- Home

- »

- Next Generation Technologies

- »

-

U.S. 3D Concrete Printing Market Size, Industry Report 2030GVR Report cover

![U.S. 3D Concrete Printing Market Size, Share & Trends Report]()

U.S. 3D Concrete Printing Market (2025 - 2030) Size, Share & Trends Analysis Report By Printing System, By Material Type (Cement-based, Geopolymer-based, Fiber-reinforced Concrete, Custom Proprietary Mortars/Binders), By Application, By End-user, And Segment Forecasts

- Report ID: GVR-4-68040-605-4

- Number of Report Pages: 80

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2025 - 2030

- Industry: Technology

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

U.S. 3D Concrete Printing Market Trends

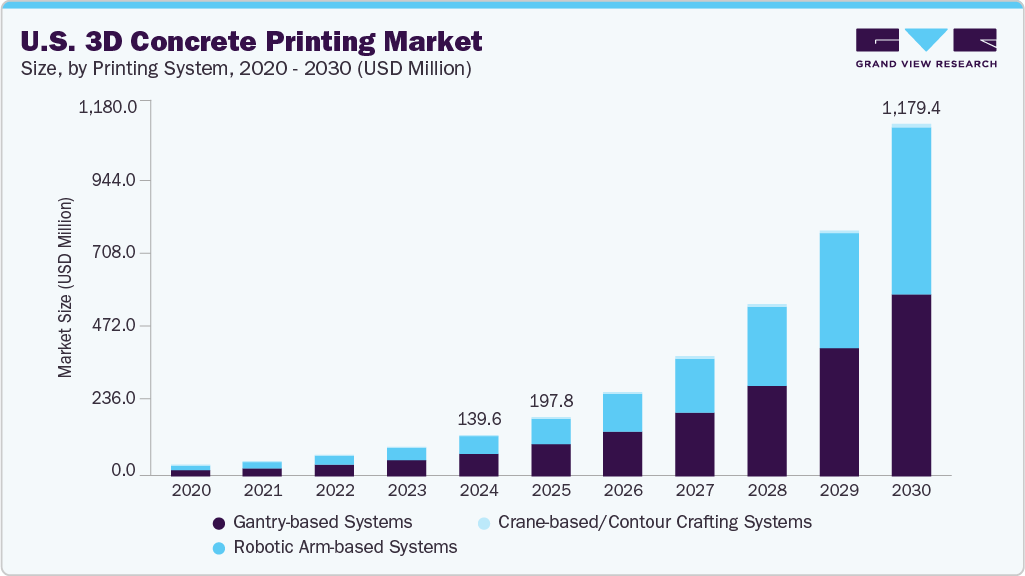

The U.S. 3D concrete printing market size was estimated at USD 139.6 million in 2024 and is projected to grow at a CAGR of 42.9% from 2025 to 2030. Several key drivers are driving the U.S. 3D concrete printing industry's growth. The construction industry's focus on faster, cost-effective, and sustainable building methods has led to the adoption of 3D concrete printing technologies. This approach addresses challenges such as labor shortages and the need for affordable housing by enabling rapid construction with reduced material waste. In addition, technology’s ability to create complex and customized structures aligns with the growing demand for innovative architectural designs. These factors collectively contribute to the increasing interest and investment in 3D concrete printing within the U.S. construction sector.

Technological advancements have significantly influenced the U.S. 3D concrete printing market. The integration of automation and robotics has enhanced precision and efficiency in the printing process, allowing for the construction of intricate designs with minimal human intervention. Innovations in material science, such as the development of sustainable concrete mixes incorporating recycled aggregates and industrial by-products, have improved the environmental footprint of 3D printed structures. Furthermore, the adoption of artificial intelligence and machine learning is optimizing print parameters in real-time, leading to improved quality and reduced construction times.

Significant investments are also driving the expansion of the 3D concrete printing capabilities in the U.S. For instance, in 2024, companies such as ICON Technology, Inc. spearheaded projects such as the construction of the world's first 3D-printed hotel in Texas, demonstrating the commercial viability of the technology. Collaborations between private firms and government agencies have facilitated research and development efforts, focusing on enhancing printing technologies and material formulations. These investments highlight the commitment to advancing 3D concrete printing as a mainstream construction method.

The U.S. housing shortage has prompted the exploration of innovative construction methods. 3D concrete printing has emerged as a viable solution, offering rapid construction and reduced labor costs. For instance, Habitat for Humanity utilized 3D printing to build homes in Virginia and Arizona, completing structures faster and at lower costs compared to traditional methods. These projects demonstrate the technology's potential in addressing affordable housing needs.

Despite the promising outlook, certain restraints challenge the widespread adoption of 3D concrete printing in the U.S. High initial investment costs for equipment and training pose significant barriers, particularly for smaller construction firms. In addition, the limited availability of specialized materials and the need for skilled operators hinder scalability. Concerns regarding the long-term durability and structural integrity of 3D-printed buildings also contribute to cautious adoption. Addressing these challenges through continued research, standardization, and workforce development is essential for the U.S. 3D concrete printing industry's growth.

Printing System Insights

The gantry-based systems segment dominated the market in 2024 and accounted for the largest share of 55.4%. The gantry-based systems segment’s growth can be attributed to their ability to construct large-scale structures with high precision and efficiency. These systems are particularly well-suited for residential, commercial, and infrastructure projects that require substantial build volumes. The precision offered by gantry systems ensures structural integrity. It allows for complex architectural designs, making them an attractive option for developers aiming to reduce construction time and costs while maintaining quality. In addition, their compatibility with various concrete mixtures enhances their versatility across different project requirements.

The robotic arm-based systems segment is expected to grow at the fastest CAGR during the forecast period. Robotic arm-based 3D concrete printing systems are gaining traction, especially for projects that demand intricate designs and customization. These systems offer enhanced maneuverability, allowing for the construction of complex geometries and detailed architectural elements that are challenging to achieve with traditional methods. Their flexibility makes them ideal for residential and commercial projects where design uniqueness is a priority. Moreover, robotic arms can operate in confined spaces and adapt to various site conditions, providing a level of versatility that is particularly beneficial for retrofitting and renovation projects, thereby driving the segment’s growth.

Material Type Insights

The cement-based concrete mixes segment held the largest share of the U.S. 3D concrete printing market in 2024. Growth in the cement-based concrete segment has been largely driven by its widespread availability, familiarity among U.S. contractors, and compatibility with existing construction standards. This material type remains the preferred choice for most 3D concrete printing applications in the U.S. due to its proven strength, ease of handling, and cost efficiency. Many large-scale projects, such as affordable housing developments in Texas and Arizona, have utilized cement-based mixes to leverage existing supply chains and labor knowledge.The abundant domestic availability of raw materials further enhances scalability and cost-effectiveness, positioning cement-based concrete as the foundational material driving near-term market growth in large-scale residential and infrastructure applications.

The geopolymer-based mixes segment is expected to register the fastest CAGR of 46.9% during the forecast period. Increased emphasis on sustainability and carbon footprint reduction has spurred interest in geopolymer-based mixes for 3D concrete printing in the U.S. These materials, which use industrial byproducts such as fly ash or slag in place of Portland cement, offer significant environmental benefits by emitting fewer greenhouse gases. While adoption is still in the early stages, their potential for high thermal resistance and long-term durability makes them attractive for military, infrastructure, and climate-resilient construction.

Application Insights

The residential housing segment dominated the U.S. 3D concrete printing industry in 2024. The dual pressures of housing affordability and skilled labor shortages drive the segment's growth. States such as Texas, California, and Arizona have become focal points for pilot communities and single-family home developments built using 3D printing. Furthermore, the scalability of 3D printed housing, along with its ability to produce durable, energy-efficient, and aesthetically flexible homes, is being increasingly recognized by developers and municipal housing authorities seeking innovative solutions to address housing gaps across both urban and rural communities.

The emergency & disaster relief shelters segment is expected to register the fastest CAGR during the forecast period. 3D concrete printing is gaining momentum in the U.S. as a viable solution for emergency and disaster relief shelters due to its rapid deployment capabilities and resilience. Federal agencies have shown growing interest in technology’s potential to deliver durable shelters quickly in the aftermath of hurricanes, wildfires, or other natural disasters. Unlike traditional temporary housing, 3D-printed shelters can be constructed on-site in a matter of days and are designed to withstand extreme weather conditions. Pilot projects and defense-related initiatives in states such as Florida and Louisiana frequently affected by climate-related events, highlight the growing importance of 3D printing in disaster response planning. Increased federal funding for resilient infrastructure and emergency preparedness is expected to further support this application segment.

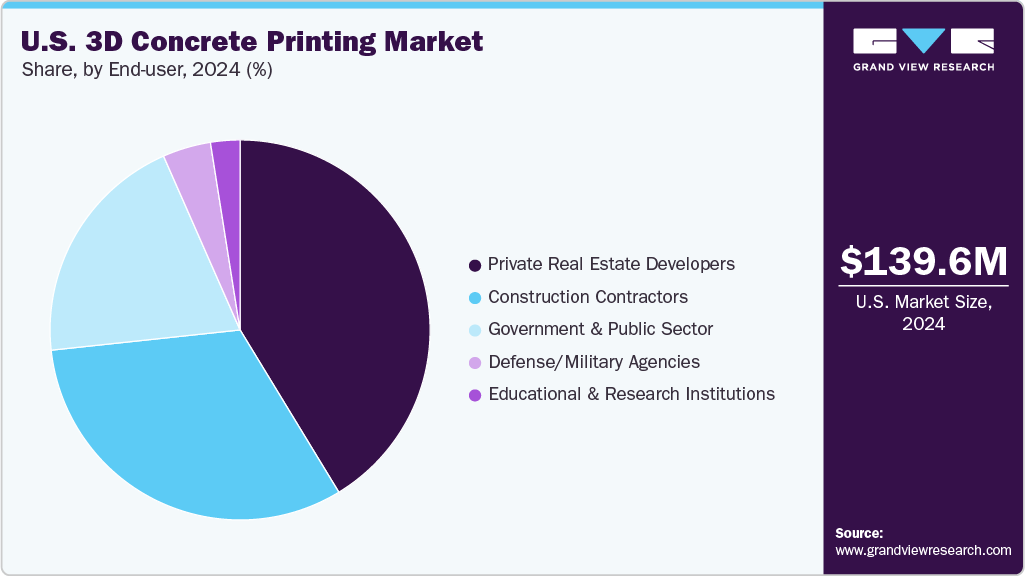

End-user Insights

The private real estate developers segment dominated the market in 2024.Private real estate developers in the U.S. are increasingly driving the adoption of 3D concrete printing as they seek to address market demands for affordable housing, faster project turnaround times, and design flexibility. Technology enables the rapid construction of customized homes at reduced costs by minimizing labor needs and material waste factors that directly impact developers' bottom line. The ongoing housing supply shortage and rising costs of conventional building methods are expected to sustain private sector momentum in adopting 3D concrete printing for residential and mixed-use developments.

The defense/military agencies segment is expected to grow at the fastest CAGR during the forecast period.The segment growth is driven by defense and military agencies’ interest in mobile, rapidly deployable construction solutions for forward-operating bases, shelters, and infrastructure. The U.S. Department of Defense, through initiatives such as those funded by the (USACE) and the Defense Advanced Research Projects Agency (DARPA), has actively explored 3D printing for creating semi-permanent structures in remote or hostile environments. These systems reduce the logistical burden of transporting prefabricated materials and allow troops to build on-demand facilities using locally sourced aggregates. Defense agencies' focus on speed, adaptability, and sustainability in operational environments is driving the demand for 3D concrete printing within the military construction landscape.

Key U.S. 3D Concrete Printing Company Insights

Some of the key companies in the U.S. 3D concrete printing industry include ICON Technology, Inc., Contour Crafting Corporation, and Sika Corporation, among others. These players are driving market momentum through proprietary printing systems, material innovation, and strategic partnerships with government agencies and private developers.

-

ICON Technology, Inc. is a Texas-based construction technologies company recognized as a pioneer in large-scale 3D concrete printing for housing and infrastructure. The company developed its proprietary Vulcan printer and Lavacrete material to deliver sustainable, resilient, and cost-effective homes.

-

Contour Crafting Corporation specializes in automated construction technologies for rapid and scalable building solutions. The company developed a patented layered fabrication process aimed at printing entire building structures. The company is focused on advancing its technologies to transform construction practices across building, infrastructure, and space-related applications.

Key U.S. 3D Concrete Printing Companies:

- ICON Technology, Inc.

- COBOD International A/S

- Apis Cor Inc.

- Contour Crafting Corporation

- Sika Corporation

- Black Buffalo 3D Corporation

- Mudbots 3D Concrete Printing, LLC

- X-Hab 3D

- CyBe Construction

- XtreeE

Recent Developments

-

In May 2025, Walmart and Alquist announced the successful completion of their second 3D concrete printing (3DCP) project at the Owens Cross Roads Supercenter in Alabama. Utilizing advanced robotics and 3D printing technology, Alquist 3D constructed the 5,000-square-foot expansion by layering concrete to form the building’s walls. This innovative method delivered cost savings, tripled structural strength, and reduced construction time by 50% compared to traditional techniques. The project marks the second 3D concrete printed structure Alquist has completed for Walmart, reinforcing the retailer’s commitment to adopting cutting-edge construction solutions.

-

In August 2024, ICON’s Vulcan printer announced it is nearing completion of Wolf Ranch, Texas, the world’s largest 3D-printed neighborhood with 100 homes. This massive 3D printer builds houses layer by layer, offering faster, cheaper construction with less labor and waste compared to traditional methods.

U.S. 3D Concrete Printing Market Report Scope

Report Attribute

Details

Revenue forecast in 2030

USD 1,179.4 million

Growth rate

CAGR of 42.9% from 2025 to 2030

Base year for estimation

2024

Historical data

2018 - 2023

Forecast period

2025 - 2030

Quantitative units

Revenue in USD million, and CAGR from 2025 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Printing system, material type, application, end-user

Country scope

U.S.

Key companies profiled

ICON Technology, Inc.; COBOD International A/S; Apis Cor Inc.; Contour Crafting Corporation; Sika Corporation; Black Buffalo 3D Corporation; Mudbots 3D Concrete Printing, LLC; X-Hab 3D; CyBe Construction; XtreeE

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

U.S. 3D Concrete Printing Market Report Segmentation

This report forecasts revenue growth at a country level and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the U.S. 3D concrete printing market report based on printing system, material type, application, and end-user.

-

Printing System Outlook (Revenue, USD Million, 2018 - 2030)

-

Gantry-based Systems

-

Robotic Arm-based Systems

-

Crane-based/Contour Crafting Systems

-

-

Material Type Outlook (Revenue, USD Million, 2018 - 2030)

-

Cement-based Concrete Mixes

-

Geopolymer-based Mixes

-

Fiber-reinforced Concrete Mixes

-

Custom Proprietary Mortars/Binders

-

-

Application Outlook (Revenue, USD Million, 2018 - 2030)

-

Residential Housing

-

Commercial & Office Buildings

-

Public Infrastructure

-

Emergency & Disaster Relief Shelters

-

Architectural & Decorative Elements

-

-

End-user Outlook (Revenue, USD Million, 2018 - 2030)

-

Government & Public Sector

-

Private Real Estate Developers

-

Construction Contractors

-

Defense/Military Agencies

-

Educational & Research Institutions

-

Frequently Asked Questions About This Report

b. The U.S. 3D concrete printing market size was estimated at USD 139.6 million in 2024 and is expected to reach USD 197.8 million in 2025.

b. The U.S. 3D concrete printing market is expected to grow at a compound annual growth rate of 42.9% from 2025 to 2030 to reach USD 1,179.4 million by 2030.

b. The gantry-based systems segment dominated the market in 2024 and accounted for the largest share of 55.4%. The gantry-based systems segment’s growth can be attributed to their ability to construct large-scale structures with high precision and efficiency.

b. Some key players operating in the U.S. 3D concrete printing market include ICON Technology, Inc., COBOD International A/S, Apis Cor Inc., Contour Crafting Corporation, Sika Corporation, Black Buffalo 3D Corporation, Mudbots 3D Concrete Printing, LLC, X-Hab 3D, CyBe Construction, and XtreeE.

b. The U.S. 3D concrete printing market is being driven by several key drivers. The construction industry's focus on faster, cost-effective, and sustainable building methods has led to the adoption of 3D concrete printing technologies.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.