- Home

- »

- Plastics, Polymers & Resins

- »

-

Aerosol Market Size, Share, Growth & Trends Report, 2030GVR Report cover

![Aerosol Market Size, Share & Trends Report]()

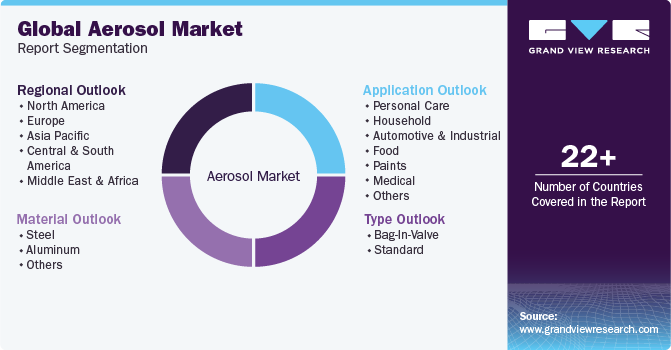

Aerosol Market (2024 - 2030) Size, Share & Trends Analysis Report By Material (Steel, Aluminum), By Type (Bag-in-valve, Standard), By Application (Personal Care, Household, Automotive & Industrial), By Region, And Segment Forecasts

- Report ID: 978-1-68038-288-4

- Number of Report Pages: 220

- Format: PDF

- Historical Range: 2018 - 2022

- Forecast Period: 2024 - 2030

- Industry: Bulk Chemicals

- Report Summary

- Table of Contents

- Interactive Charts

- Methodology

- Download FREE Sample

-

Download Sample Report

Aerosol Market Summary

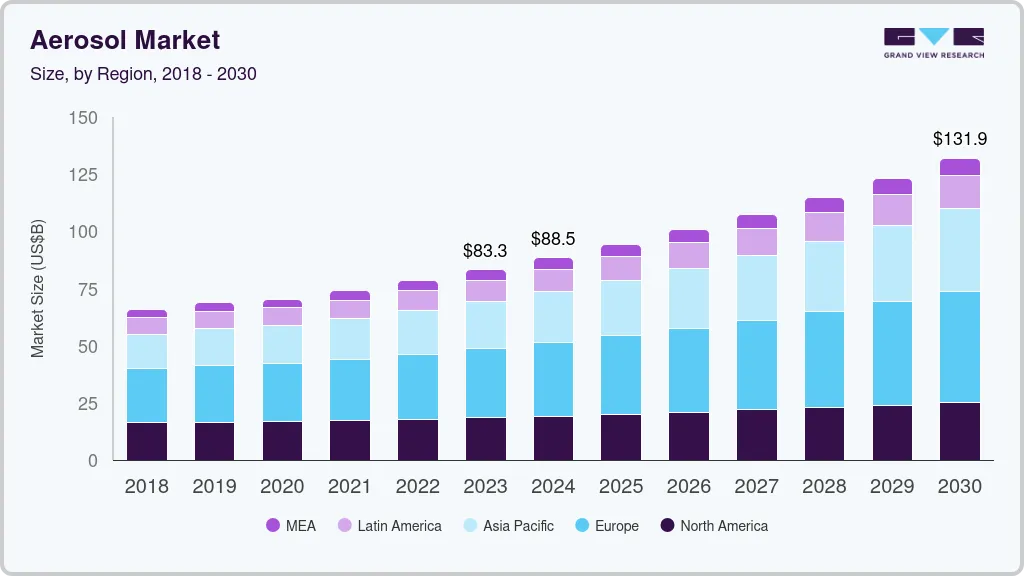

The global aerosol market size was estimated at USD 83.29 billion in 2023 and is projected to reach USD 131.93 billion by 2030, growing at a CAGR of 6.9% from 2024 to 2030. The industry is anticipated to be driven by the growing demand for various products including deodorants, hair sprays, hair mousse, dry shampoos, insecticides, air fresheners, cleaning, lubricants, and medical spray.

Key Market Trends & Insights

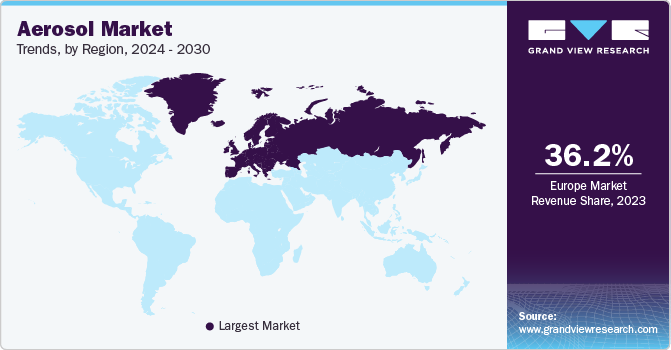

- The aerosol market in Europe held the largest market share of 36.2% in terms of revenue in 2023.

- The aerosol market in the UK is expected to grow in the upcoming years.

- Based on materials, The aluminum segment dominated the market with the largest revenue share of 60.8% in 2023.

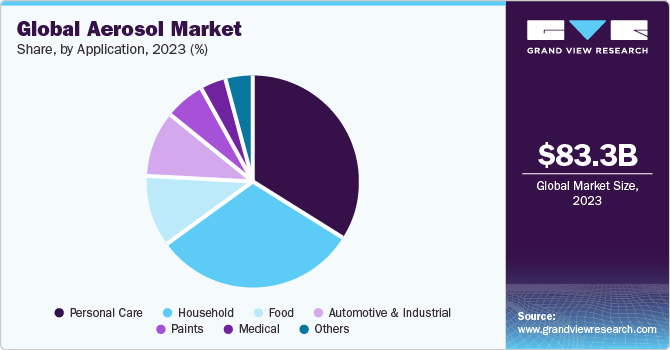

- Based on application, the personal care segment dominated the market with the largest revenue share in 2023.

- Based on type, the standard type segment dominated the market with the largest revenue share in 2023.

Market Size & Forecast

- 2023 Market Size: USD 83.29 Billion

- 2030 Projected Market Size: USD 131.93 Billion

- CAGR (2024-2030): 6.9%

- Europe: Largest market in 2023

- Asia Pacific: Fastest growing market

The market is rapidly increasing due to expanding personal care and household industry. Aerosol finds wide applications including personal care & household products such as hair sprays, deodorants, insecticides, shaving gels, fabric care, air fresheners, furniture polish, oven cleaners, and leather care. Other applications include automotive, paints & varnishes, industrial, pharmaceutical, veterinary, and food industries. The introduction of new product formats and gender-specific products is expected to drive the demand for personal care products. The growing use of aerosol propellants in hair sprays, styling mousses, and deodorants & antiperspirants is expected to further drive the market.

Furthermore, companies such as S. C. Johnson & Son, Inc. have been continuously making efforts to promote the usage of the repellent and its benefits. Therefore, increasing usage of repellents has been boosting the demand for aerosols in the household segment. Increasing use of Clean Development Mechanism (CDM) in the domestic manufacturing industry and the adoption of the Montreal Protocol is anticipated to restrict the demand for products emitting VOC compounds. Therefore, regulatory inclination concerning the restriction of VOC emissions is anticipated to restrict the demand for aerosol owing to HFC composition. Further, the demand for sanitizing spray and disinfectants is also expected to rise significantly in the country owing to the increased cleaning amid the COVID-19 outbreak. This is expected to support the demand growth of aerosol in household application.

Key players operating in the aerosol market are now shifting their focus to producing recyclable aerosols to reduce carbon footprint and their products market. For instance, in June 2022, Ball Corporation launched a new low-carbon footprint aluminum aerosol can, in line with its 2030 science-based targets and net-zero emissions prior to 2050. The newly launched cans incorporate up to 50% recycled content as well as low carbon aluminum that has been smelted using renewable energy sources, such as hydroelectric power. Producing cans with recycled content and low-carbon aluminum helps support the company’s progress toward reducing absolute value chain emissions by 16% by 2030.

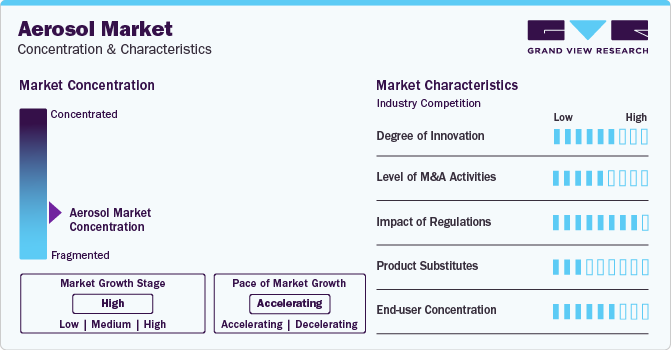

Market Concentration & Characteristics

The market is highly fragmented due to the presence of a large number of players across the world. Increasing preference for aerosol products by consumers owing to ease of product handling has been driving the existing consumer goods companies to offer their products in aerosol forms. Besides, the growing packaged food and consumer goods industries across the world have further been fueling the aerosol demand. On account of growing end-use industries globally, the existing companies are expected to enter new geographies along with the emergence of new entrants in the market.

For instance, in April 2022, Sidel launched PressureSAFE, an innovative PET aerosol container design for home and personal care brands. This new PET product-packaging solution is approved for the traditional PET recycling stream. This newly launched product is intended for use with products such as perfumes and deodorants.

In May 2022, The Can Manufacturers Institute (CMI) and the Household & Commercial Products Association (HCPA) launched an Aerosol Recycling Initiative with the support of almost 20 companies across the aerosol value chain to increase access to aerosol recycling and on-pack recyclability messaging. The initiative’s goal is to achieve by 2030 at least an 85 % recycling access rate for all aerosol cans and label at least 90% of aerosols as recyclable.

Material Insights

Based on materials, the market can be segmented into steel, aluminum, and others. The aluminum segment dominated the market with the largest revenue share of 60.8% in 2023 and is also projected to expand at a considerable growth rate over the forecast period. Aluminum is an environment-friendly material and can be recycled multiple times. In addition, it also offers robust packaging and significantly enhances the aesthetic appeal of the product. These factors are majorly contributing to the growth of the segment.

Increasing aluminum prices are leading to a rise in the final costs of aerosols. On account of this factor, aerosol manufacturers are expected to opt for a low-priced alternative, which may hamper the growth of the aluminum material segment in the coming years. The plastic material segment has also been experiencing significant demand for the past few years due to the low weight, low cost, and high recyclability of PET plastic. However, a strict ban on plastic packaging, especially in Europe, is expected to hamper the growth of this segment over the coming years.

Application Insights

The personal care segment dominated the market with the largest revenue share in 2023. The segment is driven by the growing demand for hair care products and deodorants. The demand for personal care products is increasing in emerging economies owing to the changing lifestyle, rising consumer spending, and emphasis on gender-specific products.

The rapid growth of the household segment is attributed to the improvement in standards of living and emphasis on hygiene, especially in developing regions. This has led to a rise in the consumption of household products like air fresheners, cleaners, sanitizing agents, and disinfectants. Dispersion of these products in less quantity reduces wastage and increases their longevity.

Type Insights

The standard type segment dominated the market with the largest revenue share in 2023 and is projected to continue its dominance throughout the forecast period. This segment includes continuous and metering type valves; continuous valves are used in applications where continuous spray is required. The increasing utilization of these valves in food products, technical products, and home care products, such as insecticides, rodenticides, and decoration products, is expected to drive the segment growth. Metered valves are specifically preferred for efficient dispensing of metered doses, thus used in pharmaceutical applications and air fresheners.

Bag-in-valve is a packaging technology wherein the bag containing the product is welded to the valve. The propellant is placed in between the bag and the can. Therefore, the propellant and the product are completely separated from each other, which improves the integrity of the packaged product. In a bag-in-valve aerosol, the product is dispensed mainly by the propellant by squeezing the bag after the pressing of the spray button. Cosmetic, medical, and food products are usually packaged in the aerosol with a bag-in-valve to maintain the purity of the product. The bag in the valve offers nearly 99.5% product dispersion; the bag is usually made of four-layer laminates, which minimizes the possibility of oxidation, and the product is hermetically sealed with the bag. These advantages are attracting various product manufacturers toward the bag in the valve aerosol type segment.

Regional Insights

North America aerosol market is projected to grow at a CAGR of 4.6% during the forecast period. The use of aerosols in hair sprays, shaving gels, insecticides, deodorants, air fresheners, oven cleaners, fabric care products, furniture polishes, leather care products, and different personal care products is a crucial driver for the growth of the market in the region. Moreover, the high levels of disposable income in the U.S. and Canada are also contributing to the consumption of cosmetics and personal care products.

U.S. Aerosol Market Trends

The aerosol market in the U.S. is expected to grow over the forecast period owing to the surging demand for vehicles. According to the International Organization of Motor Vehicle Manufacturers, total vehicles in use in the U.S. increased by 9.4%, reaching 289.04 million units in 2020 from 264.19 million units in 2015. This surging ownership of vehicles in the country is driving the growth of aerosol market in the U.S. as aerosols are used for greasing, spray painting, and lubricating vehicles.

Europe Aerosol Market Trends

The aerosol market in Europe held the largest market share of 36.2% in terms of revenue in 2023. The region is also the leading producer of aerosols. Its large share is mainly attributable to the personal care industry. Factors including high cosmetics consumption, rapid growth in the fragrance industry, and increasing consumer spending are boosting the regional market growth.

The Germany aerosol market is growing as consumers in the country are switching toward sustainable aerosol solutions, thereby surging the demand for them in the country. Companies are adopting various strategies to cater to this demand for green aerosol solutions. For instance, in February 2024, Wolf Group OÜ expanded its operations by establishing a new entity, Wolf Group Deutschland GmbH, in Germany. This move marks the 14th sales branch of the group. Wolf Group Deutschland GmbH is part of the strategic efforts of the company to strengthen its position in the D-A-CH region (Germany, Austria, and Switzerland).

The aerosol market in the UK is expected to grow in the upcoming years. The rapid growth of e-commerce platforms in the UK has also impacted the dynamics of aerosol market. Online retail channels provide a convenient avenue for consumers to purchase aerosol products, thereby leading to increased accessibility of consumers to these products and enhanced visibility for their manufacturers.

Asia Pacific Aerosol Market Trends

The Asia Pacific emerged as the fastest-growing region in the aerosol market, as the middle-class millennial population has been significantly growing in emerging countries such as India and China for the past several years. For instance, millennials held a majority share of India’s overall working population in 2022. Millennials are characterized by high levels of disposable income and are digitally connected individuals. Therefore, this population group is well informed and a significant consumer of various personal care products such as deodorants, hair mousse, hair spray, and shaving foam. Furthermore, the working millennial population in India is increasing at a considerably higher rate as compared to the rest of the world, which, in turn, is expected to impact positively on the aerosol market in the Asia Pacific.

The China aerosol market is expected to grow during the forecast period. China's rapid urbanization has led to lifestyle changes and increased demand for aerosol products, particularly in urban centers where consumers seek convenience and efficiency. The expanding middle-class population has disposable income available to spend on personal care and household products, which will drive the market for aerosol-based cosmetics, air fresheners, and cleaning products.

The aerosol market in India is growing as one of the major consumers of personal care products owing to its large population coupled with the increased adoption rate for such products. Increasing awareness for hygiene and the social image is augmenting the consumption of aerosol products in household applications. The aforementioned reasons are expected to propel the demand for aerosol products in the country over the forecast period.

Central & South America Aerosol Market Trends

Rising per capita income in the Central & South America region is responsible for the increased spending on premium beauty products in various Central & South American countries. Avon, Beiersdorf, Natura, Boticario, P&G, and Unilever are the key personal care manufacturers operating in the region. The region is also home to a thriving middle-income group, which is expected to drive the demand for various personal care and household products in the coming years.

The Brazil is one of the largest markets in the region for aerosol consumption, primarily driven by rising income levels, increasing preference toward personal care products, and affordability of hygiene products. According to the World Bank, Brazil’s GNI per capita increased to 17,270 PPP dollars in 2022 from 15,750 PPP dollars in 2021. The market is complemented by the presence of large corporations focused on metal-based packaging solutions. Brazil is one of the top 10 steel-producing countries in the world with the presence of leading vertically integrated steel producers. Brazil is also one of the top 20 aluminum-producing countries followed by Argentina in the region

Key Aerosol Company Insights

Key companies are increasingly adopting market strategies such as new product launches, and joint venture to strengthen their market position and expand into new territories.

-

In March 2024, Procter & Gamble patented an aerosol package design that utilizes adsorbent materials as propellants, maintaining pressure within the package throughout its lifespan. The design includes a bag, can, and valve with an adsorption matrix of Metal-Organic Framework (MOF) and carbon dioxide, ensuring pressure stability. This innovation highlights Procter & Gamble's focus on patenting strategies and nano-emulsion cosmetics, with a grant share of 52% as of January 2024.

-

In September 2023, Beiersdorf announced that all deodorant cans in the European assortment of NIVEA, 8X4, Hidrofugal, and Hansaplast will contain at least 50% recycled aluminum and will weigh 11.6% less. This will reduce CO2 emissions in the aerosol can value chain by around 58%. This corresponds to a reduction of around 30 tons of CO2 per year.

-

In October 2023, Colep Packaging and Envases Group signed a joint venture agreement for the construction of an aerosol packaging plant in Mexico. the new plant will produce 3 aluminum aerosol lines, which serve customers in Mexico as well as the Central America market using this production unit.

Key Aerosol Companies:

The following are the leading companies in the aerosol market. These companies collectively hold the largest market share and dictate industry trends.

- Henkel AG & Co., KGaA

- S. C. Johnson & Son, Inc.

- Procter & Gamble

- Unilever

- Colep Consumer Products

- Akzo Nobel N.V.

- Beiersdorf AG

- Estée Lauder Inc

- Oriflame Cosmetics S.A.

- Honeywell International Inc

- Reckitt Benckiser

Aerosol Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 88.55 billion

Revenue forecast in 2030

USD 131.93 billion

Growth rate

CAGR of 6.9% from 2024 to 2030

Base year

2023

Historical data

2018 - 2022

Forecast period

2024 - 2030

Report updated

June 2024

Quantitative units

Volume in million units; revenue in USD million/billion, and CAGR from 2024 to 2030

Report coverage

Volume Forecast, revenue forecast, competitive landscape, growth factors and trends

Segments covered

Material, type, application, and region

Regional scope

North America; Europe; Asia Pacific; Central & South America; Middle East & Africa

Country Scope

U.S.; Canada; Mexico; Germany; France; UK; Italy; Spain; Netherlands; China; India; Japan; South Korea; Vietnam; Singapore; Australia; Brazil Argentina; Chile; Saudi Arabia; South Africa; UAE

Key companies profiled

Henkel AG & Co.; KGa; S. C. Johnson & Son, Inc.; Procter & Gamble; Unilever; Colep Consumer Products; Akzo Nobel N.V.; Beiersdorf AG; Estée Lauder Inc; Oriflame Cosmetics S.A.; Honeywell International Inc; and Reckitt Benckiser

Customization scope

Free report customization (equivalent up to 8 analyst’s working days) with purchase. Addition or alteration to country, regional & segment scope

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Aerosol Market Report Segmentation

This report forecasts volume & revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global aerosol market report based on material, type, application, and region:

-

Material Outlook (Volume, Million Units; Revenue, USD Million, 2018 - 2030)

-

Steel

-

Aluminum

-

Others

-

-

Type Outlook (Volume, Million Units; Revenue, USD Million, 2018 - 2030)

-

Bag-in-valve

-

Standard

-

-

Application Outlook (Volume, Million Units; Revenue, USD Million, 2018 - 2030)

-

Personal Care

-

Deodorants

-

Hair Mousse

-

Hair Spray

-

Shaving Mousse/Foam

-

Suncare

-

Others

-

-

Household

-

Insecticides

-

Plant Protection

-

Air Fresheners

-

Furniture & Wax Polishes

-

Disinfectants

-

Surface care

-

Others

-

-

Automotive & Industrial

-

Greases

-

Lubricants

-

Spray Oils

-

Cleaners

-

-

Food

-

Oils

-

Whipped Cream

-

Edible Mousse

-

Sprayable Flavours

-

-

Paints

-

Industrial

-

Consumer

-

-

Medical

-

Inhaler

-

Topical Application

-

-

Others

-

-

Regional Outlook (Volume, Million Units; Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

Italy

-

Spain

-

Netherlands

-

-

Asia Pacific

-

China

-

India

-

Japan

-

South Korea

-

Vietnam

-

Singapore

-

Australia

-

-

Central & South America

-

Brazil

-

Argentina

-

Chile

-

-

Middle East & Africa

-

Saudi Arabia

-

UAE

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global aerosol market was estimated at USD 83.29 billion in the year 2023 and is expected to reach USD 88.54 billion in 2024.

b. The global aerosol market is expected to grow at a compound annual growth rate of 6.9% from 2024 to 2030, reaching USD 131.93 billion by 2030.

b. The European region dominated the market and accounted for more than 36.1% of revenue in 2023. The factors attributed to driving the European market are the presence of global players in the cosmetic and pharmaceutical industries in Europe and the high per capita consumption of cosmetic products.

b. The key market player in the aerosol market includes Henkel AG & Co., KGaA; S. C. Johnson & Son, Inc.; Procter & Gamble; Unilever; Honeywell International Inc.; Akzo Nobel N.V.; Beiersdorf AG; Estée Lauder Inc.; Oriflame Cosmetics Global SA.

b. Global aerosol market is anticipated to be driven by the growing demand for various products including deodorants, hair sprays, hair mousse, dry shampoos, insecticides, air fresheners, cleaning, lubricants, and medical spray. Increasing disposable income and changing consumer lifestyles are key factors attributing to the growing demand of aerosol products.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.