- Home

- »

- Communication Services

- »

-

Unified Communication As A Service Market Report, 2030GVR Report cover

![Unified Communication As A Service Market Size, Share & Trends Report]()

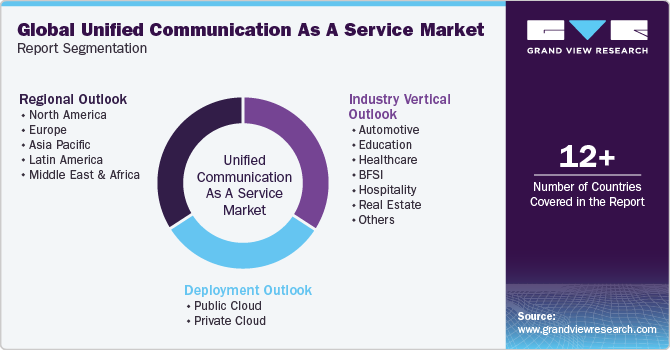

Unified Communication As A Service Market Size, Share & Trends Analysis Report By Deployment (Public Cloud, Private Cloud), By Industry Vertical (Education, Healthcare, BFSI, Hospitality, Real Estate), By Region, And Segment Forecasts, 2023 - 2030

- Report ID: GVR-4-68038-155-9

- Number of Pages: 105

- Format: Electronic (PDF)

- Historical Range: 2018 - 2021

- Industry: Technology

Market Size & Trends

The global unified communication as a service market size was estimated at USD 58.45 billion in 2022 and is expected to expand at a compound annual growth rate (CAGR) of 20.4% from 2023 to 2030. The increasing trend of work from home model is compelling employers to use solutions as it is beneficial for enterprises to re-evaluate their operational costs and protect their marginal revenue from dwindling. In September 2023, ALE International expanded its collaboration with Nokia in the Australia & New Zealand (ANZ) region. This collaboration is expected to provide partners and their business customers with an extended and fully integrated portfolio to address changing network requirements as companies adapt and progress.

Integration of various communication channels, such as voice, video, and messaging, into a single platform to improve productivity and streamline communication across businesses has created ample growth opportunities for unified communication as a service (UCaaS) market. Introduction of 5G technology and high-speed internet is also favouring the market expansion, as video and audio-conferencing needs high speed and low latency in connection, which is easily provided by 5G network. Increasing demand regarding real-time communication has allowed vendors to offer Web RTC solutions, which provide faster video streaming and chats in client devices. Intelligent chatbots and predictive intelligence features allow businesses to communicate and collaborate effectively with teams and clients situated around the world, which is expected to drive market growth significantly over the forecast period.

UCaaS encourages effective communication and collaboration across teams in organizations, regardless of their location. It aids small-scale enterprises to lower their communication costs significantly by eliminating investments in expensive software or hardware. The pay-as-you-go model of communication service helps businesses pay only for the services they need, making it an economical solution. Additionally, the market offers scalability to small businesses, enabling them to seamlessly add or remove features, services, and users according to their requirements, thus helping them expand their operations.

Cloud-based solutions offer various benefits, including cost-effectiveness, scalability, and greater flexibility. They can be easily accessed from any device with a reliable internet connection, making them suitable for organizations functioning with remote workforces. Moreover, these solutions are typically based on a predictable monthly billing model, which helps businesses manage their budgets effectively. Besides, cloud-based UCaaS solutions are supported by robust security protocols, ensuring optimum security for sensitive business communications. Increasing demand for cloud service models is paving the way for UCaaS, as enterprises seek more flexible, scalable, and cost-effective communication solutions.

Market Dynamics

PAY-AS-YOU-GO MODEL FOR END USERS

Pay-as-you-go services for UCaaS are largely preferred due to the advantages associated with this payment model. These services allow businesses to access most advanced collaboration tools without having to invest in expensive hardware or software. In addition, UCaaS solutions are highly scalable and easily provide new features as the organizations grow. These features can be included on a per-user basis enabling the users to only pay for what they require. Besides, users can also easily add or remove phones as per their convenience, providing more flexibility. In addition, UCaaS services are typically supported by robust security protocols, ensuring that sensitive business communications always remain secure.

TECHNOLOGICAL ADVANCEMENTS AND ADOPTIONS

Unified communication as a service market is witnessing significant growth on account of the ongoing technological developments introduced by the market players. Artificial intelligence (AI) is being increasingly used for automating the routine communication processes. There are several use cases of AI in UCaaS, such as speech to text, real time translation, real time transcription, smart framing for video, etc. These are some of the high-utility applications that are not supported by conventional systems of unified communications. UCaaS solution providers are now adopting AI and Augmented Reality (AR) to support teams working remotely, thereby reducing the dependence on in-office teams. This trend facilitates the development of latest UCaaS features comprising voice intelligence, post-call summaries, and live call sentiment analysis.

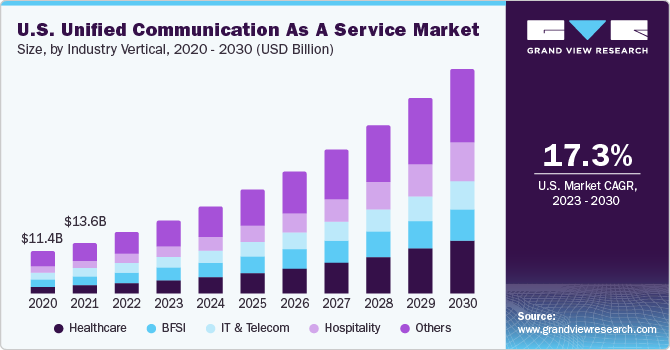

Industry Vertical Insights

Healthcare segment dominated the market with a revenue share of more than 17.0% in 2022. Leveraging technologies such as messaging, video conferencing, and cloud-based telephony, can access critical healthcare data in real time. Governments of several regions, such as South Korea, are testing telemedicine to provide affordable remote patient care, providing opportunities for providers. Apart from helping clinicians communicate and collaborate effectively while on the move, solutions also support telehealth initiatives by allowing patients with their providers through voice, instant messaging, and video chat.

Hospitality segment is expected to witness a CAGR of over 23.0% over the forecast period. This growth can be attributed to the growing digitization to monitor customer behaviour, enhance customer experience, optimize production, and improve sales and productivity. Hospitality businesses are focusing aggressively on customer experience to build their brand image and improve their revenue position. Considering the growing preference for digitization, customer service is expected to emerge as a major challenge as customers continue to use various modes of communication.

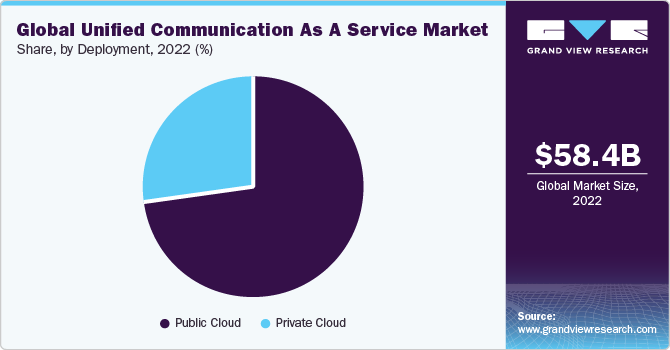

Deployment Insights

Public cloud segment dominated the market with a revenue share of 70.0% in 2022. This growth can be attributed to the rise in IoT, edge computing, growing use of real-time analytics, rise in consumption of big data, and increasing digital transformation among industries such as BFSI, IT & telecom, and manufacturing, etc. Organizations are changing their business activities and operational procedures due to digital transformation. Communication with external partners, other industries, and customers is becoming more prevalent, and public cloud is offering an ideal foundation for developing an open inter-company network. The essential functions of storage, processing, and networking power are covered by public cloud services.

Private cloud segment is expected to witness a CAGR of over 21.0% over the forecast period. This growth can be attributed to the growing adoption of bring-your-own-device (BYOD), growing emphasis on ensuring real-time and quick access data, and growing deployment of mobile workforce. A private cloud server is an infrastructure that provides hosted services to a single enterprise. It provides all the advantages, such as agility, scalability, and ability to build many virtual machines for complicated computational activities and operations, while retaining a high level of data security and privacy protection.

Regional Insights

North America accounted for a significant revenue share of around 35.0% in 2022. The region is renowned for its seamless integration of online and offline channels, resulting in a unified customer experience. Proactive services are intended to connect customers via various touchpoints, such as e-commerce platforms, social media, mobile applications, physical stores, and customer support channels. This omnichannel approach ensures consistent and unified interactions, resulting in stronger customer relationships. AI-driven intelligent virtual assistants are becoming increasingly prevalent in the region.

To learn more about this report, request a free sample copy

Asia Pacific is expected to witness a growth rate of over 23.0% over the forecast period. This significant growth can be credited to continuous digitization and growing mobile workforce, as the region is expanding in the field of technology with increasing penetration of 4G and 5G technology. Moreover, the presence of several multinational companies in this region is driving the demand for UCaaS. Organizations are evolving through modern technology by becoming a hub for artificial intelligence, and there is considerable growth for organizations that provide AI-related services related at a global scale.

Key Companies & Market Share Insights

Key players in the market, having intensified competition and growth in customer expectations, are creating a storm for using unified communication as a service, which is becoming a solution provider to build up customer engagement innovatively. Manufacturers are bringing AI capabilities with UCaaS technology which helps them to improve their product portfolio and service offerings. In October 2023, Mitel officially completed its previously announced acquisition of Unify, which includes Communication and Collaboration Services (CCS) and Unified Communications and Collaboration (UCC) businesses of the Atos group. With this acquisition, the company has now increased its customer base to more than 75 million users in over 100 countries.

Key Unified Communication As A Service Companies:

- 8x8 Inc.

- ALE International

- Avaya LLC

- Cisco Systems Inc.

- Fuze Inc.

- IBM Corporation

- Mitel Network Corporation

- NEC Corporation

- RingCentral Inc.

- Verion

Recent Development

-

In October 2023, ALE International, a provider of communications, networking and cloud solutions, is expanding its distribution network globally with Rainbow Hub with the help of their global partner network. This is expected to cater to the growing demand of businesses looking for innovative solutions to connect and engage with their teams, customers, and suppliers.

-

In August 2023, 8x8, Inc., a prominent provider of an integrated cloud contact centre and unified communications platform, has achieved a notable accolade. The company has been honoured with a Gold Stevie Award in the Technology Team of the Year category at the 20th Annual International Business Awards.

-

In June 2023, Cisco partnered with AT&T mobile network to natively integrate Webex Calling. This partnership is expected to deliver a mobile-first, powerful, and unified collaboration experience via a single business mobile number. Such developments are expected to drive the industry growth.

-

In October 2023, Avaya Inc. collaborated with Flouris, a major Dutch mortgage lender, to use OneCloud CCaaS and improve customer experience while also allowing its contact centre personnel to operate in a hybrid environment.

Unified Communication As A Service Market Report Scope

Report Attribute

Details

Market size value in 2023

USD 71.56 billion

Revenue forecast in 2030

USD 262.37 billion

Growth rate

CAGR of 20.4% from 2023 to 2030

Base year for estimation

2022

Historical data

2018 - 2021

Forecast period

2023 - 2030

Report updated

November 2023

Quantitative units

Revenue in USD million/billion and CAGR from 2023 to 2030

Report coverage

Revenue forecast, company ranking, consumer behavior analysis, leading regional games, competitive landscape, growth factors, trends

Segments covered

Deployment, industry vertical, region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; Germany; U.K.; China; Japan; India; South Korea; Australia; New Zealand; Mexico; Brazil; Saudi Arabia; UAE; South Africa

Key companies profiled

8x8 Inc.; ALE International; Avaya LLC; Cisco Systems Inc.; Fuze Inc.; IBM Corporation; Mitel Network Corporation; NEC Corporation; RingCentral Inc.; Verion

Customization scope

Free report customization (equivalent up to 8 analyst’s working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options.

Global Unified Communication As A Service Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global unified communication as a service market report based on deployment, industry vertical, and region:

-

Deployment Outlook (Revenue, USD Billion, 2018 - 2030)

-

Public Cloud

-

Private Cloud

-

-

Industry Vertical Outlook (Revenue, USD Billion, 2018 - 2030)

-

Automotive

-

Education

-

Healthcare

-

BFSI

-

Hospitality

-

Real Estate

-

Legal

-

IT & Telecom

-

Others

-

-

Regional Outlook (Revenue, USD Billion, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

-

Europe

-

Germany

-

U.K.

-

-

Asia Pacific

-

China

-

Japan

-

India

-

South Korea

-

Australia

-

New Zealand

-

-

Latin America

-

Brazil

-

Mexico

-

-

Middle East and Africa

-

Saudi Arabia

-

UAE

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global unified communication as a service market size was estimated at USD 58.45 billion in 2022 and is expected to reach USD 71.56 billion in 2023.

b. The global unified communication as a service market is expected to grow at a compound annual growth rate of 20.4% from 2023 to 2030 to reach USD 262.37 billion by 2030.

b. Public cloud dominated the global market revenue, with a market share of around 70% in 2022. The segmental growth can be attributed to the rise in Internet of Things (IoT), edge computing, growing use of real-time analytics, rise in consumption of big data, and increasing digital transformation among end use industries

b. Some of the key players in the global UCaaS market include 8x8, Inc.; ALE International; Avaya Inc.; Cisco Systems Inc.; IBM Corporation; and RingCentral, Inc.

b. The increasing trend of work from home model is compelling employers to use solutions as it's beneficial for enterprises to re-evaluate their operational costs and protect their marginal revenue from dwindling.

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."