- Home

- »

- Communication Services

- »

-

Unified Communication As A Service Market Report, 2030GVR Report cover

![Unified Communication As A Service Market Size, Share & Trends Report]()

Unified Communication As A Service Market Size, Share & Trends Analysis Report By Deployment, By Industry Vertical (Automotive, Education, Healthcare, BFSI, Hospitality, Real Estate, Legal, IT & Telecom), By Region, And Segment Forecasts, 2025 - 2030

- Report ID: GVR-4-68038-155-9

- Number of Report Pages: 130

- Format: PDF, Horizon Databook

- Historical Range: 2018 - 2024

- Forecast Period: 2025 - 2030

- Industry: Technology

UCaaS Market Size & Trends

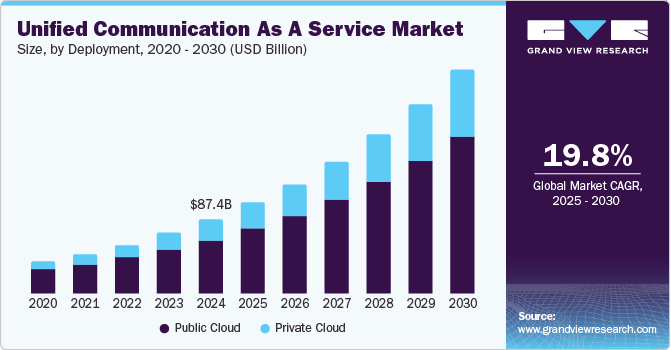

The global unified communication as a service market size was estimated at USD 87.39 billion in 2024 and is expected to grow at a CAGR of 19.8% from 2025 to 2030. The growth of the unified communication as a service (UCaaS) market is driven by the increasing demand for efficient and integrated communication solutions among businesses. Organizations are recognizing the need for seamless collaboration tools that enhance productivity and streamline operations, especially in an era marked by remote and hybrid work models. Additionally, the rising emphasis on customer engagement and improved employee collaboration further fuels the demand for UCaaS, as businesses seek to enhance their communication infrastructure to stay competitive in a rapidly evolving marketplace.

Government initiatives are playing a crucial role in boosting the sales of the UCaaS market by promoting digital transformation and enhancing telecommunications infrastructure. Many governments around the world are investing in improving broadband connectivity and supporting technology adoption to facilitate business growth and innovation. These initiatives often include funding programs, grants, and tax incentives aimed at encouraging organizations to adopt cloud-based solutions like UCaaS. By fostering an environment conducive to technological advancement, governments are helping businesses transition to modern communication systems, thereby driving the adoption of UCaaS solutions across various sectors.

The unified communication as a service industry presents numerous growth opportunities driven by the ongoing digital transformation across industries. As businesses increasingly seek to improve operational efficiency and enhance customer interactions, there is a growing demand for customizable and scalable communication solutions. Additionally, the rise of remote work has created opportunities for UCaaS providers to develop tailored solutions that cater to the unique needs of distributed teams. Emerging markets also present significant potential for growth as organizations in these regions seek to modernize their communication systems. Furthermore, integrating artificial intelligence and machine learning into UCaaS platforms offers opportunities for enhanced analytics and improved decision-making, further driving market expansion.

Manufacturers in the UCaaS industry are increasingly focusing on growth strategies to capitalize on the rising demand for unified communication solutions. This includes investing in research and development to innovate and enhance their offerings, ensuring they meet the evolving needs of businesses. Partnerships and collaborations with other technology providers are also becoming common, enabling manufacturers to offer more comprehensive and integrated solutions. Additionally, marketing efforts are being intensified to raise awareness about the benefits of UCaaS among potential users, especially in sectors like education, healthcare, and finance. By focusing on customer-centric solutions and expanding their product portfolios, manufacturers are positioning themselves to gain a competitive edge in the growing UCaaS market.

Technological innovation is a key driver of growth in the UCaaS industry, as advancements in cloud computing, artificial intelligence, and collaboration tools are transforming how organizations communicate. The integration of AI and machine learning enables smarter communication solutions that offer features like predictive analytics, automated responses, and enhanced customer service capabilities. Additionally, advancements in mobile technology allow for greater flexibility, enabling users to access

Deployment Insights

The public cloud segment dominates the market share of around 72% in 2024, driven by its scalability, cost-effectiveness, and ease of deployment. Businesses are increasingly opting for public cloud solutions to leverage advanced communication tools without the burden of heavy infrastructure investments. The public cloud allows organizations to quickly scale their operations, accommodating fluctuating communication demands, which is particularly appealing in today’s fast-paced business environment. Furthermore, the rapid advancements in cloud technology and increased internet connectivity enhance the performance and reliability of public cloud solutions, making them an attractive option for enterprises looking to improve collaboration and communication efficiency.

The private cloud segment is experiencing significant growth in the unified communication as a service market, primarily due to heightened concerns around data security and compliance. Organizations, especially in regulated industries, are increasingly opting for private cloud solutions to maintain control over their sensitive data and ensure adherence to strict regulatory requirements. Private clouds offer enhanced customization and security features, which are crucial for businesses that prioritize data protection. Additionally, the ability to integrate with existing on-premises systems while providing the benefits of cloud technology makes private cloud solutions particularly appealing. As organizations seek to balance flexibility with security, the demand for private cloud UCaaS offerings is expected to rise.

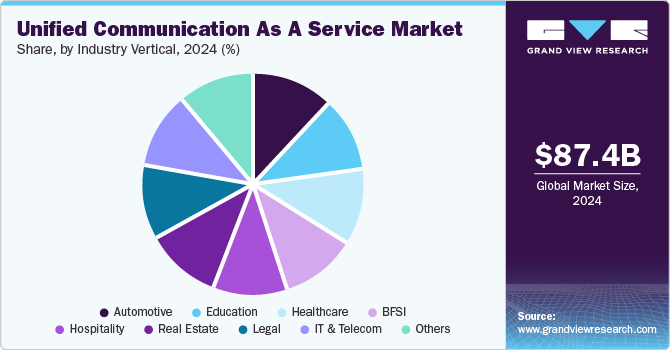

Industry Vertical Insights

The healthcare segment is witnessing significant share in the UCaaS market, in 2024, due to the increasing need for efficient communication among healthcare providers and improved patient care. With the rise of telehealth services and remote patient monitoring, healthcare organizations are seeking integrated communication solutions that facilitate seamless collaboration between medical professionals, patients, and administrative staff. UCaaS enables healthcare providers to coordinate care effectively, share critical information in real-time, and enhance patient engagement through various communication channels. Furthermore, the emphasis on data security and compliance in the healthcare sector has led to increased investments in UCaaS solutions that meet stringent regulatory standards, fueling further growth in this segment.

The hospitality segment holds a substantial share of the UCaaS industry, driven by the need for enhanced guest experiences and operational efficiency. Hotels and other hospitality providers are increasingly adopting unified communication solutions to streamline operations, improve guest interactions, and facilitate seamless collaboration among staff. The demand for integrated communication tools that support real-time messaging, video conferencing, and mobile accessibility is rising as hospitality businesses strive to deliver personalized services. Additionally, the growing trend of remote check-ins and virtual concierge services has further propelled the adoption of UCaaS in the hospitality sector, positioning it as a vital deployment of modern guest management strategies.

Regional Insights

North America unified communication as a service market accounted for a significant revenue share of over 33.98% in 2024. The region's advanced technological infrastructure facilitates the adoption of cloud-based communication solutions. Businesses are increasingly prioritizing seamless collaboration tools that enhance productivity and reduce operational costs. Additionally, the presence of major UCaaS providers in North America fosters competition and innovation, further driving market growth.

U.S. Unified Communication As A Service Market Trends

The U.S. is a major contributor to the unified communication as a service industry, primarily due to its strong technology ecosystem. Companies across various sectors are adopting UCaaS to streamline communication and improve operational efficiency. The growth of remote work culture has led to increased investment in collaboration tools, enabling real-time communication and data sharing.

Europe Unified Communication As A Service Market Trends

Europe is experiencing notable growth in the UCaaS industry, driven by a combination of factors including regulatory support and a strong focus on digital transformation. Organizations across the region are increasingly adopting cloud-based solutions to improve communication efficiency and flexibility. The emphasis on remote work has led to heightened demand for integrated communication tools that enable collaboration across geographies.

Asia Pacific Unified Communication As A Service Market Trends

The Asia Pacific unified communication as a service market is expected to witness a CAGR of over 22% over the forecast period. The Asia Pacific region is witnessing significant growth in the UCaaS market, fueled by rapid digital transformation and increasing internet penetration. Countries in this region are investing heavily in advanced communication technologies to improve business operations. The rise of SMEs and startups in countries like India and Southeast Asia is driving demand for cost-effective UCaaS solutions.

The China unified communication as a service market is expected to grow during the forecast period. China is emerging as a significant player in the UCaaS market, with rapid advancements in technology and a growing demand for integrated communication solutions. The country's push towards digitalization, backed by government policies and investments, is driving the adoption of cloud-based services. Businesses in China are increasingly recognizing the importance of efficient communication tools to enhance productivity and competitiveness.

India's UCaaS market is experiencing remarkable growth, driven by the country's digital transformation and the rise of a technology-savvy workforce. The increasing number of startups and SMEs in India is fueling demand for cost-effective and scalable communication solutions. Remote work and hybrid work models have gained traction, leading to a heightened focus on collaborative tools.

Key Unified Communication As A Service Company Insights

Some of the key players operating in the market include Cisco Systems Inc. and 8x8 Inc.

-

Cisco Systems Inc. is a leading technology company renowned for its comprehensive portfolio of networking and communication solutions, including its robust offerings in the Unified Communication as a Service (UCaaS) market. Cisco's UCaaS platform, known as Cisco Webex, integrates voice, video, messaging, and collaboration tools into a seamless user experience. This solution is designed to enhance productivity and streamline communication for organizations of all sizes.

-

8x8 Inc. is a prominent player in the UCaaS market, offering an integrated communication platform that combines voice, video, chat, and contact center services into a single solution. The company's flagship product, 8x8 X Series, is designed to enhance collaboration and connectivity for businesses, regardless of their size. 8x8 focuses on delivering a user-friendly experience with advanced features such as AI-driven analytics, seamless third-party integrations, and global reach with reliable performance.

Key Unified Communication As A Service Companies:

The following are the leading companies in the unified communication as a service market. These companies collectively hold the largest market share and dictate industry trends.

- 8x8 Inc.

- ALE International

- Avaya LLC

- Cisco Systems Inc.

- Fuze Inc.

- IBM Corporation

- Mitel Network Corporation

- NEC Corporation

- RingCentral Inc.

- Version

View a comprehensive list of companies in the Unified Communication As A Service Market

Recent Developments

-

In September 2023, Alcatel-Lucent Enterprise (ALE) has partnered with Nuvola Distribution to launch the Alcatel-Lucent Rainbow Hub, a cloud-based communication platform, in the UK market. Nuvola, recognized for its expertise in technology distribution, will handle the distribution of this Unified Communications-as-a-Service (UCaaS) platform, which incorporates ALE's well-known UC and PBX solutions.

-

In June 2023, Cisco and AT&T have unveiled new solutions aimed at improving connectivity and enhancing the calling experience for hybrid workforces. Today’s workforce operates across various locations-be it on the shop floor, at the executive level, in branch offices, home offices, or during commutes-making them less tied to a single space or device. The new offerings, which include Cisco's Webex Calling and SD-WAN solutions in conjunction with AT&T's mobile network, empower businesses of all sizes to provide employees with seamless, secure, and consistent experience, enabling them to excel in any environment.

-

In January 2023, Atos, a worldwide leader in digital transformation, has announced that it is engaged in exclusive negotiations with Mitel Networks (“Mitel”) regarding the sale of its Unified Communications & Collaboration Services businesses. Unify provides a range of solutions, including on-premises Unified Communications, cloud-based Unified Communications-as-a-Service (UCaaS), and Cloud Contact Center-as-a-Service (CCaaS) offerings.

Unified Communication As A Service Market Report Scope

Report Attribute

Details

Market size in 2025

USD 106.32 billion

Revenue forecast in 2030

USD 262.37 billion

Growth rate

CAGR of 19.8% from 2025 to 2030

Actual data

2018 - 2024

Forecast period

2025 - 2030

Quantitative units

Revenue in USD million/billion and CAGR from 2025 to 2030

Report coverage

Revenue forecast, company ranking, consumer behavior analysis, leading regional games, competitive landscape, growth factors, and trends

Segments covered

Deployment, industry vertical, region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; Mexico; Germany; UK; France; China; Japan; India; South Korea; Australia; Brazil; UAE; Saudi Arabia; South Africa

Key companies profiled

8x8 Inc.; ALE International; Avaya LLC; Cisco Systems Inc.; Fuze Inc.; IBM Corporation; Mitel Network Corporation; NEC Corporation; RingCentral Inc.; Verion

Customization scope

Free report customization (equivalent up to 8 analyst’s working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options. Global Unified Communication As A Service Market Report Segmentation

This report forecasts revenue growth at the global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented global unified communication as a service market report based on deployment, industry vertical, and region:

-

Deployment Outlook (Revenue, USD Million, 2018 - 2030)

-

Public Cloud

-

Private Cloud

-

-

Industry Vertical Outlook (Revenue, USD Million, 2018 - 2030)

-

Automotive

-

Education

-

Healthcare

-

BFSI

-

Hospitality

-

Real Estate

-

Legal

-

IT & Telecom

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

-

Asia Pacific

-

China

-

Japan

-

India

-

South Korea

-

Australia

-

-

Latin America

-

Brazil

-

-

Middle East and Africa

-

South Africa

-

Saudi Arabia (KSA)

-

UAE

-

-

Frequently Asked Questions About This Report

b. The global unified communication as a service market size was estimated at USD 87.39 billion in 2024 and is expected to reach USD 106.32 billion in 2025.

b. The global unified communication as a service market is expected to grow at a compound annual growth rate of 19.8% from 2025 to 2030 to reach USD 262.37 billion by 2030.

b. Public cloud dominated the global market revenue, with a market share of around 72% in 2024. The segmental growth can be attributed to the rise in Internet of Things (IoT), edge computing, growing use of real-time analytics, rise in consumption of big data, and increasing digital transformation among end use industries

b. Some of the key players in the global UCaaS market include 8x8, Inc.; ALE International; Avaya Inc.; Cisco Systems Inc.; IBM Corporation; and RingCentral, Inc.

b. The increasing trend of work from home model is compelling employers to use solutions as it's beneficial for enterprises to re-evaluate their operational costs and protect their marginal revenue from dwindling.

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."