- Home

- »

- Medical Devices

- »

-

U.S. Ambulatory Surgery Center Market Size, Report, 2030GVR Report cover

![U.S. Ambulatory Surgery Center Market Size, Share & Trends Report]()

U.S. Ambulatory Surgery Center Market (2024 - 2030) Size, Share & Trends Analysis Report By Specialty (Orthopedics, Otolaryngology), By Ownership (Physician, Hospital) By Center Type (Single, Multispecialty), By Device Type, By Region, And Segment Forecasts

- Report ID: GVR-4-68039-920-7

- Number of Report Pages: 100

- Format: PDF

- Historical Range: 2018 - 2022

- Forecast Period: 2024 - 2030

- Industry: Healthcare

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Market Size & Trends

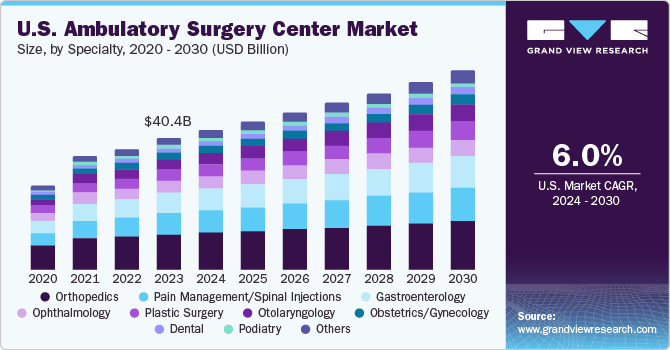

The U.S. ambulatory surgery center market size was estimated at USD 40.41 billion in 2023 and is expected to grow at a CAGR of 6.02% from 2024 to 2030. The U.S. ambulatory surgery center devices market size was estimated at USD 26.57 billion in 2023 and is anticipated to grow at a CAGR of 8.89% from 2024 to 2030.The market growth can be attributed to rising investment in ambulatory surgery centers (ASCs) and favorable reimbursement for services at ASCs in the U.S. For instance, in January 2024, Tarrant Capital IP, LLC, an asset management firm, revealed a strategic investment in Compass Surgical Partners, an independent, full-service ASC management and development partner. The investment aims to accelerate Compass Surgical Partners' growth, expand its capabilities, and enhance its ability to meet the rising demand for ASC joint ventures among healthcare system partners.

Ambulatory services have positively impacted the U.S. healthcare system, making care more accessible, efficient, and cost-effective for patients and providers. The number of inpatient admissions has significantly decreased in recent years due to shifting procedures to ASCs. In the U.S., more than 65% of surgeries are performed in ASCs. This is primarily due to high inpatient hospitalization costs and a rise in the adoption of advanced technologies by ASCs, enabling rapid & cost-effective treatment provision. Growing pressure from payers and Medicare has also increased the number of people preferring nearby ambulatory community care units for diagnostic tests over city hospitals.

Market Concentration & Characteristics

The chart below illustrates the relationship between market concentration, market characteristics, and market participants. The x-axis represents the level of market concentration, ranging from low to high. The y-axis represents various market characteristics, including industry competition, degree of innovation, level of mergers & acquisition activities, the impact of regulations, product substitutes, and regional expansion. For instance, the degree of innovation is medium, the level of mergers & acquisitions activities is also medium, and product expansion is low. The impact of regulations on the market is low, and the regional expansion of the market is medium.

Several industry players launch new products to improve their industry penetration. For instance, in November 2023, BD launched an advanced ultrasound system to help clinicians with the placement of Peripherally Inserted Central Catheters (PICCs), IV lines, central venous catheters, and other vascular access devices. This system is developed to improve clinician efficiency and make the process smoother

Key industry players, including Envision Healthcare Corporation; Tenet Healthcare Corporation; Mednax Services, Inc.; TeamHealth; UnitedHealth Group; Quorum Health, McKesson Corp., BD, Koninklijke Philips N.V.; and 3M, involved in merger and acquisition activities to expand their industry presence. For instance, in April 2023, Abbott acquired Cardiovascular Systems, Inc. (CSI), a medical device company. The acquisition would provide Abbott with a complementary solution for treating vascular disease

The impact of regulations on the U.S. ASC industry is high. ASCs are highly regulated healthcare settings. They are regulated by the Ambulatory Surgery Center Association. Regulations for ASCs vary from state to state

Industry players leverage the strategy of product substitutes to increase their product capabilities and promote the reach of their product & service offerings. For instance, in July 2023, Stryker launched the Ortho Q guidance system, a robotics-ready platform. The system has a small footprint and is designed to be used in the ASCs and operating rooms

There is the presence of several local companies that understand the regional industry and customer preferences that pose significant competition to ASCs. Some prominent companies in the industry are implementing various strategies, such as launching new products and regional expansion, to consolidate their industry position across the country. For instance, in November 2022, TeamHealth announced its expansion into the Dallas-Fort Worth area with the acquisition of Acute Care Transitions, LLP, a provider of advanced care and emergency medicine through at-home telehealth services

Specialty Insights

The orthopedics segment dominated the market in 2023 with a revenue share of 27.23% owing to improving diagnostic methods & imaging technologies in orthopedic surgeries and constant developments by market players in this segment. For instance, in February 2023, Spire Orthopedic Partners entered into a partnership agreement with the Orthopedic Associates of Dutchess County, making Spire one of the biggest orthopedic platforms in the U.S. This would help the company better serve the existing patients and meet the growing demand.

The cardiology segment is anticipated to grow at the fastest CAGR during the forecast period owing to strong reimbursement rates, lower cost of procedures, and an increasing number of single-specialty cardiology ASCs in the U.S. For instance, the January 2021 Update of the Ambulatory Surgical Center (ASC) Payment System by the CMS included the addition of four new HCPCS codes to describe the technology associated with Peripheral Intravascular Lithotripsy (IVL).

Ownership Insights

The physician-owned segment dominated the market in 2023 with a share of 62.16%. Physician-owned centers focus on a small number of procedures in a single setting and bring concerns directly to the physicians who have proper knowledge about every patient’s case. Furthermore, it offers maximum professional control over the clinical setting and the standard of patient care. Some of these factors are responsible for contributing to the rise in patient footfall in physician-owned ASCs, thereby driving segment growth.

The hospital-owned segment is anticipated to grow at the fastest CAGR during the forecast period owing to the migration of patients from inpatient hospital settings to hospital-owned ASCs. Furthermore, strategic initiatives undertaken by key players increase their market share by acquiring physician offices and outpatient facilities. For instance, in February 2022, Mayo Clinic announced a USD 432 million expansion in Jacksonville, Florida, which will upgrade an existing facility with 121 inpatient beds. This investment is expected to drive market growth.

Center Type Insights

The single-specialty segment dominated the market in 2023 with a share of 61.29%. This can be attributed to the presence of a large number of single-specialty ASCs in the U.S. Surgeries performed in single-specialty ASCs include cataract surgery, hernia repair, joint replacements, colonoscopies, and other minimally invasive procedures. These facilities must comply with strict regulations and standards for patient safety & quality of care. Moreover, these centers are likely to have a high reimbursement per procedure.

The multi-specialty segment is anticipated to grow at the fastest rate during the forecast period due to a comprehensive and patient-centered approach to surgical care, providing a range of services under one roof and helping streamline patients' healthcare experience. Unlike single-specialty ASCs, a multi-specialty center has 50 to 100 surgeons. Thus, benefits associated with multi-specialty ASCs are expected to drive market growth.

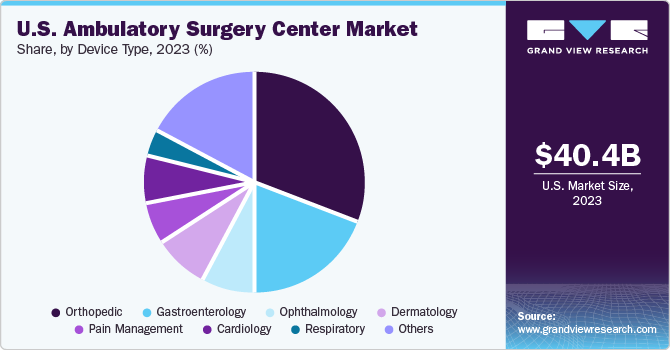

Device Type Insights

The orthopedic segment dominated the market in 2023 with a market share of 31.37%. This can be attributed to the shift of orthopedic procedures towards outpatient centers in the U.S. This shift has been caused by the pandemic and Medicare's increasing compliance to reimburse procedures conducted at ASCs. Thus, observing an opportunity in this trend, medical device companies are now providing financing plans for equipment and even assembling design teams to assist as an increasing number of physicians establish ASCs.

The cardiology segment is anticipated to grow at the fastest CAGR from 2024 to 2030. With the growing shift of procedures being performed in hospital settings to ASCs, many providers are launching specific suites designed to cater to the demand by ASCs in the U.S. For instance, in June 2023, Royal Philips entered into a strategic alliance with Biotronik for the expansion of its cardiovascular devices’ products, specifically for Philips SymphonySuite. It is the solution for opening and expanding cardiovascular ASCs and Office-based Labs (OBLs) and includes highly specialized equipment & devices.

Region Insights

The Southeast region dominated the market in 2023 with a revenue share of 29.16% due to the increasing popularity of outpatient surgery and a significant number of physician-owned ASCs in the region. In September 2022, Intermountain Healthcare opened a new state-of-the-art ambulatory surgery center (ASC) in St. George. This new ASC is expected to provide surgical services in a convenient, patient-centered environment. Patients can receive high-quality care in a facility with the latest medical technology and equipment.

The Midwest region is expected to grow at the fastest CAGR during the forecast period due to several advancements in ASCs across the Midwest region, including improvements in technology, patient experience, and medical procedures. Moreover, ASCs in the Midwest have adopted new surgical techniques that minimize pain, scarring, and recovery time. For instance, in November 2022, Hammes, a market player in healthcare development, announced the launch of an ASC in Kansas City. The center is being established by the Mid-America Division of HCA Healthcare in partnership with approximately 20 physician partners.

Key U.S. Ambulatory Surgery Center Company Insights

The demand for ASCs has led to increased competition among companies in the market. Furthermore, increasing industry consolidation activities, such as partnership & collaboration, acquisitions, and mergers, by the top market players as well as growing initiatives in launching new products by key players are also anticipated to increase their share in the market.

Key U.S. Ambulatory Surgery Center Companies:

Service Providers:

- Envision Healthcare Corporation (KKR & CO. Inc.) LLC

- Tenet Healthcare Corporation

- Mednax Services, Inc. (Pediatrix Medical Group, Inc.)

- TeamHealth

- UnitedHealth Group.

- Quorum Health

- Surgery Partners

- Community Health Systems, Inc.

- SurgCenter

- Prospect Medical Systems

- Edward-Elmhurst Health

Manufacturers

- McKesson Corp.

- BD.

- Koninklijke Philips N.V.

- 3M

- Olympus America

- Abbott

- Medtronic

- Zimmer Biomet

- Henry Schein, Inc.

- STERIS Plc

Recent Developments

-

In January 2024, GE HealthCare announced the acquisition of MIM Software, a provider of medical imaging analysis and AI solutions for the practice of radiation molecular radiotherapy, oncology, urology, & diagnostic imaging at imaging centers, specialty clinics, hospitals, and research organizations worldwide

-

In December 2023, GE HealthCare introduced Vscan Air SL, a wireless ultrasound imaging system specifically developed for swift cardiac, portable, and vascular assessments at the point of care. The product was an addition to the company’s Vscan suite. The incorporation of XDclear and SignalMax technology can provide high-quality imaging performance with penetration, sensitivity, & resolution. Through this offering, the company aims to improve diagnosis rates and treatment decision efficiency

-

In April 2023, Koninklijke Philips N.V. and Northwell Health, a healthcare provider, entered a 7-year partnership to help the health system standardize patient monitoring, improve patient outcomes, and enhance patient care while promoting interoperability & data innovation. This collaboration enables Northwell Health to establish the groundwork for a futureproof, enterprise-wide platform while providing the flexibility to scale patient monitoring systems & adapt to evolving innovative technologies swiftly & efficiently

-

In July 2022, Envision Healthcare Corporation announced its entry into Liquidity Enhancing Transactions. It aimed to offer high-quality, patient-centered care and support healthcare partners to enhance patient access to care

U.S. Ambulatory Surgery Center Market Report Scope

Report Attribute

Details

Procedure revenue forecast in 2030

USD 60.8 billion

Procedure growth rate

CAGR of 6.02% from 2024 to 2030

Devices revenue forecast in 2030

USD 49.08 billion

Devices growth rate

CAGR of 8.89% from 2024 to 2030

Actual data

2018 - 2022

Forecast data

2024 - 2030

Quantitative units

Revenue in USD billion, and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Specialty, ownership, center type, device type, region

Envision Healthcare Corp. (KKR & Co. Inc.); Tenet Healthcare Corp.; Mednax Services, Inc. (Pediatrix Medical Group, Inc.); TeamHealth; UnitedHealth Group; Quorum Health; Surgery Partners; Community Health Systems, Inc.; SurgCenter; Prospect Medical Systems; Edward-Elmhurst Health; McKesson Corp.; BD, Koninklijke Philips N.V.; 3M; Olympus America; GE HealthCare; Abbott; Medtronic; Zimmer Biomet; Henry Schein; Inc.; STERIS Plc

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

U.S. Ambulatory Surgery Center Market Report Segmentation

This report forecasts revenue growth at the country level and provides an analysis of the latest trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the U.S. ambulatory surgery center market report based on specialty, ownership, center type, device type, and region:

-

Specialty Outlook (Revenue, USD Billion, 2018 - 2030)

-

Orthopedics

-

Pain Management/Spinal Injections

-

Gastroenterology

-

Ophthalmology

-

Plastic Surgery

-

Otolaryngology

-

Obstetrics/Gynecology

-

Dental

-

Podiatry

-

Cardiology

-

Respiratory

-

Others

-

-

Ownership Outlook (Revenue, USD Billion, 2018 - 2030)

-

Physician Owned

-

Hospital Owned

-

Corporate Owned

-

-

Center Type Outlook (Revenue, USD Billion, 2018 - 2030)

-

Single-specialty

-

Multi-specialty

-

-

Device Type Outlook (Revenue, USD Billion, 2018 - 2030)

-

Orthopedic

-

Gastroenterology

-

Ophthalmology

-

Dermatology

-

Pain Management

-

Cardiology

-

Respiratory

-

Others

-

-

Regional Outlook (Revenue, USD Billion, 2018 - 2030)

-

Southeast

-

West

-

Midwest

-

Northeast

-

Southwest

-

Frequently Asked Questions About This Report

b. The orthopedics segment dominated the U.S. ambulatory surgery centers market by application with a share of 27.23% in 2023. This is attributable to the increasing demand for minimally invasive orthopedic surgical procedures such as hip and joint replacement from the geriatric population.

b. Some of the key players operating in the U.S. ambulatory surgery centers market include Envision Healthcare, Tenet Healthcare, Medmax services, Prospect group, TeamHealth. UnitedHealth Group, Quorum Health Corporation, Surgery Partners, Community Health Systems, Inc., SurgCenter Development, Prospect Medical Group, and Edward-Elmhurst Health, MCKESSON CORPORATION, BD, Koninklijke Philips N.V., 3M, Olympus America, Zimmer Biomet, GE HealthCare, Abbott, Medtronic, and Henry Schein, Inc.

b. Key factors that are driving the U.S. ambulatory surgery centers market growth include increasing demand for minimally invasive surgeries (MIS), technological developments in surgical devices and equipment, and surgeons’ control over the choice of such equipment.

b. The U.S. ambulatory surgery center market size was estimated at USD 40.41 billion in 2023 and is expected to reach USD 42.79 billion in 2024.

b. The U.S. ambulatory surgery center market is expected to grow at a compound annual growth rate of 6.02% from 2024 to 2030 to reach USD 60.8 billion by 2030.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.