- Home

- »

- Next Generation Technologies

- »

-

U.S. Architectural Services Market, Industry Report, 2030GVR Report cover

![U.S. Architectural Services Market Size, Share & Trends Report]()

U.S. Architectural Services Market (2024 - 2030) Size, Share & Trends Analysis Report By Service Type (Interior Design Services, Engineering Services, Urban Planning Services), By End-use (Education, Healthcare), And Segment Forecasts

- Report ID: GVR-4-68040-254-0

- Number of Report Pages: 125

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2024 - 2030

- Industry: Technology

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

U.S. Architectural Services Market Trends

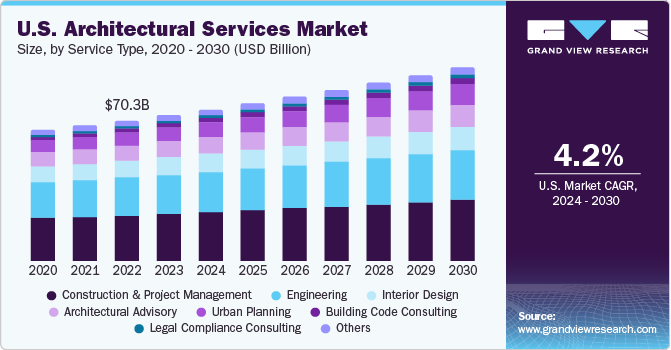

The U.S. architectural services market size was valued at USD 73.01 billion in 2023 and is projected to grow at a CAGR of 4.2% from 2024 to 2030. The U.S. accounted for 19.4% of the global architectural services market. Increasing construction activities in the United States is the primary driver of the growth of architectural services. Both residential and commercial construction projects are on the rise big cities with densely and semi-densely populated cities in the U.S.

Moreover, construction and project management companies offer assistance by collaborating with architectural service providers to assist project managers in architectural needs. Such service providers assist project managers in effectively allocating resources, such as labor, materials, and equipment, to ensure their timely availability. This minimizes expenses, avoids delays due to the lack of resources, and helps owners and developers leverage technology to improve efficiency, communication, and collaboration.

In addition, many U.S. builders are investing and allocating their budget in architectural services due to the growing environmental concerns and initiatives by business owners to construct green buildings, which are expected to contribute to the demand for architectural advisory and interior design services. Therefore, the above factors are expected to drive growth in the U.S. architectural services market over the forecast period.

Furthermore, the factors such as rapid urbanization, growing population, and increasing residential and industrial construction projects in tier 2 cities are pushing the market demand for architectural services. Such services include engineering designs, schematic designs, space planning, and interior design, which are driving the growth of the architectural market in the U.S.

However, U.S. construction companies increasingly opt for advanced pre-engineering analysis services to meet complex mechanical and electrical requirements. The preference for 2D and 3D Computer-Aided Design (CAD) design and drafting services is growing in demand. However, the construction industry is complex and dynamic, relying on changing economic conditions and recession-like conditions that may impact the market growth in U.S.

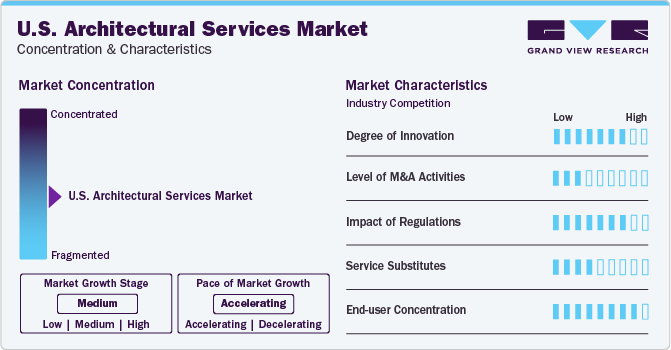

Market Concentration & Characteristics

The market growth stage is moderate, and the pace of the market growth is accelerating. The U.S. architectural services market is fairly fragmented. As architectural expertise is growing due to rapid urbanization, particularly in U.S. metropolitan areas and tier 2 cities which is driving the need for infrastructure development and the construction of residential and commercial complexes and generating the demand for architectural in the U.S.

Although there is a vast scope for innovation in architecture services yet the U.S. Government

has drafted regulations to drive sustainable construction, further propelling the adoption of sustainable design practices. Designing energy-efficient buildings with minimal environmental impact calls for dedicated architectural expertise in the U.S. architectural services market.

The market is witnessing strategic partnerships, mergers & acquisitions, and joint ventures to execute construction projects. For instance, in September 2023, STV, a professional services firm that plans, designs and manages infrastructure projects, and PARTNERS in Architecture, announced a partnership on designing a new Central Intake and Assessment Center for the Macomb County Jail in the Detroit metropolitan area.

In the United States, the healthcare and industrial sectors are witnessing remarkable growth. This is because there is a strong emphasis on ensuring patient satisfaction and the need for large industrial facilities, which is driving demand for architectural services in these sectors. As a result, the adoption of architectural services is expected to experience significant growth in U.S. market.

Services Type Insights

Construction and project management services segment led the market and accounted highest revenue share of 32.3% in 2023. Construction and project management are crucial aspects of any building process. With the constant rise in construction activities taking place in the United States, the demand for construction and project management services is increasing rapidly. As a result, these services help to manage project life cycle management, cost control, scheduling, and risk management effectively.Therefore, construction & project management has a significant market share in the U.S. architectural services market.

Legal compliance consulting segment is anticipated to witness CAGR of 6.2% from 2024 to 2030 in the U.S. Architectural Services market. Modern construction & architectural projects often involve complex legalities. Modern construction technologies with innovative design approaches may require technical legal compliance counseling services to ensure approval processes. As a result, companies seek specialized expertise in legal technical assistance to execute core architectural design and navigate these complexities, driving the demand for architectural services.

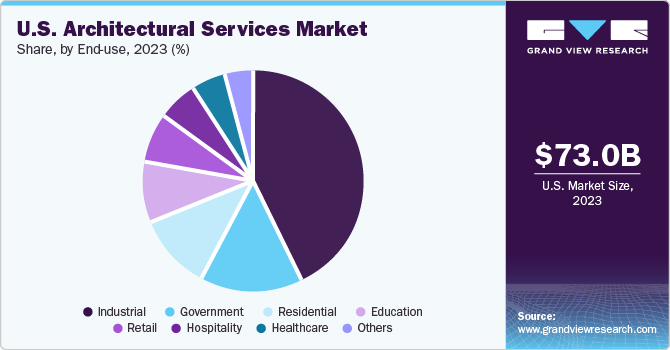

End-use Insights

Industrial segment accounted for the largest market revenue share of 43.2% in 2023. Industrialization across the U.S., coupled with increasing acquisitions and new factory establishments carried out by business firms. In addition, the growing environmental concerns and initiatives carried out by business owners to construct green buildings are expected to contribute to the demand for architectural advisory and interior design services. This is expected to impact the segment growth of the U.S. architectural services market positively.

Education segment is expected to register the fastest CAGR of 6.1% during the forecast period. Educational facilities need to be designed to facilitate effective teaching and learning. Architectural service providers consider various factors such as classroom size, layout, and natural light to create spaces that promote focus, collaboration, and student engagement. Additionally, effective architectural services ensure that facilities are accessible and inclusive for students with diverse needs. This denotes that the education sub-segment is a key driver in the U.S. architectural services market.

Key U.S. Architectural Services Company Insights

AECOM, Gensler, and others are some of the prominent participants operating in the U.S. architectural services market.

-

AECOM is one of the leading firms positioned to design, build, finance, and operate infrastructure assets for governments, businesses, and organizations throughout the world. The company operates through three business segments, namely Americas, International, and AECOM Capital (ACAP). Under the Americas segment, the company provides architectural, consulting, planning, design, construction, and engineering services.

-

Gensler is an architecture and design firm. The company offers its expertise across areas such as aviation, critical facilities, education, civic & culture, health & wellness, urban strategies & design, brand design, digital experience design, hospitality, retail, food & beverage, sports & convention centers, consulting & real estate services, office buildings, and product development.

Some of the emerging companies operating in the market include Perkins Eastman, Perkins and Will and others.

-

Perkins Eastman is a global architecture firm focusing on offering services across different industries and sectors, such as healthcare, education, and transit-oriented developments. The company offers a wide range of specialized project types, such as healthcare, civil, higher education, office & retail, hospitality, planning & urban design, residential, science & technology, and transportation & infrastructure.

-

Perkins and Will is primarily engaged in offering consulting architectural activities. The company has a presence and operates across the U.S., which includes design studios in Atlanta, Austin, Boston, Charlotte, Chicago, Dallas, Denmark, Denver, Houston, London, Dubai, Durham, Los Angeles, Miami, Minneapolis, New York, Ottawa, Monterrey, San Francisco.

Key U.S. Architectural Services Companies:

- AECOM

- CannonDesign

- Foster + Partners

- Gensler

- HDR

- HKS, Inc.

- HOK

- Arcadis IBI Group

- Jacobs Engineering Group

- LMN Architects

- Perkins and Will

- Perkins Eastman

- Stantec

- ZGF Architects

Recent Developments

-

In February 2024, CannonDesign partners with SRG Partnership, a dynamic architecture, interiors and planning firm with studios in Portland, Oregon, and Seattle, Washington. This merger will bring a fusion of talent to empower business resources, and now both entities are committed to making a profound difference through design.

-

In January 2024, Stantec, a global leader in sustainable design and engineering, signed an agreement to acquire Morrison Hershfield. The acquisition will strengthen. The acquisition of Morrison Hershfield expands Stantec’s presence in the U.S. for building engineering and architectural services.

-

In December 2023, HDR, a construction services and related expertise completed acquisition of Boston-based City Point Partners. This acquisition will provide greater technical expertise to its clients for infrastructural development.

-

In November 2023, AECOM, the company signed a memorandum of understanding with Boryspil International Airport to work as a reconstruction delivery partner for reconstructing the Boryspil International Airport. AECOM will provide infrastructure consulting services that encompass asset condition and capability assessment, planning, design, program management, and construction management. In addition, the company helped develop program management capabilities for the broader reconstruction of the country's aviation industry.

U.S. Architectural Services Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 75.87 billion

Revenue forecast in 2030

USD 97.09 billion

Growth Rate

CAGR of 4.2% from 2024 to 2030

Actual data

2018 - 2023

Forecast period

2024 - 2030

Quantitative units

Revenue in USD billion and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company share, competitive landscape, growth factors, and trends

Segments covered

Service type, end-use

Country scope

U.S.

Key companies profiled

AECOM; CannonDesign; Foster + Partners; Gensler; HDR; HKS, Inc.; HOK; Arcadis IBI Group; Jacobs Engineering Group; LMN Architects; Perkins and Will; Perkins Eastman; Stantec; ZGF Architects

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

U.S. Architectural Services Market Report Segmentation

This report forecasts revenue growth at country level and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the U.S. architectural services market report based on service type, and end-use.

-

Service Type Outlook (Revenue, USD Billion, 2018 - 2030)

-

Architectural Advisory Services

-

Construction And Project Management Services

-

Engineering Services

-

Interior Design Services

-

Urban Planning Services

-

Building Code Consulting

-

Legal Compliance Consulting

-

Others

-

-

End-use Outlook (Revenue, USD Billion, 2018 - 2030)

-

Education

-

Government

-

Healthcare

-

Hospitality

-

Industrial

-

Residential

-

Retail

-

Others

-

Frequently Asked Questions About This Report

b. The U.S. architectural services market size was estimated at USD 73.01 billion 2023 and is expected to reach USD 75.87 billion in 2024

b. The U.S. architectural services market is expected to grow at a compound annual growth rate of 4.2% from 2024 to 2030 to reach USD 97.09 billion in 2030.

b. Industrial segment accounted for the largest market revenue share of 43.2% in 2023. Industrialization across the U.S., coupled with increasing acquisitions and new factory establishments carried out by business firms. In addition, the growing environmental concerns and initiatives carried out by business owners to construct green buildings are expected to contribute to the demand for architectural advisory and interior design services.

b. Some key players operating in the U.S. architectural services market are AECOM; CannonDesign; Foster + Partners; Gensler; HDR; HKS, Inc.; HOK; Arcadis IBI Group; Jacobs Engineering Group; LMN Architects; Perkins and Will; Perkins Eastman; Stantec; ZGF Architects among others.

b. Increasing construction activities in the United States is the primary driver of the growth of architectural services. Both Residential and commercial construction projects are on the rise big cities with densely and semi-densely populated cities in the U.S.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.