U.S. Antacids Market Summary

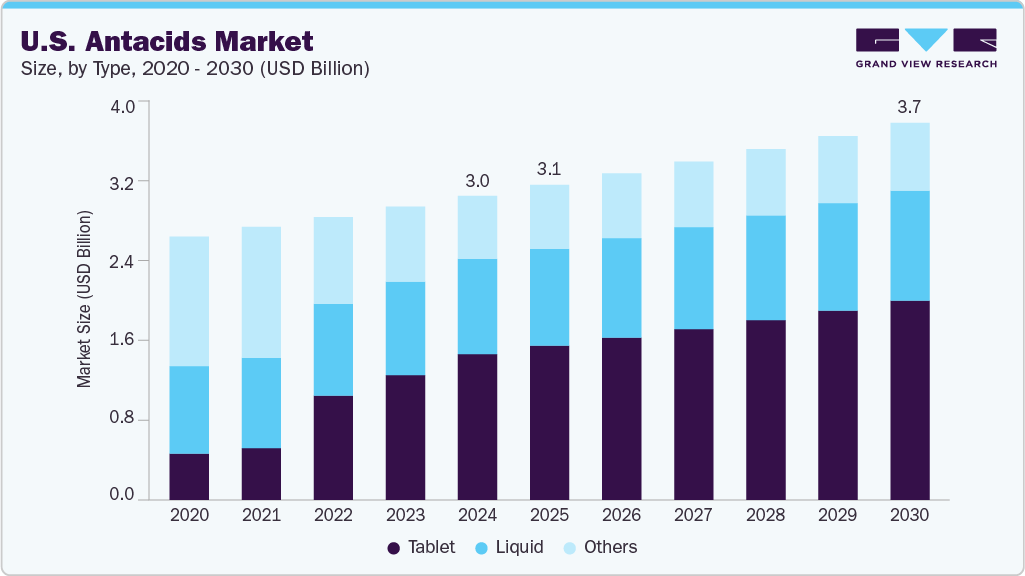

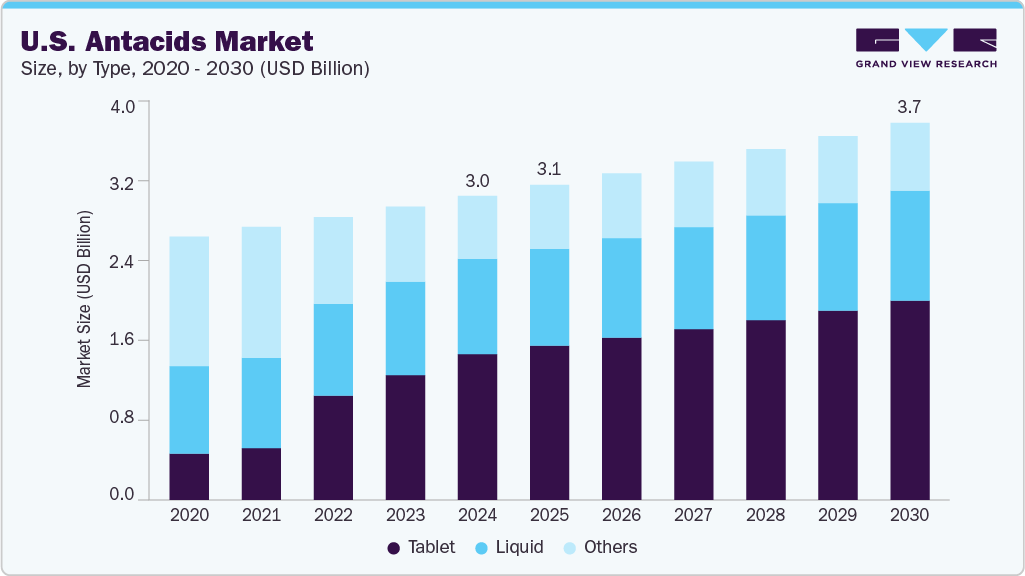

The U.S. antacids market size was estimated at USD 3.00 billion in 2024 and is projected to reach USD 3.73 billion in 2030, growing at a CAGR of 3.7% from 2025 to 2030. Changing dietary habits is a key factor propelling market growth over the forecast period.

Key Market Trends & Insights

- By type, the liquid segment held a significant market share of 31.3% in 2024.

- Based on the end use, the retail pharmacy segment held a significant market share in 2024.

Market Size & Forecast

- 2024 Market Size: USD 3.00 Billion

- 2030 Projected Market Size: USD 3.73 Billion

- CAGR (2025-2030): 3.7%

Rising cases of digestive issues such as gastroesophageal reflux disease (GERD), peptic ulcers, and other stomach problems that cause acidity, indigestion, and heartburn are also expected to support market expansion. According to a report published by the CDC in December 2024, approximately 5.9% U.S. adults were diagnosed with ulcers. Other key drivers include rising awareness and easy access to over-the-counter (OTC) antacids, which provide fast and effective relief from symptoms.

In addition, lifestyle factors such as stress, smoking, alcohol use, poor diet, and obesity, all of which contribute to acid-related conditions, are expected to further influence the growth of the U.S. antacid industry. For instance, according to a report by the CDC published in September 2024, the prevalence of obesity was 40.3% among adults in the U.S. from August 2021 to August 2023. The highest rates are seen in adults aged 40-59 and those with lower education levels. Severe obesity affected 9.4% of adults, with women showing higher rates than men across all age groups.

Most product development focuses on delivery formats such as chewable, liquids, fast-dissolve tablets, and branding. Some moderate innovation comes from combo formulations or OTC-probiotic hybrids which are expected to drive the demand for U.S. antacid industry.

The U.S. antacid market is subject to the high impact of regulations, particularly because antacids are available over-the-counter (OTC). The FDA monitors formulation, labeling, and marketing claims to ensure safety and efficacy. New formulations or combinations must meet specific OTC monograph standards, and some ingredients, such as ranitidine, have been withdrawn due to safety concerns. This means manufacturers must continuously adapt to evolving regulatory guidelines, especially around product safety, recalls, and transparency.

Type Insights

The liquid segment held a significant revenue share of 31.3% in 2024. The market is driven by its rapid-onset action, convenience, and ease of use for specific age groups, such as children, older people, and people with swallowing difficulties. In addition, a shift toward on-the-go liquid formulations, such as pre-dosed shots and portable bottles that offer both convenience and dosing accuracy, is also driving the U.S. antacid industry. Leading pharmaceutical and consumer health companies are responding by expanding their product portfolio, launching new liquid SKUs, and innovating in packaging design to enhance ease of use.

The tablet segment is anticipated to grow at a significant CAGR of 2.6% during the forecast period, due to its unmatched convenience and consumer familiarity. Chewable tablets such as Pepcid Complete (famotidine with calcium carbonate and magnesium hydroxide) are easy to carry, widely available in drugstores, and trusted for quick relief. According to a report by the U.S. FDA in December 2024, tablets such as Tums, Rolaids, and Mylanta are widely available in drugstores and supermarkets. Their pocket-size packaging makes them the go-to for consumers seeking immediate relief on the move.

End-use Insights

The retail pharmacy segment held a significant revenue share in 2024, due to the widespread availability of retail pharmacies in convenient locations such as shopping centers and neighborhoods, making it easy for consumers to purchase antacids without prescriptions. Retail pharmacies also offer various antacid products, including tablets and chewable forms, which are preferred for their ease of use and precise dosing, which is expected to drive the antacid market. In addition, trained pharmacists provide consumers with professional advice, enhancing trust and convenience.

The hospital pharmacy segment is anticipated to register a lucrative growth rate during the forecast period. The increasing number of patients with gastrointestinal conditions such as acid reflux and GERD drives the growth of the antacid market. Hospitals provide antacids as part of comprehensive care, especially for more severe or chronic cases, which drives demand for the U.S. antacid industry.

Key U.S. Antacids Company Insights

The market can be characterized by several multinational players and small-scale companies, competing to gain higher market share. New product launches, geographical expansion, and joint ventures are some of the key strategies undertaken by key players in the market.

-

Haleon Group of Companies leads the U.S. digestive‑health portfolio, which includes Tums, a fast-acting calcium carbonate chewable antacid and market leader in heartburn relief, and ENO, an effervescent fruit‑salt sachet offering quick neutralization of stomach acid.

-

Pfizer Inc. is a major player in the U.S. pharmaceutical market and offers over-the-counter antacid products such as Nexium 24HR for heartburn relief. The company supports its antacid portfolio through brand recognition and wide retail distribution.

Key U.S. Antacids Companies:

- Haleon Group of Companies.

- Bayer AG

- Boehringer Ingelheim International GmbH

- Dr. Reddy’s Laboratories Ltd.

- Sanofi

- Reckitt Benckiser Group plc

- Sun Pharmaceuticals Ltd.

- Takeda Pharmaceutical Company Limited

- Pfizer Inc.

- Procter & Gamble

Recent Developments

-

In March 2024, Lil’ Drug Store Products (LDSP) announced a partnership with P&G to distribute the trusted heartburn relief brand, Rolaids, to travel & convenience retailers nationwide.

U.S. Antacids Market Report Scope

|

Report Attribute

|

Details

|

|

Revenue forecast in 2030

|

USD 3.73 billion

|

|

Growth rate

|

CAGR of 3.7% from 2025 to 2030

|

|

Base year for estimation

|

2024

|

|

Historical data

|

2018 - 2023

|

|

Forecast period

|

2025 - 2030

|

|

Quantitative units

|

Revenue in USD million/billion, and CAGR from 2025 to 2030

|

|

Report coverage

|

Revenue forecast, company ranking, competitive landscape, growth factors, trends

|

|

Segments covered

|

Type, end-use

|

|

Key companies profiled

|

Haleon Group of Companies.; Bayer AG; Boehringer Ingelheim International GmbH; Dr. Reddy’s Laboratories Ltd.; Sanofi; Reckitt Benckiser Group plc; Sun Pharmaceuticals Ltd.; Takeda Pharmaceutical Company Limited; Pfizer Inc.; Procter & Gamble

|

|

Customization scope

|

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

|

|

Pricing and purchase options

|

Avail customized purchase options to meet your exact research needs. Explore purchase options

|

U.S. Antacids Market Report Segmentation

This report forecasts revenue growth and provides an analysis of the latest trends in each of the sub-segments from 2018 to 2030. For the purpose of this report, Grand View Research has segmented the U.S. antacid market on the basis of types, and end-use:

-

Type Outlook (Revenue, USD Million, 2018 - 2030)

-

End-use Outlook (Revenue, USD Million, 2018 - 2030)

-

Hospital Pharmacy

-

Retail Pharmacy

-

Others