- Home

- »

- Backup Power Solutions

- »

-

U.S. Battery Market Size And Share, Industry Report, 2030GVR Report cover

![U.S. Battery Market Size, Share & Trends Report]()

U.S. Battery Market (2024 - 2030) Size, Share & Trends Analysis Report By Product (Lead Acid, Li-ion, Nickle Metal Hydride, Ni-Cd), By Application, By End-use, And Segment Forecasts

- Report ID: GVR-4-68040-214-5

- Number of Report Pages: 110

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2024 - 2030

- Industry: Energy & Power

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

U.S. Battery Market Size & Trends

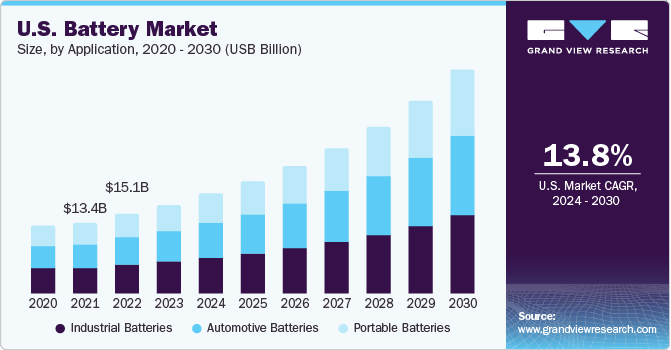

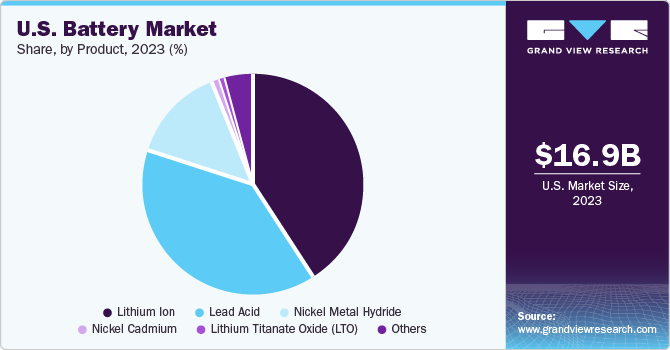

The U.S. battery market size was estimated at USD 16.9 billion in 2023 and is expected to grow at a compound annual growth rate (CAGR) of 13.8% from 2024 to 2030. Cutting-edge batteries are vital for multiple commercial markets, including stationary storage systems, electric vehicles, and aviation. The rising penetration of EV vehicles and the presence of a prominent manufacturing base of primary lithium-ion batteries in the U.S. are driving the market growth. The demand for hybrid EVs and EVs is rising exponentially in the U.S., driven by green initiatives and collaborative efforts.

As per the World Economic Forum, lithium-ion batteries have come under scrutiny after they were reported as fire hazards. A significant number of batteries are imported from Korea, China, and Japan, with China alone accounting for an export trade value of $9.3 billion in 2022, according to the UN Comtrade Database.

Large volume of water is required in battery production. The preparation of reactive materials used in battery manufacturing plants in preparing electrolytes and reactive materials, material deposition on electrode structure, removing impurities, and washing finished cells, production equipment and manufacturing areas.

The manufacturing plants generate wastewater and other toxic byproducts. Regulated pollutants include chromium, cadmium, cobalt, cyanide, iron, copper, lead, manganese, mercury, nickel, oil & grease, silver, and zinc. Regulatory bodies such as the U.S. Consumer Product Safety Commission (CPSC) and Environmental Protection Agency (EPA), among others, are participating in addressing concerns related to hazardous direct and indirect byproducts.

Market Concentration & Characteristics

U.S. has a robust R&D framework that facilitates product innovation, development of new materials, battery innovation & manufacturing, recycling, and performance characterization. Instituting an equitable and competitive local lithium-battery supply and distribution chains in an exponentially growing EV and grid storage market is the preliminary phase in capitalizing on the rising demand for cost-effective and sustainable energy resources.

The R&D pipeline, ranging from electrolyte materials and new electrodes for next-generation lithium-ion batteries to advances in solid-state batteries, and electrode, novel material, and cell manufacturing methods remains integral to maintaining U.S. dominant position in the global battery market. The R&D is supported by strong IP protection and quick movement of product innovations from labs to market through public-private R&D partnerships such as those established in the semiconductor industry is fostering market growth.

The market players are focused on developing nickel- and cobalt-free cathode materials and electrode compositions that pose a threat to the market. The alternatives to lithium-ion batteries offer significant benefits including electrochemical stability, energy density, safety, and cost-effectiveness, and outperform their current counterparts. The market participants are also focused on accelerating R&D activities to enable at-scale production and demonstration of ground-breaking battery technologies such as solid-state and Li-metal.

Battery storage expansion is rapid in the U.S., which is fuelling competitiveness amongst new and established players. According to a January 2024 U.S. Energy Information Administration report, battery storage capacity in the U.S. has been increasing since 2021 and is projected to grow by 89% at the end of 2024. This is primarily due to the focus of the industry players to bring all of the energy storage systems online by their respective planned commercial operation dates. Presently, the aim is to expand the U.S. battery capacity to over 30 gigawatts (GW) before 2025. This would surpass the capacity of petroleum liquids, wood and wood waste, geothermal, or landfill gas, particularly in Texas and California. At the end of 2023, the operational and planned U.S. utility-scale battery capacity accounted for approximately 16 GW. As per EIA’s Preliminary Monthly Electric Generator Inventory, developers have strategized to add another 15 GW in 2024 and 9 GW in 2025.

Product Insights

The lithium-ion battery segment accounted for the largest revenue share of 41.2% in 2023 and is expected to register the fastest CAGR during the forecast period. Despite electric vehicles (EVs) accounting for a significant share of the lithium-ion segment, the batteries are also widely adopted in consumer electronics, critical defense applications, and stationary storage for the electric grid. With the increasing electrification of the U.S. transportation sector, employment growth associated with EVs is evident in the country. Battery development and production are strategically important for the U.S., both as part of the transition to a clean-energy economy and as a key element of the competitiveness of the automotive industry.

Nickel-metal hydride batteries are expected to grow at a significant CAGR from 2024 to 2030. Nickel-metal hydride batteries are known for their reasonable energy and specific power capabilities. They are commonly used in computers and medical equipment due to their longer life cycle and safety features, making them a popular choice. Nickel-metal hydride batteries are known for their longer life cycle and safety features, allowing their widespread adoption in HEVs. However, they do come with their own set of challenges, such as high cost, high self-discharge rate, heat generation at high temperatures, and the need to control hydrogen loss.

End-use Insights

The automobile segment dominated the market with over a share of 32.67% in 2023. Transportation accounts for about 28% of total U.S. greenhouse gas (GHG) emissions, making it the largest contributor to U.S. GHG emissions. The electrification of the transportation sector aids in addressing deteriorating climate conditions, and building a sustainable and clean-energy economy that benefits all communities in an equitable and just manner. It is projected that the worldwide sales of 56 million passenger EVs in 2040, of which 17% (about 9.6 million EVs) will be in the U.S. market.

The energy storage segment is expected to expand at the fastest CAGR from 2024 to 2030 owing to the growing demand for uninterrupted electricity in heavy industries and large-scale installation of power grids across the country. According to EIA, in 2019, over 60% of the major battery system capacity to store and provide energy in the United States was located in regions covered by local grid operators including California Independent System Operator (CAISO) and PJM Interconnection (PJM).

Application Insights

Industrial batteries accounted for the largest revenue share of 36.11% in 2023 owing to the rising demand for energy storage systems and efficient power backup across several industries including power generation, marine, agricultural equipment & machinery, recreation equipment, and chemical manufacturing. The requirement for compact lithium-ion batteries used in consumer electronics, particularly portable devices is projected to drive the growth of the U.S. battery market.

Automotive batteries are expected to expand at the fastest CAGR from 2024 to 2030. The segment growth is driven by the ramped up production of passenger cars and advancements in autonomous vehicles.

Key U.S. Battery Company Insights

The U.S. is a prominent market for batteries due to the high demand from consumer electronics, energy storage projects, electric vehicles, and the development of renewable energy infrastructure. The industry players have identified and are focused on capitalizing on the potential growth opportunity. There is significant competitiveness among the key players and are adopting mergers & acquisitions and product innovations to gain a strong foothold.

Some of the key players operating in the market include:

-

Motion Industries, Inc. is headquartered in Birmingham, Alabama, and is a distributor of rechargeable and non-rechargeable batteries of several types such as seal lead acid, nickel cadmium, alkaline, carbon zinc, silver oxide, and nice metal hybrid batteries. The company serves food & beverage, the automotive, chemical, paper, cement, pulp, wood, and oil & gas industries.

-

Hollingsworth & Vose Co. is headquartered in Massachusetts, United States, and is a supplier of batteries for industries including electronics, telecommunications, energy storage systems, motorcycles, and automotive. The company’s battery portfolio includes flooded lead batteries and VRLA gel batteries.

Key U.S. Battery Companies:

- American Battery Technology Company

- Scott’s Emergency Lighting & Power Generation, Inc.

- Dantona Industries, Inc.

- Tenergy Corporation

- American Crane & Equipment Corp.

- Hello Bom

- Hollingsworth & Vose Co.

- Airmatic

- GE Vernova

- Our Next Energy Inc.

- American Battery Technology Company

Recent Developments

-

In November 2023, American Battery Technology Company received a grants of $57 million from the US DOE for establishment of Tonopah Flats Lithium ProjectTonopah, Nevada. The grants shall be used for the establishment of Commercial-Scale Lithium Hydroxide Refinery.

-

In November 2023, GE Vernova and Our Next Energy Inc. (ONE) entered into a collaboration to build battery energy storage solutions using locally produced batteries. The initiative shall assist the clientele of companies to gain incentive offerings by the Inflation Reduction Act (IRA) and Investment Tax Credits (ITC).

-

In November 2023, the U.S. Department of Energy (DOE) under the Administration announced the investment of $3.5 billion to boost the domestic production capacity of advanced materials and batteries. This will minimize the country’s dependency on critical battery raw minerals, technologies, and components from foreign entities of concern.

-

In October 2023, Toyota announced an investment of $8 billion for the establishment of eight new BEV/PHEV battery production lines and increase the capacity of plug-in hybrid electric vehicles (PHEVs) and battery electric vehicles (BEVs) in Toyota Battery Manufacturing North Carolina (TBMNC). The investment is aimed at increasing the overall annual production by 30GWh by 2030.

U.S. Battery Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 19.0 billion

Revenue forecast in 2030

USD 42.6 billion

Growth rate

CAGR of 13.8% from 2024 to 2030

Base year for estimation

2023

Historical data

2018 - 2021

Forecast period

2024 - 2030

Quantitative units

Revenue in USD million/billion and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, trends

Segments covered

Product, end-use, application

Key companies profiled

American Battery Technology Company; Scott’s Emergency Lighting & Power Generation, Inc.; Dantona Industries, Inc.; Tenergy Corporation; American Crane & Equipment Corp.; Hello Bom; Hollingsworth & Vose Co.; Airmatic; GE Vernova; Our Next Energy Inc.; American Battery Technology Company

Customization scope

Free report customization (equivalent up to 8 analyst’s working days) with purchase. Addition or alteration to country, regional, and segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

U.S. Battery Market Report Segmentation

This report forecasts revenue growth at country levels and provides an analysis of latest industry trends in each of sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the U.S. battery market report based on product, end-use, and application:

-

Product Outlook (Revenue, USD Million, 2018 - 2030)

-

Lead Acid

-

Lithium Ion

-

Nickel Metal Hydride

-

Nickel Cadmium

-

Lithium Titanate Oxide (LTO)

-

Others

-

-

End-use Outlook (Revenue, USD Million, 2018 - 2030)

-

Aerospace

-

Automobile

-

Electronics

-

Energy Storage

-

Military & Defense

-

Others

-

-

Application Outlook (Revenue, USD Million, 2018 - 2030)

-

Automotive Batteries

-

Industrial Batteries

-

Portable Batteries

-

Frequently Asked Questions About This Report

b. The key market player in the U.S. battery market includes American Battery Technology Company; Scott’s Emergency Lighting & Power Generation, Inc.; Dantona Industries, Inc.; Tenergy Corporation; American Crane & Equipment Corp.; Hello Bom; Hollingsworth & Vose Co.; Airmatic; GE Vernova; Our Next Energy Inc.; and American Battery Technology Company.

b. The key factors that are driving the U.S. battery market include, considerable demand for cutting-edge batteries vital for multiple commercial markets, including stationary storage systems, electric vehicles, and aviation.

b. The U.S. battery market was valued at USD 16.9 billion in the year 2023 and is expected to reach USD 19.0 billion in 2024.

b. The U.S. battery market is expected to grow at a compound annual growth rate of 13.8% from 2024 to 2030 to reach USD 42.6 billion by 2030.

b. The automobile segment emerged as a dominating segment in the market with over a share of 32% in 2023 due to inclination towards purchasing of electric vehicles.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.