- Home

- »

- Agrochemicals & Fertilizers

- »

-

U.S. Agrochemicals Market Size, Industry Report, 2030GVR Report cover

![U.S. Agrochemicals Market Size, Share & Trends Report]()

U.S. Agrochemicals Market (2024 - 2030) Size, Share & Trends Analysis Report By Product (Fertilizers, Crop Protection Chemicals), By Application (Cereals & Grains, Oilseeds & Pulses, Fruits & Vegetables), And Segment Forecasts

- Report ID: GVR-4-68040-216-0

- Number of Report Pages: 80

- Format: PDF

- Historical Range: 2018 - 2022

- Forecast Period: 2024 - 2030

- Industry: Bulk Chemicals

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

U.S. Agrochemicals Market Size & Trends

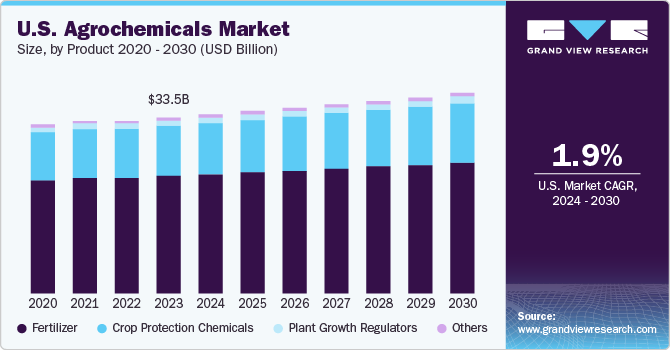

The U.S. agrochemicals market size was estimated at USD 33.46 billion in 2023 and is anticipated to grow at a compound annual growth rate (CAGR) of 1.9% from 2024 to 2030. The growth is attributed to the increasing demand for food linked with the growing population, which subsequently drives higher demand for fertilizers and crop protection products. Increasing the use of fertilizers by the farmers to supply nutrients to the crops and enhance their yield is a key factor driving the agrochemicals demand.

The United States is one of the most dominant players in the agrochemicals market. According to data from the Food and Agriculture Organization (FAO), the agricultural utilization of nitrogen fertilizers in the United States witnessed a marginal increase from 11,581.7 thousand metric tons in 2017 to 11,672.4 thousand metric tons in 2019. Similarly, the agricultural use of pesticides remained relatively stable, standing at 407,779 metric tons in 2019.

Amidst escalating demand for nutritious food and the imperative to enhance production and productivity, farmers are compelled to intensify their utilization of fertilizers and pesticides to mitigate crop losses. This underscores the indispensable role of agrochemicals in modern agriculture, serving as indispensable tools to safeguard crop yields and ensure food security amidst evolving agricultural landscapes.

Market Concentration & Characterisation

The U.S. agrochemicals market is characterized by its high concentration, with major players exerting significant influence over industry dynamics. Notably, the industry is dominated by agricultural giants such as Syngenta, Bayer, BASF, and Corteva. For instance, in 2022, Syngenta reported record sales of $33.4 billion and EBITDA of $5.6 billion, underlining the substantial impact these key players have on market trends and performance.

The agrochemicals industry in the United States is undergoing continuous evolution, driven by various factors contributing to its growth trajectory. Shifts in production techniques, the imperative to enhance productivity, and the pressing need to meet the nutritional requirements of a burgeoning population are among the primary drivers. Additionally, robust growth, evolving crop mix trends, and stringent environmental regulations are pivotal in shaping the industry landscape.

In response to regulatory pressures and sustainability imperatives, the industry is witnessing the emergence of innovative, eco-friendly production methods. These methods not only address environmental concerns but also cater to the growing demand for sustainable agricultural practices. Despite challenges such as shrinking arable land and crop losses due to pests, the demand for fertilizers and crop protection products remains robust. This demand is fueled by the necessity to augment production levels and ensure food security amidst evolving agricultural conditions.

Product Insights

Fertilizers dominated the market with the largest revenue share of 66.8% in 2023. The demand for fertilizers remains high owing to their crucial role in enhancing crop yield and quality in controlled environments.

Alongside fertilizers, crop protection chemicals constitute a significant segment, playing a vital role in safeguarding crops from pests, diseases, and weeds, thereby ensuring optimal yields and quality produce. Additionally, plant growth regulators have emerged as the fastest-growing segment in 2023. This growth reflects the industry's shift towards advanced cultivation techniques and the emphasis on maximizing yield efficiency.

Fertilizers Insights

Nitrogenous fertilizers dominated the market in 2023, accounting for more than half of the market share. These fertilizers play a critical role in promoting robust plant growth and are essential for the synthesis of proteins and chlorophyll. Alongside nitrogenous fertilizers, phosphatic and potassic fertilizers are key components of farming practices, providing essential nutrients for plant development and soil fertility management.

Moreover, secondary fertilizers, including calcium, magnesium, and sulfur fertilizers, emerged as the fastest-growing segment with a notable compound annual growth rate (CAGR) of 3.8%. This growth underscores the increasing recognition of the importance of micronutrients in optimizing plant health and productivity in farming systems.

Crop Protection Insights

Herbicides command the largest market share in crop protection, comprising 45% of the market. These chemical compounds play a crucial role in controlling unwanted vegetation, ensuring the health and vitality of cultivated crops by minimizing competition for resources. Following closely, insecticides represent the second-largest segment and exhibit the fastest growth with a notable CAGR of 3.2%. This growth underscores the increasing emphasis on pest management strategies to mitigate losses and enhance yield efficiency in farming operations.

Application Insights

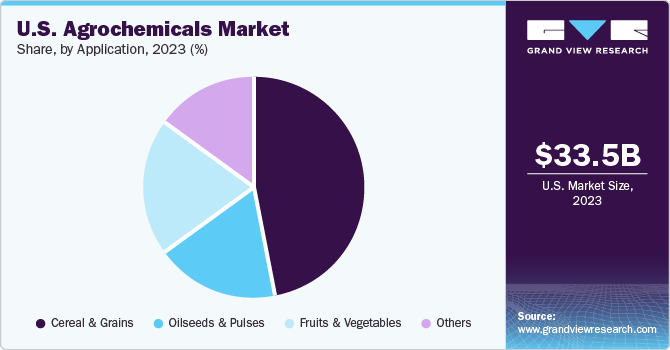

Cereals and grains dominate the US agrochemicals market, capturing nearly 47% of the market share in 2023. This category encompasses staple crops like corn, wheat, rice, oats, and barley, with corn being the primary feed grain, accounting for over 95% of total production and consumption.

Fruits & Vegetables represent the fastest-growing segment, with a projected CAGR of 2.5% over the forecast period. This growth trajectory reflects the rising consumer demand for fresh and high-quality fruits and vegetables, coupled with advancements in farming technologies aimed at enhancing productivity and sustainability in fruit and vegetable cultivation.

Following closely, oilseeds & pulses emerge as the second fastest-growing segment, forecasted to experience a notable compound annual growth rate (CAGR) of 2% over the forecast period. This growth is indicative of the increasing demand for oilseeds and pulses, driven by their versatile applications in food, feed, and industrial sectors.

Key U.S. Agrochemicals Company Insights

The market players are involved in undertaking numerous strategic initiatives.

Key U.S. Agrochemicals Companies:

- Syngenta

- Bayer

- FMC Corporation

- Nutrien Ltd

- Bayer Crop Science

- Gowan, Inc.

- Dow Agro Sciences

- Syngenta

- BASF

- Corteva Agriscience

- ADM

- Yara International ASA

Recent Developments

-

In June 2023, Bayer's Crop Science Innovation Summit showcased the journey toward regenerative agriculture.

-

According to Bloomberg, as of October 2023, FMC ranked first in the agricultural chemicals industry for performance on material ESG issues

-

In February 2021, Bayer has launched a multi-faceted insecticide called Vayego 200SC, which works against caterpillars and addresses the diverse protectional needs of modern farmers.

-

FMC Corporation, renewed its multi-year contracts with Corteva Agriscience in December 2021. The agreements ensure the continued provision of Rynaxypyr and Cyazypyr actives for Corteva's seed treatment products, extending the ongoing worldwide partnership between the two firms.

-

In June 2021, FMC Corporation obtained registration from the U.S. Environmental Protection Agency (EPA) for Fluindapyr, a new broad-spectrum succinate dehydrogenase inhibitor (SDHI) fungicide.

U.S. Agrochemicals Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 34.03 billion

Revenue forecast in 2030

USD 38.12 billion

Growth rate

CAGR of 1.9% from 2023 to 2030

Base year for estimation

2023

Historical data

2018 - 2022

Forecast period

2024 - 2030

Report updated

November 2023

Quantitative units

Volume in tons, revenue in USD million/billion, and CAGR from 2024 to 2030

Report coverage

Volume & revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product, crop, application

Key companies profiled

FMC Corporation, Nutrien Ltd, Bayer Crop Science, Gowan, Inc., Dow Agro Sciences, Syngenta, BASF, Corteva Agriscience, ADM, Yara International ASA.

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

U.S. Agrochemicals Market Report Segmentation

This report forecasts revenue & volume growth of the U.S. agrochemicals market and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the U.S. agrochemicals market report based on product and application:

-

Product Outlook (Volume, Thousand Tons; Revenue, USD Million, 2018 - 2030)

-

Fertilizer

-

Nitrogenous

-

Phosphatic

-

Potassic

-

Secondary Fertilizers (Calcium, Magnesium, and Sulfur Fertilizers)

-

Others

-

-

Crop Protection Chemicals

-

Herbicides

-

Insecticides

-

Fungicides

-

Others

-

-

Plant Growth Regulators

-

Others

-

-

Application Outlook (Volume, Thousand Tons; Revenue, USD Million, 2018 - 2030)

-

Cereal & Grains

-

Oilseeds & Pulses

-

Fruits & Vegetables

-

Others

-

Frequently Asked Questions About This Report

b. The U.S. agrochemicals market size was estimated at USD 33.46 billion in 2023 and is anticipated to reach USD 34.03 billion on 2024.

b. The U.S. agrochemicals market is anticipated to grow at a CAGR of 1.9% from 2024 to 2030 and reach USD 38.12 billion by 2030

b. Fertilizers dominated the market with the largest revenue share of 66.8% in 2023. The demand for fertilizers remains high owing to their crucial role in enhancing crop yield and quality in controlled environments.

b. Some of the key players in the U.S. agrochemicals market are FMC Corporation, Nutrien Ltd, Bayer Crop Science, Gowan, Inc., Dow Agro Sciences, Syngenta, BASF, Corteva Agriscience, ADM, Yara International ASA

b. The growth of the U.S. agrochemicals market is attributed to the increasing demand for food linked with the growing population, which subsequently drives higher demand for fertilizers and crop protection products.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.