Market Size & Trends

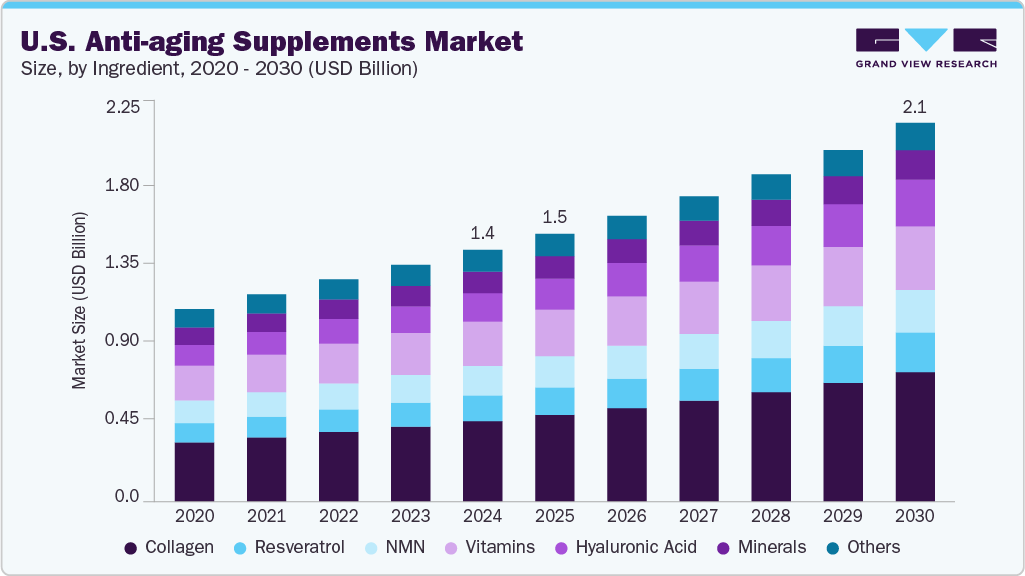

The U.S. anti-aging supplements market was valued at USD 1.39 billion in 2024 and is expected to grow at a CAGR of 7.2% from 2025 to 2030. Growth is driven by increasing health consciousness, rising life expectancy, and a proactive approach to age-related health management among U.S. consumers. The aging population aims to preserve energy levels, cognitive function, skin health, and immune strength, which has significantly increased demand for supplements designed to meet these needs.

The shift toward preventive wellness and holistic self-care, along with strong retail and e-commerce infrastructure, is accelerating the adoption of anti-aging nutraceuticals across diverse consumer segments. The growing emphasis on personalized nutrition and science-backed formulations is reshaping consumer expectations in the U.S. anti-aging supplements industry. Consumers seek targeted solutions that address specific concerns such as cognitive function, joint flexibility, and cellular regeneration. This shift encourages brands to invest in advanced R&D and precision wellness technologies, supporting individualized health outcomes. Supportive regulatory frameworks, ongoing studies, and collaborations with healthcare professionals fuel consumer trust and industry credibility. As public health strategies prioritize healthy aging and disease prevention, anti-aging supplements are positioned to support longevity and quality of life within the broader wellness ecosystem.

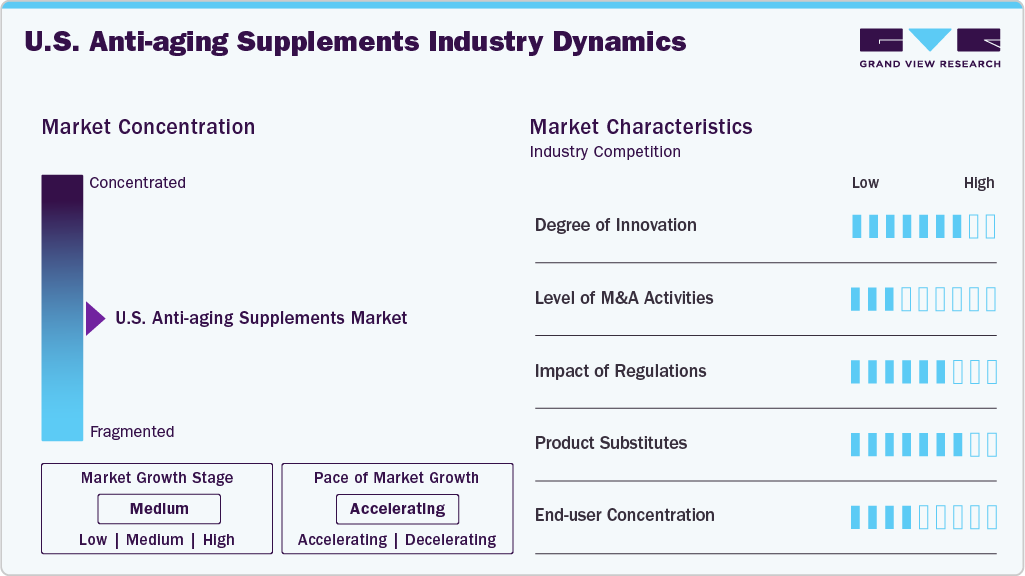

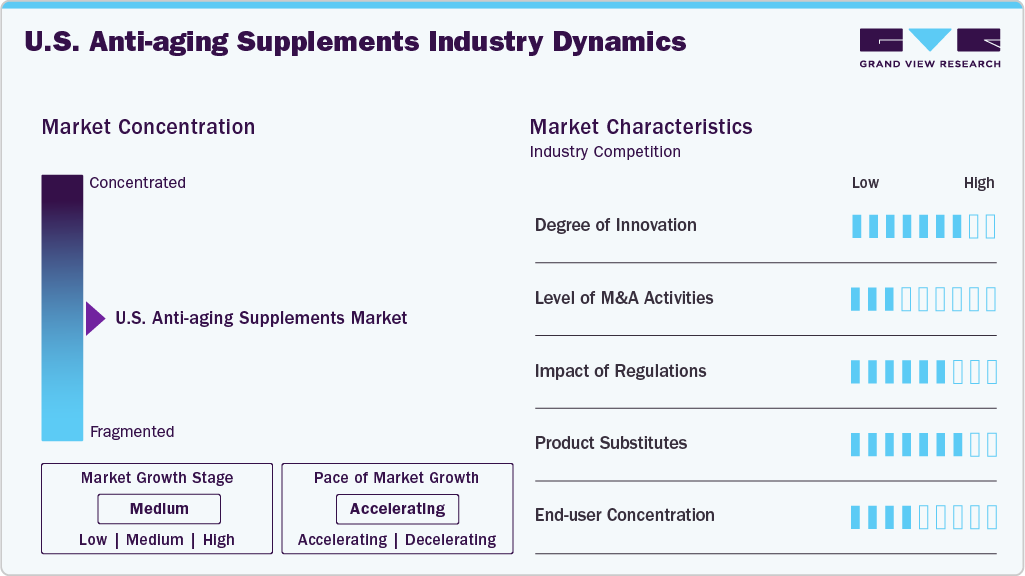

Market Concentration & Characteristics

The industry growth stage is medium, and the pace of growth is accelerating. The market is moderately fragmented, with a combination of multinational corporations and specialized wellness brands contributing to a diverse and competitive landscape. Companies offer a broad spectrum of products, including NAD⁺ boosters, collagen supplements, antioxidants, and peptide-based formulations, backed by clinical research and marketed to support skin health, longevity, and cellular repair.

The market demonstrates rapid innovation, strong brand positioning, and growing consumer loyalty across multiple distribution channels such as e-commerce, specialty retailers, and D2C platforms. Nu Skin Enterprises, Inc. maintains its leadership through the ageLOC line, delivering topical and ingestible solutions targeting the sources of aging. Niagen Bioscience continues to advance its longevity platform through patented NAD⁺ precursors such as Niagen.

The U.S. anti-aging supplements industry has experienced Merger and Acquisition (M&A) activity, with most companies focused on organic growth, innovation, and product development. In May 2025, Shaklee Corporation acquired Modere’s business, including its right to all patents, trademarks, and formulas of Modere products, including its portfolio’s two most popular product lines, Liquid BioCell Collagen and Trim.

Ingredients Insights

The collagen segment accounted for the largest revenue share of 32.0% in 2024. Growth is primarily driven by collagen’s benefits in supporting skin elasticity, fine line reduction, and joint and bone health, which are key concerns among aging consumers. Collagen is popular in various formulations such as powders, capsules, and ready-to-drink beverages designed for beauty-from-within and healthy aging. Growing consumer awareness, influencer-driven marketing, and dermatologist recommendations continue to support the segment’s leadership in the U.S. anti-aging supplements industry.

The hyaluronic acid segment is expected to grow at the fastest CAGR of 8.6% during the forecast period from 2025 to 2030, driven by rising demand for ingestible skincare solutions and hydration-focused supplements. Hyaluronic acid is widely recognized for improving skin moisture retention and elasticity, which makes it a key ingredient in anti-aging formulations. For example, clinical research has shown that consuming either 120 or 240 milligrams of hyaluronic acid daily improves skin hydration and relieves dry skin symptoms, directly supporting its appeal among consumers seeking visible skin health benefits. Its compatibility with ingredients such as collagen, coenzyme Q10, and biotin further boosts its inclusion in multifunctional supplements.

Application Insights

The hair, skin, and nail care segment had the largest revenue share in 2024. This growth is driven by increasing demand for supplements that support skin glow, hair strength, and nail health, especially among consumers looking for natural beauty solutions. These products often include collagen, biotin, and hyaluronic acid. Companies are expanding into skin-focused supplements to fulfill the rising demand for beauty-from-within products. For instance, Nutrafol launched Nutrafol Skin in 2024, a supplement designed for women 18 and over with mild to moderate acne.

The energy and stamina segment is expected to grow significantly over the forecast period, driven by an aging population seeking to maintain an active lifestyle, reduce fatigue, and improve daily energy levels. Products in this segment commonly include coenzyme Q10, ginseng, L-carnitine, and adaptogenic herbs that support energy metabolism and physical endurance. Rising awareness of fatigue and age-related energy decline has strengthened the demand for natural energy supplements, especially among older adults and working professionals.

Formulation Insights

The capsule segment accounted for the largest share in 2024. This growth is driven by ease of consumption, accurate dosing, portability, and longer shelf life. Manufacturers have incorporated clinically studied ingredients into capsule formulations to support cellular health and metabolic function and reduce signs of skin aging.

The powder segment is expected to grow at the fastest CAGR over the forecast period. The demand for flexible dose, rapid absorption, and compatibility with beverages and foods impels the growth. Powdered supplements, such as smoothies or post-workout nutrition, are easily incorporated into daily routines. Companies are focused on expanding powder-based offerings to meet the demand for collagen-infused, multifunctional supplements.

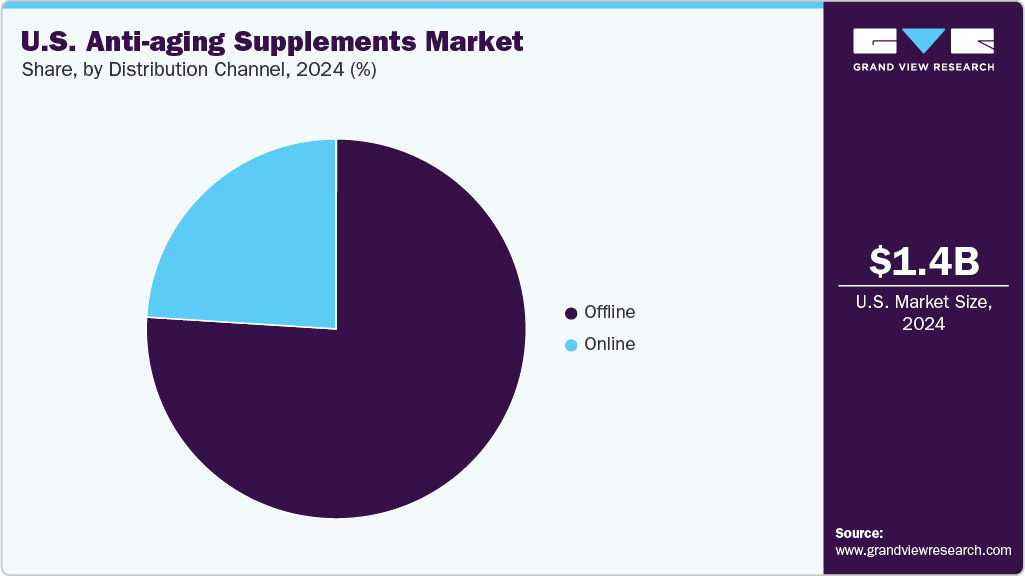

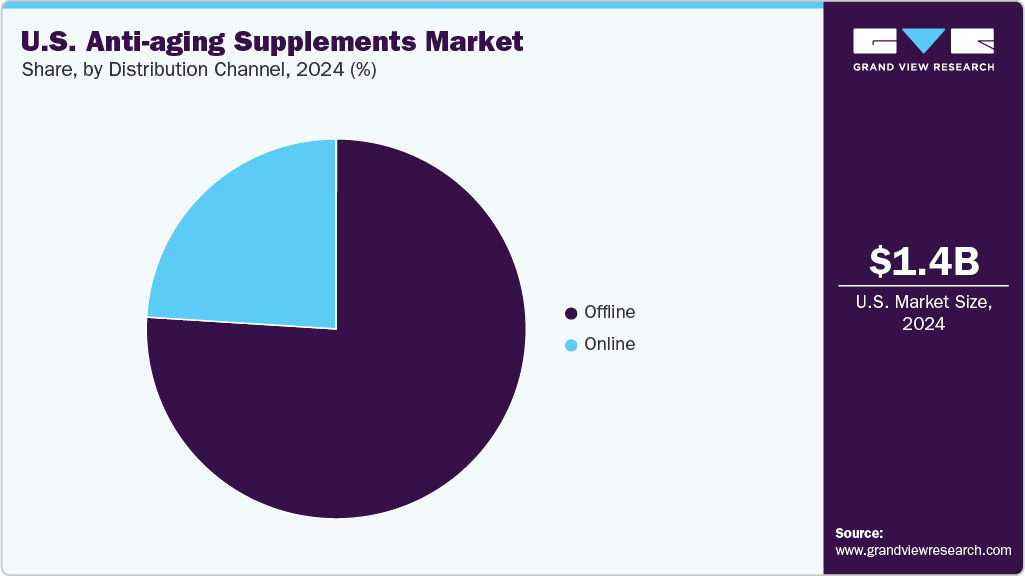

Distribution Channel Insights

The offline segment dominated the market in 2024, driven by strong consumer engagement with traditional retail environments. Sub-channels such as pharmacies and drug stores, hypermarkets, supermarkets, and specialty retailers are crucial in enhancing product visibility and access and building consumer trust. Pharmacies and drug stores are the primary choice for consumers seeking OTC recommendations.

The online segment is expected to grow at the fastest CAGR over the forecast period, driven by the widespread availability of e-commerce platforms and the shift in consumer behavior toward digital platforms for convenience. Consumers increasingly rely on online sources to compare ingredients, read user reviews, and make informed purchasing decisions from their homes. The rise in influencer marketing, subscription-based supplement models, and data-driven advertising strategies has further strengthened online engagement and repeat purchases.

Key U.S. Anti-aging Supplements Company Insights

Some of the key players in the U.S. anti-aging supplements industry are Shaklee Corporation, Life Extension, Nu Skin Enterprises, Inc., and Niagen Bioscience:

-

Life Extension is a prominent U.S.-based supplement brand known for its research-backed anti-aging formulas. Its product portfolio includes NAD+ boosters, antioxidants, and cellular health blends designed to extend longevity and improve skin and organ function.

-

Nu Skin Enterprises, Inc., is a global leader in beauty and wellness, offering advanced anti-aging solutions through its ageLOC brand. The company delivers topical skincare and dietary supplements aimed at targeting the sources of aging.

Key U.S. Anti-aging Supplements Companies:

- Shaklee Corporation

- Decode Age

- GNC Holdings, LLC

- Life Extension

- Nu Skin Enterprises, Inc

- Nutrova

- Climic Health Pvt. Ltd.

- Niagen Bioscience

U.S. Anti-aging Supplements Market Report Scope

|

Report Attribute

|

Details

|

|

Revenue Forecast in 2030

|

USD 2.09 billion

|

|

Growth Rate

|

CAGR of 7.2% from 2025 to 2030

|

|

Base year for estimation

|

2024

|

|

Historical data

|

2018 - 2023

|

|

Forecast period

|

2025 - 2030

|

|

Quantitative units

|

Revenue in USD million and CAGR from 2025 to 2030

|

|

Report coverage

|

Revenue forecast, company ranking, competitive landscape, growth factors, trends

|

|

Segments covered

|

Ingredients, application, formulation and distribution channel

|

|

Key companies profiled

|

Shaklee Corporation; Decode Age; GNC Holdings, LLC; Life Extension; Nu Skin Enterprises, Inc.; Nutrova ; Climic Health Pvt. Ltd.; Niagen Bioscience

|

|

Customization scope

|

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

|

|

Pricing and purchase options

|

Avail customized purchase options to meet your exact research needs. Explore purchase options

|

U.S. Anti-aging Supplements Market Report Segmentation

This report forecasts revenue growth and provides an analysis of the latest trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the U.S. anti-aging supplements report based on ingredient, application, formulation, and distribution channel.

-

Ingredient Outlook (Revenue, USD Million, 2018 - 2030)

-

Collagen

-

Resveratrol

-

NMN

-

Vitamins

-

Hyaluronic Acid

-

Minerals

-

Others

-

Application Outlook (Revenue, USD Million, 2018 - 2030)

-

Hair, Skin, & Nail Care

-

Energy & Stamina

-

Bone & Joint Health

-

Others

-

Formulation Outlook (Revenue, USD Million, 2018 - 2030)

-

Capsules

-

Powder

-

Tablets

-

Others

-

Distribution Channel Outlook (Revenue, USD Million, 2018 - 2030)