- Home

- »

- Clothing, Footwear & Accessories

- »

-

U.S. Billiards & Accessories Market Size, Share Report, 2033GVR Report cover

![U.S. Billiards & Accessories Market Size, Share & Trends Report]()

U.S. Billiards & Accessories Market (2025 - 2033) Size, Share & Trends Analysis Report By Billiards Table, By Accessories, By Material (Slate, Wooden, Acrylic), By Distribution Channel (Online, Offline), And Segment Forecasts

- Report ID: GVR-4-68040-822-3

- Number of Report Pages: 90

- Format: PDF

- Historical Range: 2021 - 2024

- Forecast Period: 2025 - 2033

- Industry: Consumer Goods

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

U.S. Billiards & Accessories Market Summary

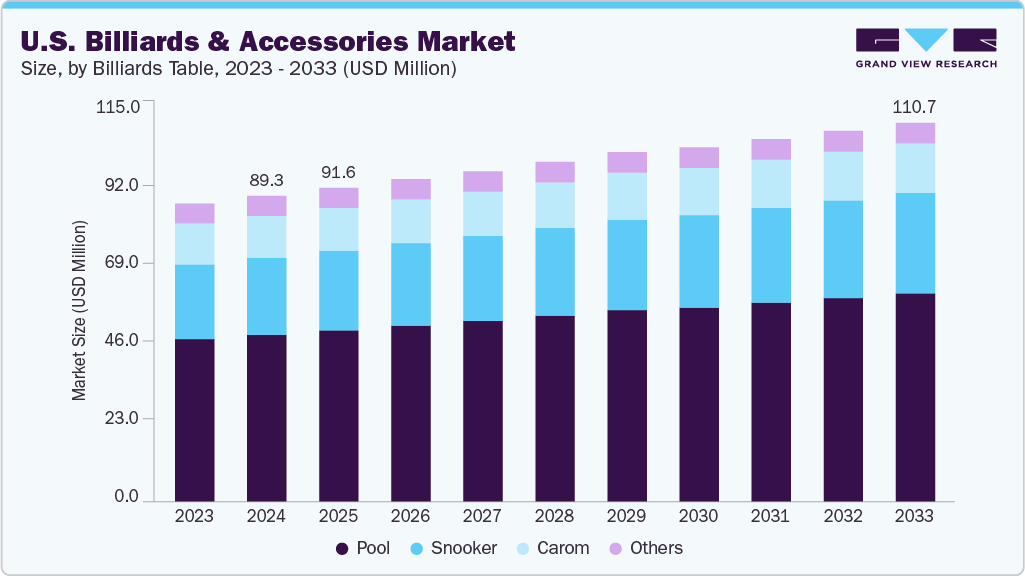

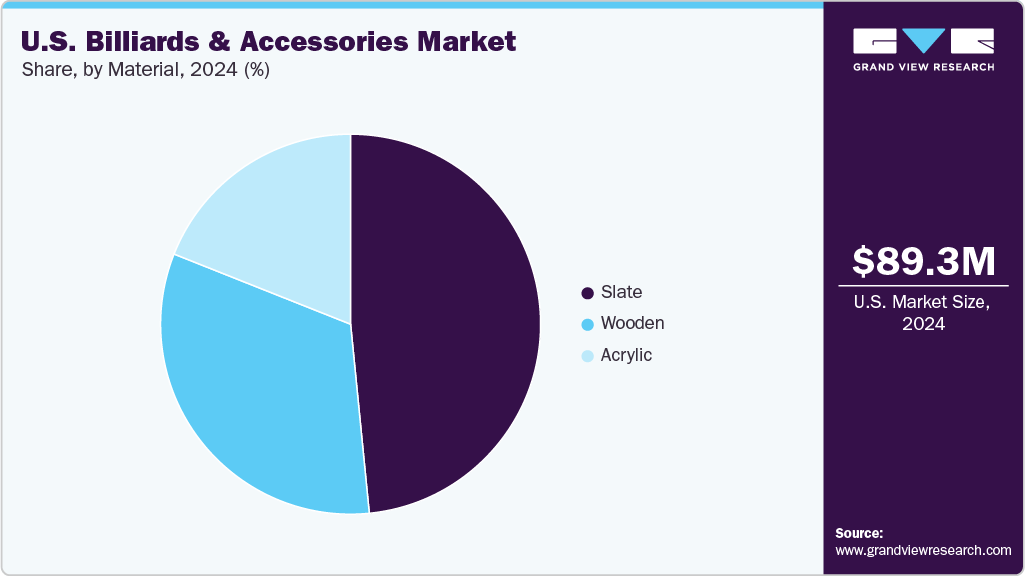

The U.S. billiards & accessories market size was estimated at USD 89.3 million in 2024 and is projected to reach USD 110.7 million by 2033, growing at a CAGR of 2.4% from 2025 to 2033. As more consumers invest in home recreation, including dedicated game rooms, the demand for billiards tables and accessories has increased.

Key Market Trends & Insights

- By billiards table, the pool segment led the market, with a revenue share of 54.5% in 2024.

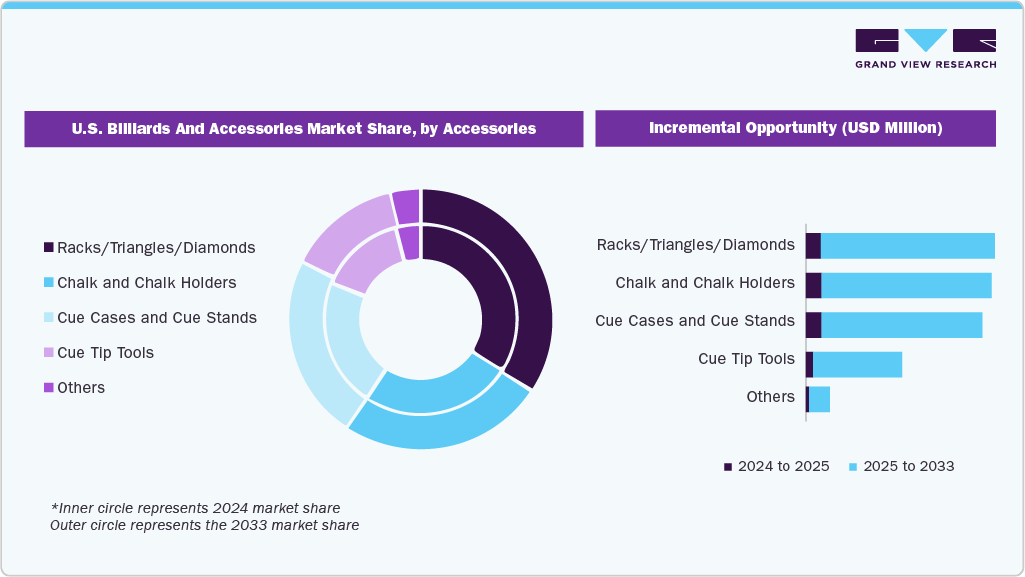

- By accessories, the racks/triangles/diamonds segment led the market, with a revenue share of 33.7% in 2024.

- By material, the slate segment led the market and accounted for a revenue share of 48.1% in 2024.

- By distribution channel, the offline segment led the market and accounted for a revenue share of around 90.0% in 2024.

Market Size & Forecast

- 2024 Market Size: USD 89.3 Million

- 2033 Projected Market Size: USD 110.7 Million

- CAGR (2025-2033): 2.4%

This shift is particularly noticeable as consumers seek ways to enhance their home leisure spaces, resulting in higher sales of both premium tables and specialized accessories. The increasing popularity of billiards in commercial venues also fuels the U.S. billiards & accessories industry’s growth. Sports bars, lounges, resorts, and entertainment centers are incorporating billiards as part of their broader social and recreational offerings, creating a demand for multiple tables and accessories per venue. Billiards is no longer just a casual game in bars; it has become a key component of social gatherings, with commercial venues investing in higher-end equipment to provide a premium experience for their customers.Another major factor contributing to the market's expansion is the growing trend of product innovation. Manufacturers are introducing high-quality, premium cues, custom-designed billiards tables, and accessories that appeal to both serious players and collectors. The introduction of smart and interactive pool tables is also opening up new market opportunities, with tech-savvy consumers seeking connected experiences that integrate digital features such as automated scoring and augmented reality. These innovations are not only driving sales of billiards tables but also contributing to the growth of accessory markets such as high-end cues, balls, racks, and maintenance kits. The younger demographic, particularly Millennials and Gen Z, is also playing a key role in the growth of the billiards market. These generations are increasingly seeking out alternative forms of entertainment, and billiards offers a social and engaging experience that aligns with their lifestyle preferences. As these younger consumers invest in home game rooms and seek out recreational activities outside of traditional video games, the demand for billiards tables and accessories is expected to continue rising.

Moreover, the increasing popularity of competitive play, including amateur leagues and tournaments, is helping to position billiards as not just a recreational activity but a serious hobby for many enthusiasts. This is driving demand for high-performance equipment and accessories, as players seek out the best tools to enhance their skills and performance. As the competitive aspect of billiards grows, more players are willing to invest in premium products, further fueling market expansion.

Buyer Insights

As more consumers invest in home recreation, particularly in game rooms and entertainment spaces, billiards tables are becoming a popular choice for homeowners looking to enhance their living spaces. This shift is not just about having a pool table but creating a dedicated space for socializing and relaxation. The desire to replicate the enjoyable experiences found in commercial venues has led to an increase in the purchase of billiards tables and accessories for home use.

Another trend driving demand is the growing popularity of billiards among younger generations. Millennials and Gen Z are increasingly seeking out alternative forms of entertainment, and billiards offers a social and interactive experience that fits their preferences. This demographic is more willing to invest in high-quality recreational equipment, seeing it as both a leisure activity and a serious hobby. Billiards is being repositioned as a versatile activity beyond bar games, which is driving higher sales of premium tables and accessories.

Several independent billiards clubs such as Borderline Bar & Billiards (Charlotte, NC) and World Class Billiard Room (Waldorf, MD) also opened their doors in 2024.

The trend of increased disposable income is also contributing to the rise in demand. As consumers have more income to spend on non-essential items, many are choosing to invest in lifestyle products that enhance their recreational experiences. Billiards, often regarded as a high-end or classic game, aligns perfectly with this broader trend of spending on leisure and home entertainment. In addition, the growth of commercial venues, such as sports bars, lounges, and entertainment centers that feature billiards tables, is also fueling interest. These venues attract a broad audience, and as consumers enjoy playing in these locations, they are more likely to consider installing similar equipment at home.

Billiards Table Insights

The pool segment led the U.S. billiards & accessories market, accounting for a revenue share of 54.5% in 2024. With more consumers investing in game rooms, home bars, and shared recreational spaces, the demand for quality pool tables, cues, racks, and accessories has surged. Furthermore, an increasing shift toward online shopping makes it easier for enthusiasts to access premium gear that was once limited to specialist stores. As lifestyles evolve toward experience-based spending, rather than solely on material goods, pool billiards is benefiting from its blend of leisure, sport, and social interaction, positioning it as a growing category in the broader recreational equipment market.

The snooker segment is anticipated to witness a CAGR of 2.9% from 2025 to 2033. In the U.S., the market for snooker, billiards, and related accessories is experiencing a resurgence driven by a combination of social, lifestyle, and home entertainment trends. The increasing interest in “game room” culture, driven by millennials and young professionals seeking social leisure experiences at home or in dedicated entertainment spaces, has led to a surge in demand for tables, cues, racks, and other accessories. At the same time, the rise of craft‑beer bars, upscale sports lounges, and alternative recreational venues has integrated billiards into mainstream leisure environments, boosting accessory sales.

Accessories Insights

The racks/triangles/diamonds segment led the U.S. billiards & accessories industry, accounting for a revenue share of 33.7% in 2024. As the U.S. billiards market continues to shift from purely competitive play toward recreation, social gaming, and home entertainment, the demand for essential yet often overlooked accessories, such as racks/triangles/diamonds, is gaining momentum. Racks and triangles are integral to every pool or nine‑ball setup, making them high‑frequency items in both commercial venues (bars, clubs) and residential game rooms. Additionally, the expansion of e‑commerce and online access for billiards accessories increases visibility and ease of purchase for players upgrading their home setups, further driving accessory uptake.

The cue cases and cue stands segment is anticipated to witness a CAGR of 3.0% from 2025 to 2033. The rise of the U.S. market for cue cases and cue stands in the billiards accessories sector is driven by a growing shift toward cue sports as both a serious hobby and a lifestyle statement. As more players invest in high‑quality cues and accessories, they also seek proper storage and display solutions—cue cases and stands—as essential gear rather than optional add‑ons. Additionally, the surge in home game rooms and dedicated recreation spaces post‑pandemic has made aesthetically pleasing, premium accessories more desirable.

Material Insights

The wooden billiards & accessories held the largest share of the U.S. billiards & accessories market, accounting for a revenue share of 48.1% in 2024. The growing consumer demand for premium, durable, and aesthetically pleasing pieces in both home and commercial spaces drives the growth of the segment. Wooden tables and accessories, crafted from high-quality hardwoods such as oak, walnut, or mahogany, offer superior durability and an upscale look that complements modern interiors and luxury leisure environments. As game rooms, entertainment lounges, and private clubs seek furnishings that are not only functional but also stylish, wooden billiards equipment offers a blend of performance and design appeal.

The slate U.S. billiards & accessories segment is anticipated to witness a CAGR of 2.7% from 2025 to 2033. Slate is widely acknowledged as the gold-standard material for high-quality billiards tables due to its durability and precision-level playing surface. As disposable incomes rise and urban homes integrate dedicated recreation zones, slate‑based billiards tables become more than just game equipment; they become lifestyle statements.

Distribution Channel Insights

Sales of U.S. billiards & accessories through offline channels account for a revenue share of around 90.0% in 2024. The tactile nature of the equipment drives the growth of billiards and accessories through offline retail channels, as consumers prefer to see, touch, and feel items like billiard tables, cues, racks, and cases before making a purchase, which makes physical stores important. Additionally, the global expansion of entertainment venues, bars, sports clubs, and gaming lounges is driving demand for cues, accessories, and tables in commercial settings, where orders are typically placed through traditional offline channels.

Sales of U.S. billiards & accessories through online channels are anticipated to witness a CAGR of 2.8% from 2025 to 2033. As more consumers seek to purchase billiard tables, cue accessories, and maintenance tools, online platforms provide easy access to a wide variety of products, often with competitive pricing and home delivery. The expansion of online retail giants and niche e-commerce stores dedicated to billiards supplies has allowed consumers to browse and compare products more conveniently than ever before.

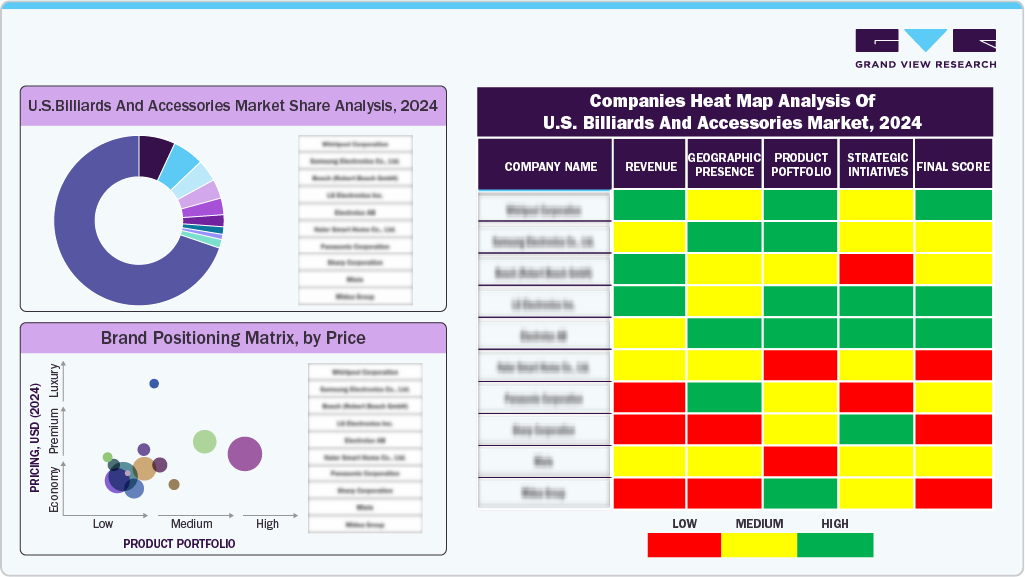

Key U.S. Billiards & Accessories Company Insights

Companies in the U.S. billiards and accessories market are increasingly investing in innovative materials, designs, and sustainable manufacturing methods to enhance the durability, aesthetic appeal, and environmental impact of their products. These innovations focus on creating billiards tables and accessories that are more long-lasting, high-performing, and eco-friendly, catering to the growing demand for sustainable and responsibly sourced products.

Key U.S. Billiards & Accessories Companies:

- Escalade Sports

- Xingpai Billiards

- Chevillotte Billiards

- Olhausen Billiard MFG, Inc

- Betson Enterprises

- Diamond Billiard Products Inc.

- Sharma Billiard Accessories

- Wiraka Pte Ltd

- Valley Dynamo

- EastPoint Sports Ltd. LLC

U.S. Billiards & Accessories Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 91.6 million

Revenue forecast in 2033

USD 110.7 million

Growth rate

CAGR of 2.4% from 2025 to 2033

Actual data

2021 - 2024

Forecast period

2025 - 2033

Quantitative units

Revenue in USD million/billion and CAGR from 2025 to 2033

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Billiards table, accessories, material, distribution channel

Key companies profiled

Escalade Sports; Xingpai Billiards; Chevillotte Billiards; Olhausen Billiard MFG, Inc.; Betson Enterprises; Diamond Billiard Products Inc.; Sharma Billiard Accessories; Wiraka Pte Ltd; Valley Dynamo; EastPoint Sports Ltd. LLC

Customization scope

Free report customization (equivalent up to 8 analysts’ working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

U.S. Billiards & Accessories Market Report Segmentation

This report forecasts revenue growth at the country level and provides an analysis of the latest trends and opportunities in each sub-segment from 2021 to 2033. For this study, Grand View Research has segmented the U.S. billiards & accessories market report based on billiards table, accessories, material, and distribution channel:

-

Billiards Table Outlook (Revenue: USD Million, 2021 - 2033)

-

Pool

-

Snooker

-

Carom

-

Others

-

-

Accessories Outlook (Revenue: USD Million, 2021 - 2033)

-

Racks/Triangles/Diamonds

-

Chalk and Chalk Holders

-

Cue Cases and Cue Stands

-

Cue Tip Tools

-

Others

-

-

Material Outlook (Revenue: USD Million, 2021 - 2033)

-

Slate

-

Wooden

-

Acrylic

-

-

Distribution Channel Outlook (Revenue: USD Million, 2021 - 2033)

-

Offline

-

Online

-

Frequently Asked Questions About This Report

b. The U.S. billiards & accessories market was estimated at USD 89.3 million in 2024 and is expected to reach USD 91.6 million in 2025.

b. The U.S. billiards & accessories market is expected to grow at a compound annual growth rate of 2.4% from 2025 to 2033, reaching USD 110.7 billion by 2033.

b. Racks/triangles/diamonds held the largest share, accounting for a share of around 33.7% in 2024. As the U.S. billiards market continues its shift from purely competitive play toward recreation, social gaming and home entertainment, the demand for essential yet often overlooked accessories like racks/triangles/diamonds is gaining momentum.

b. Some of the key players operating in the U.S. billiards & accessories market include Escalade Sports, Xingpai Billiards, Chevillotte Billiards, Olhausen Billiard MFG, Inc, Betson Enterprises, Diamond Billiard Products Inc., and others

b. Key factors that are driving the market growth include growing popularity of cue sports as recreational activities and growth of organized sports events & leagues

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.