- Home

- »

- Automotive & Transportation

- »

-

U.S. Automotive Engine Management System Market Report, 2030GVR Report cover

![U.S. Automotive Engine Management System Market Size, Share & Trends Report]()

U.S. Automotive Engine Management System Market (2025 - 2030) Size, Share & Trends Analysis Report By Component (Electronic Control Unit, Sensors, Fuel Pump), By Engine Type, By Vehicle Type, And Segment Forecasts

- Report ID: GVR-4-68040-610-7

- Number of Report Pages: 100

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2025 - 2030

- Industry: Technology

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Market Size & Trends

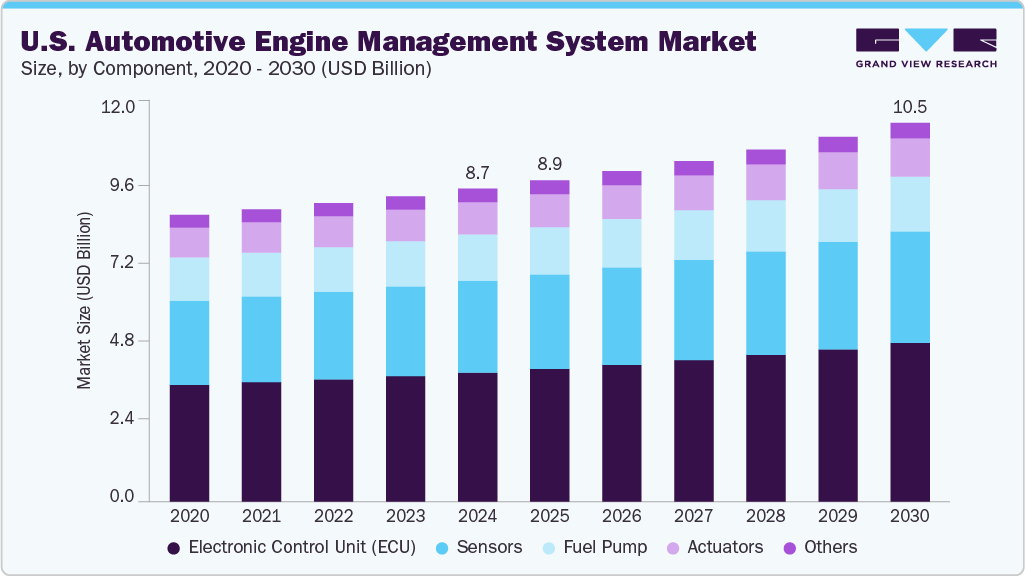

The U.S. automotive engine management system market size was estimated at USD 8.71 billion in 2024 and is projected to grow at a CAGR of 3.4% from 2025 to 2030.The market growth is being significantly boosted by the stringent implementation of Tier 3 emission standards, which aim to reduce gasoline sulfur content to 10 ppm and enforce fleet-average emission targets through 2025. The Environmental Protection Agency’s (EPA) 2024 Multi-Pollutant Emissions Standards, set to phase in through 2032, are driving automakers to overhaul their engine systems. The required 57% per-mile NOx emission reduction compared to 2021 levels has accelerated the adoption of next-gen automotive engine management systems, integrated with real-time emission tracking, adaptive catalytic converters, and gasoline particulate filters. These evolving regulatory pressures are forcing OEMs to invest in more advanced automotive engine management system technologies, positioning them as central to compliance strategies and sustainability roadmaps.

Automotive engine management system solutions are increasingly being integrated with autonomous vehicle systems and V2X (vehicle-to-everything) networks, which U.S. transportation agencies support. Automotive engine management system now plays a critical role in synchronizing engine output with real-time data from radar, LiDAR, GPS, and onboard computers that power self-driving features. By enabling smoother acceleration, predictive braking, and optimal fuel burn in autonomous environments, this integration is propelling automotive engine management system demand in high-tech vehicle platforms. As autonomous driving tech gains ground, especially in urban delivery fleets and high-end passenger vehicles, automotive engine management system evolution becomes non-negotiable, leading to significant investments by OEMs.

Between 2022 and 2025, the use of artificial intelligence (AI) and machine learning (ML) in automotive engine management systems has surged. AI-powered automotive engine management system platforms can analyze driving behavior, weather conditions, and traffic patterns to dynamically adjust engine parameters for peak efficiency. These self-learning systems not only boost fuel economy and reduce GHG emissions but also ensure long-term engine performance. Supported by U.S. initiatives around clean transportation and digital mobility, OEMs are actively embedding AI into automotive engine management system units. This trend is creating a competitive advantage and pushing rapid automotive engine management system software upgrades, reshaping the technological landscape of engine management.

The push for cleaner and smarter engines has fueled the adoption of advanced sensors like knock sensors, MAF (mass airflow), NOx sensors, and oxygen sensors. These sensors are now smaller, faster, and more accurate, enabling the automotive engine management system to fine-tune combustion in milliseconds. High-resolution data from these sensors is essential for real-time diagnostics, emission control, and efficient fuel injection. As Tier 3 and future emission regulations tighten, automotive engine management system platforms equipped with sensor fusion capabilities are becoming a market standard, driving exponential growth in both passenger and commercial vehicle segments.

Component Insights

The Electronic Control Unit (ECU) segment dominated the U.S. automotive engine management system industry with a revenue share of 41.2% in 2024. The ECU segment is experiencing a surge in demand, firmly establishing itself as the command center of the modern automotive engine management system. In the U.S., rising vehicle electrification, stricter EPA emission mandates, and the transition toward autonomous capabilities are collectively boosting ECU innovation and adoption. ECUs are now expected to process far more data, ranging from real-time fuel maps to predictive maintenance inputs, driving a shift from single-core to multi-core, AI-optimized control architectures. U.S.-based OEMs and Tier 1 suppliers are investing in domain controller-based ECUs, consolidating functions to meet the demands of software-defined vehicles, particularly in high-performance passenger cars and EV-hybrid platforms.

The sensors segment is expected to experience substantial growth over the forecast period. The demand for high-fidelity sensors for oxygen, NOx, MAP, knock, and temperature is being propelled by the Tier 3 compliance mandate and ongoing initiatives for real-time diagnostics. The market has seen significant adoption of smart, self-calibrating sensor systems capable of delivering enhanced resolution and faster feedback loops to the ECU. In the U.S., this trend is also tied to the growing popularity of vehicle subscription and fleet-sharing models, which require a reliable, sensor-driven automotive engine management system to ensure operational continuity and compliance. Sensor growth is thus closely aligned with the rising volume of connected and semi-autonomous vehicles on American roads.

Engine Type Insights

The gasoline engines accounted for the largest share of the U.S. automotive engine management system market in 2024. With the EPA enforcing stricter NOx and particulate emission levels, even traditional gasoline powertrains are undergoing deep automotive engine management system reengineering. Technologies such as variable valve timing, gasoline particulate filters (GPFs), and adaptive ignition control are now standard, requiring highly responsive automotive engine management system platforms. The gradual phasing out of older emission norms has triggered a retrofit wave, especially in light commercial and utility segments, further stimulating the demand for updated automotive engine management system modules in gasoline-based vehicles.

The hybrid engines segment is expected to experience the fastest growth over the forecast period, fueled by consumer demand for fuel-efficient options and government incentives for reduced emissions. The complexity of managing dual power sources, internal combustion and electric, necessitates advanced automotive engine management system integration, especially in plug-in hybrid variants (PHEVs). U.S. automakers are focusing on automotive engine management system units that can seamlessly optimize power switching, regenerative braking logic, and battery load balancing. Additionally, growing interest in hydrogen-hybrid and alternative fuel hybrids is pushing R&D in this space, making hybrid automotive engine management systems an innovation hotspot within the engine type spectrum.

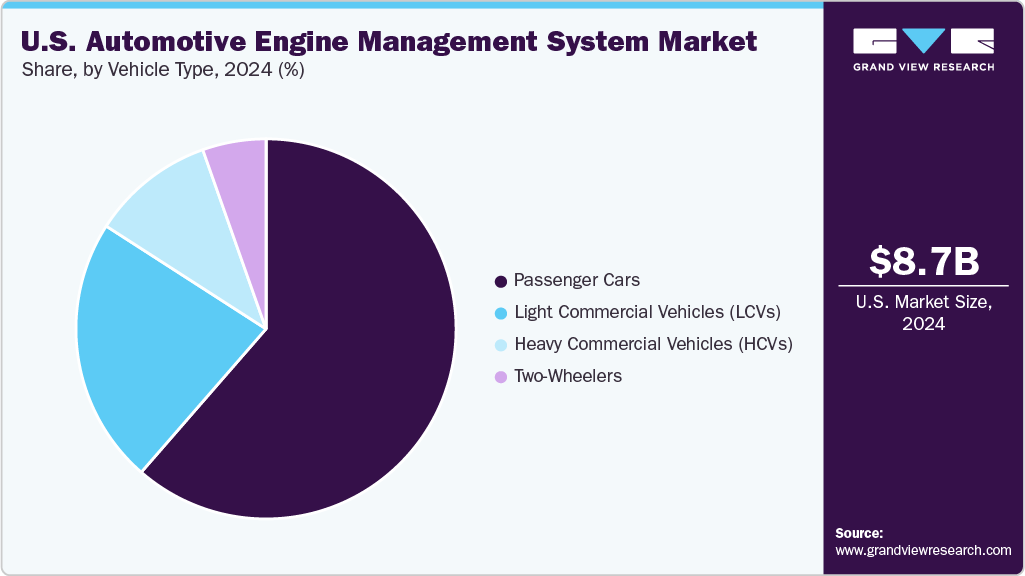

Vehicle Type Insights

The passenger cars segment held the largest revenue share of the U.S. automotive engine management system industry in 2024, and their evolution toward digital, connected, and autonomous mobility is reshaping automotive engine management system architectures. The segment’s growth is propelled by increasing consumer expectations for performance, reliability, and compliance, leading to rapid deployment of software-rich automotive engine management system platforms. Automakers are leveraging automotive engine management systems to support real-time emission analytics, adaptive cruise control, and integrated infotainment power management, aligning automotive engine management systems with broader in-vehicle systems. Luxury and premium brands in particular are rolling out automotive engine management system solutions with AI-enhanced torque control and predictive combustion analytics, setting benchmarks for the rest of the market.

The two-wheelers segment is expected to experience the fastest growth over the forecast period. Though a smaller segment, two-wheelers are undergoing a technological shift in the U.S., led by demand for efficient urban mobility solutions and tightened emissions norms for motorcycles and scooters. Automotive engine management systems in this segment are becoming more intelligent and compact, integrating ECU and sensor functionalities into modular control units optimized for space and power. Additionally, with electric two-wheelers gaining traction, a hybrid-compatible automotive engine management system is being tested for multi-modal drivetrain architectures. The market’s future growth is tied to micro-mobility initiatives, government support for low-emission commuting, and the retooling of traditional combustion two-wheelers with modern automotive engine management systems.

Key U.S. Automotive Engine Management System Company Insights

Some of the key companies in the U.S. Automotive Engine Management System industry includes Robert Bosch GmbH; Continental AG; Denso Corporation; BorgWarner Inc.; and Hitachi Astemo, Ltd. These companies consistently invest in research and development to innovate components like electronic control units and advanced sensors, which are essential for improving fuel efficiency, reducing emissions, and meeting stringent regulatory standards.

-

Continental AG plays a pivotal role in the U.S. Automotive Engine Management System market through its advanced powertrain and vehicle electronics solutions. The company develops and manufactures cutting-edge engine control units (ECUs), sensors, and actuator technologies that contribute significantly to engine optimization, emissions reduction, and fuel efficiency. Continental’s automotive engine management systems solutions are deeply integrated with smart mobility frameworks, supporting hybrid and gasoline engine configurations across various vehicle segments. The firm’s investments in software-defined vehicles and its capability to embed intelligent control logic into ECUs make it a leader in adapting to evolving U.S. emission norms and autonomous driving integration. Their deep partnerships with American OEMs further solidify their presence in the U.S. automotive engine management systems landscape.

-

Denso Corporation, a Japanese automotive components giant, has firmly established its footprint in the U.S. EMS market through its American subsidiaries and long-standing partnerships with major U.S. carmakers. Denso offers a comprehensive suite of automotive engine management systems components, including high-precision sensors, high-performance ECUs, and integrated fuel systems that support gasoline, hybrid, and increasingly electrified vehicle architectures. The company is known for driving innovation in combustion efficiency, real-time diagnostics, and AI-powered engine control technologies. Its U.S. operations benefit from Denso’s global R&D capabilities, helping American automakers meet stringent EPA and Tier 3 emission standards. As electrification and smart mobility trends expand in the U.S., Denso continues to align its automotive engine management systems offerings with these future-focused shifts.

Key U.S. Automotive Engine Management System Companies:

- Robert Bosch GmbH

- Continental AG

- Denso Corporation

- BorgWarner Inc.

- Hitachi Astemo, Ltd.

- Valeo

- Infineon Technologies AG

- Sensata Technologies, Inc.

- Mitsubishi Heavy Industries Ltd.

- Cummins Inc.

Recent Developments

-

In August 2024, Continental AG announced a potential spinoff of its automotive business, which includes its engine management system operations, to be presented for shareholder approval by April 2025. This strategic move aims to enhance focus on software-defined vehicle architectures, integrating the engine management system with advanced driver assistance systems (ADAS) for improved vehicle efficiency and safety.

-

In April 2025, Denso Corporation demonstrated its MobiQ keyless access solutions and vehicle-to-everything (V2X) technology, enhancing vehicle connectivity and security, which supports integrated engine management systems.

U.S. Automotive Engine Management System Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 8.94 billion

Revenue forecast in 2030

USD 10.54 billion

Growth rate

CAGR of 3.4% from 2025 to 2030

Base year for estimation

2024

Historical data

2018 - 2023

Forecast period

2025 - 2030

Quantitative units

Revenue in USD million/billion and CAGR from 2025 to 2030

Report coverage

Revenue forecast, company market share, competitive landscape, growth factors, and trends

Segments covered

Component, engine type, vehicle type

Key companies profiled

Robert Bosch GmbH; Continental AG; Denso Corporation; BorgWarner Inc.; Hitachi Astemo, Ltd.; Valeo; Infineon Technologies AG; Sensata Technologies, Inc.; Mitsubishi Heavy Industries Ltd.; Cummins Inc.

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

U.S. Automotive Engine Management System Market Report Segmentation

This report forecasts revenue growth and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the U.S. automotive engine management system market report based on component, engine type, andvehicle type:

-

Component Outlook (Revenue, USD Million, 2018 - 2030)

-

Electronic Control Unit (ECU)

-

Sensors

-

Fuel Pump

-

Actuators

-

Others

-

-

Engine Type Outlook (Revenue, USD Million, 2018 - 2030)

-

Gasoline Engines

-

Diesel Engines

-

Hybrid Engines

-

Electric Engines

-

-

Vehicle Type Outlook (Revenue, USD Million, 2018 - 2030)

-

Passenger Cars

-

Light Commercial Vehicles (LCVs)

-

Heavy Commercial Vehicles (HCVs)

-

Two-Wheelers

-

Frequently Asked Questions About This Report

b. The U.S. automotive engine management system market size was estimated at USD 8.71 billion in 2024 and is expected to reach USD 8.94 billion in 2025.

b. The U.S. automotive engine management system market size is expected to grow at a significant CAGR of 3.4% to reach USD 10.54 billion in 2030.

b. The Electronic Control Unit (ECU) held the largest market share of 41.2% in 2024. This is due to its central role in controlling key engine functions such as fuel injection, ignition timing, and emission regulation. As vehicles become more software-driven and complex, the ECU has evolved into a critical component enabling real-time decision-making, diagnostics, and compliance with stringent environmental standards. Its widespread integration across all vehicle types, including hybrids and EVs, further reinforces its dominant market position.

b. Some of the players in the U.S. automotive engine management system market are Robert Bosch GmbH, Continental AG, Denso Corporation, BorgWarner Inc., Hitachi Astemo, Ltd., Valeo, Infineon Technologies AG, Sensata Technologies, Inc., Mitsubishi Heavy Industries Ltd., and Cummins Inc.

b. The key driving trend in the U.S. automotive engine management system market is the shift toward advanced, emission-compliant technologies to improve fuel efficiency and support hybrid and electric vehicles.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.