- Home

- »

- Advanced Interior Materials

- »

-

U.S. Air Curtains Market Size & Share, Industry Report, 2033GVR Report cover

![U.S. Air Curtains Market Size, Share & Trends Report]()

U.S. Air Curtains Market (2025 - 2033) Size, Share & Trends Analysis Report By Airflow (Up To 500 m3/h, 500 To 1000 m3/h), By Distribution Channel (Online, Retail Stores), By Application (Residential, Commercial), By Deployment (Wall-mounted), And Segment Forecasts

- Report ID: GVR-4-68040-638-8

- Number of Report Pages: 100

- Format: PDF

- Historical Range: 2021 - 2023

- Forecast Period: 2025 - 2033

- Industry: Advanced Materials

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

U.S. Air Curtains Market Summary

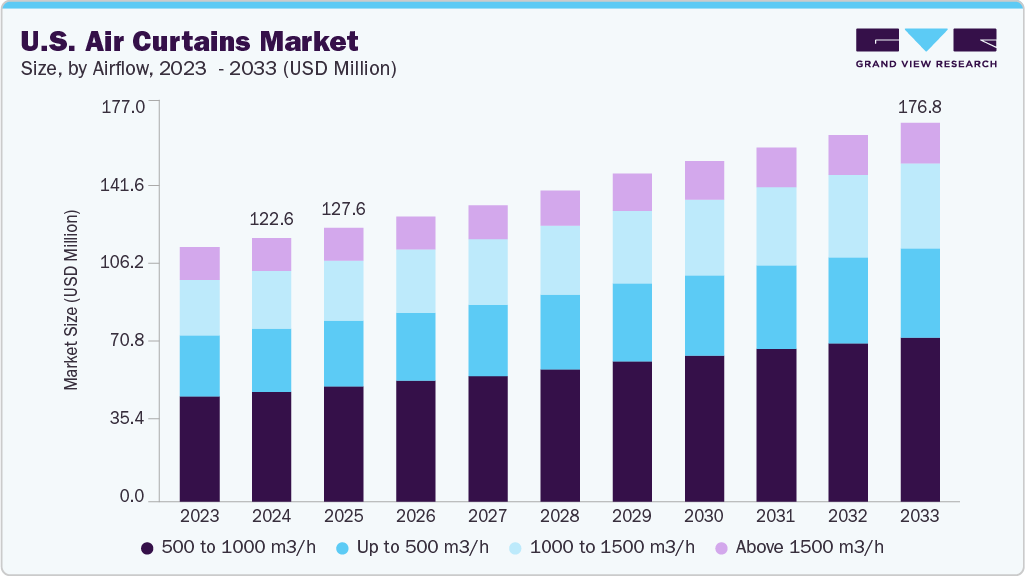

The U.S. air curtains market size was estimated at USD 122.6 million in 2024, and is projected to reach USD 176.8 million by 2033, growing at a CAGR of 4.2% from 2025 to 2033. In the U.S., growing emphasis on energy conservation is a major factor driving the air curtains market.

Key Market Trends & Insights

- The air curtains market in the U.S. is expected to grow at a substantial CAGR of 4.2% from 2025 to 2033.

- By airflow, 500 to 1000 m3/h segment is expected to grow at a considerable CAGR of 4.6% from 2025 to 2033 in terms of revenue.

- By distribution channel, online segment is expected to grow at a considerable CAGR of 4.6% from 2025 to 2033 in terms of revenue.

- By deployment, ceiling-mounted segment is expected to grow at a considerable CAGR of 4.4% from 2025 to 2033 in terms of revenue.

- By application, industrial segment is expected to grow at a considerable CAGR of 4.8% from 2025 to 2033 in terms of revenue.

Market Size & Forecast

- 2024 Market Size: USD 122.6 Million

- 2033 Projected Market Size: USD 176.8 Million

- CAGR (2025-2033): 4.2%

Strict regulations from agencies such as the Department of Energy (DOE) and Environmental Protection Agency (EPA) encourage the use of energy-efficient HVAC systems. The expansion of commercial infrastructure such as malls, hospitals, and airports in the U.S. has increased demand for air curtains.

Businesses are focusing more on maintaining clean, controlled environments at entry points. The COVID-19 pandemic further heightened awareness about indoor air quality and contamination prevention. These factors are prompting broader adoption of air curtains across both public and private sectors.

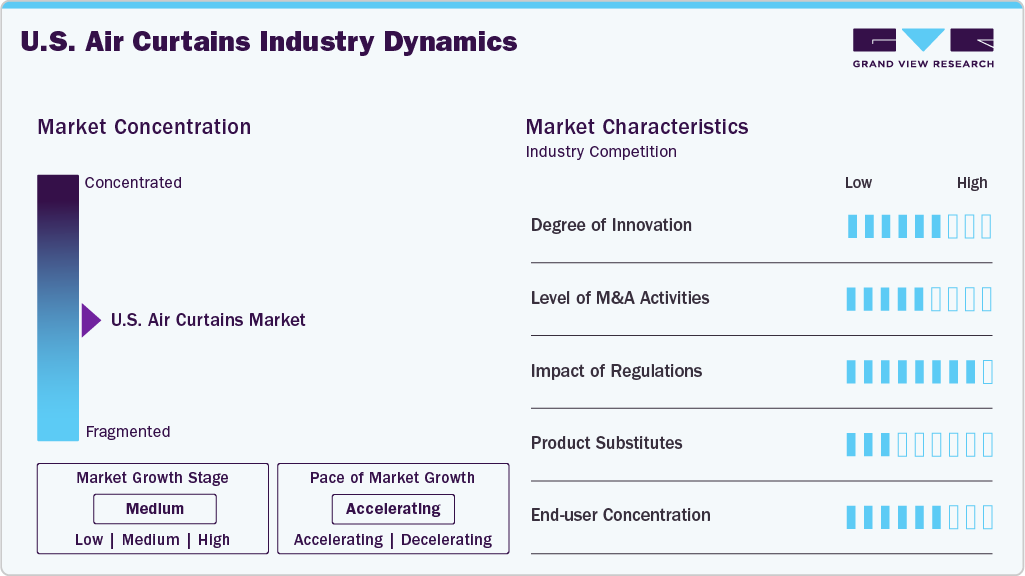

Market Concentration & Characteristics

The U.S. air curtains market is moderately fragmented, with a mix of well-established manufacturers and several regional players. Major companies dominate large commercial and industrial projects due to strong brand presence and distribution networks. However, niche and regional firms also cater to small businesses and retrofit applications. The presence of diverse application needs creates room for both large-scale and specialized competitors.

The U.S. air curtains market shows steady innovation, particularly in smart features such as motion sensors, variable speed controls, and IoT integration. Manufacturers are focusing on developing energy-efficient, low-noise units tailored for modern commercial needs. Innovation is also driven by customization for different building types and environmental conditions. These advancements enhance user convenience, energy savings, and system performance.

The market has experienced moderate mergers and acquisitions as larger HVAC firms aim to broaden their product portfolios and geographic reach. Acquisitions consolidate distribution networks and strengthen technological capabilities. Strategic partnerships with building system integrators and HVAC contractors are also increasing. This trend supports growth and competitiveness in both national and regional markets.

Regulations in the U.S., especially those from the DOE and EPA, significantly influence product design and deployment. Energy efficiency standards and green building codes encourage businesses to install compliant air curtain systems. Incentives and certifications such as LEED further drive adoption in sustainable construction projects. These regulations create a favorable policy environment for market expansion.

Drivers, Opportunities & Restraints

The U.S. air curtains market is driven by increasing demand for energy-efficient solutions and better indoor air quality. Growth in commercial infrastructure such as malls, hospitals, and airports further boosts adoption. Regulatory pressure to reduce energy consumption supports the integration of air curtains. The need to control dust, odors, and airborne contaminants at entry points also fuels demand.

Rising adoption of smart building technologies offers strong growth opportunities for air curtain manufacturers. Integration with automated HVAC and building management systems is gaining traction. Expanding cold storage and logistics sectors provide additional demand channels. Moreover, retrofitting projects in older buildings present a lucrative segment for compact and efficient air curtain solutions.

High initial installation costs can deter small businesses from investing in air curtains. Limited awareness in certain sectors about their long-term benefits may slow adoption. Design limitations for specific architectural setups can also restrict installation flexibility. Additionally, competition from traditional HVAC solutions in budget-sensitive markets poses a challenge.

Airflow Insights

The 500 to 1000 m3/h segment dominated the market and accounted for a share of 41.6% in 2024, due to its suitability for commercial spaces like retail stores, restaurants, and small offices. These units offer an effective balance between performance and energy efficiency, aligning well with DOE regulations. Their widespread use in climate-controlled buildings supports consistent demand. This segment’s adaptability to standard-sized doorways contributes to its market leadership.

The 1000 to 1500 m³/h segment is expanding rapidly in the U.S., driven by increased deployment in hospitals, supermarkets, and distribution centers. These applications require stronger air barriers to manage temperature and air quality across wider entrances. Growth in logistics and cold chain facilities is accelerating demand for high-capacity models. Additionally, sustainability goals and larger infrastructure investments are fueling segment growth.

Distribution Channel Insights

The retail stores segment dominated the market and accounted for a share of 48.1% in 2024, owing to their established supplier relationships and hands-on customer support. Contractors and commercial buyers often prefer in-store purchases for guidance, installation advice, and service access. Retail outlets also offer brand variety and localized availability, enhancing purchasing convenience. Their strong regional presence supports consistent sales across sectors.

The online segment is growing rapidly in the U.S. as buyers increasingly turn to e-commerce platforms for convenience and broader product options. Digital sales channels allow easy comparison of features, pricing, and customer reviews, which appeals to tech-savvy professionals and small businesses. The rise of direct-to-consumer models and improved shipping logistics further fuels this trend. The COVID-19 pandemic accelerated digital purchasing habits, giving sustained momentum to the growth of the online segment.

Deployment Insights

Ceiling-mounted segment accounted for a share of 59.8% in 2024. Ceiling-mounted air curtains dominate the U.S. market due to their space-saving design and compatibility with large commercial and institutional buildings. They are commonly used in malls, hospitals, and airports where aesthetics and unobstructed entryways are important.

Wall-mounted air curtains are gaining momentum in the U.S., especially in small businesses, restaurants, and retrofit applications. Their straightforward installation and cost-effectiveness make them attractive for buildings lacking ceiling integration options. The growing number of SMEs and renovation projects is contributing to demand for flexible solutions. Additionally, rising awareness of indoor air quality and energy savings is supporting their adoption.

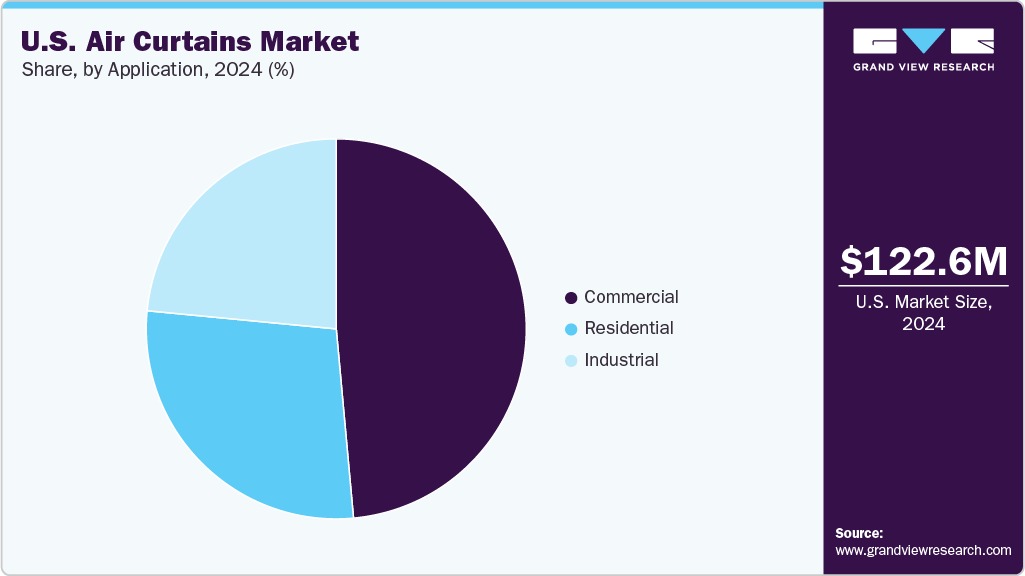

Application Insights

Commercial segment accounted for a share of 48.6% in 2024 due to widespread usage in retail stores, hotels, offices, and healthcare facilities. These environments require efficient climate control and barrier protection to enhance comfort and reduce energy loss. High foot traffic at entrances makes air curtains essential for maintaining indoor air conditions. Continued investment in commercial infrastructure sustains this segment’s dominance.

The industrial segment is expanding quickly in the U.S. due to the rise in warehousing, manufacturing, and cold storage facilities. Air curtains help these facilities maintain temperature zones, reduce HVAC load, and prevent dust or fumes from entering workspaces. Regulatory standards for energy efficiency and workplace safety are also encouraging adoption. Growth in e-commerce and logistics hubs is further driving industrial demand.

Key U.S. Air Curtains Company Insights

Some of the key players operating in the market include Panasonic Corporation, Airtecnics, and Thermoscreens.

-

Panasonic Corporation is actively involved in the HVAC market, offering advanced air curtain solutions tailored for energy efficiency and indoor comfort. The company integrates features like sensor-based activation, low-noise operation, and eco-friendly refrigerants into its designs. Its air curtains are commonly used in commercial establishments, including retail, healthcare, and hospitality sectors. Panasonic leverages its global brand reputation to supply highly durable and technologically advanced systems. Continuous innovation in smart building integration enhances its competitive edge in the market.

-

Airtecnics specializes in manufacturing premium air curtains with a focus on design flexibility, customization, and energy efficiency. The company provides a broad product range, including decorative, recessed, and industrial models for complex applications. Known for integrating EC motors, automation systems, and control protocols, Airtecnics serves diverse sectors such as retail, cleanrooms, and logistics. It collaborates closely with architects and engineers to deliver tailored solutions. With strong European presence, it emphasizes sustainability and high-performance standards.

Key U.S. Air Curtains Companies:

- Panasonic Corporation

- Airtecnics

- Thermoscreens

- Solar and Palau

- Frico AB

- Mars Air Systems.

- Meech International

- Novovent

- Systemair.

- Powered Aire Inc.

Recent Developments

-

In May 2025, Airtècnics introduced three new air curtain models tailored for cold storage rooms and industrial freezers. These solutions enhance climate separation, minimize thermal loss, and boost energy efficiency. Designed to prevent warm air infiltration, they help maintain optimal storage conditions, reduce moisture buildup, and prevent ice formation-ultimately improving refrigeration system performance and safety.

-

January 2024, Thermoscreens launched a new IP66-rated air curtain, specifically designed for harsh and hygiene-sensitive environments such as food processing plants and washdown areas. The unit provides full protection against dust and powerful water jets, ensuring reliable performance in demanding conditions. It helps maintain climate control while supporting strict cleanliness standards. This product reflects Thermoscreens’ focus on delivering robust and efficient air management solutions for industrial applications.

U.S. Air Curtains Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 127.6 million

Revenue forecast in 2033

USD 176.8 million

Growth rate

CAGR of 4.2% from 2025 to 2033

Historical data

2021 - 2023

Forecast period

2025 - 2033

Quantitative units

Revenue in USD million/billion and CAGR from 2025 to 2033

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Airflow, distribution channel, deployment, application

Country scope

U.S.

Key companies profiled

Panasonic Corporation; Airtecnics; Thermoscreens; Solar and Palau; Frico AB; Mars Air Systems.; Meech International; Novovent; Systemair; Powered Aire Inc.

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

U.S. Air Curtains Market Report Segmentation

This report forecasts revenue growth at U.S. levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2033. For this study, Grand View Research has segmented the U.S. air curtains market report based on airflow, distribution channel, deployment, and application.

-

Airflow Outlook (Revenue, USD Million, 2021 - 2033)

-

Up to 500 m3/h

-

500 to 1000 m3/h

-

1000 to 1500 m3/h

-

Above 1500 m3/h

-

-

Distribution Channel Outlook (Revenue, USD Million, 2021 - 2033)

-

Online

-

Retail Stores

-

Wholesale Stores

-

Others

-

-

Deployment Outlook (Revenue, USD Million, 2021 - 2033)

-

Wall-mounted

-

Ceiling-mounted

-

-

Application Outlook (Revenue, USD Million, 2021 - 2033)

-

Residential

-

Commercial

-

Industrial

-

Frequently Asked Questions About This Report

b. Some of the key players operating in the U.S. air curtains market include Panasonic Corporation; Airtecnics; Thermoscreens; Solar and Palau; Frico AB; Mars Air Systems.; Meech International; Novovent; Systemair.; TPI Corporation; Envirotec Ltd.; Powered Aire Inc.; Biddle Air Systems Ltd.; VTS Group; Aleco.

b. The U.S. air curtains market is primarily driven by the growing emphasis on energy conservation and the need to maintain indoor air quality in buildings. Increasing urban development, commercial expansion, and the adoption of smart HVAC technologies further support market growth.

b. The U.S. air curtains market size was estimated at USD 122.6 million in 2024 and is expected to be USD 127.6 million in 2025.

b. The U.S. air curtains market, in terms of revenue, is expected to grow at a compound annual growth rate of 4.2% from 2025 to 2033 to reach USD 176.8 million by 2033.

b. Commercial segment accounted for a share of 48.6% in 2024 due to widespread usage in retail stores, hotels, offices, and healthcare facilities. These environments require efficient climate control and barrier protection to enhance comfort and reduce energy loss. High foot traffic at entrances makes air curtains essential for maintaining indoor air conditions.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.