Uropathy Treatment Market Size & Trends

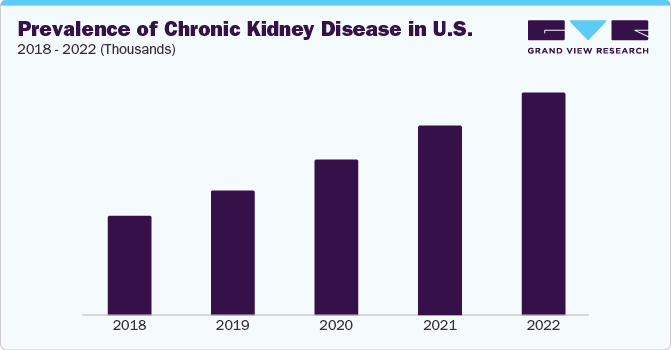

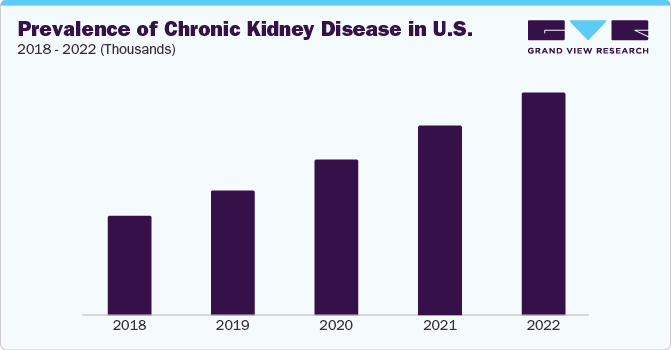

The global uropathy treatment market size was valued at USD 4.2 billion in 2022 and is expected to grow at a compound annual growth rate (CAGR) of 4.0% from 2023 to 2030. The market is driven by the growing prevalence of kidney stones, urological disorders, an increasing occurrence of cancer, and advancements in catheters and stent technology. Uropathy is commonly caused by bladder stones, uterine cancer, blood clots, colon cancer, and cervical cancer. Uropathy treatment options include stents, catheters, and medications.

According to the Advances in Urology, kidney stone diseases are a growing urological health concern that impacts roughly 15% of the global population. While it can affect individuals of all age groups, it is more prevalent in men between the age of 20 to 49. Furthermore, around 7% of women and 13% of men are expected to develop kidney stones over the course of their lifetime. Thus, the increasing prevalence of kidney disorders is encouraging the prominent players in the market to invest in technological advancements in uropathy treatment.

The COVID-19 pandemic had a significant impact on the market. While the prevalence of urological disorders, kidney stones, and cancer-related uropathy continues to rise, the pandemic disrupted healthcare systems and priorities. Non-essential medical procedures were postponed, including many uropathy treatments, leading to delayed interventions and potential complications for patients.

Additionally, the redirection of resources and focus towards COVID-19 research and care slowed down innovations and advancements in uropathy treatment technology. The economic repercussions of the pandemic also affected healthcare budgets and patient affordability, potentially impacting the adoption of uropathy treatments. However, the increased awareness of health and the importance of telemedicine during the pandemic drove interest in remote monitoring and non-invasive treatment options, potentially reshaping the uropathy treatment landscape in the post-pandemic era.

Treatment Insights

Based on treatment, the market is segmented into devices and stents. The stents segment held the largest market share in 2022. The segment growth is attributed to its application intreating ureter blockage caused by kidney stones. It facilitates the diversion of urine flow around the obstruction, simultaneously reducing the associated pain, which is typically caused by the blockage. In certain instances, stents also aid in draining infected urine when infections are linked to kidney stones. Thus, key players in the market are developing cost-effective and technologically advanced stents capable of catering to the rising demand.

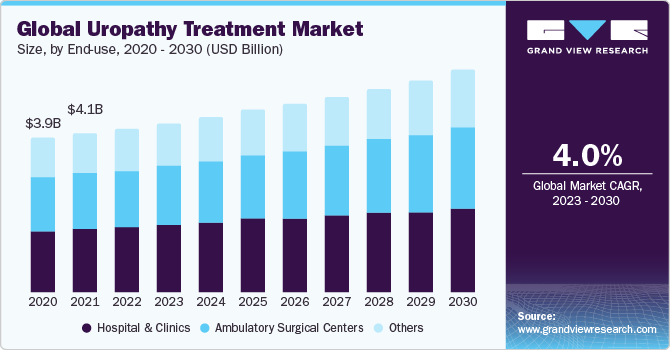

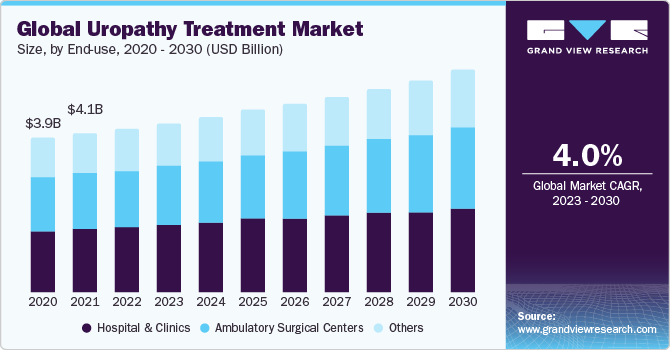

End-use Insights

Based on the end use, the market is segmented into hospitals and clinics, ambulatory surgical centers, and others. The hospitals and clinics segment dominated the market in 2022. The segment’s dominance is attributed to the increasing prevalence of kidney stones, urological disorders, and uropathy related to cancer. Hospitals often have specialized urology departments or centers equipped to diagnose and treat various uropathic conditions, providing patients access to experts in the field.

Furthermore, advancements in minimally invasive surgical techniques and medical technologies that might be available at hospitals are impelling the segment’s growth.

Regional Insights

North America dominated the market in 2022 owing to the growing incidence of kidney stones cases in the region. According to research published in the Clinical Journal of the American Society of Nephrology, 1 in 11 people in the U.S. experience a urinary stone at least once in their lifetime. Furthermore, the occurrence of urinary stone disease among adolescents is increasing annually by 4% to 6%. This spike in uropathy conditions is significantly contributing to the regional market growth. Furthermore, technological developments, the launch of new products, and the presence of well-established healthcare infrastructure are all driving the market growth in this region.

Key Companies & Market Share Insights

Key players operating in the market are Boston Scientific Corporation, Cook Medical, Bayer AG, Sanofi, B. Braun Melsungen AG, C. R. Bard, Inc., Olympus Corporation, Teleflex Incorporated, Merit Medical Systems, Inc., and Argon Medical Devices, Inc. The market participants are constantly working towards new product development, clinical trials, M&A activities, and other strategic alliances to gain further market avenues.

The following are some instances of strategic initiatives:

-

In February 2023, Johnson & Johnson subsidiary Ethicon announced the successful use of the MONARCH Platform for Urology to perform a robotic-assisted removal of kidney stones on the first patient. This groundbreaking procedure, which involved robotically guided electromagnetic (EM) assistance, was carried out as part of a clinical study conducted by UCI Health, the clinical arm of the University of California, Irvine (UCI). The study marked the successful completion of the first-ever robotically guided percutaneous access and mini-percutaneous nephrolithotomy (PCNL) operation.

-

In May 2022, the Ureteral Stent Co. and the University Hospitals Cleveland’s Dr. Lee received FDA 510k clearance for their collaboratively developed Relief Stent. This approval is expected to facilitate the marketing of the stent in the U.S. for patients suffering from kidney stones and kidney drainage issues.