- Home

- »

- Next Generation Technologies

- »

-

U.S. Aerospace Testing Market Size, Industry Report, 2033GVR Report cover

![U.S. Aerospace Testing Market Size, Share & Trends Report]()

U.S. Aerospace Testing Market (2025 - 2033) Size, Share & Trends Analysis Report By Testing Type (Material Testing, Environmental Testing, Electromagnetic Compatibility (EMC) Testing), By Application, By Aviation Type, By End Use, And Segment Forecasts

- Report ID: GVR-4-68040-632-9

- Number of Report Pages: 100

- Format: PDF

- Historical Range: 2021 - 2024

- Forecast Period: 2025 - 2033

- Industry: Technology

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

U.S. Aerospace Testing Market Size & Trends

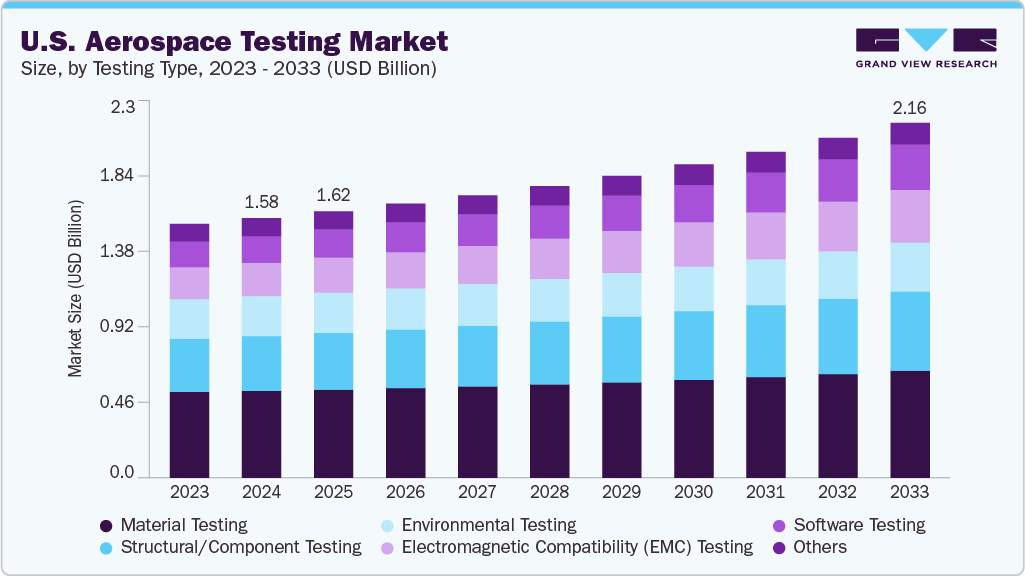

The U.S. aerospace testing market size was estimated at USD 1,585.8 million in 2024 and is projected to reach USD 2,167.4 million by 2033, growing at a CAGR of 3.6% from 2025 to 2033. The U.S. Aerospace Testing market is growing due to the increasing use of remote inspection and digital twin technologies. These tools create virtual models of aircraft and systems, allowing for detailed analysis without physical access. High-resolution imaging and data integration improve the accuracy of defect detection. This reduces the need for on-site inspection teams, cutting operational costs.

Extended reality applications support virtual assessments across geographically dispersed fleets. Together, these advancements enable faster, more efficient, and data-driven maintenance and testing processes. Companies are now using these technologies to make aerospace inspection and maintenance more efficient. For instance, in April 2025, Gecko Robotics, Inc., a U.S.-based AI and robotics company, and L3Harris Technologies, Inc. partnered to develop an extended reality (XR) solution that creates high-resolution digital twins of aircraft for remote maintenance and defect detection. This partnership enhances inspection accuracy, reduces operational costs, and supports the modernization of military aircraft through advanced virtual assessment tools.

Next-generation display system testing is becoming increasingly important in the U.S. aerospace testing market. As aircraft manufacturers integrate advanced digital cockpit displays, testing requirements are evolving to match the complexity of these systems. This trend is closely tied to real-world product development, with testing driven by specific instances of display integration and prototyping. New display systems often rely on high-performance processors and require validation across multiple performance parameters. Several aerospace technology developers are actively working on large-area and high-resolution displays, increasing the need for rigorous and continuous testing protocols. For instance, in January 2025, Honeywell International Inc. and NXP Semiconductors, a semiconductor company, expanded their partnership to accelerate the development of next-generation aviation technologies, including AI-driven avionics, large-area cockpit displays, and autonomous flight capabilities. The partnership utilizes NXP's high-performance processors and Honeywell's Anthem system to enhance safety, efficiency, and long-term value in both traditional and electric aircraft.

Electric and eVTOL aircraft testing is gaining momentum in the U.S. aerospace testing market as companies accelerate development of next-generation air mobility solutions. With increased focus on electric propulsion and vertical takeoff and landing systems, testing now emphasizes powertrain performance, flight control stability, and integrated system validation. These aircraft require rigorous evaluation of battery systems, thermal management, noise levels, and flight autonomy. Testing protocols are adapting to address both urban and regional flight profiles, where efficiency, safety, and regulatory compliance are critical. The transition toward electric aviation is instance-driven, with real-time prototyping pushing the demand for customized test environments. Several developers are actively progressing electric and eVTOL platforms, expanding the scope and intensity of testing operations.

Testing Type Insights

The material testing segment dominated the U.S. Aerospace Testing market in 2024 with a market share of 33.5%. This dominance is driven by the growing need for advanced materials that can withstand extreme conditions while maintaining structural integrity. Aerospace manufacturers are increasingly adopting lightweight composites and high-performance alloys, which require rigorous testing to ensure compliance with safety and durability standards. Material testing is crucial in identifying fatigue resistance, thermal behavior, and corrosion properties of components. As aircraft and spacecraft designs evolve, the demand for precise and reliable material evaluation continues to grow. Continuous innovation in non-destructive testing methods and automated analysis is further strengthening this segment’s influence in the market.

Software testing is growing in the U.S. Aerospace Testing market due to increasing system complexity and digital integration. Modern aircraft rely heavily on embedded software for navigation, communication, and control. Ensuring software reliability is critical to safety and regulatory compliance. Automated testing tools are being adopted to handle large volumes of code and complex algorithms. Cybersecurity validation is also becoming a core part of aerospace software testing. These factors are driving continued investment and growth in this segment. The focus on simulation, real-time monitoring, and AI-driven validation is further accelerating demand for advanced software testing solutions.

Application Insights

Aircraft structures dominated the U.S. aerospace testing market in 2024 due to the critical need for ensuring airframe durability and reliability. Structural components undergo repeated stress and extreme environmental conditions, requiring comprehensive validation. Testing focuses on load-bearing capacity, fatigue resistance, and deformation behavior under simulated flight scenarios. The shift toward innovative designs with reduced weight has led to greater testing precision and complexity. Non-invasive techniques such as ultrasonic and X-ray inspections are being widely used to detect internal flaws. The growing demand for advanced aircraft platforms continues to support structural testing as a central area of focus.

Avionics and electronics are growing in the U.S. aerospace testing market as aircraft systems become increasingly software-driven and interconnected. These components must function accurately under a range of environmental and operational conditions. Testing ensures signal integrity, electromagnetic compatibility, and fault tolerance in critical flight systems. The expansion of autonomous technologies and digitally controlled platforms is raising the bar for validation standards. Advanced testing frameworks are being developed to address performance under stress, vibration, and electronic noise. This shift shows a broader move toward smarter, more integrated aerospace systems requiring rigorous electronic evaluation.

Aviation Type Insights

Commercial Aviation dominated the U.S. Aerospace Testing market. Testing demand is being driven by fleet upgrades, increasing aircraft complexity, and higher expectations for operational safety and efficiency. Airlines are placing greater emphasis on structural integrity, software validation, and system reliability to meet certification standards. As air travel demand continues to rebound, testing for fuel-efficient designs and reduced-emission engines is becoming more critical. Enhanced digital tools such as sensor-integrated diagnostics and automated inspection systems are being used to streamline testing cycles. These factors are reinforcing commercial aviation’s dominant role in shaping aerospace testing priorities in the U.S.

The space exploration segment is gaining momentum in the U.S. aerospace testing market, driven by the rapid evolution of private space ventures and government-backed initiatives. The growing launch frequency of satellites, crewed missions, and experimental spacecraft is increasing the complexity and scope of required testing. Testing protocols now extend beyond structural validation to include thermal behavior, radiation exposure, and propulsion system resilience. Emerging technologies, such as AI-powered simulations and remote autonomous testing platforms, are improving test accuracy and speed. Investment in reusable launch systems and lunar or planetary missions is also intensifying the need for advanced aerospace validation.

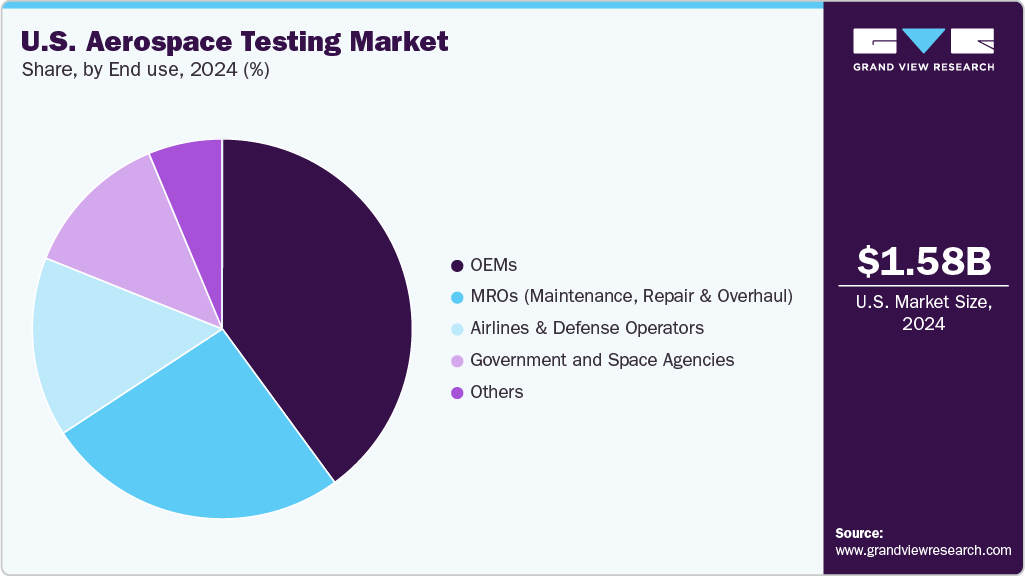

End Use Insights

OEMs dominated the U.S. Aerospace Testing market. Original equipment manufacturers are central to the U.S. aerospace testing market as they oversee the design, development, and integration of critical components. Their responsibility for delivering high-performance and safe aircraft drives continuous investment in testing infrastructure. In-house facilities allow OEMs to conduct extensive validation across structural, software, and propulsion systems with full control over data and process confidentiality. Increasing system integration and tighter delivery schedules are pushing OEMs to adopt automated testing and simulation tools. Collaborations with suppliers often involve joint validation efforts to meet tight performance and certification requirements. These dynamics have helped OEMs retain a dominant position in shaping the direction and volume of aerospace testing activities.

Government and Space Agencies in the U.S. are expanding their role in aerospace testing as national interests shift toward innovation and strategic dominance. A growing number of programs targeting deep space exploration, satellite constellations, and high-altitude defense platforms are contributing to increased demand for advanced testing infrastructure. These agencies are focusing on stress testing, environmental simulations, and materials validation to ensure operational reliability in hostile or variable conditions. Rapid development of emerging aerospace technologies such as reusability systems and AI-guided navigation has intensified the need for precision testing. Cross-sector collaborations with research labs and academic institutions are helping accelerate experimentation cycles and reduce technical uncertainty.

Key U.S. Aerospace Testing Company Insights

Some of the key companies in the U.S. Aerospace Testing market include General Dynamics Corporation, Honeywell International Inc., Intertek Group plc, L3Harris Technologies, Inc., Lockheed Martin Corporation, and others. Organizations are focusing on increasing customer base to gain a competitive edge in the industry. Therefore, key players are taking several strategic initiatives, such as mergers and acquisitions, and partnerships with other major companies.

-

Honeywell International Inc. continues to expand its presence in the U.S. aerospace testing market through integrated software and hardware testing platforms. The company focuses on advancing avionics, propulsion systems, and environmental controls with rigorous in-house testing protocols. Its testing infrastructure supports real-time data analysis and simulation, improving accuracy and reliability. Honeywell is also investing in automated test systems to reduce downtime and enhance operational efficiency.

-

Intertek Group plc is enhancing its aerospace testing services by expanding its U.S.-based facilities and capabilities. The company provides a wide range of testing, including materials, fatigue, vibration, and environmental simulations. It supports both commercial and defense programs with customized solutions tailored to client specifications. Intertek is integrating advanced non-destructive testing (NDT) and digital twin technologies to improve efficiency and precision.

Key U.S. Aerospace Testing Companies:

- Boeing

- General Dynamics Corporation

- Honeywell International Inc.

- Intertek Group plc

- L3Harris Technologies, Inc.

- Lockheed Martin Corporation

- MISTRAS Group, Inc.

- Northrop Grumman

- RTX

- SGS SA

Recent Developments

-

In March 2025, Honeywell International Inc. collaborated with the International Test Pilots School in Canada to launch a hybrid flight test-training program, combining virtual and hands-on components, to enhance flight test team capabilities and readiness with the goal of improving efficiency, safety, and mission performance in complex aerospace testing environments.

-

In September 2024, Honeywell International Inc. opened an aerospace innovation hub at ASU’s Tempe campus. The facility supports student-industry collaboration and will help develop new testing technologies in avionics, propulsion, and systems engineering.

U.S. Aerospace Testing Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 1,627.1 million

Revenue forecast in 2033

USD 2,167.4 million

Growth rate

CAGR of 3.6% from 2025 to 2033

Base year for estimation

2024

Historical data

2021 - 2024

Forecast period

2025 - 2033

Quantitative units

Revenue in USD million/billion and CAGR from 2025 to 2033

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segment scope

Testing type, application, aviation type, end use

Country scope

U.S.

Key companies profiled

Boeing; General Dynamics Corporation; Honeywell International Inc.; Intertek Group plc; L3Harris Technologies, Inc.; Lockheed Martin Corporation; MISTRAS Group, Inc.; Northrop Grumman; RTX; SGS SA

Customization scope

Free report customization (equivalent up to 8 analysts’ working days) with purchase. Addition or alteration to country, segment scope

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

U.S. Aerospace Testing Market Report Segmentation

This report offers revenue growth forecasts at the country level and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2033. For this study, Grand View Research has segmented the U.S. aerospace testing market report based on testing type, application, aviation type, and end use:

-

Testing Type (Revenue, USD Million, 2021 - 2033)

-

Material Testing

-

Environmental Testing

-

Structural/Component Testing

-

Electromagnetic Compatibility (EMC) Testing

-

Software Testing

-

Others

-

-

Application Outlook (Revenue, USD Million, 2021 - 2033)

-

Aircraft Structures

-

Propulsion Systems

-

Interiors

-

Space Systems

-

Avionics & Electronics

-

-

Aviation Type (Revenue, USD Million, 2021 - 2033)

-

Commercial Aviation

-

Military Aviation

-

Space Exploration

-

Others

-

-

End Use (Revenue, USD Million, 2021 - 2033)

-

OEMs

-

MROs (Maintenance, Repair & Overhaul)

-

Airlines & Defense Operators

-

Government and Space Agencies

-

Others

-

Frequently Asked Questions About This Report

b. The U.S. aerospace testing market size was estimated at USD 1,585.8 million in 2024 and is expected to reach USD 1,673.2 million in 2033.

b. The U.S. aerospace testing market is expected to grow at a compound annual growth rate of 3.6% from 2025 to 2033 to reach USD 2,167.4 million by 2033.

b. In terms of testing type, material testing dominated the U.S. Aerospace Testing market with a share of 33.5% in 2024. This is attributable to the critical need for evaluating structural integrity, fatigue resistance, and material performance under extreme aerospace conditions.

b. Some key players operating in the U.S. Aerospace Testing market include Boeing, General Dynamics Corporation, Honeywell International Inc., Intertek Group plc, L3Harris Technologies, Inc., Lockheed Martin Corporation, MISTRAS Group, Inc., Northrop Grumman, RTX, and SGS SA.

b. Key factors driving the market growth include rising demand for lightweight high-performance materials, stricter safety regulations, adoption of advanced non-destructive testing methods, integration of AI-enabled testing, and the expansion of additive manufacturing.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.