- Home

- »

- Advanced Interior Materials

- »

-

U.S. Adhesives And Sealants Market Size Report, 2022-2030GVR Report cover

![U.S. Adhesives And Sealants Market Size, Share & Trends Report]()

U.S. Adhesives And Sealants Market Size, Share & Trends Analysis Report By Technology, By End-use, By Region (Northeast, Midwest, West, South), And Segment Forecasts, 2022 - 2030

- Report ID: GVR-4-68039-960-7

- Number of Report Pages: 100

- Format: PDF, Horizon Databook

- Historical Range: 2017 - 2020

- Forecast Period: 2022 - 2030

- Industry: Advanced Materials

Report Overview

The U.S. adhesives and sealants market size was valued at USD 8.4 billion in 2021 and is expected to expand at a compound annual growth rate (CAGR) of 4.7% from 2022 to 2030. The U.S. Government is investing significantly in the construction & infrastructure sector to stimulate their economy owing to the negative impact created by the COVID-19 pandemic, which is expected to positively influence market growth in the country. The rising investment by government and private players in the building and construction industry is expected to propel market growth. For instance, in November 2021, the government announced an investment of USD 170.0 billion for affordable housing. The country’s government plans to build or preserve more than 1.0 million affordable homes by 2026.

The U.S. is one of the major markets for adhesives and sealants in the world. The U.S. economy grew by 5.7% in 2021, the largest expansion since 1984. The growth is attributed to increasing investment by the government in various industries such as infrastructure and construction, manufacturing, energy, and transportation, which positively influenced the demand for the products in 2021. In 2022, the country’s GDP growth is expected to be sluggish, owing to geopolitical turbulence created by the Russia-Ukraine conflict, increasing inflation, and the negative impact of the COVID-19 outbreak. This may impact market growth temporarily.

Adhesives and sealants offer high reliability and durability to the medical devices to withstand extreme conditions such as ultraviolet light exposure, high temperature, sterilization cycles, and more. Thus, the rising investment in the medical industry is expected benefit market growth. For instance, the country’s national health expenditure expanded by 4.2% to reach USD 4.3 trillion in 2021. Health spending was 18.5% of the GDP of the U.S. and government support for national health spending grew by 3.4% in 2021.

Volatile Organic Compound (VOC) emissions that take place during the industrial and commercial application of adhesives & sealants pose risks to both, human health and environment. Owing to this these products are always under strict scrutiny in U.S. Hence, the Environmental Protection Agency makes it mandatory for suppliers and manufacturers of the industry to comply with the established VOC standards.

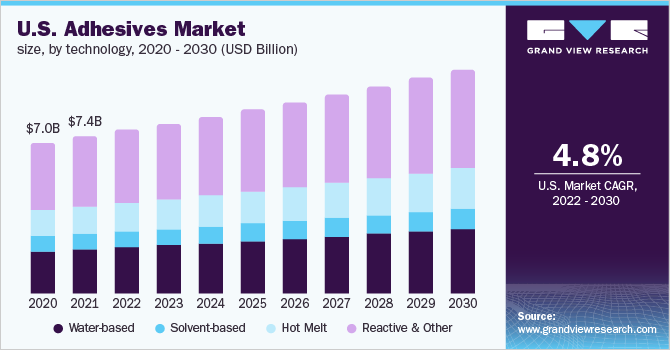

Technology Insights

The hot melt technology segment is expected to register the fastest CAGR of 5.3% in terms of revenue of the U.S. adhesives market during the forecast period. The technology is ideal for permeable and porous substrates. The hot melt adhesives are capable of bonding different substrates including rubber, metals, ceramics, paper, glass, plastic, and more.

The water-based segment is expected to witness lucrative growth across the forecast period.Water-based products are manufactured using a combination of polymers, water, and additives. Water-based adhesives are ideal for non-porous and porous substrates. These are extensively used in industries such as packaging, medical, consumer good, and books.

Owing to increasing demand for water-based products key manufacturers are investing to expand their production capacity. For instance, Synthos announced about investing in the dispersions and adhesives segment. The company is planning to expand production capacity and enhance its product portfolio. This expansion plan is expected to be completed by 2023.

The reactive and others segment held the largest revenue share of more than 47.0% in 2021 of the U.S. adhesives market and is anticipated to continue its dominance across the forecast period. The products in this segment offer several advantages such as higher heat resistance, high manufacturing speed owing to short setting time, and strong adhesion properties to a broad range of substrates.

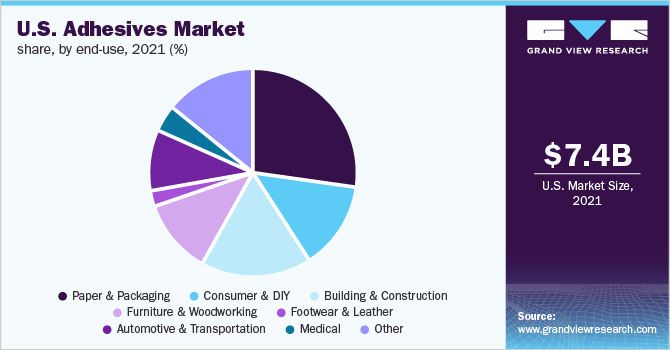

End-use Insights

The paper and packaging end-use segment held the largest revenue share of more than 29.0% in 2021 of the U.S. adhesives market. Rising demand for packaged food and increasing penetration of e-commerce is driving the growth of the segment. For instance, according to U.S. Census Bureau, the total e-commerce sales in Q1 of 2022, were up 6.7% as compared to Q1 2021.

The building and construction segment is expected to witness a CAGR of 4.1% in terms of revenue from 2022 to 2030 of the U.S. adhesives market. Adhesives are used as a bonding agent to join materials. Increasing spending on building & construction in the country will propel the demand for the products in the said forecast period. For instance, the construction spending in the U.S. in first 5 months of 2022, amounted to USD 686.9 billion, which was 11% above for the same period in 2021.

Automotive is a vital application segment of the U.S. sealants market. It held a revenue share of more than 16.0% in 2021. The products are suitable for many applications such as door sealing, hood, trunk, and others. The increasing demand for lightweight vehicles and penetration of EVs is expected to increase the demand of sealants in the said forecast period.

Regional Insights

South U.S. is expected to register the fastest growth rate of 5.0% in terms of revenue from 2022 to 2030 of the U.S. adhesives and sealants market. The boost in the investments in infrastructure sector is likely to propel market growth in the region. For instance, in November 2021, U.S. government announced that Texas will receive USD 35 billion for infrastructure development.

West U.S. accounted for nearly 29.0% of the revenue share in 2021. Rising investment in residential and construction sector is anticipated to augment market growth in the region. For instance, in February 2022, the government of California announced that they are going to build 2,300 housing units by 2026.

Midwest is anticipated to grow at a rate of 3.8%, in terms of revenue, over the forecast period. Increasing investment in manufacturing, packaging, EVs, and construction is driving the market for adhesives and sealants in the region. For instance, in January 2022, General Motors announced that they are going to invest USD 7 billion in the construction of an EV manufacturing facility in Michigan. The plant is expected to have a manufacturing capacity of 1 million units by the end of 2025.

Key Companies & Market Share Insights

The increasing demand for adhesives and sealants in various industries such as construction, infrastructure, automotive, footwear, and leather has pushed key manufacturers of the market for adhesives and sealants to adopt strategic initiatives such as merger & acquisition and capacity expansion. For instance, Scott Bader Company Ltd. acquired a new adhesive and gelcoats manufacturing facility in North Carolina, U.S.

In 2021, APPLIED Adhesives, a manufacturer and distributor of adhesives in U.S., announced the acquisition of American Chemical, a regional supplier of adhesives. As APPLIED Adhesives is a key supply chain partner to leading manufacturers, this acquisition is expected to help the company strengthen its sales in the region with improved technical support and a strong consumer base. Some of the prominent players in the U.S. adhesives and sealants market include:

-

3M

-

American Sealants, Inc

-

Astro Chemical Company, Inc.

-

deVan Sealants, Inc.

-

Dow

-

Franklin International

-

H.B. Fuller

-

Huntsman Corporation

-

Parker Hannifin Corp

-

United Resin Corporation

U.S. Adhesives And Sealants Market Report Scope

Report Attribute

Details

Market size value in 2022

USD 8.8 billion

Revenue forecast in 2030

USD 12.7 billion

Growth rate

CAGR of 4.7% from 2022 to 2030

Base year for estimation

2021

Historical data

2017 - 2020

Forecast period

2022 - 2030

Quantitative units

Volume in kilotons, revenue in USD million, and CAGR from 2022 to 2030

Report coverage

Volume and revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Adhesives - Technology, End-use, Region

Sealants - End-use, Region

Country scope

U.S. (Northeast, West, Midwest, South)

Key companies profiled

3M; Dow; H.B. Fuller; American Sealants, Inc.; Franklin International; deVan Sealants, Inc.; Huntsman Corporation; Parker Hannifin Corp; Astro Chemical Company, Inc.

Customization scope

Free report customization (equivalent to up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

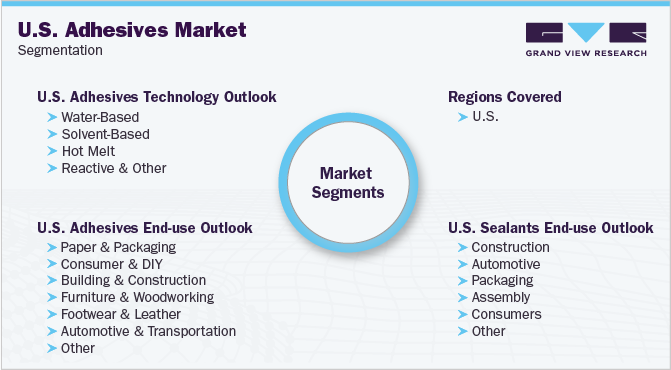

U.S. Adhesives And Sealants Market Segmentation

This report forecasts revenue growth at revenue and volume at the country level (the U.S.) and provides an analysis of the latest industry trends in each of the sub-segments from 2017 to 2030. For the purpose of this study, Grand View Research has segmented the U.S. adhesives and sealants market report on the basis of technology, end-use, and region:

U.S. Adhesives Market

-

Technology Outlook (Volume, Kilotons; Revenue, USD Million, 2017 - 2030)

-

Water-Based

-

Solvent-Based

-

Hot Melt

-

Reactive & Other

-

-

End-use Outlook (Volume, Kilotons; Revenue, USD Million, 2017 - 2030)

-

Paper & Packaging

-

Consumer & DIY

-

Building & Construction

-

Furniture & Woodworking

-

Footwear & Leather

-

Automotive & Transportation

-

Medical

-

Other

-

-

Regional Outlook (Volume, Kilotons; Revenue, USD Million, 2017 - 2030)

-

U.S.

-

Northeast

-

Midwest

-

West

-

South

-

-

U.S. Sealants Market

-

End-use Outlook (Volume, Kilotons; Revenue, USD Million, 2017 - 2030)

-

Construction

-

Automotive

-

Packaging

-

Assembly

-

Consumers

-

Other

-

-

Regional Outlook (Volume, Kilotons; Revenue, USD Million, 2017 - 2030)

-

U.S.

-

Northeast

-

Midwest

-

West

-

South

-

-

Frequently Asked Questions About This Report

b. The U.S. adhesives & sealants market was estimated at USD 8.4 billion in 2021 and is expected to reach USD 8.8 billion in 2022.

b. The U.S. adhesives & sealants market is expected to grow at a compound annual growth rate of 4.7% from 2022 to 2030 to reach USD 12.7 billion by 2030.

b. South U.S was the key regional segment of the market with a revenue share of above 44.0% in 2021.

b. Some of the key players operating in the U.S. adhesives & sealants market are 3M, Dow, H.B. Fuller, Parker Hannifin Corp, and Huntsman Corporation, among others.

b. Increasing penetration of packaged food along with rising production of electric vehicles and batteries is driving the growth for the U.S. adhesives & sealants market.

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."