- Home

- »

- Medical Devices

- »

-

Urology Surgical Instruments Market, Industry Report, 2033GVR Report cover

![Urology Surgical Instruments Market Size, Share & Trends Report]()

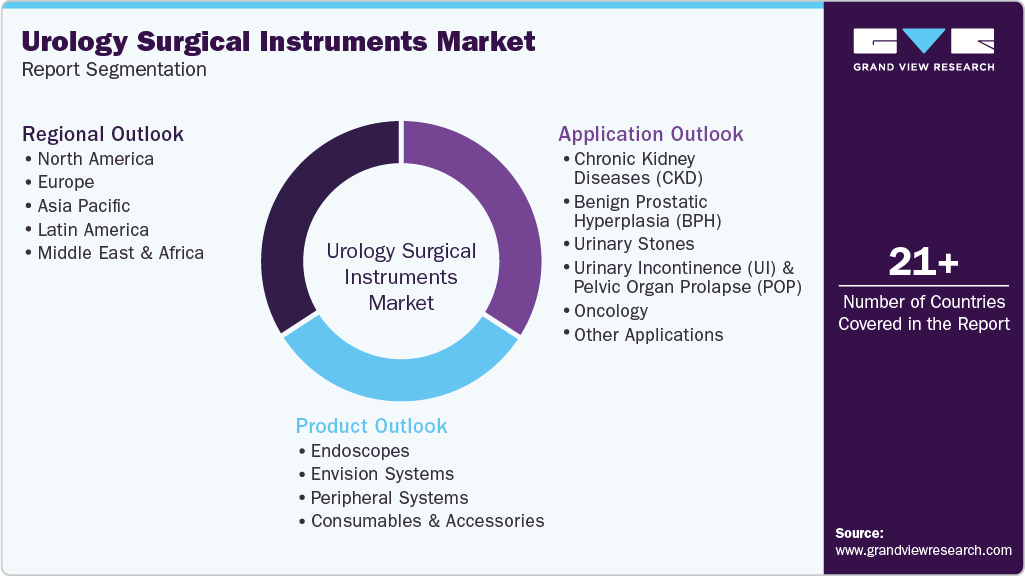

Urology Surgical Instruments Market (2025 - 2033) Size, Share & Trends Analysis Report By Product (Endoscopes, Endovision Systems, Peripheral Systems, Accessories & Consumables), By Application, By Region, And Segment Forecasts

- Report ID: GVR-2-68038-323-2

- Number of Report Pages: 115

- Format: PDF

- Historical Range: 2021 - 2023

- Forecast Period: 2025 - 2033

- Industry: Healthcare

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Urology Surgical Instruments Market Summary

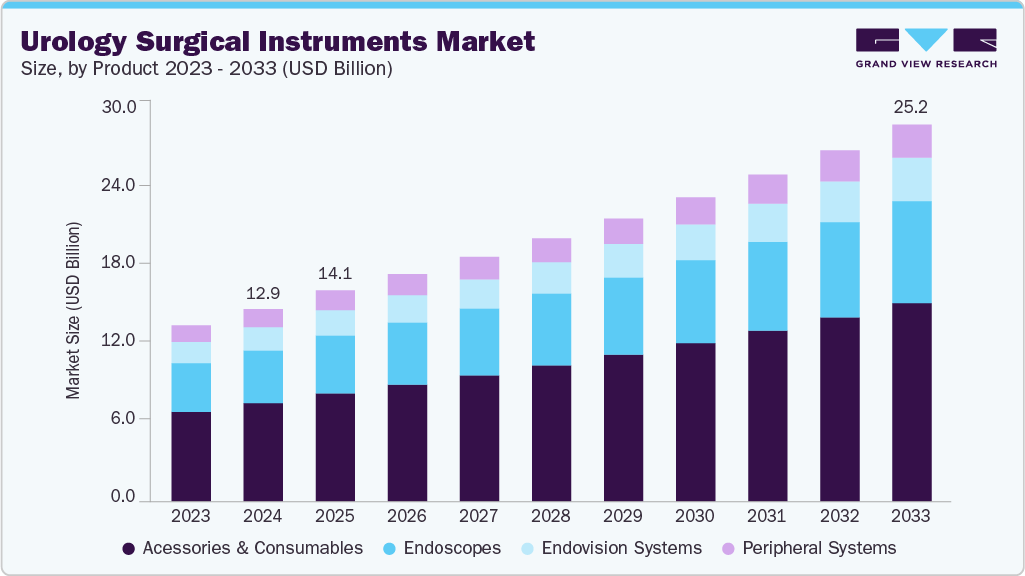

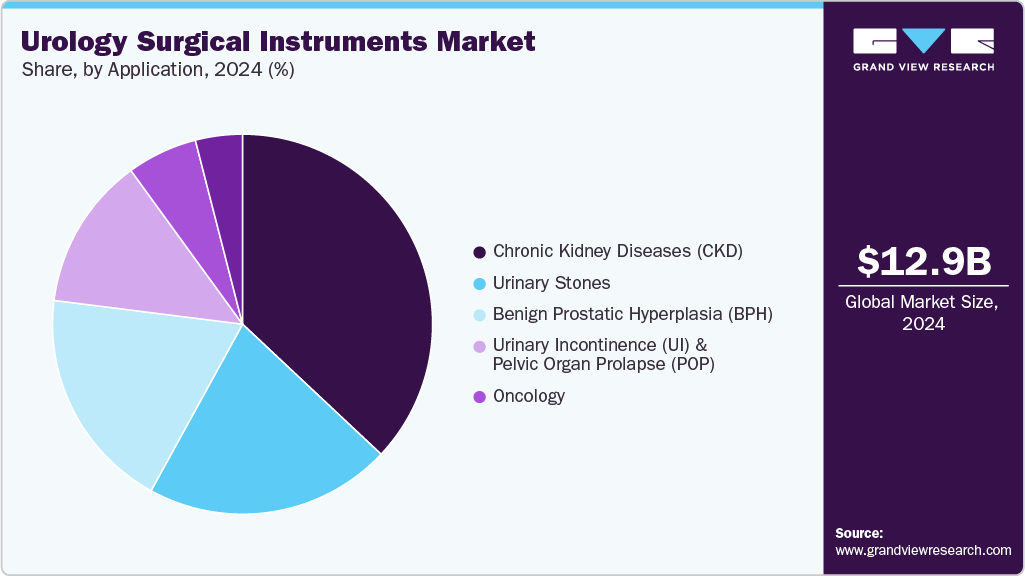

The global urology surgical instruments market size was estimated at USD 12.88 billion in 2024 and is expected to reach USD 25.24 billion by 2033, growing at a CAGR of 7.52% from 2025 to 2033. The urology surgical instruments market is expanding rapidly due to numerous factors, including the rising geriatric population and the increasing prevalence of urological problems such as kidney stones, involuntary leakage of urine (urinary incontinence), benign prostatic hyperplasia (BPH, or enlarged prostate), and cancers affecting the urinary system.

Key Market Trend and Insights

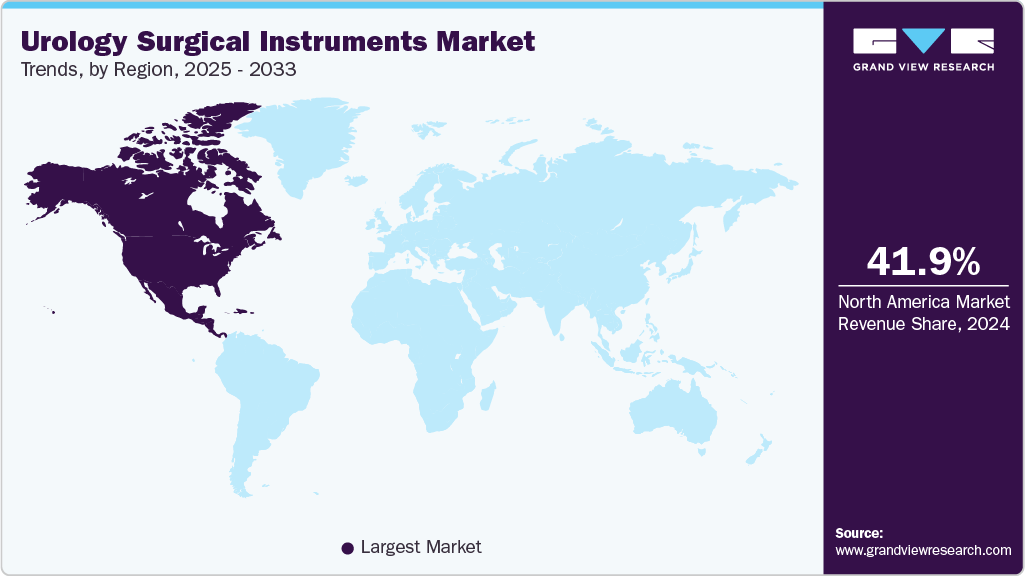

- North America dominated the urological surgical instruments market with the largest revenue share of 41.90% in 2024.

- By product, accessories & consumables segment led the market with the largest revenue share of 51.03% in 2024.

- By application, chronic kidney disease segment led the market with the largest revenue share of 37.30 % in 2024.

Market Size & Forecast

- 2024 Market Size: USD 12.88 Billion

- 2030 Projected Market Size: USD 25.24 Billion

- CAGR (2025-2030): 7.52%

- North America: Largest market in 2024

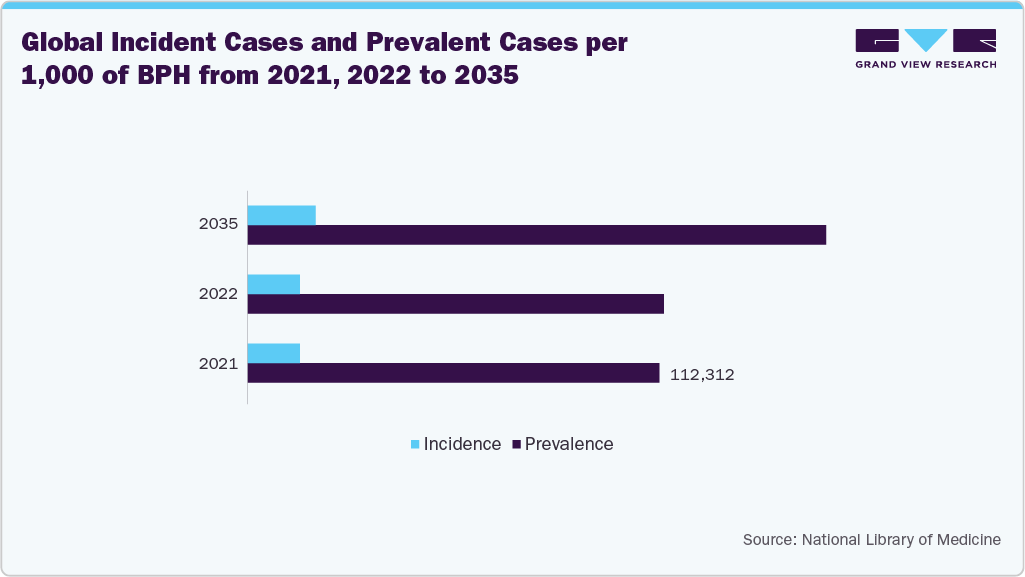

These disorders necessitate surgical intervention, which increases the demand for urological surgical instruments. The growing burden of benign prostatic hyperplasia (BPH) is expected to drive the demand for urology surgical instruments significantly in the coming years. Surgical instruments, such as catheters, play a crucial role in the management of BPH by providing immediate relief from urinary symptoms and significantly enhancing patients’ quality of life. In individuals with BPH, urinary catheters offer a direct pathway for urine to exit the body, effectively bypassing the blockage caused by an enlarged prostate. Due to their essential role in symptom management and patient care, the rising prevalence of BPH is anticipated to contribute to an increased demand for surgical instruments.

Furthermore, prostate cancer is one of the most commonly diagnosed cancers in men, leading to a growing number of surgical interventions such as prostatectomies and biopsies. This rising volume of procedures drives increased demand for advanced urological surgical instruments, including minimally invasive and robotic-assisted technologies. According to data published by the Indian Journal of Urology in September 2024, prostate cancer is the second most common cancer among males across the globe, accounting for approximately 14.2% of all new cancer cases in men, with an age-adjusted incidence rate of 29.4 per 100,000 population. In addition, urinary incontinence is a common complication following prostate cancer surgery, often resulting from nerve and muscle damage around the bladder. As a result, treatments such as urethral slings and artificial urinary sphincters are increasingly used to manage post-surgical urinary incontinence.

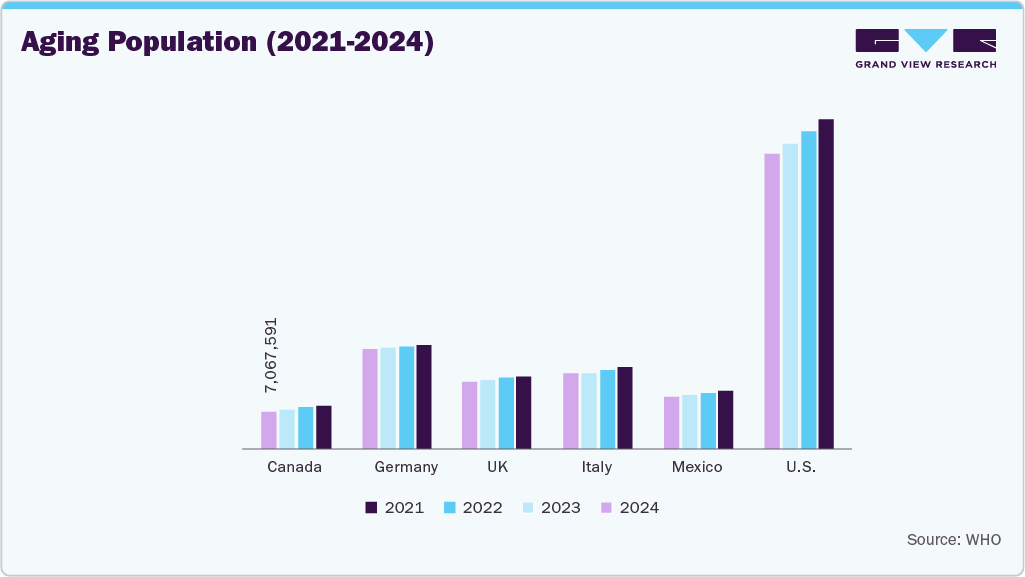

Moreover, the rapidly aging global population is a major factor driving the growth of the urological surgical instruments market, as age-related conditions like benign prostatic hyperplasia (BPH), urinary incontinence, prostate cancer, and kidney stones become increasingly common in older adults. As the number of seniors increases, the demand for diagnostic assessments and surgical interventions to restore urinary function and enhance quality of life rises. This demographic shift is prompting hospitals and surgical centers to expand their urological services and adopt advanced, surgical instruments that offer faster recovery and reduced complications.

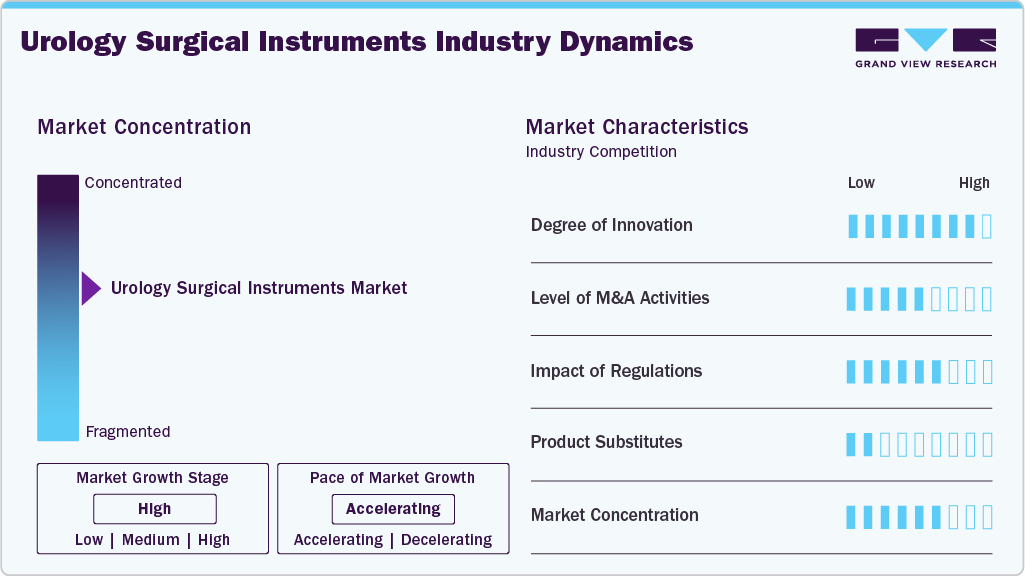

Market Concentration & Characteristics

The urological surgical instruments market is in a high-growth stage, characterized by significant technological advancements, increasing product launches, and expanding adoption in outpatient and home care settings.

The urological surgical instruments market is rapidly advancing, driven by strong growth in robot-assisted and minimally invasive technologies, which are improving precision, outcomes, and recovery times. Innovations in robotics, visualization, and instrument design are enabling more efficient procedures and encouraging hospitals to upgrade their capabilities. Companies are launching novel products. For instance, in September 2024, Olympus Corporation, a global medical technology company, introduced a new 4K camera head for use in endoscopic gynecologic and urology procedures in Europe.

The urology surgical instruments market is witnessing significant regional expansion, driven by increasing collaborations, strategic partnerships, and distribution agreements that enhance global reach and product accessibility. For instance, in September 2025, Olympus Corporation collaborated with MacroLux Medical Technology Co., Ltd. to market and distribute a range of single-use urology devices, including ureteroscopes, cystoscopes, and suction access sheaths. Such initiatives strengthen market presence, improve the availability of advanced technologies, and support the ongoing globalization of urological surgical solutions across key healthcare regions.

"Olympus is a trusted endoscopy partner for treatment of urological disease and now is uniquely positioned to provide access to a broad range of high-quality endoscopes. This includes reusable and single-use flexible scopes, rigid and semi-rigid scopes, powerful lithotripsy solutions, and gold-standard NMIBC detection," said Glen Branconier, Senior Vice President & General Manager of Urology/Gynecology, Olympus Corp.

Product Insights

The accessories and consumables segment held the largest market share in 2024. This segment is expected to grow at the fastest CAGR over the forecast period. The frequent use and disposable nature of these instruments are the primary drivers of this market. Additionally, a projected increase in urological treatments worldwide is expected to drive demand for these instruments in the coming years.

The endoscopes segment held a significant market share in 2024. One of the primary factors driving the growth of the urology endoscopes segment is the increasing demand for less invasive approaches in diagnostic and therapeutic procedures. In addition, factors such as increased private player investments, increased public sector grants or funds, and a rise in the number of hospitals and clinics globally are expected to drive segment growth.

Application Insights

Based on application, the chronic kidney disorders (CKD) segment dominated the market in 2024 due to the increasing prevalence of CKD, the expansion of clinical trials for novel, non-invasive therapies for these conditions, and global government initiatives. According to the American Kidney Fund, in August 2025, approximately 35.5 million people are living with chronic kidney disease in the U.S.

Indicator

Value

Americans with Chronic Kidney Disease (CKD)

35.5 million

Americans with Kidney Failure

815,000

Americans on Dialysis

555,000

Prevalence of CKD in Adults

14% (1 in 7 adults)

Source: American Kidney Fund

The Urinary Incontinence (UI) and Pelvic Organ Prolapse (POP) segment is projected to grow at a significant CAGR over the forecast period. This can be attributed to the rise in the number of surgeries performed to treat urinary incontinence, increased awareness of incontinence, advancements in technology, and the growing use of these products to treat incontinence. The demand for urology surgical instruments is also expected to increase in the coming years due to an increase in POP surgical procedures. For instance, an article published by CU Medicine in October 2024 reported that up to 50% of women with pelvic organ prolapse (POP) also experience urinary incontinence (UI). It highlighted that approximately 6-40% of women may require a follow-up continence procedure after undergoing POP surgery alone.

Regional Insights

North America dominated the market, accounting for the largest revenue share in 2024. Growing geriatric populations in the U.S. and Canada, rising urology cancer and disorder incidences, rising hospital urology equipment purchases, an increase in urologists, a favorable reimbursement environment, and rising healthcare spending on urology disorders are some of the major factors anticipated to drive the regional market for urology surgical instruments over the forecast period.

U.S. Urology Surgical Instruments Market Trends

The U.S. is the largest market in the region for urology surgical instruments, and its expansion can be attributed to the prevalence of large patient populations with urinary disorders, increasing urology procedures, rising hospital spending on urology surgical instrument purchases, and the development of cutting-edge technological products. In the coming years, it is anticipated that the availability of reimbursement for urology operations would increase the volume of urological procedures performed and, consequently, the need for related instruments.

Europe Urology Surgical Instruments Market Trends

The European urology surgical instruments market is experiencing consistent growth driven by a rising incidence of prostate cancer, urinary disorders, and age-related urological conditions. European healthcare systems are early adopters of advanced surgical solutions to improve outcomes and patient safety. Strong regulatory frameworks and ongoing investments in research and innovation support the development of high-precision surgical instruments. Collaborations between hospitals, universities, and medical device companies are accelerating technological progress and expanding access to advanced urology care across the region.

The UK urological surgical market is advancing steadily, supported by a high burden of prostate cancer, kidney disease, and other urological conditions. The National Health Service (NHS) continues to adopt advanced technologies to improve surgical precision and reduce hospital stays. Increasing investments in hospital infrastructure and surgical training are further enhancing the availability of advanced urology procedures. In addition, collaborations with global medical device leaders and ongoing R&D initiatives contribute to innovation and widespread market growth nationwide.

Asia Pacific Urology Surgical Instruments Market Trends

The Asia Pacific market is projected to grow at the fastest CAGR over the forecast period 2025-2033. The market growth is anticipated to be supported by an increase in government spending on urology healthcare, strict regulations governing the use of invasive devices, improved healthcare infrastructure in China and India, and a sharp rise in medical tourism. To address the growing demand for urological procedures, numerous private and governmental institutions in China, India, Japan, and Australia are also investing in modern urology technology.

The urological surgical instruments market in India is expanding rapidly due to the growing prevalence of kidney stones, prostate disorders, and urinary incontinence, driven by lifestyle shifts and an increasing elderly population. Government healthcare initiatives and improved insurance coverage are enhancing access to advanced urological treatments. Moreover, collaborations between global device manufacturers and Indian healthcare providers are boosting local availability of cutting-edge surgical instruments and technologies.

Middle East and Africa Urology Surgical Instruments Market Trends

The Middle East and Africa urological surgical market is steadily growing due to rising cases of kidney stones, prostate cancer, and urinary disorders linked to lifestyle changes and an aging population. Governments are heavily investing in healthcare modernization, increasing access to advanced urology services and minimally invasive surgeries. The adoption of robotic-assisted technologies is gradually expanding, particularly in major healthcare hubs such as the UAE, Saudi Arabia, and South Africa. Medical tourism and strategic collaborations with global device manufacturers are strengthening the market’s technological capabilities and procedure volumes.

Key Urology Surgical Instruments Company Insights

The urology surgical instruments market is highly competitive, with several major players competing for market dominance. Players operating in the market are adopting strategies such as new product launches, technological innovation, partnerships, and distribution network expansion to gain a competitive advantage. To introduce novel equipment and stay on the cutting edge of technical breakthroughs, companies frequently spend on research and development. Technological innovation has led to the development of increasingly sophisticated and effective urological surgical instruments.

Key Urology Surgical Instruments Companies:

The following are the leading companies in the urology surgical instruments market. These companies collectively hold the largest market share and dictate industry trends.

- Medtronic

- Boston Scientific Corporation

- Olympus America

- KARL STORZ

- Cook

- Richard Wolf GmbH.

- Stryker

- Teleflex Incorporated.

- Advin Urology

Recent Development

-

In September 2025, Olympus announced a distribution partnership with MacroLux Medical to expand access to its single-use urology products. This collaboration aims to enhance procedure efficiency and reduce infection risk by offering high-quality disposable devices. The partnership strengthens Olympus’ presence in the urological solutions and supports the growing shift toward single-use technologies in clinical settings.

-

In February 2025, the American Urological Association (AUA) announced 14 companies selected for its third annual Innovation Nexus Showcase. This program showcases emerging technologies in urological care, connecting innovators with key industry leaders and investors. The initiative reflects growing momentum in the development and commercialization of advanced urological surgical solutions, supporting market innovation and future product adoption.

-

In September 2024, Olympus launched a new 4K camera head designed for endoscopic urology and gynecology procedures in Europe. Compatible with the VISERA ELITE III surgical endoscopy system, the device enhances visualization and surgical precision. Olympus also plans sequential launches in Japan, Hong Kong, and Singapore pending regulatory approvals. The camera head was developed through the Sony Olympus Medical Solutions joint venture, combining advanced imaging expertise from both companies.

Urology Surgical Instruments Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 14.12 billion

Revenue forecast in 2033

USD 25.24 billion

Growth rate

CAGR of 7.52% from 2025 to 2033

Base year for estimation

2024

Historical data

2021 - 2023

Forecast period

2025 - 2033

Quantitative units

Revenue in USD million/billion and CAGR from 2025 to 2033

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product, application, and region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; Mexico; UK; Germany; France; Italy; Spain; Denmark; Sweden; Norway; Japan; China; India; Australia; Thailand; South Korea; Brazil; Argentina; Saudi Africa; South Arabia; UAE; Kuwait

Key companies profiled

Medtronic; Boston Scientific Corporation; Olympus America; KARL STORZ; Cook; Richard Wolf GmbH.; Stryker; Teleflex Incorporated.; Advin Urology

Customization scope

Free report customization (equivalent to up to 8 analyst working days) with purchase. Addition or alteration to country, regional & segment scope

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Urology Surgical Instruments Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2033. For the purpose of this study, Grand View Research has segmented the global urology surgical instruments market on the basis of product, application, and region:

-

Product Outlook (Revenue, USD Million, 2021 - 2033)

-

Endoscopes

-

Laparoscopes

-

Ureteroscopes

-

Nephroscopes

-

Resectoscopes

-

Cystoscopes

-

-

Envision Systems

-

Light Sources

-

Cameras

-

Camera Heads

-

Monitors & Displays

-

-

Peripheral Systems

-

Insufflators

-

Endoscopy Fluid Flushing Devices

-

-

Consumables & Accessories

-

Guidewires

-

Stone Baskets/Retrieval Devices and Extractors

-

Catheters

-

Stents

-

Biopsy Devices

-

Fluid Flushing Devices, Connecting Tubes, Clamps, Overtubes, and Distal Attachments

-

Dilator Sets and Ureteral Access Sheaths

-

Drainage Bags

-

Surgical Dissectors

-

Needle Forceps and Needle Holders

-

Others

-

-

-

Application Outlook (Revenue, USD Million, 2021 - 2033)

-

Chronic Kidney Diseases (CKD)

-

Benign Prostatic Hyperplasia (BPH)

-

Urinary Stones

-

Urinary Incontinence (UI) and Pelvic Organ Prolapse (POP)

-

Oncology

-

Other Applications

-

-

Regional Outlook (Revenue, USD Million, 2021 - 2033)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

Spain

-

Denmark

-

Sweden

-

Norway

-

-

Asia Pacific

-

Japan

-

China

-

India

-

Australia

-

Thailand

-

South Korea

-

-

Latin America

-

Brazil

-

Argentina

-

-

MEA

-

South Africa

-

UAE

-

Kuwait

-

Saudi Arabia

-

-

Frequently Asked Questions About This Report

b. The global urology surgical instruments market size was estimated at USD 12.88 billion in 2024 and is expected to reach USD 14.12 billion in 2025.

b. The global urology surgical instruments market is expected to grow at a compound annual growth rate of 7.52% from 2025 to 2033 to reach USD 25.24 billion by 2033.

b. North America dominated the urology surgical instruments market, accounting for a 41.90% share in 2024. Growing geriatric populations in the U.S. and Canada, rising urology cancer and disorder incidences, rising hospital urology equipment purchases, an increase in urologists, a favorable reimbursement environment, and rising healthcare spending on urology disorders are some of the major factors anticipated to drive the regional market for urology surgical instruments over the forecast period.

b. Some of the key players operating in the urology surgical instruments market include Medtronic, Boston Scientific Corporation, Olympus America, KARL STORZ, Cook, Richard Wolf GmbH, Stryker, Teleflex Incorporated, and Advin Urology.

b. Key factors driving market growth include increasing R&D expenditures & incessant product launches, a growing preference for minimally invasive surgeries, and a rising prevalence of urinary disorders.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.