U.S. Air Fresheners Market Size & Trends

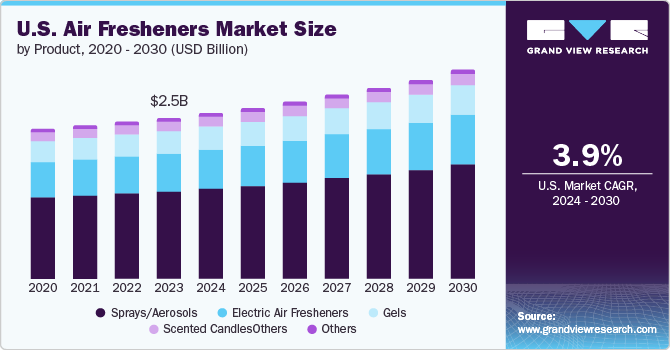

The U.S. air fresheners market size was valued at USD 2.50 billion in 2023 and is projected to grow at a CAGR of 3.9% from 2024 to 2030. The key growth-driving factors for the market are changing consumer preferences, rising disposable income levels, and growing awareness about personal care and well-being. In addition, easy availability of the products and trends such as using sustainably developed products are expected to generate greater demand for this industry during the forecast period.

Advancements in technologies related to the development and delivery of fragrant materials have been driving growth for this market. Moreover, the growing inclination towards usage of premium products is encouraging manufacturers to build strong product portfolios, contributing towards market growth. Customization and personalization offered by the companies in the fresheners industry are also expected to fuel the overall demand for the products.

Furthermore, increasing consumer awareness and the constant nature of new product launches are important factors propelling the growth of this industry. In addition, the manufacturers have been working on vigorous testing of different scents & fragrance to generate relevant data regarding consumer preferences. In recent years, product diversification has increased enormously as companies have to cater to unceasing competition with innovation and enhanced product delivery.

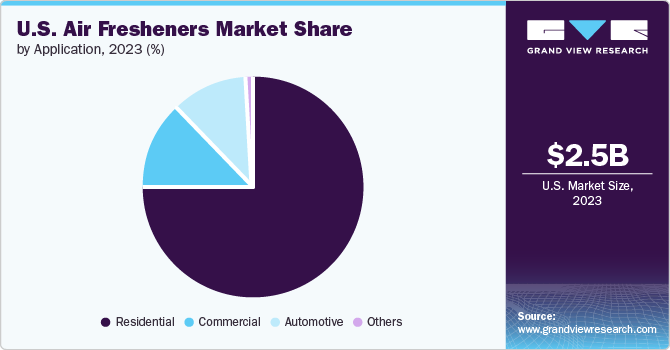

Increasing adoption of air fresheners by commercial users such as hotels, restaurants, banks, corporate office spaces, and others has also assisted this market in terms of growth. The industry has been experiencing an upsurge in demand owing to constantly growing commercial use. In addition, the emergence of air freshener portfolios for automotive space in particular has driven growth for the industry in the recent past.

Product Insights

The sprays/aerosol segment held the largest revenue share and accounted for 53.9% in 2023. Water-based air freshener sprays are eco-friendly, free from chemicals, and offer long-lasting fragrance. Additionally, a diverse range of cost-effective products offered by the companies has generated greater demand for this segment. The propellants used in aerosols have a strong ability to neutralize or break down odor due to which this category of products is increasingly preferred by consumers over other products.

Electric air fresheners segment is expected to experience significant CAGR during the forecast period. This segment is mainly driven by the advancements in the technologies related to the industry. Rising concerns about indoor air quality in urbanized areas, rise in disposable incomes, and growing demand for automatic or touch-free air freshening solutions have propelled growth for this segment.

Application Insights

The residential segment dominated the market in 2023. Increasing adoption of electronic air fresheners, easy availability of products through offline point of sales, growing inclination towards use of scented candles for aesthetic value, and increasing expenditure on home care and décor have driven the demand for this segment. In addition, companies operating in this industry, have been launching new collections of fresheners, equipped with unique fragrances and formulations. This has generated an increase in demand. For instance, in January 2024, Febreze, a P & G brand, launched a new scent and product named Romance & Desire.

The automotive segment is projected to experience a significant CAGR during forecast period. Growth for this segment is primarily driven by factors such as technology advancements leading to the emergence of innovative products, easy availability, especially through stores along the highways, a wide range of products offered by companies, constantly increasing number of companies in the category and innovation.

Key U.S. Air Fresheners Company Insights

Some of the key companies in U.S. air fresheners market are Procter & Gamble, Reckitt Benckiser Group PLC, Henkel AG & Co. KGaA, S. C. Johnson& Son, Inc., Air-Scent International, Renegade Products USA and others. Major industry participants have adopted strategies such as enhanced research, new product developments, collaborations, and efficient distribution through multiple channels.

-

Procter & Gamble, an American corporation operating in multinational consumer goods markets, specializes in a wide range of personal care, consumer health, and hygiene products. The company offers air fresheners, car fresheners and few other products through one of its brands, Febreze.

-

Renegade Products USA, one of the key market participants in premium air fresheners industry, markets its products under brand Detailer Series. The portfolio consists multiple natural fragrances including tropical, floral, and citrus.

Key U.S. Air Freshener Companies:

- Procter & Gamble

- Reckitt Benckiser Group PLC

- Henkel AG & Co. KGaA

- S. C. Johnson& Son, Inc.

- Air-Scent International

- Renegade Products USA.

- Good & Well Supply Co.

- The Yankee Candle Company, Inc.

- Bath & Body Works Direct, Inc.

- ILLUME Candles

Recent Development

U.S. Air Fresheners Market Report Scope

|

Report Attribute

|

Details

|

|

Revenue forecast in 2030

|

USD 3.24 billion

|

|

Growth rate

|

CAGR of 3.9% from 2024 to 2030

|

|

Base year for estimation

|

2023

|

|

Historical data

|

2018 - 2022

|

|

Forecast period

|

2024 - 2030

|

|

Report updated

|

August 2024

|

|

Quantitative units

|

Revenue in USD million and CAGR from 2024 to 2030

|

|

Report coverage

|

Revenue forecast, company share, competitive landscape, growth factors and trends

|

|

Segments covered

|

Product, application

|

|

Key companies profiled

|

Procter & Gamble; Reckitt Benckiser Group PLC; Henkel AG & Co. KGaA; S. C. Johnson& Son, Inc.; Air-Scent International; Renegade Products USA.; Good & Well Supply Co.; The Yankee Candle Company, Inc.; Bath & Body Works Direct, Inc.; ILLUME Candles

|

|

Customization scope

|

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

|

|

Pricing and purchase options

|

Avail customized purchase options to meet your exact research needs. Explore purchase options

|

U.S. Air Fresheners Market Report Segmentation

This report forecasts revenue growth at the country level and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the U.S. air fresheners market report based on product, and application:

-

Product Outlook (Revenue, USD Million, 2018 - 2030)

-

Sprays/Aerosols

-

Electric Air Fresheners

-

Gels

-

Scented Candles

-

Others

-

Application Outlook (Revenue, USD Million, 2018 - 2030)

-

Residential

-

Commercial

-

Automotive

-

Others