U.S. Antibiotics Market Summary

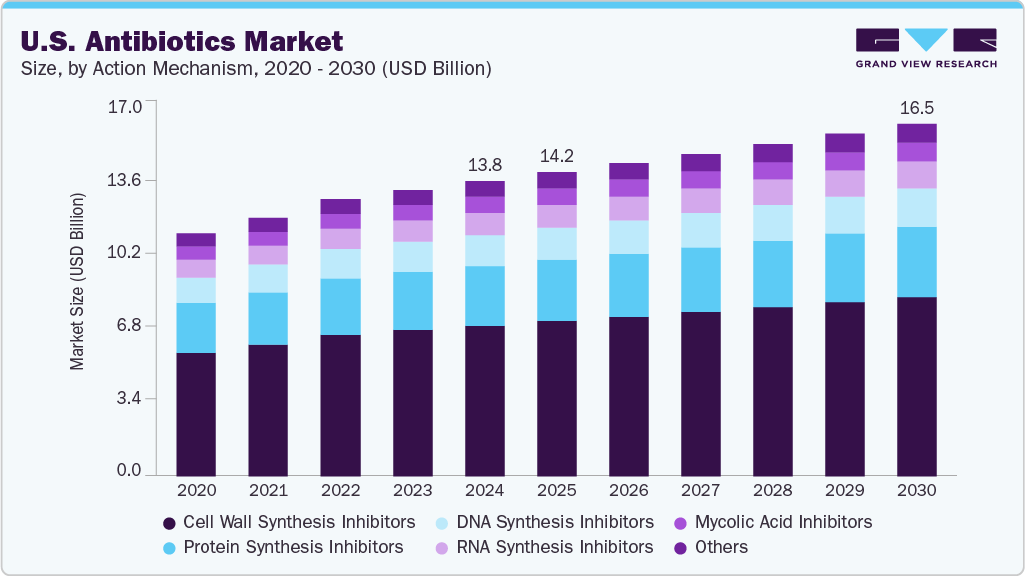

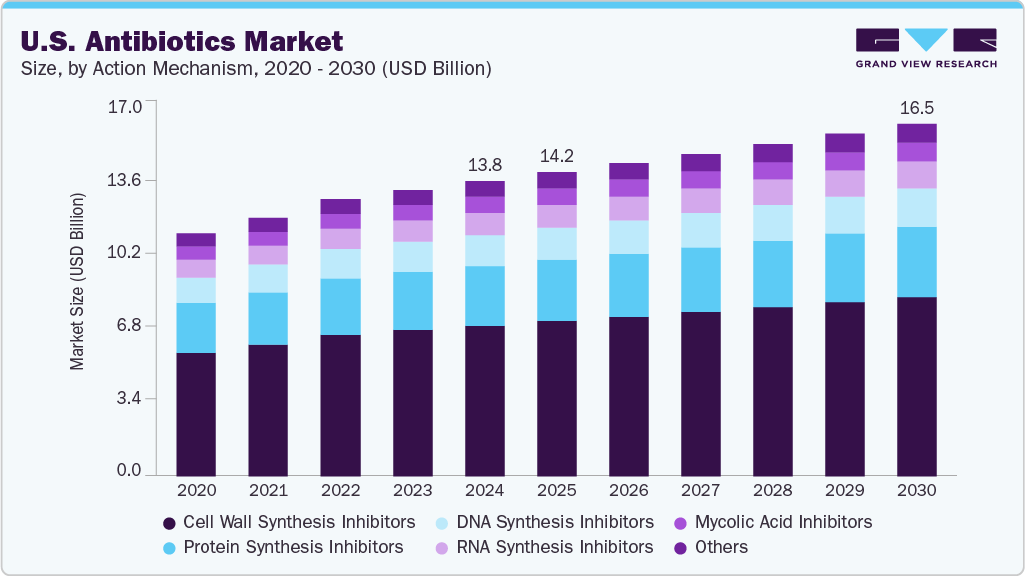

The U.S. antibiotics market size was estimated at USD 13.77 billion in 2024 and is projected to reach USD 16.46 billion by 2030, growing at a CAGR of 3.0% from 2025 to 2030. The growing prevalence of infectious diseases is a major factor contributing to market growth.

Key Market Trends & Insights

- By action mechanism, the cell wall synthesis inhibitors held the highest market share of 50.9% in 2024.

- By type, the generic antibiotics segment held the highest market share in 2024.

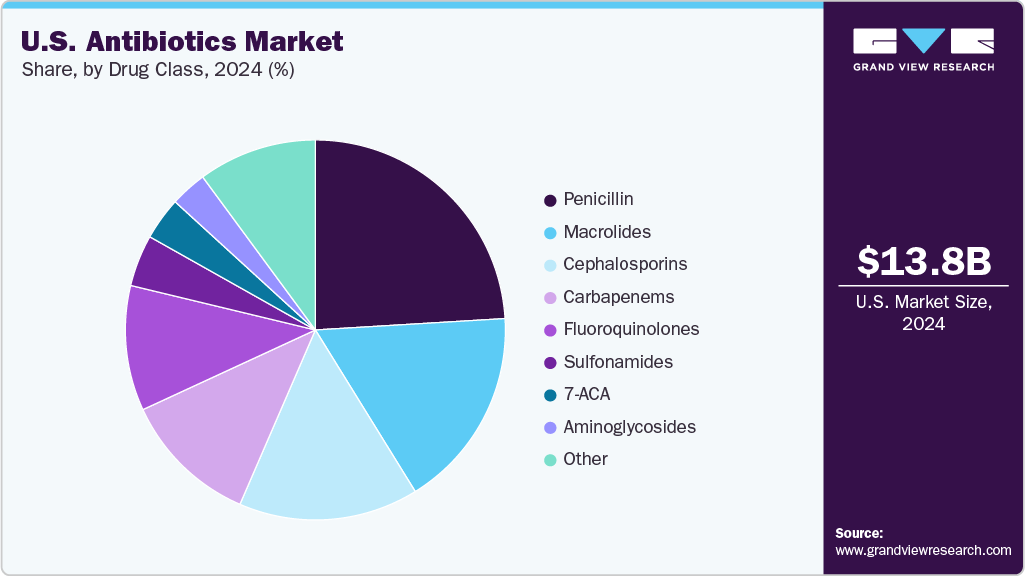

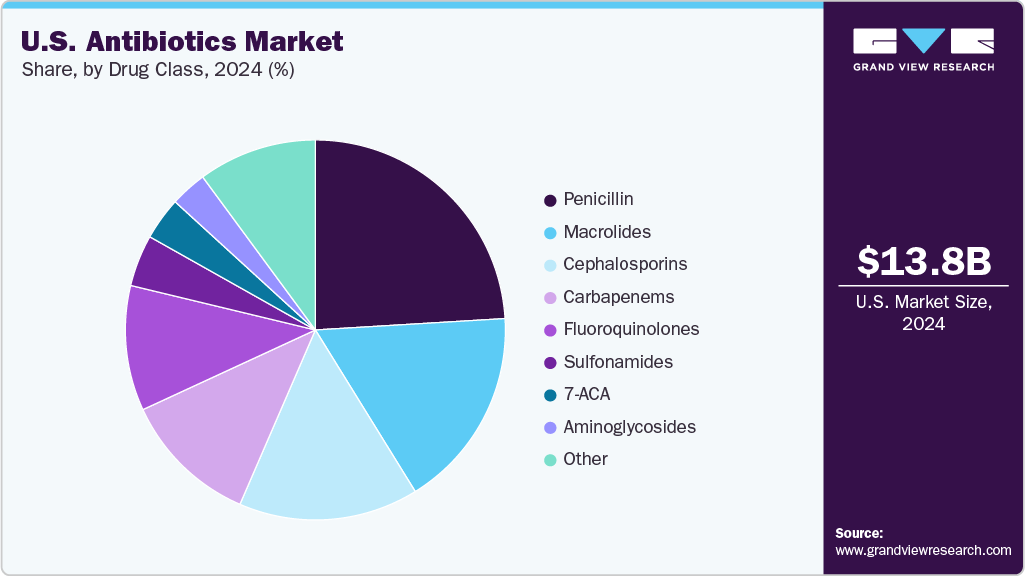

- By drug class, the penicillin segment held the highest market share in 2024.

Market Size & Forecast

- 2024 Market Size: USD 13.77 Billion

- 2030 Projected Market Size: USD 16.46 Billion

- CAGR (2025-2030): 3.0%

The increasing prevalence of infections in the elderly and chronically ill significantly drives the U.S. antibiotics market. In 2024, over 60 million Americans were aged 65 or older, a demographic highly susceptible to infections like pneumonia, UTIs, and sepsis. In addition to that, the rising incidence of chronic conditions such as diabetes, cancer, and COPD compromises immune systems, leading to a greater need for antibiotics. According to CDC, nearly 60% of U.S. adults have at least one chronic disease, further expanding the patient base requiring antibiotic treatment.

The increasing number of surgical procedures and advanced medical interventions significantly contribute to the demand for antibiotics in the U.S. market. Procedures such as organ transplants, cancer treatments, and orthopedic surgeries often carry a high risk of post-operative infections, making preventive and therapeutic antibiotics essential. Hospitals and outpatient facilities depend on effective antibiotic regimens to reduce complications and improve patient recovery. As access to these procedures expands, antibiotics play an even more critical role in ensuring positive patient outcomes, solidifying their position as a vital part of modern medical care.

The U.S. antibiotics market is growing due to cutting-edge R&D, substantial healthcare spending, and a strong emphasis on innovation. The country leads globally in developing next-generation antibiotics to counter AMR, supported by policies such as the Generating Antibiotic Incentives Now (GAIN) Act of 2012, which provides incentives such as extended exclusivity periods. A notable instance is the collaboration between Merck and the National Institute of Allergy and Infectious Diseases (NIAID) in 2023 to develop novel antibiotics targeting multidrug-resistant bacteria.

Action Mechanism Insights

The cell wall synthesis inhibitors segment led the market with the largest revenue share of 50.9% in 2024 due to their proven clinical efficacy. These antibiotics, including penicillins and cephalosporins, are frontline agents in managing both community-and hospital-acquired infections.

The RNA synthesis inhibitors segment is expected to grow at the fastest CAGR of 3.3% over the forecast period. It is primarily due to intensified research and development efforts and the introduction of new products. This growth is further supported by the success of clinically approved natural products, such as rifamycins and fidaxomycin, which are recognized for their ability to inhibit RNA polymerase (RNAP)

Type Insights

The generic antibiotics segment led the market with the largest revenue share in 2024. The presence of many manufacturers leading to an increase in buyers' bargaining power, affordability of generic formulations, and a supportive regulatory framework are some of the factors driving the segment growth.

The branded antibiotics segment is expected to grow significantly over the forecast period. This is attributed to the rising need for new and novel antibiotics, a robust investigational pipeline, and an increasing focus of major players on strengthening their distribution network and product offerings. In February 2025, the FDA approved Emblaveo (aztreonam-avibactam), a branded combination antibiotic from AbbVie, for treating complicated intra-abdominal infections.

Drug Class Insights

The penicillin segment held the largest revenue share in the U.S. antibiotics market in 2024, primarily due to its critical role in treating infections like syphilis, streptococcal, listeria and clostridium. They act by either inhibiting cell wall synthesis or by preventing the formation of the peptidoglycan layer. These medicines represent the first line of treatment in treating infections such as skin infections, pharyngitis, bronchial cough, ear infections and gonorrhea.

The carbapenems segment is expected to grow significantly over the forecast period. A subtype of beta-lactam antibiotics, carbapenems target gram-positive and gram-negative bacteria, including Klebsiella pneumoniae, Pseudomonas aeruginosa, and Bacteroides fragilis.

Key U.S. Antibiotics Company Insights

Some of the market players include AbbVie, Inc., Pfizer Inc., Novartis AG, Merck & Co., Inc., and others.

- Pfizer is a pharmaceutical company that produces a range of antibiotics, including both generic and branded products. Some of its notable antibiotics include Zithromax (azithromycin) and Zinforo (ceftaroline fosamil). Pfizer also develops new antibiotic combinationsto combat drug-resistant bacteria.

Key U.S. Antibiotics Companies:

- AbbeVie, Inc.

- Pfizer Inc.

- Novartis AG

- Merck & Co., Inc.

- Teva Pharmaceutical Industries Ltd.

Recent Developments

-

In March 2025, Avenacy launched 5 injectable antibiotic products in the U.S. to strengthen its portfolio of critical and high-usage injectable products.

-

In April 2024, the U.S. FDA approved Zevtera to treat various serious bacterial infections including Staphylococcus aureus bloodstream infections, community-acquired bacterial pneumonia and acute bacterial skin and skin structure infections.

U.S. Antibiotics Market Report Scope

|

Report Attribute

|

Details

|

|

Market size value in 2025

|

USD 14.19 billion

|

|

Revenue forecast in 2030

|

USD 16.46 billion

|

|

Growth rate

|

CAGR of 3.0% from 2025 to 2030

|

|

Base year for estimation

|

2024

|

|

Historical data

|

2018 - 2023

|

|

Forecast period

|

2025 - 2030

|

|

Quantitative units

|

Revenue in USD Million and CAGR from 2025 to 2030

|

|

Report coverage

|

Revenue forecast, company ranking, competitive landscape, growth factors, trends

|

|

Segments covered

|

Action mechanism, type, drug case

|

|

Key companies profiled

|

AbbeVie, Inc., Pfizer Inc., Novartis AG, Merck & Co., Inc., Teva Pharmaceutical Industries Ltd.

|

|

Customization scope

|

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

|

|

Pricing and purchase options

|

Avail customized purchase options to meet your exact research needs. Explore purchase options

|

U.S. Antibiotics Market Report Segmentation

This report forecasts revenue growth at country level as well as provides an analysis of the latest trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the U.S. antibiotics market report on the basis of action mechanism, type, and drug class:

-

Action Mechanism Outlook (Revenue, USD Million, 2018 - 2030)

-

Type Outlook (Revenue, USD Million, 2018 - 2030)

-

Branded Antibiotics

-

Generic Anitbiotics

-

Drug Class Outlook (Revenue, USD Million, 2018 - 2030)

-

Cephalosporins

-

Penicillins

-

Fluoroquinolones

-

Macrolides

-

Carbapenems

-

Aminoglycosides

-

Sulfonamides

-

7-ACA

-

Other