% during the forecast period. The introduction of favorable government policies and mandates is aiding the establishment of manufacturing plants in the Asia Pacific region. Several emerging economies, mainly China and India, focus on developing infrastructure to boost several businesses and develop their economic position in the global marketplace. The Indian government is encouraging small & medium enterprises to adopt the latest technologies that help boost output and generate profits.

Product Insights

Based on the product, the global unified communication and business headsets market is sub-segmented into earphones and headphones. The headphones segment accounted for the largest revenue share of 67.9% in 2022. The growing preference for advanced forms of communication and collaboration, wherein employees can work from public spaces such as airport gate areas, hotel lounges, and open offices, is expected to drive the growth of the headphones segment. The development of audio technology and growing preference for noise-cancellation & wireless connectivity encourage manufacturers to develop and launch new products in the UC and business headsets market.

Furthermore, growing technological advancements such as the introduction of nano-chip technology in the development of headphones are enabling manufacturers to reduce the headphones' size and manufacture headphones that perfectly fit the human ear. For instance, in September 2022, Sony Corporation launched next-gen and premium headphones, WH-1000XM5, in India. Sony has integrated its widely acclaimed noise-canceling technology into the WH-1000XM5. According to the company, the headphones utilize two processing units and eight microphones to decrease noise, particularly in the mid-to-high frequency range. The headphones also contain a 30mm driver unit, which improves noise cancellation.

The earphones segment is expected to grow at the fastest CAGR of 14.9% during the forecast period. The growing trend of remote work and the increasing number of professionals working on the have contributed to the demand for earphones in the UC and business headsets market. Earphones provide a convenient and portable option for individuals to participate in calls, attend virtual meetings, and engage in collaborative discussions while maintaining mobility and flexibility.

Price Insights

On the basis of price, the market is segmented into < 50, 50 to 100, and > 100. The 50 to 100 segment accounted for the largest revenue share of 50.9% in 2022. Consumers prefer mid-range audio devices, primarily owing to benefits such as comfortable wearing style and high fidelity. It further drives the demand for UC and business headphones priced between 50 to 100 USD.

Furthermore, the market players are developing and launching wireless headsets with advanced features, such as noise canceling and battery backup of up to 20 hours, at competitive prices. It is prompting the key players in the market to focus on developing innovative and next-generation business headphones to stay competitive.

The > 100 segment is estimated to register the fastest CAGR of 14.7% over the forecast period. Comfort and durability are also significant factors driving the demand for headsets in this price range. Manufacturers in this segment typically invest in premium types, ergonomic designs, and adjustable headbands to provide a comfortable fit for extended periods of use. Cushioned ear cups, breathable types, and lightweight construction minimize fatigue and discomfort, enabling users to focus on their work without distractions.

Distribution Channel Insights

Based on distribution channel, the market is segmented into exclusive showrooms, online sales channel, and others. The exclusive showrooms segment is anticipated to capture the significant revenue share during the forecast period. Exclusive showrooms offer in-store listening stations to test the sound quality of different headphones. It enables buyers to choose the most suitable headphones as per their requirements. Showrooms provide a tailored environment where customers can engage with knowledgeable staff who provide expert guidance and recommendations based on individual needs and preferences. The face-to-face interaction fosters trust, confidence, and a deeper understanding of the features and benefits of different headsets, ultimately influencing purchase decisions.

The online sales channel segment is expected to grow at the fastest CAGR of 15.3% over the forecast period. Its vast worldwide distribution network allows headset manufacturers to sell their products globally. Furthermore, online sales channels are offering various price discounts, which help attract large numbers of consumers to buy headsets through online sales channels.

Key Companies & Market Share Insights

The key players in the industry are focusing on organic and inorganic growth strategies to maintain their market position. In August 2022, FUJIFILM Business Innovation Asia Pacific partnered with Jabra to enhance seamless unified communication for Asia Pacific companies. This partnership provides clients with the latest plug-and-play communication tools, including Jabra's cutting-edge Evolve 2 Series and Speak devices, to improve efficiency and seamless interaction for companies with a hybrid work environment. The partnership also encompasses solutions that assure integration and real plug-and-play experiences and authorized Jabra gadgets that integrate smoothly with leading UC platforms.

Key Unified Communication And Business Headsets Companies:

- Agero Inc.

- Aplicom

- Mitacs

- Masternaut Limited.

- Meta System S.p.A

- MiX Telematics.

- Octo Telematics S.p.A

- Sierra Wireless

- TomTom Telematics BV

- TRIMBLE INC.

Recent Developments

-

In February 2023, Zoho Corporation Pvt. Ltd. launched Trident, a unified communications platform. Trident is Zoho's inaugural desktop native application, integrating collaboration, productivity, and communication into a single location. Alongside this launch, the company has bolstered its collaboration technologies to provide businesses with simplified communication across various channels, diminishing tool confusion and enhancing overall digital adoption within organizations.

-

In January 2023, Mitel Networks Corp. acquired Unify, a subsidiary of the Atos group. This strategic transaction enables Mitel to gain ownership of Unify's voice platforms, collaboration and contact centre products, device and endpoint portfolio, and associated intellectual property. Furthermore, Unify's Managed Services division, known for assisting enterprises in digitally transforming their communication systems, will enhance Mitel's capabilities in providing diverse options for unified communication customers.

-

In July 2022, Ericsson acquired Vonage Holdings Corp. to bolster its mobile network business and enter the enterprise market. This strategic move equips Ericsson with the essential elements to deliver a wide range of communication solutions. Ericsson intends to expand Vonage's unified communications as a service and contact centre as a service solution by increasing investments in research and development and offering these solutions to communications service providers.

-

In May 2022, Jabra launched the latest addition to their Engage series, the Engage 55. This cutting-edge DECT wireless professional headset delivers exceptional conversation quality owing to its enhanced noise-canceling technology and microphone performance. With these advancements, multiple employees can hold meetings nearby without disruptive interference. Moreover, the Engage 55 boasts the highest level of security among all wireless headsets on the market, making it the perfect choice for professionals in various industries, whether remotely or in traditional office environments.

Unified Communication And Business Headsets Market Report Scope

Report Attribute

Details

Market size value in 2023

USD 3.80 billion

Revenue forecast in 2030

USD 9.61 billion

Growth Rate

CAGR of 14.2% from 2023 to 2030

Base year for estimation

2022

Historical data

2017 - 2021

Forecast period

2023 - 2030

Report updated

November 2023

Quantitative units

Volume in thousand units, revenue in USD million and CAGR from 2023 to 2030

Report coverage

Volume, Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product, type, price, distribution channel, end use, region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; UK; Germany; France; China; India; Japan; South Korea; Australia; Brazil; Mexico; United Arab Emirates; Saudi Arabia; South Africa

Key companies profiled

Agero Inc.; Aplicom, Mitacs; Masternaut Limited.; Meta System S.p.A; MiX Telematic; Octo Telematics S.p.A; Sierra Wireless; TomTom Telematics BV; TRIMBLE INC.

Customization scope

Free report customization (equivalent to up to 8 analyst’s working days) with purchase. Addition or alteration to country, regional & segment scope

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Unified Communication And Business Headsets Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2017 to 2030. For the purpose of this study, Grand View Research has segmented the global unified communication and business headsets market on the basis of product, type, price, distribution channel, end use, and region:

-

Product Outlook (Volume in Thousand Units; Revenue in USD Million, 2017 - 2030)

-

Earphones

-

Headphones

-

-

Type Outlook (Volume in Thousand Units; Revenue in USD Million, 2017 - 2030)

-

Wired

-

Wireless

-

Bluetooth

-

NFC

-

Wi-Fi

-

Others

-

-

-

Price Outlook (Volume in Thousand Units; Revenue in USD Million, 2017 - 2030)

-

<50 USD

-

50 to 100 USD

-

>100 USD

-

-

Distribution Channel Outlook (Volume in Thousand Units; Revenue in USD Million, 2017 - 2030)

-

Exclusive Showrooms

-

Online Sales Channel

-

Others

-

-

End-use Outlook (Volume in Thousand Units; Revenue in USD Million, 2017 - 2030)

-

Contact Center

-

Business Enterprises

-

-

Regional Outlook (Volume in Thousand Units; Revenue in USD Million, 2017 - 2030)

-

North America

-

U.S.

-

Canada

-

-

Europe

-

UK

-

Germany

-

France

-

-

Asia Pacific

-

China

-

Japan

-

India

-

Australia

-

South Korea

-

-

Latin America

-

Brazil

-

Mexico

-

Middle East and Africa

-

-

United Arab Emirates (UAE)

-

Saudi Arabia

-

South Africa

-

-

Frequently Asked Questions About This Report

b. North American regional market held the largest share of around 30% in 2022. This can be attributed to the change in mindset and a shift in the traditional pattern of using desk phones to headphones.

b. The global unified communication and business headsets market size was estimated at USD 3.30 billion in 2022 and is expected to reach USD 3.80 billion in 2023.

b. The global unified communication and business headsets market is expected to witness a compound annual growth rate of 14.2% from 2023 to 2030 to reach USD 9.61 billion by 2030.

b. The headphones segment dominated the market in 2022 and was valued at USD 2.24 billion and is expected to reach USD 2.57 billion in 2023.

b. The key players the unified communication (UC) and business headsets market include Audio-Technica Corporation, Bose Corporation, Dell Technologies Inc., GN Store Nord A/S, HP Development Company, L.P, Koss Corporation, Logitech, Microsoft Corporation, Plantronics, Inc., and Sennheiser electronic GmbH & Co. KG.

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."