- Home

- »

- Automotive & Transportation

- »

-

U.S. Bicycle Accessories Market Size & Trends, Report, 2030GVR Report cover

![U.S. Bicycle Accessories Market Size, Share & Trends Report]()

U.S. Bicycle Accessories Market (2024 - 2030) Size, Share & Trends Analysis Report By Product (Apparels, Components), By Type (OEM, Aftermarket), By Bicycle Type, By Sales Channel, And Segment Forecasts

- Report ID: GVR-4-68040-202-5

- Number of Report Pages: 120

- Format: PDF

- Historical Range: 2017 - 2022

- Forecast Period: 2024 - 2030

- Industry: Technology

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

U.S. Bicycle Accessories Market Trends

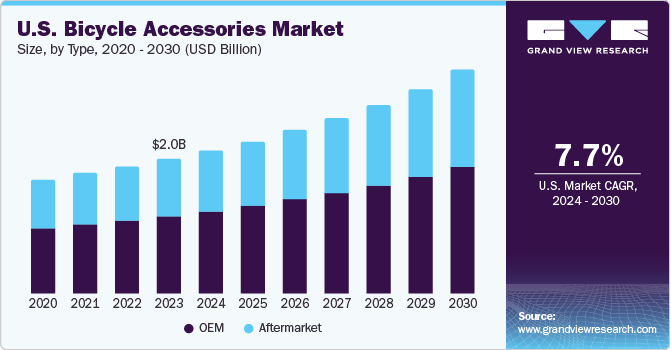

The U.S. bicycle accessories market was estimated at USD 2.1 billion in 2023 and is projected to grow at a compound annual growth rate (CAGR) of 7.7% from 2024 to 2030. The market growth can be attributed to factors such as health and fitness trends and increasing environmental concerns. With cycling being considered as a good fitness exercise, more and more people are taking up cycling for transportation, exercise, or leisure. This increased adoption of cycling has fueled the market for bicycle accessories. Bicycle accessories can enhance comfort, functionality, and safety of both the cyclist and bicycles. Bicycle accessories include helmets, lights, and locks to bags, mirrors, water bottle cages, and pedals.

The market is anticipated to have a positive growth curve in the coming years with the increased adoption of e-bikes and cycling among younger generations. The growth in the sales of e-bike: E-bikes, or electric bikes, have also aided in market growth. With large number of people shifting to e-bikes for their daily commutes or leisure rides, the demand for accessories such as mounts, integrated lighting, and horn systems has increased, as these accessories aid in increasing the rider’s safety. For example, bicycle lights increase the visibility of the bicycle to other road users in low-light conditions or while riding at night. This safety feature is vital in heavy traffic roads, where motorists may find it difficult to spot a cyclist.

The traffic congestion along with concerns for safety of riders and the increasing popularity of cycling as a fitness routine, have aided in the increased adoption of bicycle accessories. In addition, the increased interest in sports related to cycling, growing demand for sports and mountain bikes, and rising sales of electric bicycles are driving market growth. Therefore, speedometers, handlebar grips, mudguards, LED lights, helmets, mirrors, gloves, and other accessories have experienced an increase in demand, leading to anticipation of lucrative growth in the market.

Market Concentration & Characteristics

The market growth is medium, and the rate of growth is accelerating. The market is competitive and fragmented with both large and small players vying for the market share. The prominent players are pursuing various strategic initiatives, including mergers & acquisitions and new product launches, to strengthen their foothold, capture a significant market share, and improve overall profitability.

The degree of innovation in this market is high as major players are spending heavily on research and development activities to integrate advanced technologies in bicycle parts and components. For instance, in March 2023, Snik.bike launched a GPS-enabled bike security device. Snik uses GPS, Cellular, and Bluetooth technology in case of bike theft. Once the device is paired with the bike user’s mobile app, then the bike user is notified in case the bike is moved by another person.

With the introduction of e-cargo bikes, the end-user concentration in the industrial sector has risen as several government initiatives have been undertaken to encourage the use of e-cargo bikes for logistics for short distances. The primary end-users are individual bicycle users who have adopted cycling as a way to achieve fitness and a healthy lifestyle.

Product Insights

Based on product, the market is segmented into apparel (cycling gloves, cycling clothes, cycling shoes, protective gears, and others) and components (saddles, pedals, lighting systems, mirrors, water bottle cages, locks, bar ends/ grips, kickstands, fenders & mud flaps, air pumps & tyre pressure gauges, and others). The component segment dominated the market in 2023 with a revenue share of 61.52% due to the increasing popularity of cycling in transportation and fitness fields. The pedals sub-segment in components dominated the market in 2023 with a revenue share of 14.37%. As pedals undergo the most wear and tear over time, they are the most frequently replaced accessory in bicycles.

The apparel segment is anticipated to register the fastest CAGR of 7.9% over the forecast period. The segment growth is mainly due to the developments in fabric technology and design, which enable to create high-performance materials that are breathable, provide UV protection, and moisture-wicking. Thus, cyclists can wear functional and comfortable apparel that is also stylish. In the apparel segment, the protective gears sub-segment holds the largest market share of 29.2% in 2023. This large share can be attributed to the fact that wearing protective gear can prevent injuries and reduce the severity of injuries while in an accident.

Bicycle Type Insights

Based on bicycle type, the market is segmented into mountain bikes, hybrid bikes, road bikes, cargo bikes, and others. The road bicycle segment held the largest revenue share of 40.1% in 2023 and the segment is anticipated to dominate over the rest of the forecast period. As the basic bicycles are simpler to modify compared to other types of bicycles such as racing, mountain, or specialized bicycles, they are most preferred by the majority of the population. In addition, the growing trend of personalizing road bikes for specific uses is predicted to fuel the growth of the market in the coming years.

Furthermore, the cargo bikes segment is anticipated to exhibit the fastest CAGR during the forecast period. Cargo bikes are used as a sustainable and eco-friendly substitute for conventional vehicles when transporting goods, which is contributing to its growth. Therefore, accessories that can enhance the functionality and carrying capacity of cargo bikes, such as racks, bags, and baskets are high in demand. Moreover, the mountain bicycle segment is also expected to grow significantly over the forecast period as consumers opt for mountain bicycling as a form of adventure and leisure.

Type Insights

The OEM (original equipment manufacturer) segment dominated the market in 2023 with the largest revenue share of 57.92%. The large market share is attributed to the fact that they are explicitly designed to fit the bicycle model and tested for quality and durability. Therefore, OEM accessories provide a better fit and function than aftermarket accessories, which may have compatibility issues. OEM accessories are covered under the bicycle manufacturer's warranty, which acts as an additional assurance to the customer about the product's quality, compatibility, negligible shipping cost, and authenticated manuals to troubleshoot problems. OEM accessories are customized to enhance the bicycle aesthetics and are available in similar colors and finishes. This provides an integrated and cohesive look to the bicycle preferred by many customers.

The aftermarket segment is anticipated to witness the fastest CAGR of 8.0% over the forecast period. The aftermarket accessories have more diverse options than OEM accessories, which are limited to the specific bicycle model. Aftermarket accessories provide more color, design, and functionality choices, allowing customers to customize their bicycles to their preferences. The aftermarket accessories are often priced lower than OEM accessories, making them more affordable for customers. This is especially true for customers looking to upgrade their bicycles without spending significant money. In addition, the increasing popularity of e-commerce platforms and online marketplaces has made it easier for customers to access and purchase aftermarket accessories.

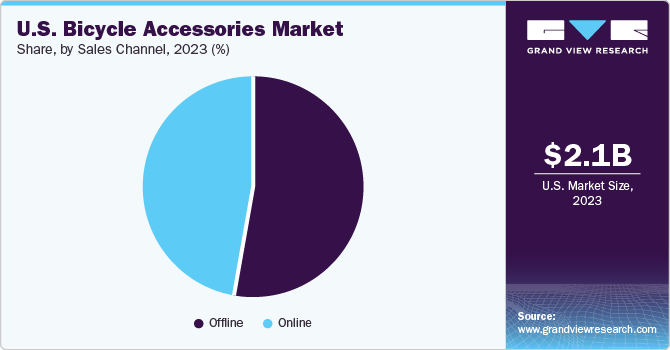

Sales Channel Insights

The offline sales channel segment held the largest share of 53.15% in 2023. This is primarily due to a significant number of consumers preferring to buy from physical stores as buying physically lends the opportunity to test- the accessories before purchase. These stores also provide customized options for consumers to choose their preferred designs and colors for bicycle accessories, and the product is available instantly. In addition, the physical stores allow customers to see and touch the products, giving them a better understanding of the quality and suitability of the accessories for their needs. In addition, the availability of branded bicycle accessories in local supermarkets and other stores is expected to drive demand for the segment.

The online sales channel segment is anticipated to be the fastest-growing segment, with a CAGR of 8.0% over the forecast period. Consumer engagement in online stores is expected to increase in emerging economies, such as Brazil, China, India, and Mexico, due to the growing penetration of smartphones and the internet. Additionally, the expanding internet reach prompts vendors to sell their products in previously untapped markets through online platforms like Ali Express, Amazon, and Flipkart. Furthermore, online channels offer attractive discounts on products, attracting consumers to purchase online and bolstering the growth of the online market.

Key U.S. Bicycle Accessories Market Company Insights

The key players in the market include Cycling Sports Group, Inc.; Giant Bicycle, Inc.; Specialized Bicycle Components, Inc.; SRAM LLC; Surly Bikes; Trek Bicycle Corporation, etc.

-

In January 2023, Giant Group acquired 32.5% of Stages Cycling's common stock following a $20 million investment. Giant Group's board approved the purchase of 32.5% of Stages Cycling Inc. common stock for $6.5 million and Stages Cycling's convertible corporate bonds for $13.5 million.

-

In August 2022, Trek Bicycle Company is acquiring two chains in the U.S., American Cycle & Fitness and East Coasters Bike Shops. The deals will raise its store total to 35.

Some of the emerging players in the U.S. market for bicycle accessories are Marin Bikes and Lezyne USA, Inc.

-

In 2023, MARIN launched all-new 2023 Rift Zone alloy models. Rift Zone alloy models are all-new from the frame-up for 2023, with more travel, fresh geometry, updated suspension kinematics, and refined details. Furthermore, the lineup has been aligned between the 29” and 27.5” wheel size models.

-

In August 2023, Lezyne, the trusted provider of high-quality cycling accessories, launched its newly overhauled, industry-leading LED product line. This latest offering has been meticulously designed and engineered in-house to provide cyclists with the best possible lighting experience.

Key U.S. Bicycle Accessories Companies:

The following are the leading companies in the U.S. bicycle accessories market. These companies collectively hold the largest market share and dictate industry trends. Financials, strategy maps & products of these U.S. bicycle accessories companies are analyzed to map the supply network.

- Cycling Sports Group, Inc.

- Giant Bicycle, Inc.

- Lezyne USA, Inc.

- Marin Bikes

- SelleRoyalGroup.com

- Shimano, Inc.

- Specialized Bicycle Components, Inc.

- SRAM LLC

- Surly Bikes

- Trek Bicycle Corporation

Recent Developments

-

In August 2023, Central European-based Aspire Sports became Poland's exclusive distributor for Lezyne products. This new partnership brings together one of Central Europe’s most innovative and modern distributors with the industry’s premier manufacturer of cycling accessories.

-

In October 2023, Yeti Cycles announced that it added the option for riders to purchase directly from its website. Yeti has now opened up the option for US customers to purchase its bikes from Yeticycles.com alongside the option of authorized dealers and online partners.

U.S. Bicycle Accessories Market Report Scope

Report Attribute

Details

Revenue forecast in 2030

USD 3.3 billion

Growth rate

CAGR of 7.7% from 2024 to 2030

Historical data

2017 - 2022

Base year for estimation

2023

Forecast period

2024 - 2030

Quantitative units

Revenue in USD million/billion and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product, bicycle type, type, sales channel

Country scope

U.S.

Key companies profiled

Cycling Sports Group, Inc.; Giant Bicycle, Inc.; Lezyne USA, Inc.; Marin Bikes; SelleRoyalGroup.com; Shimano, Inc.; Specialized Bicycle Components, Inc.; SRAM LLC; Surly Bikes; Trek Bicycle Corporation

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

U.S. Bicycle Accessories Market Report Segmentation

This report forecasts market revenue growth at a country level and offers an analysis of the qualitative and quantitative market trends in each of the sub-segments from 2017 to 2030. For this study, Grand View Research has segmented the U.S. bicycle accessories market report based on product, bicycle type, type, and sales channel:

-

Product Outlook (Revenue, USD Million, 2017 - 2030)

-

Apparels

-

Cycling Gloves

-

Cycling Clothes

-

Cycling Shoes

-

Protective Gears

-

Others

-

-

Components

-

Saddles

-

Pedals

-

Lighting System

-

Mirrors

-

Water Bottle Cages

-

Lock

-

Bar Ends/Grips

-

Kickstands

-

Fenders & Mud Flaps

-

Air Pumps & Tyre Pressure Gauge

-

Others

-

-

-

Bicycle Type Outlook (Revenue, USD Million, 2017 - 2030)

-

Mountain Bikes

-

Hybrid Bikes

-

Road Bikes

-

Cargo Bikes

-

Others

-

-

Type Outlook (Revenue, USD Million, 2017 - 2030)

-

OEM

-

Aftermarket

-

-

Sales Channel Outlook (Revenue, USD Million, 2017 - 2030)

-

Offline

-

Online

-

Frequently Asked Questions About This Report

b. The U.S. bicycle accessories market size was estimated at USD 2.1 billion in 2023 and is expected to reach USD 2,141.2 million in 2024.

b. The U.S. bicycle accessories market is expected to grow at a compound annual growth rate of 7.7% from 2024 to 2030 to reach USD 3.3 billion by 2030.

b. Components segment market with a share of 61.5% in 2023. Advancements in technology, such as lightweight and durable materials, innovative designs, increasing demand for customization options, and a growing focus on performance and safety features among cyclists are some of the factors propelling the maret growth.

b. Some key players operating in the U.S. bicycle accessories market include Cycling Sports Group, Inc, Giant Bicycle, Inc., Lezyne USA, Inc., Marin Bikes, SelleRoyalGroup.com, Shimano, Inc., Specialized Bicycle Components, Inc., SRAM LLC, Surly Bikes, Trek Bicycle Corporation, Worksman Cycles, and Yeti Cycles.

b. Key factors that are driving the U.S. bicycle accessories market growth include increased an increased focus on health and fitness, growing awareness of environmental sustainability, rising interest in recreational and alternative transportation options, advancements in bicycle technology, urbanization leading to more cycling-friendly infrastructure, and the popularity of cycling as a leisure activity.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.