Market Size & Trends

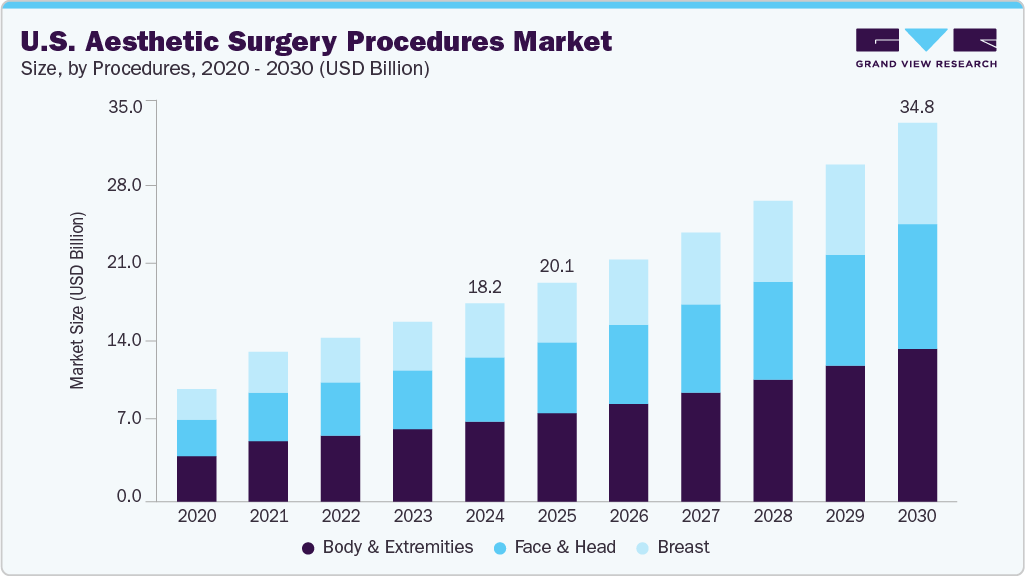

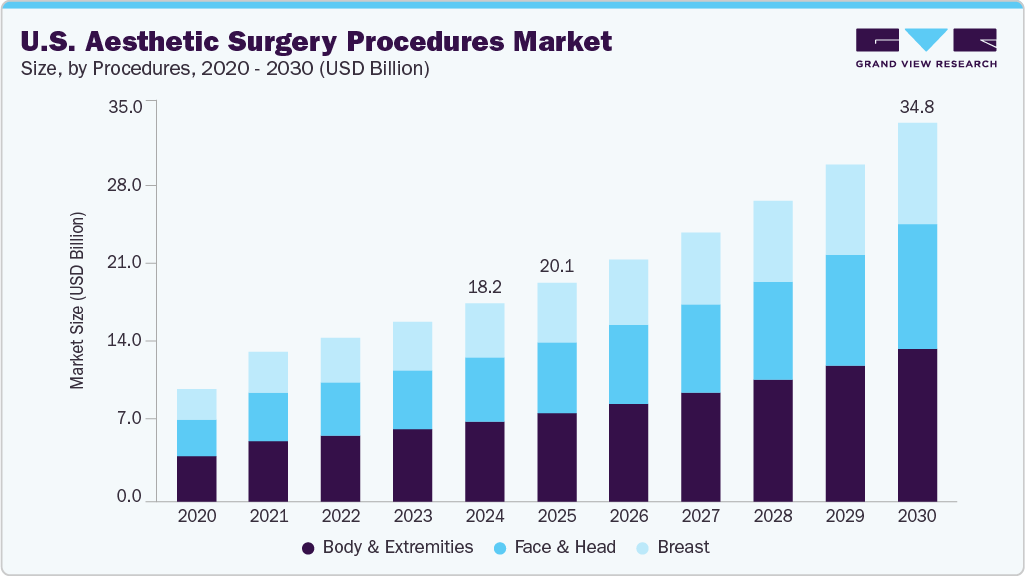

The U.S. aesthetic surgery procedures market was estimated at USD 18.24 billion in 2024 and is expected to grow at a CAGR of 11.6% from 2025 to 2030. The market has experienced significant growth in recent years due to several factors, including increasing consumer demand for advancements in surgical techniques and cosmetic enhancements, and the growing popularity of aesthetic procedures in society.

Strong consumer purchasing power and openness to aesthetics boost the demand for aesthetic surgery procedures. Minimally invasive and non-surgical procedures are gaining popularity, offering benefits such as reduced scarring, shorter recovery times, and lower complication risks. For instance, according to the Aesthetic Society (U.S.), non-invasive body fat reduction was among the top 5 non-invasive procedures in the U.S. in 2020, with 140,314 procedures performed.

The U.S. aesthetic surgery market has grown, driven by evolving consumer preferences and technological advancements. For instance, the 2023 Plastic Surgery Statistics Report from the American Society of Plastic Surgeons shows that cosmetic surgery procedures increased by 5%, with minimally invasive procedures growing by 7%. In addition, liposuction was the top surgical procedure, while Botox and soft tissue fillers led in non-surgical treatments, reflecting a strong demand for both traditional and less invasive aesthetic options.

Market Concentration & Characteristics

The market growth stage is high, and the market growth is accelerating. The U.S. aesthetic surgery procedure market is characterized by high innovation due to technological advancements, evolving patient preferences, and a strong tradition of creativity. According to an article by NIH, plastic surgery in the U.S. has a strong tradition of innovation, with surgeons regularly developing new techniques and technologies.

The U.S. aesthetic surgery market is experiencing a moderate to high level of M&A activity driven by strong market growth, increasing demand, private equity investment, and the strategic consolidation of fragmented practices. According to a report by ValuraNova, in January 2025, Carmell Corporation acquired Elevai Skincare Inc.'s skincare and haircare business, including its product portfolio, with about USD 2.5 million in annual revenue, inventory, and commercial team.

The U.S. market is subject to the high impact of regulations due to its crucial role in ensuring patient safety and treatment efficacy. Federal agencies like the FDA enforce strict requirements for the approval of surgical devices, injectables, and minimally invasive procedures, which help prevent the entry of unsafe products.

Procedure Insights

The body and extremities segment dominated the market with the largest share of 40.5% in 2024. This is attributed to the growing emphasis on body contouring and sculpting, driven by the desire for a more proportionate and aesthetically pleasing physique and societal beauty standards. The aesthetic surgery procedure industry is experiencing significant growth due to the rising prevalence of Body Dysmorphic Disorder (BDD). According to an article published by NIH in January 2024, Body Dysmorphic Disorder (BDD) affects 2% to 3% of the population globally and in the U.S., with higher rates such as approximately 2-5% in adolescents, 2-3% in adults and 3% in higher education students. In the U.S., up to 20% of rhinoplasty patients and 13% of general cosmetic surgery patients show signs of BDD, making it a key factor driving demand for aesthetic procedures and a critical concern for providers in both domestic and international markets.

The face & head segment is expected to register the fastest CAGR of 11.8% over the forecast period. This is due to an aging population seeking to address signs of age, high demand for facial rejuvenation, and the popularity of non-invasive & minimally invasive procedures. According to the 2023 ISAPS Global Survey, the U.S. is leading globally, with over 6.1 million aesthetic procedures performed. Facial and head procedures experienced notable growth, with eyelid surgeries increasing by 24% to over 1.7 million, rhinoplasties rising by 21.6% to 1.1 million, and lip enhancements growing by 29% to 0.9 million. This surge reflects a significant demand for facial and head aesthetic surgeries in the U.S

End Use Insights

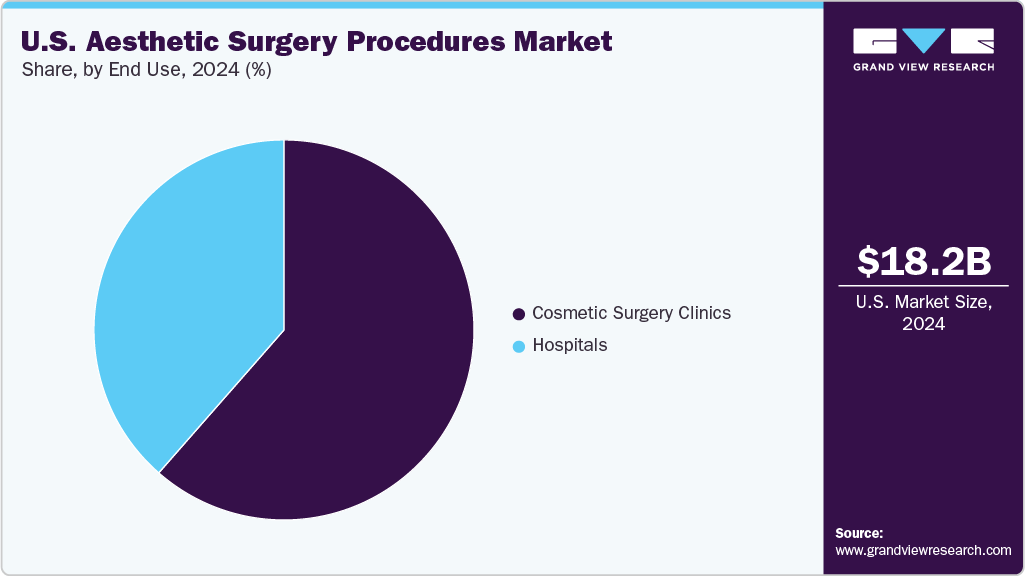

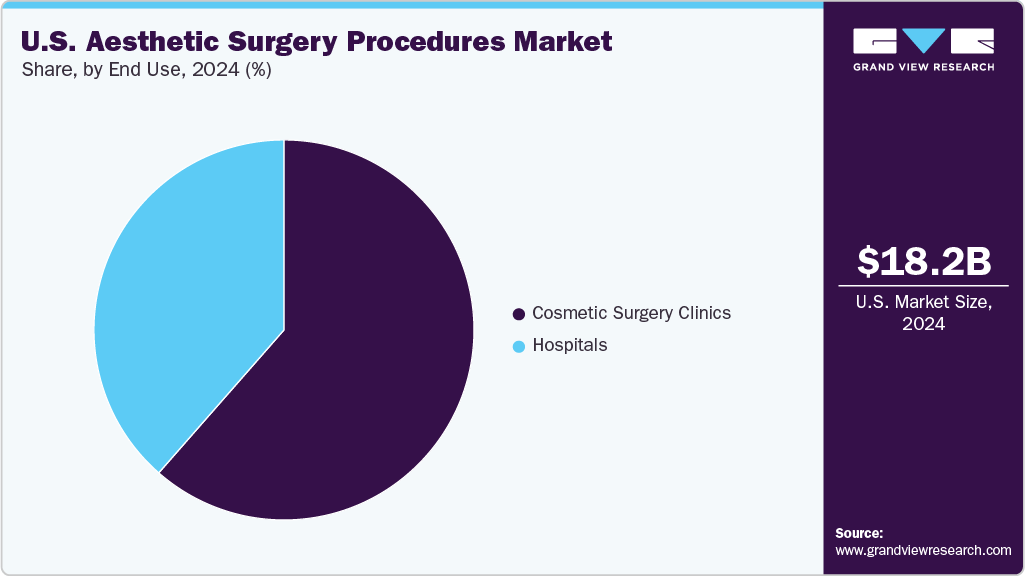

The cosmetic surgery clinics segment dominated the market in 2024, accounting for the largest share, and is expected to grow at the fastest CAGR during the forecast period. These settings are more focused on aesthetic outcomes as they understand the impact of aesthetic surgery procedures on a patient's self-confidence and body image and strive to provide a natural look.

The hospital segment is anticipated to register a lucrative CAGR during the forecast period. Hospitals provide comprehensive healthcare facilities, including specialized departments and equipment for various medical conditions. With the growing recognition of aesthetic surgery procedures as a medical concern, hospitals have expanded their services to include these treatment options, ensuring patients can access specialized care in a hospital setting. For instance, hospitals such as Mount Sinai offer a comprehensive range of aesthetic plastic surgeries, including procedures for the face, breasts, and body contouring, provided by board-certified plastic surgeons in a hospital setting.

Key U.S. Aesthetic Surgery Procedures Company Insights

The market is highly fragmented and some of the key players operating in the market include New York Plastic Surgical Group, Westlake Dermatology, Nazarian Plastic Surgery, and others. Key players are taking several strategic initiatives, such as geographical expansions, product launches, partnerships, collaborations, and mergers and acquisitions.

-

Cynosure Lutronic designs and manufactures advanced energy-based treatment systems, including laser, RF, and LED, for hair removal, skin revitalization, body contouring, scar reduction, gynecologic wellness, and more.

-

Westlake Dermatology & Cosmetic Surgery is one of Texas’s largest dermatology and plastic surgery practices, operating 19 clinics across Austin, Dallas, Houston, and San Antonio.

Key U.S. Aesthetic Surgery Procedures Companies:

- New York Plastic Surgical Group, PC

- Westlake Dermatology

- Piedmont Plastic Surgery & Dermatology

- SKINovative of Gilbert-Medical Spa

- Nazarian Plastic Surgery

- Schweiger Dermatology Group.

- Tiger Aesthetics Medical, LLC

- persimmon.life

- Cutera, Inc.

- Cynosure Lutronic

Recent Developments

-

In January 2025, MicroAire Surgical Instruments, a global leader in power-assisted liposuction, announced the acquisition of NEOSYAD. This acquisition strengthens MicroAire’s leadership in the adipose tissue market by adding NEOSYAD’s EU-approved AdiMate device and Adipure kit, which streamline and improve fat tissue procedures for better patient outcomes and greater efficiency for plastic surgeons.

U.S. Aesthetic Surgery Procedure Market Report Scope

|

Report Attribute

|

Details

|

|

Revenue forecast in 2030

|

USD 34.84 billion

|

|

Growth rate

|

CAGR of 11.6% from 2025 to 2030

|

|

Base year for estimation

|

2024

|

|

Historical data

|

2018 - 2023

|

|

Forecast period

|

2025 - 2030

|

|

Quantitative units

|

Revenue in USD Billion and CAGR from 2025 to 2030

|

|

Report coverage

|

Revenue forecast, company ranking, competitive landscape, growth factors, trends

|

|

Segments covered

|

Procedures and end use

|

|

Key companies profiled

|

New York Plastic Surgical Group, PC; Westlake Dermatology; Piedmont Plastic Surgery & Dermatology; SKINovative of Gilbert-Medical Spa; Nazarian Plastic Surgery; Schweiger Dermatology Group.; Tiger Aesthetics Medical, LLC; persimmon.life; Cutera, Inc.; Cynosure Lutronic

|

|

Customization scope

|

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

|

|

Pricing and purchase options

|

Avail customized purchase options to meet your exact research needs. Explore purchase options

|

U.S. Aesthetic Surgery Procedure Market Report Segmentation

This report forecasts revenue growth and provides an analysis of the latest trends in each of the sub-segments from 2018 to 2030. For the purpose of this report, Grand View Research has segmented the U.S. aesthetic surgery procedure market on the basis of procedure and end use:

-

Procedure Outlook (Revenue, USD Billion, 2018 - 2030)

-

Breast

-

Breast Augmentation

-

Breast Implant Removal

-

Breast Lift (Mastopexy)

-

Breast Reduction

-

Others

-

Face & Head

-

Eyelid Surgery

-

Rhinoplasty

-

Lip Enhancement

-

Fat Grafting-Face

-

Others

-

Body & Extremities

-

End-use Outlook (Revenue, USD Billion, 2018 - 2030)

-

Cosmetic Surgery Clinics

-

Hospitals