- Home

- »

- Advanced Interior Materials

- »

-

Basalt Fiber Market Size And Share, Industry Report, 2033GVR Report cover

![Basalt Fiber Market Size, Share & Trends Report]()

Basalt Fiber Market (2026 - 2033) Size, Share & Trends Analysis Report By Usage (Composite, Non-Composite), By End Use (Building & Construction, Automotive & Transportation, Marine), By Region, And Segment Forecasts

- Report ID: GVR-4-68040-253-5

- Number of Report Pages: 90

- Format: PDF

- Historical Range: 2021 - 2025

- Forecast Period: 2026 - 2033

- Industry: Advanced Materials

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Basalt Fiber Market Summary

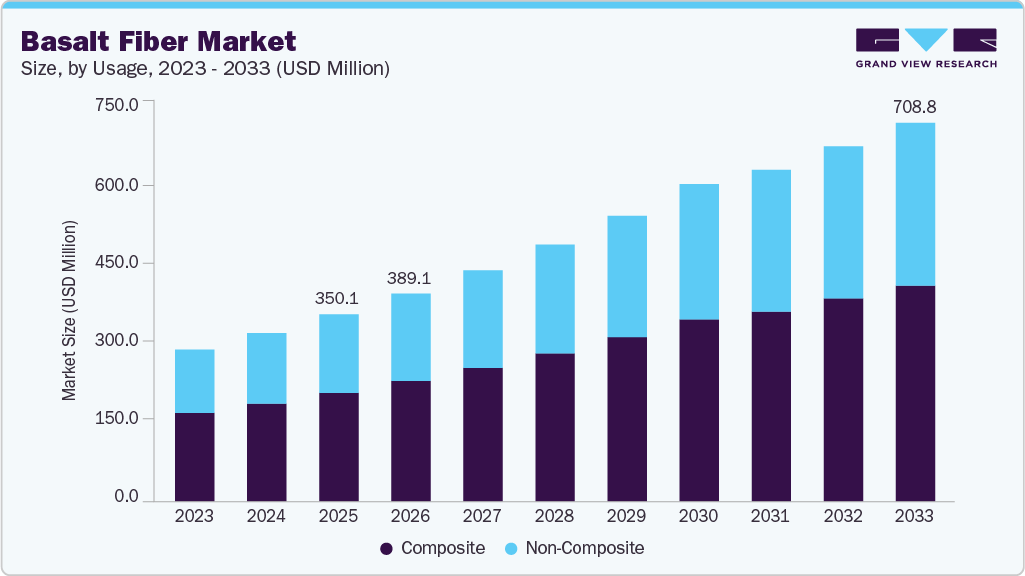

The global basalt fiber market size was estimated at USD 350.1 million in 2025 and is expected to reach USD 708.8 million by 2033, growing at a CAGR of 8.9% from 2026 to 2033. Market growth is driven by rising demand from the automotive & transportation, building & construction, wind energy, and electrical & electronics industries.

Key Market Trends & Insights

- The Asia Pacific basalt fiber market accounted for the largest revenue share of more than 52.0% in 2025.

- The basalt fiber market in India is witnessing steady growth and is among the fastest-growing economies in the APAC.

- Based on usage, the composite segment accounted for the largest revenue share of over 58.0% in 2025.

- In terms of end use, the building & construction segment accounted for the maximum revenue share of over 33.0% in 2025.

Market Size & Forecast

- 2025 Market Size: USD 350.1 Million

- 2033 Projected Market Size: USD 708.8 Million

- CAGR (2026-2033): 8.9%

- Asia Pacific: Largest market in 2025

- Middle East & Africa: Fastest growing market

Basalt fibers offer high thermal stability, heat and sound insulation, vibration resistance, durability, non-corrosive behavior, and recyclability, making them well-suited for these applications. In addition, the growing emphasis on environmentally friendly and sustainable materials is expected to further support market expansion. The market is gaining traction due to its strong sustainability profile, as basalt fibers are produced from naturally occurring volcanic rock without the need for additives or complex chemical processing. Compared to traditional reinforcement materials such as glass or carbon fiber, basalt fiber manufacturing has a lower environmental footprint, while offering high durability, corrosion resistance, and recyclability. Its long service life and resistance to harsh environmental conditions reduce maintenance and replacement needs, supporting the sustainable development of construction, transportation, and energy infrastructure.

It aligns well with environmental and governance objectives, particularly in reducing emissions, material waste, and lifecycle costs across end use industries. The use of basalt fiber supports decarbonization efforts in the automotive, wind energy, and green building sectors by enabling lightweight, energy-efficient designs. In addition, the absence of toxic chemicals in production enhances worker safety, while the increasing adoption of standardized manufacturing practices and certifications strengthens governance frameworks, improving transparency and compliance across the value chain.

Drivers, Opportunities & Restraints

The basalt fiber industry remains driven by increasing demand for lightweight, durable, and sustainable materials across key end use sectors. For example, data from 2025 shows a 15% year-over-year increase in basalt fiber imports into the U.S. market, largely attributable to automotive lightweighting initiatives and stricter emissions regulations in North America that favor high-strength-to-weight composites. In addition, wind energy OEMs integrated basalt fiber into 23% of wind turbine blade production in Germany in 2024, up from 16% in 2023, reflecting broader industry acceptance of basalt fiber’s corrosion resistance and fatigue performance in renewable applications. These shifts underline the material’s broader adoption in vehicle, energy, and infrastructure applications.

Significant growth opportunities are emerging as industry participants expand production capabilities and enter strategic partnerships targeting high-growth application segments. In January 2025, for instance, Kamennyvek announced the acquisition of Basalt Rock Fibers to strengthen its North American manufacturing footprint, signaling an increased investment to meet the demand of the automotive and aerospace sectors. Similarly, in June 2025, Shanghai Zhongfu partnered with Basalt Fiber Tech to co-develop high-strength composite solutions tailored to automotive and aerospace applications, addressing sector-specific performance requirements. The inclusion of basalt fiber solutions at JEC World 2025 in March 2025, where companies like Basalt Uzbekistan showcased next-generation continuous fiber technologies, further highlights expanding applications and global interest in advanced basalt composites.

Despite robust interest, the basalt fiber industry faces headwinds that slow broader adoption, particularly in terms of production costs and industry standards. A persistent challenge in 2024 was maintaining consistency in raw materials and supply, with the U.S. Geological Survey noting that 35% of basalt fiber manufacturers reported raw material shortages, which affected production planning and pricing competitiveness against established glass and carbon fiber alternatives. In the same period, the International Organization for Standardization reported that about 28% of producers faced difficulties due to inconsistent industrial standards, which inhibit acceptance in tightly regulated industries such as aerospace and automotive, where certification compliance is essential. These factors constrain scalability and delay more expansive use in premium segments despite rising demand.

Usage Insights

In 2025, the composites segment continued to account for the largest revenue share in the global market and is projected to maintain significant growth momentum. In composite applications, functions as a key reinforcing material in the fabrication of advanced composite structures, offering notable mechanical strength, durability, and resistance to corrosion. Its broad adoption across sectors such as automotive, aerospace, construction, and marine reflects its ability to enhance structural performance while supporting weight reduction and improved efficiency.

Based on usage, the composite segment accounted for the largest revenue share of over 58.0% in 2025. In addition to composites, it is also increasingly used in non-composite applications, such as fabrics, yarns, and tapes. These variants play crucial roles in thermal and acoustic insulation, filtration media, and reinforcement components across various industries, including textiles, insulation, and industrial filtration. The concurrent utilization of it in both composite and non-composite domains in 2025 underscores its adaptability and value in meeting diverse industrial performance and sustainability requirements.

End Use Insights

In terms of end use, the building & construction segment accounted for the maximum revenue share of over 33.0% in 2025. The increasing use of basalt fiber in environmentally friendly concrete formulations is a key growth factor, as it offers strength comparable to that of steel reinforcement while being significantly lighter and more corrosion-resistant. Rapid growth in global infrastructure development, including residential, commercial, and public construction projects, is further driving demand for lightweight and durable concrete solutions, which is expected to support sustained market growth over the forecast period.

The expansion of electric vehicles and increasing digitalization across industries are accelerating the adoption of basalt fiber in the automotive and electrical & electronics sectors. This shift has encouraged basalt fiber manufacturers to expand production capacities and establish new manufacturing facilities to meet rising demand. In automotive applications, basalt fiber-reinforced composites are increasingly used in body panels, interior components, chassis reinforcements, and structural parts, as they enhance durability and safety while enabling vehicle weight reduction, making them well-suited for next-generation mobility solutions.

Regional Insights

From 2024 to 2025, the adoption of fiber in North America has been supported by the increased use of non-corrosive reinforcement materials in infrastructure rehabilitation projects, particularly bridges, coastal structures, and highways exposed to de-icing salts. State-level transportation departments in the U.S. and Canada have expanded the use of fiber-reinforced concrete alternatives in pilot bridge deck and tunnel lining projects to extend service life and reduce maintenance costs, indirectly supporting demand for basalt fiber as a durable reinforcement material.

U.S. Basalt Fiber Market Trends

The basalt fiber market in the U.S. gained momentum in 2025 due to rising adoption in electric vehicle manufacturing and federal infrastructure upgrades. The implementation of the Infrastructure Investment and Jobs Act (IIJA) has accelerated demand for corrosion-resistant reinforcements in roads, bridges, and public buildings, while U.S. EV manufacturers have increasingly evaluated basalt fiber composites for lightweight structural and interior components to improve vehicle efficiency and durability.

Europe Basalt Fiber Market Trends

The basalt fiber market in Europe remains a key region for the adoption of basalt fiber, driven by stringent sustainability regulations and circular economic initiatives. In 2025, several EU-funded green construction programs promoted the use of low-carbon and recyclable reinforcement materials, resulting in an increased adoption of basalt fiber in building insulation, façade systems, and concrete reinforcement. In addition, wind energy projects in Germany and Spain have continued to evaluate basalt fiber composites for use in blades and structural components due to their enhanced fatigue resistance and recyclability.

Asia Pacific Basalt Fiber Market Trends

The Asia Pacific basalt fiber market accounted for the largest revenue share of more than 52.0% in 2025. The basalt fiber market in the Asia Pacific region continues to lead global demand, driven by large-scale infrastructure and manufacturing expansions. In 2025, ongoing urban rail, highway, and smart city projects in China and India increased the use of fiber-reinforced concrete solutions, benefiting basalt fiber consumption. Meanwhile, automotive and electronics manufacturers in Japan and South Korea have increased the use of advanced composite materials, including basalt fiber, to support lightweighting and thermal management requirements.

Latin America Basalt Fiber Market Trends

The basalt fiber market in Latin America remains at an early stage but is gradually increasing alongside infrastructure modernization efforts. In 2024-2025, countries such as Brazil and Mexico advanced large public infrastructure and transportation projects where durability and corrosion resistance are critical, especially in coastal and high-humidity environments. Growing awareness of lifecycle cost advantages is encouraging limited but steady integration of basalt fiber-based reinforcement solutions in construction applications.

Middle East & Africa Basalt Fiber Market Trends

The basalt fiber market in the Middle East & Africa region is expected to grow at the fastest CAGR, particularly due to construction and infrastructure projects that are exposed to extreme climatic conditions. The material’s corrosion resistance and thermal stability make it well-suited for use in coastal structures, oil & gas facilities, and large-scale urban developments. Ongoing investments in smart cities, transportation networks, and renewable energy infrastructure are expected to gradually boost basalt fiber adoption across the region.

Key Basalt Fiber Company Insights

Some of the key players operating in the market include Kamenny Vek and MAFIC, among others.

-

Kamenny Vek (est. 2001) is a leading global producer of continuous basalt fiber and basalt-based composite solutions, with a strong focus on high-performance reinforcement materials. The company offers a wide portfolio including basalt fibers, rovings, fabrics, rebars, and composite products designed for construction, infrastructure, automotive, and industrial applications. Kamenny Vek emphasizes material durability, corrosion resistance, and lightweight performance, supported by vertically integrated production and proprietary manufacturing technologies, positioning it as a key supplier for demanding structural applications.

-

MAFIC SA (est. 2013) is a technology-driven basalt fiber manufacturer specializing in continuous basalt fiber solutions for advanced composite applications. The company focuses on high-quality fibers tailored for automotive, aerospace, construction, and renewable energy sectors, where mechanical performance and thermal stability are critical. MAFIC leverages advanced melting and fiber-drawing technologies to deliver consistent fiber properties, enabling customers to replace traditional materials such as glass fiber while improving sustainability and lifecycle performance.

-

ISOMATEX SA (est. 1986) is an established manufacturer of high-performance technical textiles, including basalt fiber-based fabrics and reinforcements for industrial applications. The company supplies woven and specialty basalt fiber products used in composites, insulation, and protective applications across construction, transportation, and industrial markets. ISOMATEX emphasizes material reliability, customization capabilities, and compliance with international quality standards, making it a trusted supplier of engineered fabric solutions that require strength, heat resistance, and durability.

Key Basalt Fiber Companies:

The following key companies have been profiled for this study on the basalt fiber market.

- ARMBAS

- BASTECH

- Deutsche Basalt Faser GmbH

- Galen Ltd.

- INCOTELOGY GmbH

- ISOMATEX SA

- Kamenny Vek

- MAFIC

- Shanxi Basalt Fiber Technology Co., Ltd.

- Sudaglass Fiber Technology

- Technobasalt-Invest LLC

- Zhejiang GBF Basalt Fiber Co.

Recent Developments

-

In 2025, Kamenny Vek expanded its basalt fiber production capacity at its Russian facilities, including the commissioning of new continuous basalt fiber lines targeted at supplying high-strength reinforcement materials for infrastructure and automotive composite applications. The expansion supports rising global demand for durable, corrosion-resistant composites and enhances the company’s ability to serve export markets.

-

In 2024, MAFIC introduced an upgraded continuous basalt fiber grade optimized for wind energy and large-structure composite components. The product features improved tensile strength and thermal stability, specifically tailored for use in wind turbine blade reinforcement and industrial pultrusion processes, enabling OEMs to achieve greater performance and lifecycle durability.

-

In 2025, Zhejiang GBF Basalt Fiber Co. entered a strategic collaboration with an automotive parts manufacturer in East Asia to co-develop basalt fiber reinforced composite materials for lightweight automotive body panels and structural components. The partnership aims to reduce vehicle weight, improve crashworthiness, and increase overall fuel efficiency and sustainability in next-generation electric vehicles.

Basalt Fiber Market Report Scope

Report Attribute

Details

Market definition

The market encompasses revenues generated from the production and sale of basalt fiber that is used in different applications.

Market size value in 2026

USD 389.1 million

Revenue forecast in 2033

USD 708.8 million

Growth rate

CAGR of 8.9% from 2026 to 2033

Historical data

2021 - 2025

Forecast period

2026 - 2033

Quantitative Units

Revenue in USD million/billion, volume in kilotons, and CAGR from 2026 to 2033

Report coverage

Revenue & volume forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Usage, end use, region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; Mexico; Germany; France; UK; Italy; China; Japan; India; South Korea; Brazil; Saudi Arabia; South Africa

Key companies profiled

ARMBAS; BASTECH; Deutsche Basalt Faser GmbH; Galen Ltd.; INCOTELOGY GmbH; ISOMATEX SA; Kamenny Vek; MAFIC; Shanxi Basalt Fiber Technology Co., Ltd.; Sudaglass Fiber Technology; Technobasalt-Invest LLC; Zhejiang GBF Basalt Fiber Co.

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Basalt Fiber Market Report Segmentation

This report forecasts revenue and volume growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2033. For this study, Grand View Research has segmented the global basalt fiber market report based on usage, end use, and region:

-

Usage Outlook (Revenue, USD Million; Volume, Kilotons, 2021 - 2033)

-

Composite

-

Non-Composite

-

-

End Use Outlook (Revenue, USD Million; Volume, Kilotons, 2021 - 2033)

-

Building & Construction

-

Automotive & Transportation

-

Electrical & Electronics

-

Marine

-

Others

-

-

Regional Outlook (Revenue, USD Million; Volume, Kilotons, 2021 - 2033)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

Italy

-

-

Asia Pacific

-

China

-

Japan

-

India

-

South Korea

-

-

Latin America

-

Brazil

-

-

Middle East and Africa

-

Saudi Arabia

-

South Africa

-

-

Frequently Asked Questions About This Report

b. Factors including the increasing demand for basalt fiber within the construction sector, attributed to its non-corrosive properties, along with its growing appeal as a sustainable alternative to plastic fiber across various industries, are significantly driving the market growth.

b. The global basalt fiber market size was estimated at USD 350.1 million in 2025 and is expected to reach USD 389.1 million in 2026.

b. The global basalt fiber market is expected to grow at a compound annual growth rate of 8.9% from 2026 to 2033 to reach USD 708.8 million by 2033

b. Based on usage, the composite segment accounted for the largest revenue share, exceeding 58.0% in 2025.

b. Some of the key players in the global basalt fiber market include ARMBAS, BASTECH, Deustche Basalt Faser GmbH, Galen Ltd., INCOTELOGY GmbH, ISOMATEX SA, Kamenny Vek, MAFIC, Shanxi Basalt Fiber Technology Co., Ltd., Sudaglass Fiber Technology, Technobasalt-Invest LLC, Zhejiang GBF Basalt Fiber Co., and others.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.