- Home

- »

- Plastics, Polymers & Resins

- »

-

U.S. Bimodal HDPE Market Size, Industry Report, 2030GVR Report cover

![U.S. Bimodal HDPE Market Size, Share & Trends Report]()

U.S. Bimodal HDPE Market (2025 - 2030) Size, Share & Trends Analysis Report By Processing Method (Extrusion, Blow Molding, Injection Molding, Compression Molding), By Application (Packaging, Automotive, Electronics & Electrical, Construction), And Segment Forecasts

- Report ID: GVR-4-68040-611-4

- Number of Report Pages: 90

- Format: PDF

- Historical Range: 2018 - 2024

- Forecast Period: 2025 - 2030

- Industry: Bulk Chemicals

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

U.S. Bimodal HDPE Market Size & Trends

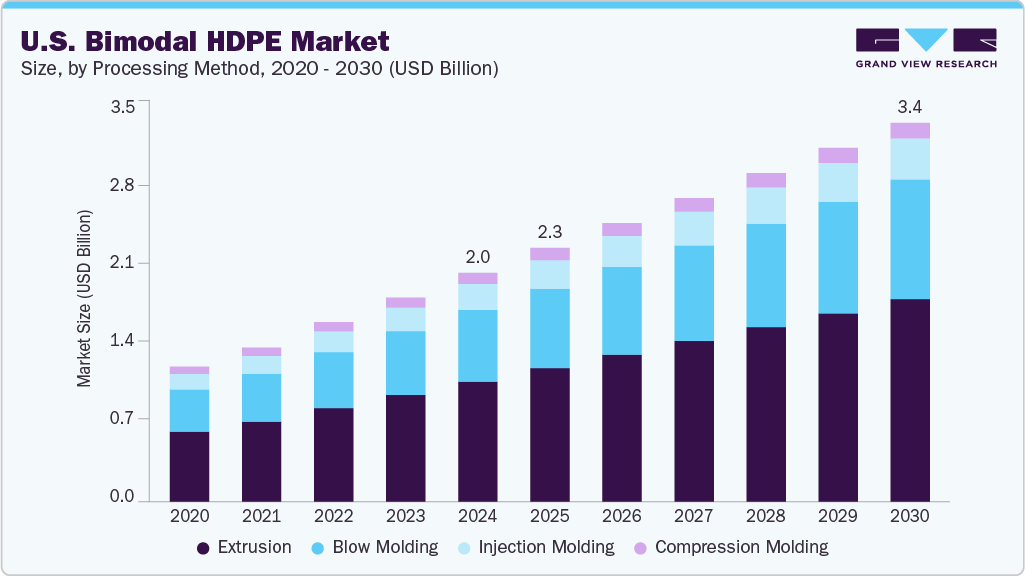

The U.S. bimodal HDPE market size was estimated at USD 2.04 billion in 2024 and is expected to grow at a CAGR of 8.36% from 2025 to 2030. The growing demand for durable and lightweight materials in the automotive and consumer goods sectors is driving the use of bimodal HDPE. Its high strength and excellent molding properties make it ideal for manufacturing fuel tanks, containers, and structural parts.

The industry is witnessing a rising trend of resin customization tailored for high-performance end-use applications, particularly in pressure pipe systems and industrial packaging. Producers are increasingly optimizing molecular weight distribution to deliver better processability without compromising mechanical strength. This is further supported by advancements in bimodal catalyst technologies and polymerization techniques, allowing for finer control over end-product properties. The trend reflects a shift toward value-engineered resins driven by downstream performance metrics rather than commodity-scale output.

Drivers, Opportunities & Restraints

A key growth driver is the accelerating replacement of traditional piping materials with high-density polyethylene in municipal water infrastructure. Aging metal and PVC-based systems are being phased out in favor of bimodal HDPE, which offers superior resistance to stress cracking, corrosion, and fatigue. The U.S. Bipartisan Infrastructure Law, which allocates significant funding toward water systems modernization, is catalyzing demand. Additionally, regulatory mandates focused on lead pipe replacement are pushing municipalities to adopt long-life and chemically inert piping solutions like bimodal HDPE.

There is a strong commercial opportunity emerging in the high-capacity packaging segment, particularly for industrial drums, intermediate bulk containers (IBCs), and high-performance caps and closures. With the U.S. witnessing increased export activity in chemicals, lubricants, and food-grade liquids, the need for robust and chemically resistant containers is growing. Bimodal HDPE’s high stiffness-to-impact ratio and excellent environmental stress crack resistance make it the preferred choice for these applications. Forward integration strategies by resin producers into packaging formats may further unlock margin expansion potential in this space.

One of the primary restraints for the U.S. Bimodal HDPE market is the significant volatility in ethylene feedstock prices, which directly impacts resin production costs and limits pricing flexibility. While the U.S. benefits from shale gas-derived ethylene, supply disruptions or shifts in global trade flows can trigger short-term cost escalations.

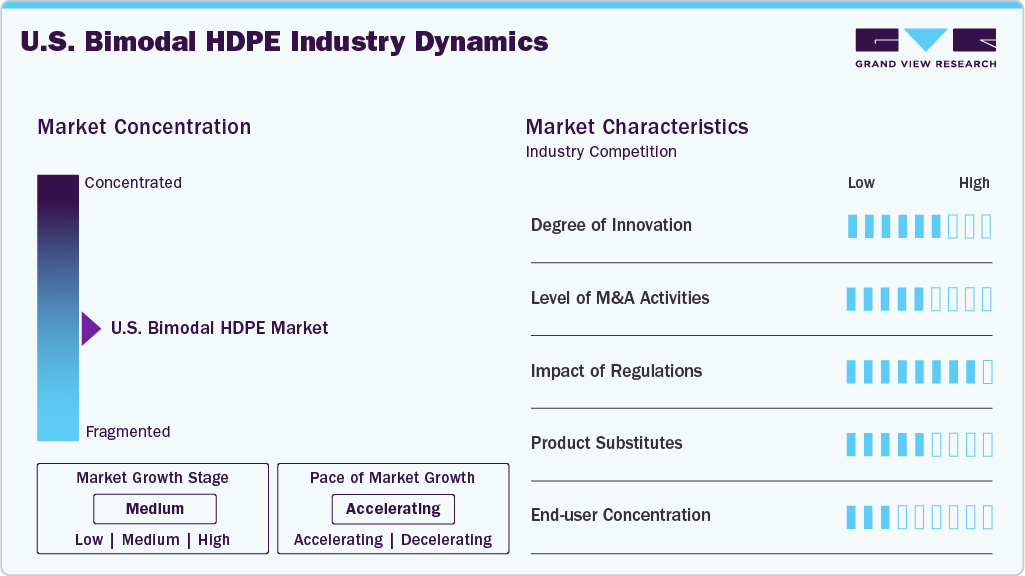

Market Concentration & Characteristics

The industry growth stage is medium, and the pace is accelerating. The industry exhibits a slight fragmentation, with key players dominating the industry landscape. Major companies Dow Inc., Braskem, SABIC, INEOS, FKuR Plastics Corp., Chevron Phillips Chemical Company, Exxon Mobil Corporation, and Mitsui Chemicals Inc., and others play a significant role in shaping the market dynamics. These leading players often drive innovation within the market, introducing new products, technologies, and materials to meet evolving industry demands.

The industry faces increasing competition from metallocene-based polyethylene (mPE) and advanced unimodal HDPE grades, especially in packaging and film applications. These substitutes offer enhanced clarity, flexibility, and sealability, making them attractive for converters in flexible packaging formats. In piping and industrial applications, polypropylene (PP) and cross-linked polyethylene (PEX) are also gaining ground due to their comparable mechanical performance in specific environments. However, bimodal HDPE retains a strong foothold in high-pressure and chemically aggressive use cases where these alternatives often fall short.

Recent federal and state-level infrastructure policies, such as the U.S. Infrastructure Investment and Jobs Act, have positively impacted demand for bimodal HDPE in water and gas distribution systems. These regulations prioritize the replacement of aging lead and metal pipelines with safer, corrosion-resistant materials—directly aligning with the technical profile of bimodal HDPE. At the same time, evolving EPA guidelines around chemical leachability and long-term environmental safety are pushing manufacturers to enhance formulation compliance. This regulatory momentum is not only driving adoption but also encouraging R&D in next-generation resins with improved environmental profiles.

Processing Method Insights

Extrusion dominated the market, accounting for a revenue share of 52.48% in 2024, owing to the accelerated modernization of municipal and industrial piping infrastructure, where bimodal HDPE’s optimized melt strength and uniform density profile translate to faster line speeds and reduced scrap rates. Producers and fabricators benefit from cost-efficient extrusion processes, as bimodal HDPE’s tailored rheology minimizes die swell and enables thinner wall designs without compromising structural integrity. This efficiency gain is particularly valuable for large-diameter pipes used in water treatment and gas distribution, where project timelines and lifecycle costs are under constant scrutiny.

The blow molding segment is anticipated to grow at a significant CAGR of 8.51% through the forecast period. The escalating demand for robust chemical and industrial containers is fueling increased uptake of bimodal HDPE resins. OEMs producing drums, IBCs, and high-capacity jerrycans are gravitating toward bimodal HDPE because its high environmental stress crack resistance ensures longer service life under harsh-loading conditions.

Application Insights

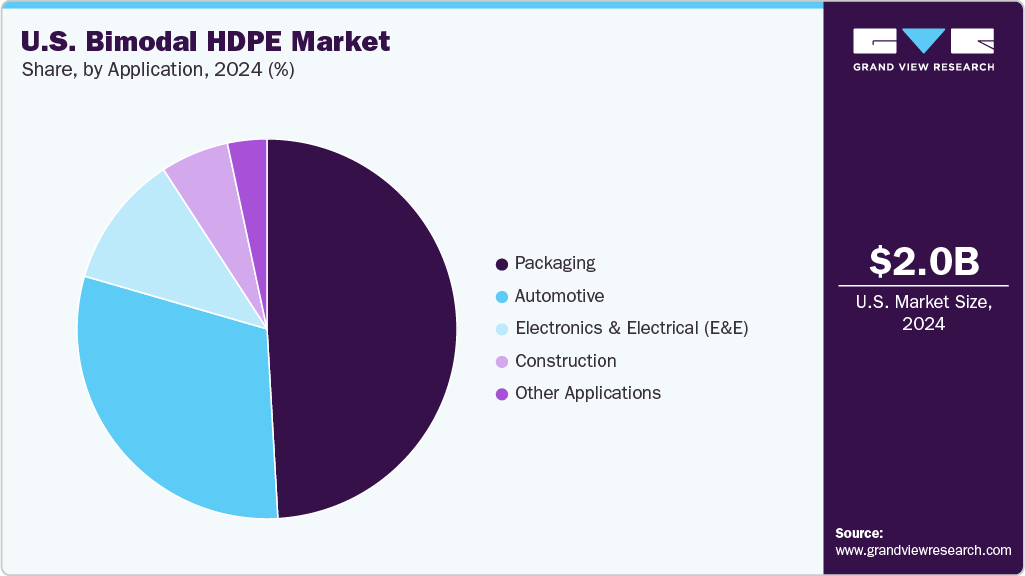

Packaging dominated the market, accounting for a revenue share of 49.09% in 2024. The surge in demand for rigid, durable, and recyclable industrial containers, such as intermediate bulk containers (IBCs), detergent bottles, and chemical drums, is a major driver for bimodal HDPE adoption. These applications require materials with high stiffness, impact resistance, and superior environmental stress crack resistance, all of which are inherent to bimodal HDPE. The resin’s ability to maintain structural integrity under heavy loads and aggressive chemical exposure makes it ideal for transport and storage packaging. Additionally, converters benefit from consistent processing performance, enabling high-throughput blow molding with reduced defect rates.

The automotive segment is projected to experience a rapid CAGR of 8.49% throughout the forecast period. The automotive industry is increasingly relying on bimodal HDPE for under-the-hood components, fuel tanks, and battery casings, driven by the need to reduce vehicle weight without compromising durability. Bimodal HDPE’s high stiffness-to-density ratio and excellent chemical resistance provide a competitive advantage in replacing traditional metal and heavier plastic parts. As electric vehicle (EV) production ramps up, manufacturers are seeking lightweight polymers that can withstand thermal and mechanical stresses, conditions under which bimodal HDPE performs well. This shift supports OEM goals to meet federal fuel economy and emissions standards through material substitution.

Key U.S. Bimodal HDPE Companies Insights

Key players operating in the U.S. bimodal HDPE market are undertaking various initiatives to strengthen their presence and increase the reach of their products and services. Strategies such as expansion activities and partnerships are key in propelling the market growth.

Key U.S. Bimodal HDPE Companies:

- Dow Inc.

- Braskem

- SABIC

- INEOS

- FKuR Plastics Corp.

- Chevron Phillips Chemical Company

- Exxon Mobil Corporation

- Mitsui Chemicals Inc.

Recent Developments

-

In June 2024, Bharat Petroleum Corporation Ltd. (BPCL) chose Univation's UNIPOL PE Process Technology for two production lines at BPCL's Bina Refinery in India. The units have a combined production capacity of 1,150,000 tons per year of polyethylene (PE)

-

In May 2025, Univation Technologies launched a new world-scale licensed design for its UNIPOL PE Process platform with a capacity of 800,000 tons per year, surpassing its previous top capacity of 650,000 tons per year. This next-generation design offers polyethylene producers significantly higher output, improved economies of scale, and flexible production capabilities for various polyethylene resins including unimodal and bimodal HDPE, LLDPE, and metallocene PE.

U.S. Bimodal HDPE Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 2.26 billion

Revenue forecast in 2030

USD 3.37 billion

Growth rate

CAGR of 8.36% from 2025 to 2030

Historical data

2018 - 2024

Forecast period

2025 - 2030

Quantitative units

Volume in kilotons; revenue in USD million/billion, and CAGR from 2025 to 2030

Report coverage

Volume & revenue forecast, competitive landscape, growth factors, and trends

Segments covered

Processing method, application

Country scope

U.S.

Key companies profiled

Dow Inc.; Braskem; SABIC; INEOS; FKuR Plastics Corp.; Chevron Phillips Chemical Company; Exxon Mobil Corporation; Mitsui Chemicals Inc.

Customization scope

Free report customization (equivalent up to 8 analyst’s working days) with purchase. Addition or alteration to country, regional & segment scope

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

U.S. Bimodal HDPE Market Report Segmentation

This report forecasts volume & revenue growth at the country level and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the U.S. bimodal HDPE market report on the basis of processing method and application:

-

Processing Method Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2030)

-

Extrusion

-

Blow Molding

-

Injection Molding

-

Compression Molding

-

-

Application Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2030)

-

Packaging

-

Automotive

-

Electronics & Electrical (E&E)

-

Construction

-

Other applications

-

Frequently Asked Questions About This Report

b. The U.S. bimodal HDPE market size was estimated at USD 2.04 billion in 2024 and is expected to reach USD 2.26 billion in 2025.

b. The U.S. bimodal HDPE market is expected to grow at a compound annual growth rate of 8.36% from 2025 to 2030 to reach USD 3.37 billion by 2030.

b. Packaging dominated the U.S. bimodal HDPE market across the application segmentation in terms of revenue, accounting for a market share of 49.09% in 2024. The surge in demand for rigid, durable, and recyclable industrial containers, such as intermediate bulk containers (IBCs), detergent bottles, and chemical drums, is a major driver for bimodal HDPE adoption.

b. Some key players operating in the U.S. bimodal HDPE market include Dow Inc., Braskem, SABIC, INEOS, FKuR Plastics Corp., Chevron Phillips Chemical Company, Exxon Mobil Corporation, and Mitsui Chemicals Inc.

b. The growing demand for durable and lightweight materials in the automotive and consumer goods sectors is driving the use of bimodal HDPE in the U.S. Its high strength and excellent molding properties make it ideal for manufacturing fuel tanks, containers, and structural parts.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.