- Home

- »

- Next Generation Technologies

- »

-

U.S. Accounting Software Market Size, Industry Report, 2030GVR Report cover

![U.S. Accounting Software Market Size, Share & Trends Report]()

U.S. Accounting Software Market (2025 - 2030) Size, Share & Trends Analysis Report By Component (Software, Services), By Deployment Type, By Enterprise Size, By End Use, And Segment Forecasts

- Report ID: GVR-4-68040-627-7

- Number of Report Pages: 80

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2025 - 2030

- Industry: Technology

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Market Size & Trends

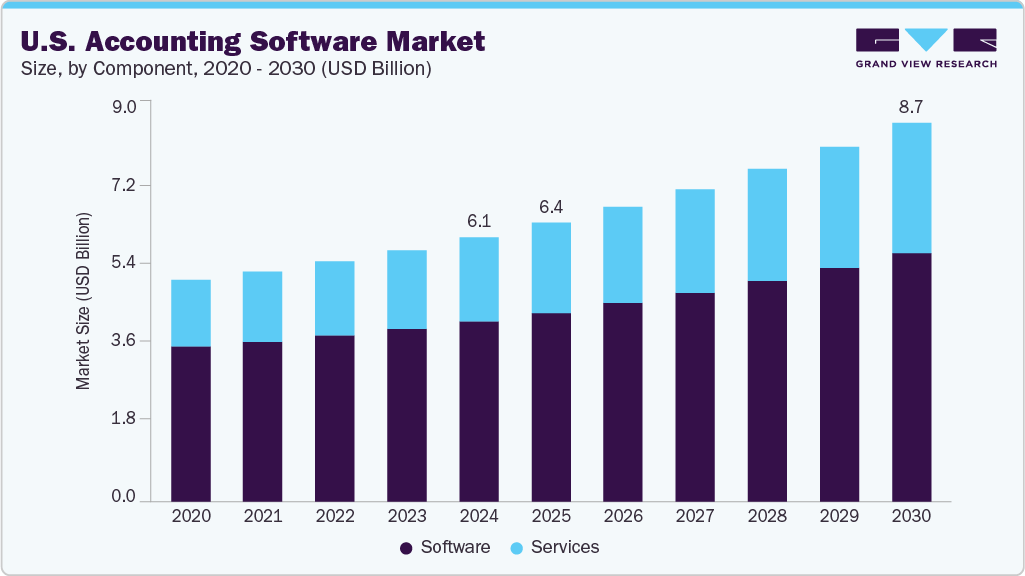

The U.S. accounting software market size was estimated at USD 6.09 billion in 2024 and is projected to grow at a CAGR of 6.3% from 2025 to 2030. The market has been driven by increasing demand for automation in financial operations, the proliferation of small and mid-sized enterprises, and a growing emphasis on real-time data accessibility. Businesses prioritize cost-efficiency, transparency, and compliance, prompting a widespread shift from manual processes to digital financial management tools. Adoption has been further accelerated by remote work trends, which have elevated the need for secure, cloud-based platforms that support decentralized financial teams.

Integration of advanced technologies in accounting software solutions is further driving the growth of the growth. Artificial intelligence (AI) and machine learning are being embedded into platforms to enable predictive analytics, fraud detection, and intelligent automation of tasks such as reconciliations and categorization. Cloud-based deployment has become the preferred model, enabling integration with third-party tools such as CRM, payroll, and ERP systems. In addition, mobile accessibility and real-time dashboards are being utilized to enhance decision-making for both in-house finance teams and external accountants.

Another growing market trend is the increasing emphasis on flexible and advanced reporting capabilities. The rise in international business operations and the complexity of global tax regulations have heightened the need for real-time, accurate financial reporting. As accounting teams increasingly rely on data-driven insights to guide strategic decisions, software providers enhance their platforms with robust business intelligence tools to meet evolving analytical and compliance requirements. In addition, personalized technology is becoming increasingly prevalent across various industries, including sales, marketing, and consumer applications. As a result, there is growing pressure on software providers to move beyond standard, off-the-shelf solutions and deliver customizable features that align with the specific operational needs of modern finance professionals.

A key component of digital transformation reshaping the accounting industry is the emphasis on real-time data analytics and reporting. Modern accounting software aggregates information from various sources such as bank feeds, sales systems, and expense management tools to provide a comprehensive view of financial performance. Immediate access to current financial reports enables business leaders to make timely, informed decisions that traditional manual processes would delay. This responsiveness is particularly valuable in competitive markets, where swift action based on accurate financial insights can offer a decisive advantage. Thus, with financial planning becoming more strategic in U.S. organizations, accounting departments demand deeper visibility into performance metrics, thereby driving market growth.

Despite the significant growth and technological advancements, the U.S. accounting software industry faces certain restraints. The high initial implementation costs associated with advanced accounting software solutions, including licensing fees, customization, and employee training, can be a deterrent, particularly for small and medium-sized enterprises with limited budgets. Resistance to change and a preference for traditional manual accounting methods, especially among smaller businesses or those with established legacy systems, can also hinder adoption. Furthermore, concerns regarding data security and privacy, while being addressed through technological improvements, remain a significant impediment for some organizations when considering cloud-based deployments.

Component Insights

The software segment dominated the market in 2024 and accounted for the largest share of 68.3%. The software segment is further bifurcated into commercial accounting, enterprise, billing & invoice software, payroll management software, custom accounting software, and spreadsheets. Accounting software allows businesses to manage their financial transactions, including tracking income and expenses, generating reports, and handling tax liabilities. In addition, accounting software offers numerous benefits for businesses, including increased efficiency, improved accuracy, cost reduction, and enhanced financial analysis capabilities, thereby driving the segment’s growth.

Services is expected to witness the fastest CAGR over the forecast period. This segment is further segmented into professional services and managed services. U.S.-based companies increasingly leverage consulting, training, system integration, and ongoing technical support to maximize ROI from their accounting platforms. The complexity of U.S. tax regulations and frequent updates to financial reporting standards have heightened demand for expert guidance to ensure compliance and optimize system performance. In addition, managed services are being adopted by small and mid-sized enterprises that lack in-house IT capabilities, enabling them to outsource system maintenance, data management, and upgrades to specialized providers.

Deployment Type Insights

The cloud-based segment held the largest market in 2024. In recent years, one of the most significant shifts has been the transition from traditional desktop accounting applications to cloud-based platforms. Cloud hosting minimizes the need for on-site hardware and IT maintenance, while offering real-time access to financial data across devices. This flexibility is particularly advantageous for small and medium-sized businesses, enabling them to scale efficiently without incurring high infrastructure costs. Furthermore, automatic updates ensure the software remains current with the latest features and security enhancements.

The on-premise segment is expected to register a moderate CAGR of 3.7% during the forecast period. Many U.S.-based companies in the government, healthcare, and finance sectors prefer on-premise solutions due to their control over sensitive financial data and compliance with strict regulatory frameworks. Despite the growing adoption of cloud platforms, on-premise systems are favored for their customization capabilities and integration with legacy infrastructure commonly found in established U.S. businesses. However, the segment faces challenges as maintenance costs and the need for dedicated IT resources remain high compared to cloud alternatives, prompting a gradual but steady migration toward hybrid deployment models in the U.S. market.

Enterprise Size Insights

The large enterprises segment dominated the market in 2024. For large enterprises, several accounting software solutions stand out due to their scalability, advanced features, and ability to handle complex financial operations. Some popular accounting software includes Oracle NetSuite, Microsoft Dynamics 365 Finance, Sage Intacct, and Workday Financial Management. These platforms are designed to manage extensive data, complex processes, and multiple users, making them suitable for the demands of large businesses.

The small and medium enterprises segment is expected to register the fastest CAGR during the forecast period. Accounting software such as QuickBooks, Xero, and FreshBooks is a popular choice for small to medium-sized businesses (SMBs). These platforms offer invoicing, expense tracking, and budgeting features, often with cloud-based options for easy access and collaboration. For instance, QuickBooks streamlines accounting for small businesses by automating key tasks such as bookkeeping, invoicing, time tracking, sales tax management, budgeting, bank reconciliation, and inventory tracking.

End Use Insights

The BFSI segment dominated the market in 2024. Accounting software for the Banking, Financial Services, and Insurance (BFSI) industry is designed to address this sector's unique financial complexities and regulatory requirements. These solutions offer automated transaction processing, risk management, compliance monitoring, and detailed financial reporting tailored to industry standards. Integration with core banking systems, loan management platforms, and insurance claim processing tools ensures seamless operations. In addition, BFSI-specific accounting software supports multi-currency transactions, audit trails, and real-time analytics, enabling organizations to maintain accuracy, transparency, and regulatory compliance in a highly dynamic financial environment.

The IT and telecom segment is expected to witness the fastest CAGR over the forecast period. IT and telecom industry accounting software is tailored to manage the sector’s complex billing structures, project-based revenue recognition, and high transaction volumes. These solutions offer automated invoice generation, contract management, and multi-tiered pricing models to accommodate diverse client agreements. Integrating customer relationship management (CRM) and enterprise resource planning (ERP) systems helps streamline financial workflows, driving the segment’s growth.

Key U.S. Accounting Software Company Insights

Some key companies in the accounting software industry include Infor, Inc., Intuit, Inc., and Oracle Corporation, among others. These companies focus on innovation, scalability, and integration capabilities, while new entrants focus on affordability and specialized features for SMEs. Strategic partnerships, acquisitions, and localized offerings are commonly employed to strengthen market position and expand customer base across diverse industries and regions.

-

Intuit Inc. is a global technology company renowned for its financial and accounting solutions tailored to small businesses, accountants, and individuals. Best known for its flagship product, QuickBooks, the company offers a comprehensive suite of tools for bookkeeping, payroll, invoicing, and tax preparation.

-

Oracle Corporation is a global technology company known for its advanced cloud infrastructure and enterprise software solutions. Its Oracle NetSuite offering is one of the prominent cloud-based ERP platforms, providing comprehensive accounting, financial planning, and business management tools for mid-sized to large enterprises.

Key U.S. Accounting Software Companies:

- Infor, Inc.

- Intuit, Inc.

- Patriot Software LLC

- Microsoft corporation

- Oracle Corporation

- Sage Group Plc

- Clearwater Analytics

- Xero Ltd.

- Tally Solutions Pvt Ltd.

- Workday

Recent Developments

-

In May 2025, Xero Ltd. announced a partnership with Tallyfor, a modern platform for business tax engagements, to introduce an integrated solution that would simplify tax preparation and enhance accounting firms' efficiency.

-

In April 2024, FreshBooks introduced FreshBooks Payments, a new offering that utilizes Stripe Connect’s capabilities, allowing business owners to accept payments smoothly and efficiently.

U.S. Accounting Software Market Report Scope

Report Attribute

Details

Revenue forecast in 2030

USD 8.74 billion

Growth rate

CAGR of 6.3% from 2025 to 2030

Base year for estimation

2024

Historical data

2018 - 2023

Forecast period

2025 - 2030

Quantitative units

Revenue in USD million/billion and CAGR from 2025 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Component, deployment type, enterprise size, end use

Country scope

U.S.

Key companies profiled

Infor, Inc.; Intuit, Inc.; Patriot Software LLC; Microsoft Corporation; Oracle Corporation; Sage Group Plc; Clearwater Analytics; Xero Ltd.; Tally Solutions Pvt Ltd.; Workday

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

U.S. Accounting Software Market Report Segmentation

This report forecasts revenue growth at a country level and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the U.S. accounting software market report based on component, deployment type, enterprise size, and end use:

-

Component Outlook (Revenue, USD Million, 2018 - 2030)

-

Software

-

Commercial Accounting Software

-

Enterprise Accounting Software

-

Billing & Invoice Software

-

Payroll Management Software

-

Custom Accounting Software

-

Spreadsheets

-

-

Services

-

Professional Services

-

Managed Services

-

-

-

Deployment Type Outlook (Revenue, USD Million, 2018 - 2030)

-

Cloud-based

-

On-premise

-

-

Enterprise Size Outlook (Revenue, USD Million, 2018 - 2030)

-

Large Enterprises

-

Small and Medium Enterprises

-

-

End Use Outlook (Revenue, USD Million, 2018 - 2030)

-

BFSI

-

Retail

-

Manufacturing

-

IT & Telecom

-

Government & Public Sector

-

Energy & Utilities

-

Media & Entertainment

-

Pharmaceutical & Healthcare

-

Others

-

Frequently Asked Questions About This Report

b. The U.S. accounting software market size was estimated at USD 6.09 billion in 2024 and is expected to reach USD 6.42 billion in 2025.

b. The U.S. accounting software market is expected to grow at a compound annual growth rate of 6.3% from 2025 to 2030 to reach USD 8.74 billion by 2030.

b. The software segment dominated the market in 2024 and accounted for the largest share of 68.3%. The software segment is further bifurcated into commercial accounting software, enterprise accounting software, billing & invoice software, payroll management software, custom accounting software, and spreadsheets.

b. Some key players operating in the U.S. accounting software market include Infor, Inc., Intuit, Inc., Patriot Software LLC, Microsoft corporation, Oracle Corporation, Sage Group Plc, Clearwater Analytics, Xero Ltd., Tally Solutions Pvt Ltd., and Workday.

b. The U.S. accounting software market has been driven by increasing demand for automation in financial operations, the proliferation of small and mid-sized enterprises, and a growing emphasis on real-time data accessibility.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.