- Home

- »

- Plastics, Polymers & Resins

- »

-

U.S. Beer Packaging Market Size, Industry Report, 2030GVR Report cover

![U.S. Beer Packaging Market Size, Share & Trends Report]()

U.S. Beer Packaging Market (2025 - 2030) Size, Share & Trends Analysis Report By Material (Glass, Plastic, Metal, Other), By Product (Bottles, Cans, Kegs, Others), By End Use (Breweries, Restaurants & Bars, Liquor Stores), And Segment Forecasts

- Report ID: GVR-4-68040-615-7

- Number of Report Pages: 80

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2025 - 2030

- Industry: Bulk Chemicals

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

U.S. Beer Packaging Market Size & Trends

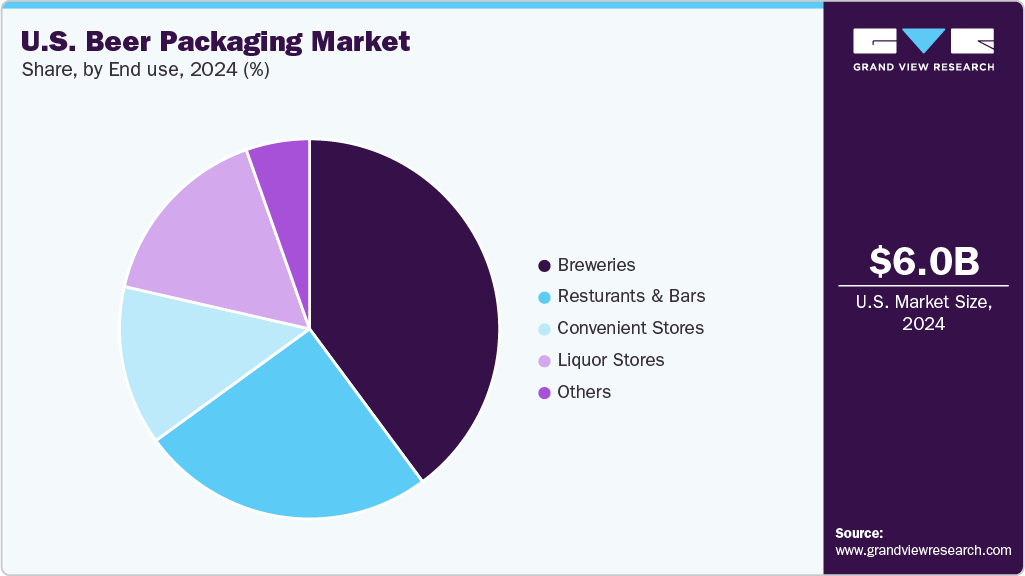

The U.S. beer packaging market size was estimated at USD 6.0 billion in 2024and is expected to grow at a CAGR of 3.6% from 2025 to 2030. The industry is driven by rising beer consumption, creative designs, sustainability, e-commerce expansion, regulation changes, and technological advancements, all of which boost the demand for high-end brands and address various demographic needs. Craft and premium beers are especially driving the demand for innovative and sustainable packaging. Brewers consistently try out various ingredients to develop unique and attractive flavors. This trend is fueled by evolving consumer preferences for high-quality and artisanal drinks that provide exceptional taste experiences, which also impacts the demand for attractive packaging.

The U.S. beer packaging industry is projected to experience growth in the forecast year, driven by the rise of craft breweries, premiumization, sustainability, and evolving consumption patterns such as online shopping. Moreover, the pandemic has permanently changed drinking behaviors, leading to more individuals consuming beer at home. This shift has boosted canned and bottled beer sales in retail, prompting increased investment in multipack and take-home packaging formats. Craft breweries are innovating with limited edition releases, high-quality materials, and customized branding to differentiate themselves. Concurrently, sustainability trends promote a transition toward recyclable and biodegradable materials, lightweight designs, and eco-friendly packaging solutions. Advances in technology, such as digital printing and AI-driven manufacturing processes, are improving flexibility, quality assurance, and operational efficiency throughout the supply chain of packaging.

The rise of e-commerce and direct-to-consumer alcohol delivery services has become a crucial growth factor. These platforms require durable, tamper-evident, and visually appealing packaging that withstands shipping while enhancing the brand experience. The increasing popularity of non-alcoholic beers, hard seltzers, and other blended beverages leads to new packaging requirements. With the evolving regulations and consumer demands, packaging remains a vital factor in brand distinction, sustainability initiatives, and satisfying the needs of a convenience-oriented and digitally connected consumer base. These drivers and emerging opportunities position the U.S. beer packaging market for strong and innovative growth.

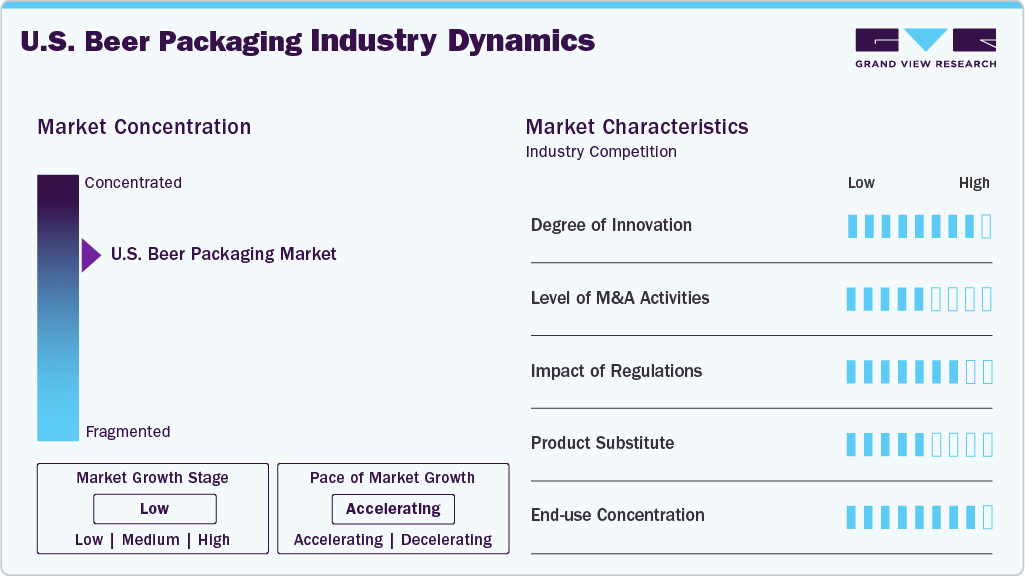

Market Concentration & Characteristics

The industry growth stage is low, and the pace of growth is accelerating. The U.S. beer packaging industry is moderately concentrated among leading material suppliers such as Ball Corporation, Crown Holdings, Ardagh Group S.A, and O-I Packaging Solutions, providing these companies with considerable market power.

In terms of industry characteristics, the degree of innovation is high, aiming at sustainability initiatives such as lightweight materials, recycled content, environmentally friendly substances, and advanced technologies. Ball Corporation highlighted its commitment to sustainability through the Combined Annual & Sustainability Report for 2024, highlighting its focus on aluminum packaging. The report emphasizes a “strengthened focus” on its leadership role in this sector, enhancing strategies to fulfill customer demands for sustainability, such as boosting recycling rates and increasing recycled content. This underlines the dominance of the company and illustrates how it serves as a fundamental competitive strategy. As a result, the market has shifted toward circular solutions and created pressure on other material suppliers. Merger and acquisition activities are moderate, reflecting broader packaging industry consolidation. The impact of regulations is moderate to high, especially concerning environmental standards and Alcohol and Tobacco Tax and Trade Bureau (TTB) labeling requirements. The end-use concentration is high, with a few large breweries accounting for a significant volume share, apart from a diverse and fragmented craft beer market.

Material Insights

The glass material segment dominated the market with a revenue share of 47.4% in 2024. Glass is a traditional and premium packaging material in the U.S. beer packaging industry, particularly for bottled beers. It is inert, nonpermeable, and effectively preserves the flavor and carbonation of beer. Craft brewers and premium brands widely use glass packaging to reflect authenticity and quality. The growing demand for premium, craft, and specialty beers in the U.S. is a major driver of glass packaging. In addition, glass is 100% recyclable without loss of quality and aligns with sustainability trends, influencing eco-conscious consumer preferences and regulatory support.

The metal material segment is expected to grow at the fastest CAGR of 4.1 % over the forecast period. This growth is attributable to the convenience, eco-friendliness, and affordability of metal cans. They are lightweight, durable, and faster to chill, making them perfect for consumption during travel and outdoor events.The growing adoption of canned beer, especially among younger consumers, is a key driver. Sustainability impels the segment growth, as aluminum is highly recyclable and has a lower carbon footprint over its lifecycle. The rise of craft breweries in the U.S. has further increased the use of cans for flexible order quantities, innovative design options, and better protection against light and oxygen. In addition, cans are well-suited to the rising trend of multipacks, variety packs, and online sales, which makes it the fastest-growing segment in the U.S.

Product Insights

The bottles segment recorded the largest market share in the U.S. in 2024. Glass bottles have served as a traditional packaging option for beer for decades. They are often associated with premium and craft beer due to their visual appeal and ability to preserve taste by providing effective protection against oxygen. Bottled beers are typically favored in on-premise consumption settings such as bars and restaurants due to their aesthetic appearance and recyclable nature. The demand for bottled beer is driven by premiumization trends in the beer market, growing demand for craft and artisanal beer, and consumer perception of glass as a more sustainable and quality-preserving material.

The cans segment is expected to grow at the fastest rate during the forecast period. Aluminum cans have grown rapidly in popularity due to their lightweight nature, high recyclability, and lower shipping costs. Cans are especially popular in retail and off-premise consumption settings. They offer excellent protection against light and oxygen, preserving beer’s freshness and allowing for easy branding with 360-degree printing. Cans are driven by their convenience, portability, and eco-friendliness due to their high recyclability. The growing popularity of ready-to-drink varieties and expanding e-commerce channels favor canned beer.

End Use Insights

The breweries segment dominated the U.S. beer packaging industry in 2024. Breweries are the primary consumers of beer packaging as they handle beer production, bottling, or canning. Packaging for this segment ranges from glass bottles and aluminum cans to kegs and multipacks. Branding and labeling requirements are a significant concern for breweries, as they directly influence consumer perception and shelf visibility. Increasing craft beer consumption, the rise of microbreweries, and innovation in sustainable packaging in the U.S. drive the demand for packaging in this segment.

The restaurants & bars segment is expected to experience the fastest CAGR during the forecast period. Restaurants and bars serve beer packaged in bottles, cans, and kegs for direct consumption. The aesthetic and functional aspects of the packaging are critical, especially for premium or specialty brews served in upscale venues. Growth in social dining culture, urban nightlife trends, and the popularity of beer with gourmet food fuel the demand for the segment.

Key U.S. Beer Packaging Company Insights

Some key players operating in the U.S. beer packaging industry are Ball Corporation, Crown, Ardagh Group S.A, Amcor plc, and O-IPS. The market is experiencing constant innovation in packaging formats, such as cans, bottles, and kegs, as well as in sustainable materials and digital labeling technologies. Companies compete on cost efficiency, product differentiation, environmental compliance, and partnerships with breweries, creating a dynamic and fragmented competitive landscape.

-

Ball Corporation, headquartered in Westminster, Colorado, is a prominent global provider of eco-friendly aluminum packaging solutions for beverages, personal care items, and household products. Ball is a prominent player in the U.S. market, offering aluminum cans that are lightweight, recyclable, and compatible with different beer varieties. The company's commitment to sustainability and innovation has established it as a favored partner for numerous breweries looking for environmentally responsible packaging alternatives.

-

O-I Glass, previously known as Owens-Illinois, is a leading manufacturer of glass containers based in Ohio. The company focuses on creating glass bottles specifically for the beer sector, serving major breweries and smaller craft beer makers. O-I's commitment to sustainability and design adaptability has enabled it to maintain a substantial presence in the U.S. beer packaging market, especially for brands favoring the classic look of glass packaging.

Key U.S. Beer Packaging Companies:

- Ardagh Group S.A

- Amcor plc

- ALPLA

- Berry Global Inc.

- Smurfit Westrock

- TricorBraun

- Crown

- CANPACK

- Gamer Packaging

- Ball Corporation

- O-IPS

- Berlin Packaging

- CCL Industries

Recent Developments

-

In January 2025, Ardagh Glass Packaging enhanced its 12-oz Heritage glass beer bottle collection with two new additions: an amber glass bottle featuring a twist-off closure and a flint (clear) glass bottle with a pry-off closure. These new bottles offer craft brewers enhanced branding flexibility with a wider label area and a shorter, lighter design compared to traditional long-neck bottles, improving transport efficiency.

-

In March 2025, CANPACK partnered with United Breweries Limited (UBL), part of the Heineken Group, to launch Kingfisher Lemon Masala and Mango Berry Twist, flavored beers inspired by Indian street food. Aimed at Gen Z, CANPACK provided 330ml recyclable aluminum cans with vibrant, culturally inspired designs that align with the values of sustainability, innovation, and individuality. The collaboration highlights CANPACK’s advanced printing and manufacturing capabilities, enhancing shelf appeal and supporting UBL’s push for adventurous, modern flavor experiences.

U.S. Beer Packaging Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 6.18 billion

Revenue forecast in 2030

USD 7.39 billion

Growth rate

CAGR of 3.6% from 2025 to 2030

Base year for estimation

2024

Historical data

2018 - 2023

Forecast period

2025 - 2030

Quantitative units

Revenue in USD Million and CAGR from 2025 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Material, product, end use

Key companies profiled

Ardagh Group S.A; Amcor plc; ALPLA; Berry Global Inc.; Smurfit Westrock; TricorBraun; Crown; CANPACK; Gamer Packaging; Ball Corporation; O-IPS; Berlin Packaging; CCL Industries

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

U.S. Beer Packaging Market Report Segmentation

This report forecasts growth at country level and provides an analysis of the latest industry trends in each of the sub-segment from 2018 to 2030. For this study, Grand View Research has segmented the U.S. beer packaging market report based on material, product, and end use:

-

Material Outlook (Revenue, USD Million, 2018 - 2030)

-

Glass

-

Plastic

-

Metal

-

Other

-

-

Product Outlook (Revenue, USD Million, 2018 - 2030)

-

Bottles

-

Cans

-

Kegs

-

Others

-

-

End Use Outlook (Revenue, USD Million, 2018 - 2030)

-

Breweries

-

Restaurants & Bars

-

Convenient Stores

-

Liquor Stores

-

Others

-

Frequently Asked Questions About This Report

b. The U.S. beer packaging market was estimated at around USD 6.0 billion in the year 2024 and is expected to reach around USD 6.18 billion in 2025.

b. The U.S. beer packaging market is expected to grow at a compound annual growth rate of 3.6% from 2025 to 2030 to reach around USD 7.39 billion by 2030.

b. Breweries dominated the end-use segment of the U.S. beer packaging market in 2024 with revenue share of 39.9% due to high production volumes and widespread distribution networks. Their focus on branding and premium packaging formats also boosted demand.

b. The key players in the U.S. beer packaging market include Ardagh Group S.A; Amcor plc; ALPLA; Berry Global Inc.; Smurfit Westrock; TricorBraun; Crown; CANPACK; Gamer Packaging; Ball Corporation; O-IPS; Berlin Packaging; and CCL Industries.

b. The U.S. beer packaging market is driven by rising demand for convenience, sustainability trends favoring eco-friendly materials, craft beer growth, and innovations in packaging design.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.