- Home

- »

- Network Security

- »

-

Unified Endpoint Management Market Size Report, 2030GVR Report cover

![Unified Endpoint Management Market Size, Share & Trends Report]()

Unified Endpoint Management Market (2023 - 2030) Size, Share & Trends Analysis Report By Component (Solution, Services), By Organization Size (SMEs, Large Enterprises), By Vertical, By Region, And Segment Forecasts

- Report ID: GVR-4-68039-032-8

- Number of Report Pages: 100

- Format: PDF

- Historical Range: 2017 - 2021

- Forecast Period: 2023 - 2030

- Industry: Technology

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Unified Endpoint Management Market Summary

The global unified endpoint management market size was estimated at USD 4.48 billion in 2022 and is projected to reach USD 21.79 billion by 2030, growing at a CAGR of 22.4% from 2023 to 2030. The advancement in computing systems and Verticals is surging the IT asset footprints across the globe.

Key Market Trends & Insights

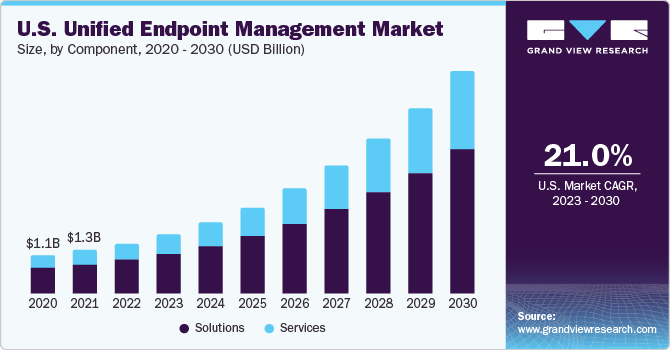

- North America dominated the market and accounted for the largest revenue share of 40.6% in 2022.

- Asia Pacific is expected to grow at the fastest CAGR of 24.4% during the forecast period.

- By component, the solution segment accounted for the largest revenue share of 68.1% in 2022.

- By organization size, the large enterprise segment accounted for the largest revenue share of around 74.2% in 2022.

- By organization size, the small and medium enterprises size segment is estimated to register the fastest CAGR of 23.5% over the forecast period.

Market Size & Forecast

- 2022 Market Size: USD 4.48 Billion

- 2030 Projected Market Size: USD 21.79 Billion

- CAGR (2023-2030): 22.4%

- North America: Largest market in 2022

- Asia Pacific: Fastest growing market

Organizations are increasingly transitioning and adopting higher endpoint models to meet the hardware requirements for the updated OS systems such as Windows 10 and ChromeOS. With the growing usage of endpoints such as laptops, tablets, mobile phones, and desktops across enterprises, the need to manage these endpoints using a single platform increases. Thus, the demand for a unified solution is growing with the adoption of advanced endpoints among organizations. The rise in the trend of implementing policies for allowing personal devices to access organization data is another factor that surges market growth.

Amongst such policies, Bring Your Own Device (BYOD) is a growing phenomenon among enterprises to improve employee productivity. Wherein enterprises allow their employees to share enterprise data over their own devices. The increased data sharing over different devices surges the organization's complexities and challenges in managing the devices. Thus, to overcome such IT complexities, the need for a Unified Endpoint Management (UEM) solution is growing and is anticipated to boost the demand over the forecast period.

Recently, the market has gained immense popularity owing to its diverse approach to managing endpoint devices. From mobile security to mobile device and Vertical management to enterprise mobility management, all are uniformly managed through a single platform or solution. Moreover, the unified platform or solution also helps enterprises comply with stringent government regulations and policies. For instance, IBM MaaS360 is a unified endpoint management platform that encrypts and secures every database and its contents while maintaining GDPR policy. Furthermore, the platform also offers IT and security admins extensive capability of auditing and reporting functionality, which helps meet GDPR compliance requirements easily.

The growing adoption of heterogeneous or mobility devices that use third-party networks other than the organization’s network is the other factor stimulating the need for UEM solutions. Using third-party networks increases not only cyber threat risks but also increases complexities for the IT administrators to manage endpoints that are pushed out of the organization network. As a result, it becomes difficult for the security and IT admins to track and manage endpoints in real-time. Hence, to support such circumstances effortlessly, UEM solutions allow admins with a unified approach to monitor and configure endpoints easily from a central location. It, in turn, increases the adoption of UEM solutions among enterprises.

The trend towards remote working and work-at-home policies implemented by organizations also stimulates market growth. The COVID-19 impact further motivated every enterprise and business to transition operations toward the remote working environment. As a result of the critical situation, companies have begun implementing a BYOD program or issuing enterprise-owned devices. Hence, to maintain and manage unified communication and collaboration with the teams and to provide required access to corporate resources while maintaining productivity, the need for UEM solutions is expected to grow.

The increasing importance of data security and the need for a single solution to manage the increasing number of traditional and non-traditional data points is expected to drive the UEM market. The emerging Bring Your Own Device (BYOD) trend has compelled organizations to deploy UEM solutions to safeguard critical data and protect devices from cyber-attacks on endpoint devices.

UEM vendors are engaged in integrating artificial intelligence and machine learning technologies in the UEM solutions to enhance and automate their core capabilities, such as Vertical and content management, endpoint security, and remote access and control. An AI-powered UEM solution also provides advanced endpoint security by tracking login time, malware attacks, geo-location, behavioral patterns, automated breaches, and more. It helps the end-users mitigate cyber-attacks and effectively automate managing endpoint devices across private and corporate networks. Such advanced technologies are expected to increase the adoption go UEM solutions, thereby bolstering market growth.

The emerging trend of Bring Your Own Device (BYOD), Choose Your Own Device (CYOD), and the Internet of Things (IoT) are some of the primary factors expected to drive the UEM market growth. The trends above have led to an increase in the number of IT devices, both private and corporate, which has created a need for a unified solution to assist IT admins in managing the workflow and access across these devices. The growing number of endpoint devices and the high volume of data sharing across these devices are expected through private and corporate networks, which is expected to increase the risk of cyber-attacks. As such, UEM solutions help an organization manage the sharing and usage of Verticals and data on endpoint devices, which is expected to drive the adoption of UEM solutions.

Increasing data flowing through devices such as smartphones, tablets, and laptops and rising cyberattacks such as identity theft and fraud are influencing the need to establish data protection regulations. Due to the rising cyber threats directed at governments and private businesses, the importance of opting for an efficient solution that manages a huge fleet of devices connected to the network is increasing. Organizations are becoming familiar with the laws and are spending high on deploying unified endpoint management solutions that help them safeguard the data and comply with stringent government regulations and policies. For instance, IBM MaaS360 is a unified endpoint management platform that encrypts and secures every database and its contents while maintaining GDPR policy. The platform offers security admins extensive capability of auditing and reporting functionality, which in turn helps in meeting GDPR compliance requirements easily. Thus, large and small enterprises demand a unified endpoint management solution that provides enhanced visibility throughout the network, enhances IT Security, improves user experience, and reduces management costs.

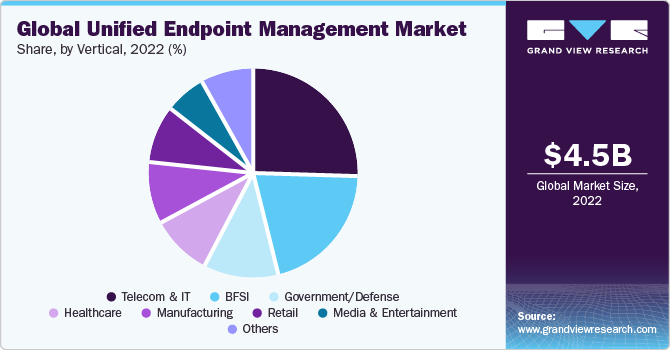

Vertical Insights

The telecom & IT segment held the largest revenue share of 25.6% in 2022. The increased spending on IT services and solutions to manage and improve their productivity is one factor contributing to the segment growth. The IT and telecom industries have complex IT network components and dedicated servers that manage overall IT assets and the flow of applications across organizations. Maintaining all the endpoints consistently without failure increases pressure on the system administrators. Hence, IT and telecom enterprises are adopting UEM solutions to overcome such complications. Furthermore, the need to uniformly maintain client and existing projects supported by third-party services providers is fueling the market growth.

The healthcare segment is expected to grow at the fastest CAGR of 25.4% over the forecast period. The factors attributable to the segment growth are the technological advancement in the healthcare sector and the growing adoption of blood pressure monitors, wearable devices, and other cloud-based devices. Furthermore, the increasing usage of mobile devices and other IoT devices to facilitate remote communication and collaboration and provide better services by sharing critical information over endpoints increases cyber threat risks and pressure on IT asset management admins. Thus, the growing need to optimize such lifesaving systems and secure patients' and healthcare facility data leads to the rising adoption of UEM solutions.

Regional Insights

North America dominated the market and accounted for the largest revenue share of 40.6% in 2022. Furthermore, it is also estimated that the region is expected to dominate the market over the forecast period. The growing investment by enterprises in advanced technologies to simplify their operations is one factor driving the regional market. Moreover, many UEM vendors and their continuous attempts to offer security solutions while providing high-quality endpoint management features surge the regional market.

Further, early availability and adoption of technology across the North American region have been one of the main reasons for the high adoption of the UEM solution. Additionally, the high number of IT and capital markets and their diversified businesses worldwide call for efficient management of endpoint devices and have contributed to the market growth in this region.

Asia Pacific is expected to grow at the fastest CAGR of 24.4% during the forecast period, owing to the high proliferation of endpoint devices in this region. The massive working population across emerging economies in the Asia Pacific is expected to increase the adoption of endpoint devices, thereby fueling the unified endpoint management market growth. The increasing adoption of mobile devices across enterprises and IoT applications is one of the major factors responsible for regional market growth. Furthermore, the rise in BYOD policies and cloud-based solutions is another factor triggering regional market growth. Additionally, the trend toward digital workplace and modernization in data centers is anticipated to boost market growth over the forecast period.

Component Insights

The solution segment accounted for the largest revenue share of 68.1% in 2022. The need for a platform that could provide endpoint management capabilities and endpoint security in a single console is driving segment growth. Furthermore, advancements and continuous upgrades in the platform are other factors responsible for segment growth. Additionally, the growing demand for cloud-based solutions and the SaaS-based model also anticipates the development of segment growth.

The services segment is expected to grow at the fastest CAGR of 23.8% during the forecast period. The need for appropriate consulting services before implementing the UEM solution drives the service market. The UEM vendors assess the existing IT infrastructure and thereby guide the enterprises to implement UEM solutions, either on-premises or on the cloud. Furthermore, UEM vendors also provide enterprises with a mix of managed services and training and support services to ensure the effective management of devices and secure business data shared through endpoints.

Organization size Insights

The large enterprise segment accounted for the largest revenue share of around 74.2% in 2022. The increasing adoption of network components, the Internet of Things (IoT) devices, and endpoints is the primary factor responsible for the segment growth. Furthermore, the increasing risk of cyber threats and the need to manage the endpoints in the existing complex IT environment is the other factor augmenting the market growth.

The small and medium enterprises size segment is estimated to register the fastest CAGR of 23.5% over the forecast period. The growing adoption of cloud-based solutions and the need to secure enterprise mobile devices are the major factors driving the market among SMEs. Moreover, the increasing practices of BYOD policies and the need to manage compliance requirements bolstered segment growth. Additionally, the rising spending on IT assets and the need to reduce operational costs are expected to favor the segment growth over the forecast period.

Key Companies & Market Share Insights

The industry players are undertaking strategies such as product launches, acquisitions, and collaborations to increase their global reach. For instance, in January 2023, Ivanti, the U.S.-based software company, expanded its strategic partnership with Lookout, a cloud security platform. The extension now incorporates Lookout Mobile Endpoint Security into the Ivanti Neurons automation platform. This cloud-based solution is a seamlessly blended add-on to Ivanti Neurons for UEM. The new add-on is fully embedded within the existing UEM client, enabling customers to effortlessly activate it without causing any inconvenience to their end users.

Key Unified Endpoint Management Companies:

- 42Gears Mobility Systems Pvt Ltd.

- BlackBerry Limited

- Citrix Systems, Inc.

- IBM Corporation

- Matrix42 GmbH

- Microsoft

- Ivanti

- Sophos Ltd.

- SOTI Inc.

- Zoho Corporation Pvt. Ltd.

- VMware, Inc.

Recent Developments

-

In April 2023, IBM introduced the QRadar Security Suite, aimed to enhance the pace of identifying and addressing potential threats. This advanced security suite was developed to streamline and expedite the overall experience of security analysts throughout the entire incident lifecycle. Leveraging automation, numerous machine learning algorithms, and behavioral models empowers organizations to safeguard their endpoints against unrecognized, zero-day vulnerabilities. The suite detects aberrant behavioral patterns and promptly responds to attacks, operating almost in real-time.

-

In July 2021, ScalePad invited the members of the MSP community to beta test its new API integration with Microsoft Endpoint Manager (MEM). By integrating with Microsoft Endpoint Manager, ScalePad streamlined the identifying and importing of devices managed by Intune. This integration is invaluable to MSPs embarking on their initial Intune deployments, as it is a crucial checkpoint to guarantee no device goes unnoticed.

-

In August 2021, Siemens AG, an automation company, switched from VMware Workspace One to Microsoft Endpoint Manager for managing its mobile endpoints. Through adopting a consolidated management platform, Siemens can guarantee data security and application compliance on every endpoint. This platform verifies user identity based on employee credentials and validates the device to determine the specific access rights of each employee.

-

In January 2023, ManageEngine, the IT management division of Zoho, a cloud software provider, announced the establishment of two data centers in Canada. By doing this, the company aims to enhance its presence in Canada and provide local organizations with the advantages of storing and processing data locally. Moreover, the announcement intends to motivate current on-premises customers who are contemplating a transition to the cloud.

Unified Endpoint Management Market Report Scope

Report Attribute

Details

Market size value in 2023

USD 5.29 billion

Revenue forecast in 2030

USD 21.79 billion

Growth rate

CAGR of 22.4% from 2023 to 2030

Base year for estimation

2022

Historical data

2017 - 2021

Forecast period

2023 - 2030

Report updated

November 2023

Quantitative units

Revenue in USD million and CAGR from 2023 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Component, organization size, vertical, region

Regional scope

North America; Europe; Asia Pacific; Latin America; Middle East & Africa

Country scope

U.S.; Canada; U.K.; Germany; France; China; Japan; India; Australia; South Korea; Brazil; Mexico; Saudi Arabia; South Africa; UAE

Key companies profiled

42Gears Mobility Systems Pvt Ltd.; BlackBerry Limited; Citrix Systems, Inc.; IBM Corporation; Matrix42 GmbH; Microsoft; Ivanti; Sophos Ltd.; SOTI Inc.; Zoho Corporation Pvt. Ltd.; VMware, Inc.

Customization scope

Free report customization (equivalent up to 8 analyst’s working days) with purchase. Addition or alteration to country, regional & segment scope

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

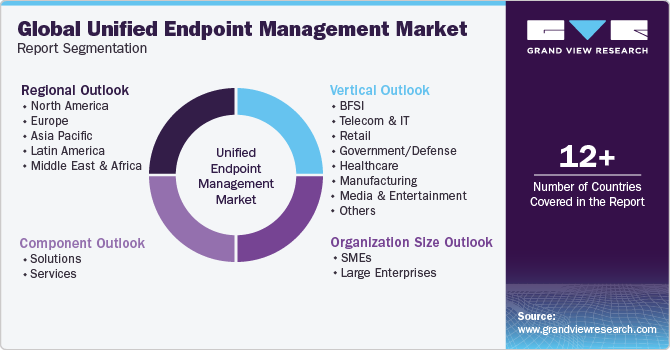

Global Unified Endpoint Management Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2017 to 2030. For this study, Grand View Research has segmented the global unified endpoint management market report based on component, organization size, vertical, and region:

-

Component Outlook (Revenue, USD Million, 2017 - 2030)

-

Solutions

-

Services

-

Professional Service

-

Managed Service

-

-

-

Organization Size Outlook (Revenue, USD Million, 2017 - 2030)

-

SMEs

-

Large Enterprises

-

-

Vertical Outlook (Revenue, USD Million, 2017 - 2030)

-

BFSI

-

Telecom & IT

-

Retail

-

Government/Defense

-

Healthcare

-

Manufacturing

-

Media & Entertainment

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2017 - 2030)

-

North America

-

U.S.

-

Canada

-

-

Europe

-

U.K.

-

Germany

-

France

-

-

Asia Pacific

-

China

-

Japan

-

India

-

Australia

-

South Korea

-

-

Latin America

-

Brazil

-

Mexico

-

-

Middle East and Africa

-

Saudi Arabia

-

South Africa

-

UAE

-

-

Frequently Asked Questions About This Report

b. The global unified endpoint management market size was estimated at USD 4.48 billion in 2022 and is expected to reach USD 5.29 billion in 2023.

b. The global unified endpoint management market is expected to grow at a compound annual growth rate of 22.4% from 2023 to 2030 to reach USD 21.79 billion by 2030.

b. North America dominated the unified endpoint management market with a share of 40.6% in 2022. The early availability and adoption of technology across the North American region have been one of the main reasons for the high adoption of the UEM solution.

b. Some of the key players operating in the unified endpoint management market include 42Gears Mobility Systems Pvt Ltd., BlackBerry Limited, Citrix Systems, Inc., IBM Corporation, Matrix42 GmbH, Microsoft, Ivanti, Sophos Ltd., SOTI Inc., Zoho Corporation Pvt. Ltd., and VMware, Inc. among others.

b. With the growing usage of endpoints such as laptops, tablets, mobile phones, and desktops across enterprises, the need to manage these endpoints using a single platform increases. Thus, the demand for a unified solution is growing with the adoption of advanced endpoints among organizations.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.