U.S. Basalt Rock Market Summary

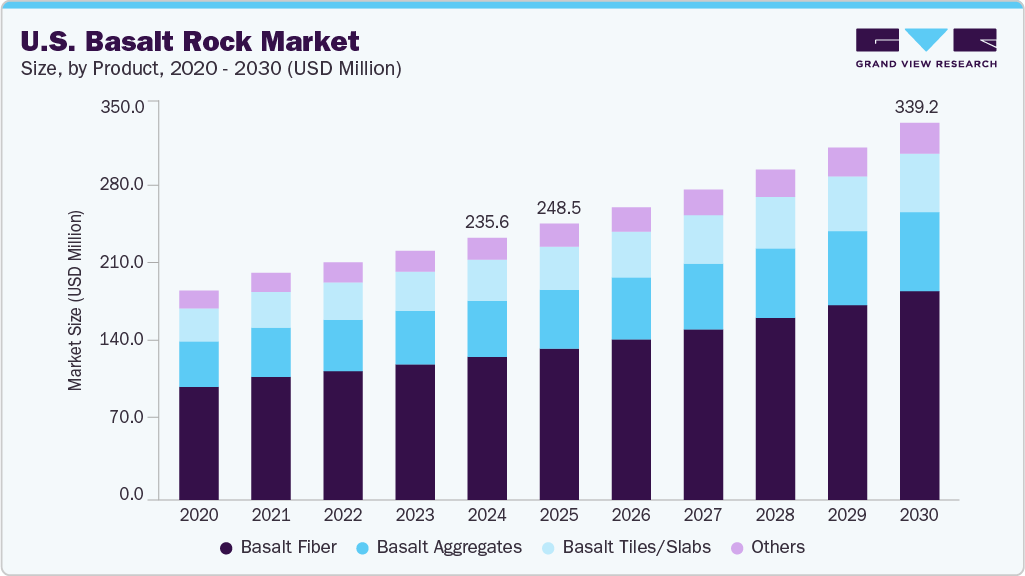

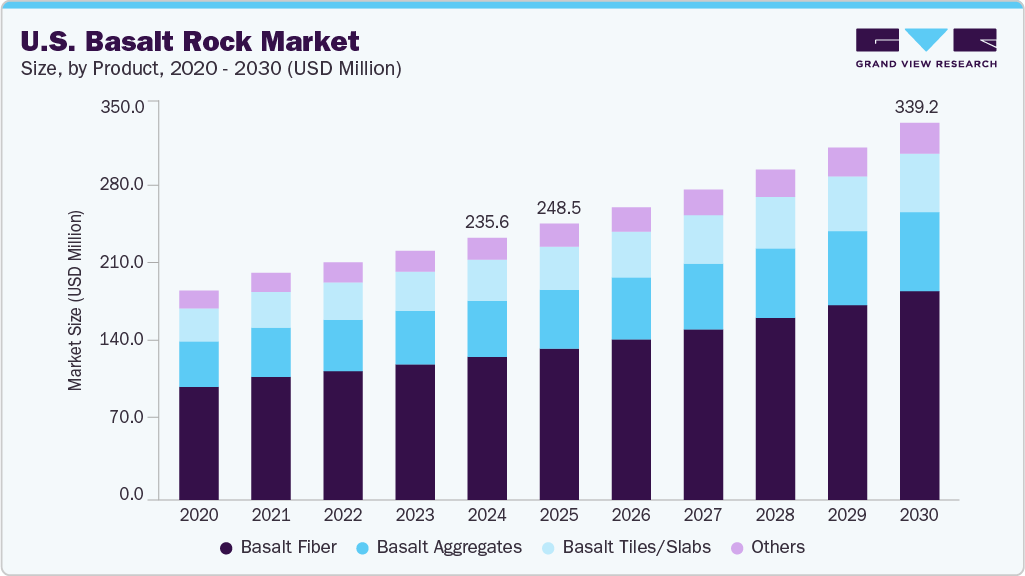

The U.S. basalt rock market size was estimated at USD 235.6 million in 2024 and is projected to reach USD 339.2 million by 2030, growing at a CAGR of 6.4% from 2025 to 2030. The growth is attributed to basalt's excellent physical properties, such as corrosion resistance, high compressive strength, and thermal stability.

Key Market Trends & Insights

- By product, the basalt fiber segment led the market with the largest revenue share of 54.6% in 2024.

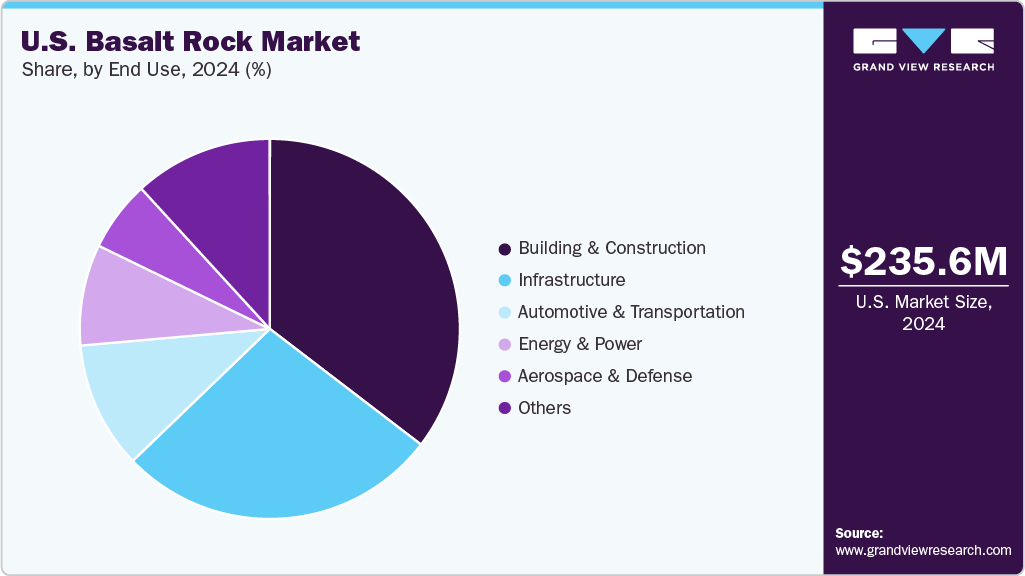

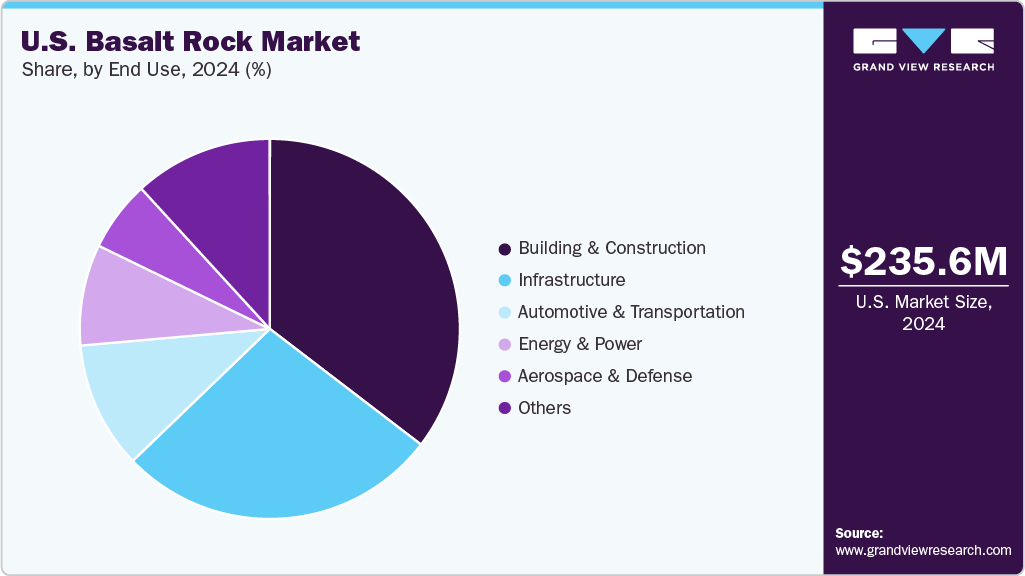

- By end use, the building & construction segment led the market with the largest revenue share of 35.4% in 2024.

Market Size & Forecast

- 2024 Market Size: USD 235.6 Million

- 2030 Projected Market Size: USD 339.2 Million

- CAGR (2025-2030): 6.4%

A significant driver is the increasing emphasis on sustainable and environmentally friendly construction practices. Basalt, a natural and recyclable material with a lower environmental impact than some synthetic alternatives, aligns well with these evolving industry standards. Furthermore, its superior properties, such as high compressive strength, resistance to weathering, and thermal stability, make it an ideal choice for infrastructure projects that require long-term durability and minimal maintenance.

The escalating demand for high-performance and lightweight materials in sectors such as automotive, aerospace, and defense also plays a crucial role. Basalt fiber composites offer an attractive strength-to-weight ratio, contributing to improved fuel efficiency and reduced emissions in transportation applications.

Product Insights

The basalt fiber segment dominated the industry with a 54.6% revenue share in 2024, and is expected to grow at the fastest CAGR over the forecast period due to its superior mechanical, thermal, and chemical properties. Derived from melted basalt rock, it offers a compelling alternative to traditional materials such as E-glass, carbon fiber, and steel. Its high tensile strength, resistance to extreme temperatures, corrosion, chemical attacks, and eco-friendly nature make it highly sought after across various industries— the construction, automotive, aerospace, and marine sectors. In January 2025, Michelman and FibreCoat GmbH partnered to introduce AluCoat, an aluminum-coated basalt fiber. Developed by FibreCoat, this innovative material addresses the demand for lightweight, conductive solutions.

The basalt tiles/ slabs segment is projected to grow at a significant CAGR from 2025 to 2030, driven by increasing demand for durable, aesthetically appealing, and sustainable natural stone solutions in residential and commercial construction. As a dense, non-porous volcanic rock, Basalt offers exceptional wear resistance, low water absorption, and a unique dark aesthetic, making it an ideal choice for flooring, wall cladding, countertops, and outdoor paving. Its inherent hardness and ability to withstand harsh climatic conditions contribute to its rising popularity among architects, designers, and homeowners seeking long-lasting and low-maintenance materials.

End Use Insights

The building and construction segment dominated the market with the highest revenue share in 2024, largely due to the material's exceptional properties and growing alignment with sustainable development goals. Basalt is widely adopted in this sector for various applications, including aggregates, tiles, slabs, and, critically, as basalt fiber rebar. Its high compressive strength, resistance to weathering, fire resistance, and durability make it an ideal choice for various construction projects, from residential and commercial buildings to large-scale infrastructure. In April 2024, C-Crete Technologies launched the world's first basalt-based concrete. It is devoid of CO2 emissions and is a step towards the company’s development of eco-conscious construction materials.

The automotive and transportation segment is projected to grow at a significant CAGR from 2025 to 2030, driven by the industry's continuous pursuit of light weighting, enhanced performance, and increased sustainability. Basalt fiber composites offer an attractive strength-to-weight ratio, contributing to improved fuel efficiency and reduced vehicle emissions. This is particularly crucial in the context of the growing electric vehicle (EV) market and stricter fuel economy standards.

Key U.S. Basalt Rock Company Insights

Some of the key players operating in the basalt rock market include American Basalt Company Inc., American Basaltworks LLC., Basalt Engineering USA, Basanite Industries and United States Basalt Corp.

-

Basalt Engineering USA designs and produces basalt fiber reinforcement systems used in construction and infrastructure projects. Its product line includes basalt rebar, mesh, and structural components that replace traditional steel reinforcement.

Key U.S. basalt rock Companies:

- American Basalt Company Inc.

- American Basaltworks LLC.

- Basalt Engineering USA

- Basanite Industries

- United States Basalt Corp.

Recent Development

U.S. Basalt Rock Market Report Scope

|

Report Attribute

|

Details

|

|

Market size value in 2025

|

USD 248.5 million

|

|

Revenue forecast in 2030

|

USD 339.2 million

|

|

Growth Rate

|

CAGR of 6.4% from 2025 to 2030

|

|

Base year for estimation

|

2024

|

|

Historical data

|

2018 - 2023

|

|

Forecast period

|

2025 - 2030

|

|

Quantitative units

|

Revenue in USD million and CAGR from 2024 to 2030

|

|

Report coverage

|

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

|

|

Segments covered

|

Product, end use

|

|

Key companies profiled

|

American Basalt Company Inc., American Basaltworks LLC., Basalt Engineering USA, Basanite Industries, United States Basalt Corp.

|

|

Customization scope

|

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to the country, regional, and segment scope.

|

|

Pricing and purchase options

|

Avail customized purchase options to meet your exact research needs. Explore purchase options

|

U.S. Basalt Rock Market Report Segmentation

This report forecasts revenue growth at country level and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the U.S. basalt rock market report based on product, and end use:

-

Product Outlook (Revenue, USD Million, 2018 - 2030)

-

Basalt Fiber

-

Basalt Aggregates

-

Basalt Tiles/ Slabs

-

Others

-

End Use Outlook (Revenue, USD Million, 2018 - 2030)