- Home

- »

- Clinical Diagnostics

- »

-

U.S. Biomarker-based Immunoassays Market Report, 2033GVR Report cover

![U.S. Biomarker-based Immunoassays Market Size, Share & Trends Report]()

U.S. Biomarker-based Immunoassays Market (2025 - 2033) Size, Share & Trends Analysis Report By Sample (Blood, Saliva), By Product (Reagents & Kits, Consumables), By Biomarker, By Diseases, By End Use, And Segment Forecasts

- Report ID: GVR-4-68040-724-6

- Number of Report Pages: 150

- Format: PDF

- Historical Range: 2021 - 2023

- Forecast Period: 2025 - 2033

- Industry: Healthcare

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Market Size & Trends

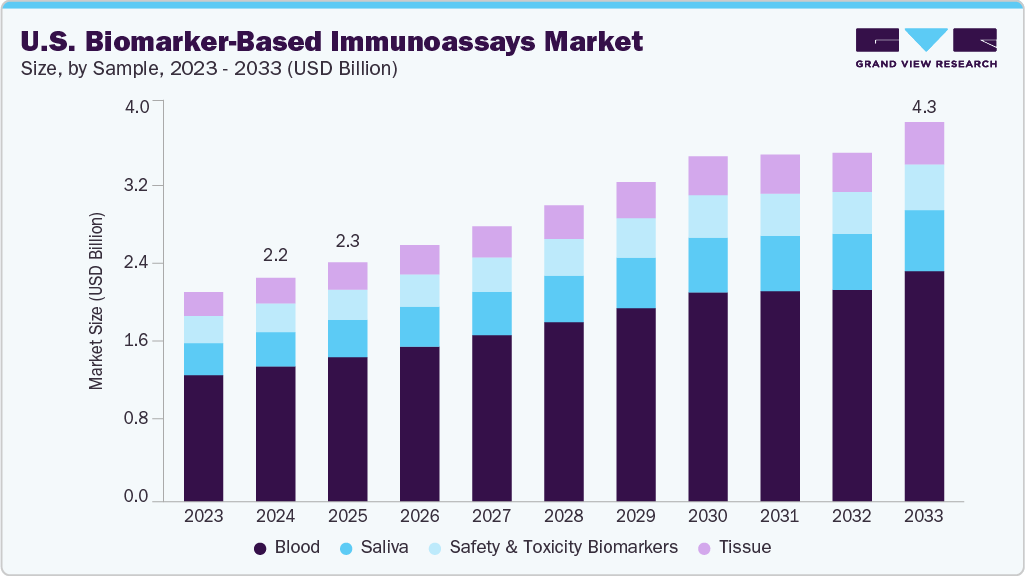

The U.S. biomarker-based immunoassays market size was estimated at USD 2.17 billion in 2024 and is projected to reach USD 4.28 billion by 2033, growing at a CAGR of 7.95% from 2025 to 2033. The market growth is fueled by the rising U.S. burden of chronic diseases such as cancer, cardiovascular disorders, and neurological conditions, which require precise and early diagnostic tools. A major driver shaping the scope of this market is the shift toward personalized medicine. Pharmaceutical and biotechnology companies increasingly depend on biomarker-based immunoassays to support companion diagnostics and patient stratification in clinical trials. This integration ensures that targeted therapies reach the right patient groups, improving therapeutic outcomes while reducing healthcare costs. The regulatory environment in the U.S. also plays a crucial role in shaping this scope.

Alongside therapeutic uses, the market is expanding due to technological progress and digital integration. Automated immunoassay platforms combined with artificial intelligence for data analysis are supporting high-throughput and very sensitive biomarker testing. This growth is not limited to central labs but also reaches decentralized healthcare models, like point-of-care and at-home testing options. The use of saliva-based biomarker immunoassays, which are less invasive and simpler to collect, presents another major opportunity within the market’s evolving landscape.

Furthermore, the U.S. biomarker-based immunoassays market extends beyond healthcare delivery into research and academic institutions, where immunoassays are vital for biomarker discovery and validation. These institutions play a key role in driving innovation and forming partnerships with industry leaders, creating a cycle that supports new product development and clinical translation. Overall, the scope of the U.S. market is broad and dynamic, covering routine diagnostics, therapeutic monitoring, drug development, and academic research. This positions biomarker-based immunoassays as a fundamental technology within the evolving landscape of precision healthcare.

The demand for minimally invasive solutions has increased as clinicians look for reliable tools to detect diseases earlier and guide treatment decisions more accurately. This trend has led leading companies to focus on innovations in plasma and serum biomarkers, especially in fields such as oncology and neurology, where early diagnosis can greatly improve patient outcomes. In this context, several product innovations highlight the growing significance of blood-based biomarker immunoassays in clinical practice. For example, in April 2024 Roche's Elecsys pTau217 plasma biomarker test, developed with Eli Lilly, received Breakthrough Device Designation from the U.S. FDA, showing its potential to transform Alzheimer’s diagnosis. This test helps healthcare providers identify amyloid pathology, a key aspect of Alzheimer's disease, which can enable earlier, more accurate diagnoses. By improving access to timely diagnosis, the test not only improves patient care but also encourages patient participation in clinical trials and access to disease-modifying treatments, further increasing the demand for innovative blood-based biomarker tests in the U.S.

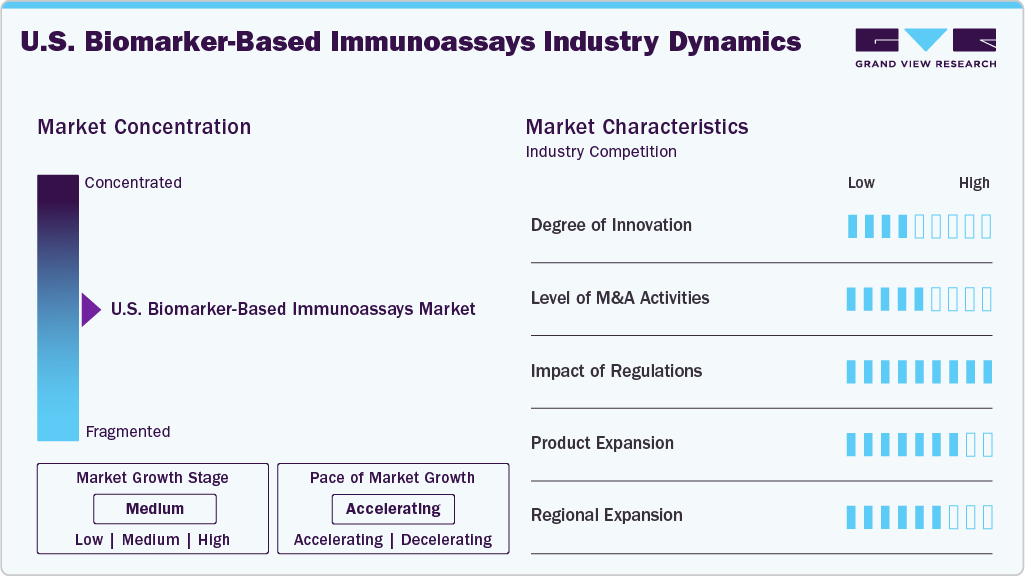

Market Concentration & Characteristics

The biomarker-based immunoassays market is characterized by a medium degree of innovation, as companies are actively developing new assays and enhancing automation but remain constrained by regulatory requirements and validation timelines. Innovation is largely focused on improving assay sensitivity, expanding non-invasive sample types such as saliva and urine, and integrating digital platforms for faster data interpretation. Recent FDA approvals of blood-based assays for Alzheimer’s and companion diagnostics for cancer therapies illustrate how innovation is closely tied to advancing personalized medicine rather than disruptive shifts.

The market has experienced a moderate level of merger and acquisition activity, with companies aiming to broaden their product portfolios and strengthen technological capabilities. Collaborations between diagnostic manufacturers and pharmaceutical companies are also noteworthy, reflecting the interdependence of biomarker immunoassays and diseases development, especially in oncology and targeted therapy markets. These activities underline the industry’s focus on portfolio diversification and enhanced technological capabilities.

Regulatory impact remains a defining element of the market, as stringent standards set by authorities such as the U.S. FDA ensure the clinical reliability, safety, and reproducibility of immunoassay-based biomarker tests. While rigorous validation requirements can act as barriers for smaller companies, they also reinforce confidence in assay performance and support adoption in clinical and research settings. Importantly, regulatory bodies have increasingly recognized the role of biomarker-based diagnostics in precision medicine, accelerating pathways for companion diagnostics approvals and thereby stimulating innovation and uptake in the field.

Companies such as Roche, Abbott, and Thermo Fisher have launched new immunoassay kits and reagents targeting disease-specific biomarkers. For example, Abbott expanded its cardiac biomarker portfolio in January 2025 with an NT-proBNP test for heart failure diagnostics, while Labcorp introduced an Alzheimer’s biomarker blood test in March 2024 for clinical use in the U.S. Such product diversification reflects the market’s move toward comprehensive biomarker panels that support preventive care, disease monitoring, and companion diagnostics.

Regional expansion in the U.S. biomarker-based immunoassays market is being shaped by the growing demand for advanced diagnostic testing across multiple states, particularly those with rising healthcare needs and strong adoption of precision medicine. Companies are strategically broadening their presence to strengthen accessibility in regions with expanding hospital networks and research hubs, such as the Northeast and West Coast, where academic medical centers and biopharmaceutical companies are concentrated. At the same time, efforts are also directed toward underserved regions in the Midwest and South, where establishing local laboratories and diagnostic service centers helps reduce turnaround times and improve patient access to specialized biomarker testing. This approach not only supports faster clinical decision-making but also aligns with the trend of decentralizing healthcare delivery.

Sample Insights

The blood segment led the biomarker-based immunoassays market in 2024 with a 60.39% share. Blood biomarkers are widely used in hospitals and reference labs, with more FDA approvals for assays supporting oncology and cardiology. However, saliva-based immunoassays are emerging as the fastest-growing category, driven by the need for non-invasive, affordable, and patient-friendly diagnostics. In June 2024, several U.S.-based startups announced saliva-based biomarker kits for stress, oral cancer, and viral infection screening. This shift supports the growth of telemedicine and home-based care, making saliva a viable option for large-scale population screening and personalized monitoring. For example, in February 2024, the FDA approved a new blood-based biomarker test for detecting recurrence in breast cancer patients, reinforcing the importance of blood in personalized oncology care. In cardiovascular diseases, blood biomarkers such as troponin and BNP remain essential for quick emergency diagnosis, and new immunoassay platforms are incorporating these markers with AI-driven analyzers to improve clinical decision-making.

The saliva segment is expected to grow at the fastest CAGR of 6.4% over the forecast period, driven by the increasing demand for non-invasive, patient-friendly, and cost-effective diagnostic solutions. Unlike blood draws, saliva collection requires no specialized training, making it highly suitable for home-based testing, telemedicine integration, and large-scale population screening programs. In 2024, multiple U.S. startups and research organizations advanced saliva-based biomarker applications for cancer, infectious diseases, and mental health. Various diagnostic firms are launching a saliva-based immunoassay for early detection of oral cancer, marking a step forward in non-invasive oncology diagnostics.

Product Insights

The reagents and kits segment led the market with the largest revenue share of 42.82% in 2024. Its dominance is supported by steady demand in oncology, infectious diseases, cardiology, and neurology. One of the major developments in 2024 was the FDA’s approval of Roche’s Elecsys Anti-HCV II assay for blood donor screening, expanding menu options on widely used analyzer platforms. In cardiovascular care, the FDA cleared Abbott’s NT-proBNP assay for the Alinity i system in January 2025, emphasizing the importance of kits in hospital emergency settings where rapid testing is essential.

The instruments/analyzers segment is expected to grow at the fastest CAGR of 6.6% over the forecast period, supported by technological innovations and the rising demand for automated, high-throughput testing systems. Hospitals and reference labs are investing in analyzers that reduce turnaround time and boost efficiency, especially as staffing shortages continue to challenge laboratories. Beckman Coulter’s DxI 9000 immunoassay analyzer, introduced in 2023 and showcased at the AACC conference in July 2023, continued to expand its presence in 2024 and 2025, offering improved sensitivity and minimal maintenance needs. Approvals related to neurology are also driving demand for analyzer upgrades.

Biomarker Insights

Based on the biomarkers, the efficacy & pharmacodynamic biomarkers segment led the market with the largest revenue share of 35.09% in 2024. They are widely used in oncology and have become essential tools in clinical trials and therapeutic decision-making. The FDA’s expanding list of companion diagnostics highlights the reliance on biomarkers for regulated treatment pathways. In October 2024, the FDA approved Genentech’s inavolisib in combination with other therapies for PIK3CA-mutated breast cancer, requiring detection by an approved test, showcasing how immunoassays are integrated into oncology care.

The predictive & prognostic biomarkers segment is projected to grow at the fastest CAGR of 6.2% during the forecast period. These biomarkers offer insights into disease progression and treatment response, making them valuable for both clinicians and patients. In December 2024, Agilent received FDA approval for its MMR IHC Panel pharmDx as a companion diagnostic for colorectal cancer,

enabling the identification of patients eligible for immunotherapy. This approval emphasized the increasing importance of prognostic markers in cancer treatment. Neurology is also contributing to the momentum in this segment.

Diseases Insights

Based on diseases, the cancer segment led the market with the largest revenue share of 38.98% in 2024. Immunoassays are critical for identifying tumor markers, measuring treatment response, and guiding precision oncology therapies. Several FDA approvals in 2024 and 2025 reinforced this leadership. In April 2024, Enhertu received a tumor-agnostic approval for HER2-expressing solid tumors, significantly expanding the use of HER2 biomarker testing across different cancer types. In October 2024, Genentech’s inavolisib was approved for PIK3CA-mutated breast cancer, requiring an FDA-approved test to confirm eligibility, underscoring the direct link between biomarker testing and treatment access.

The neurological segment is expected to grow at the fastest CAGR during the forecast period, primarily due to breakthroughs in Alzheimer’s diagnostics. On May 16, 2025, the FDA approved the first blood-based Alzheimer’s test, the Lumipulse G pTau217/β-Amyloid ratio, which enables physicians to assess patients without relying solely on expensive PET scans or invasive cerebrospinal fluid analysis. This approval marked a turning point in neurology testing and is expected to drive significant adoption in both hospitals and reference laboratories.

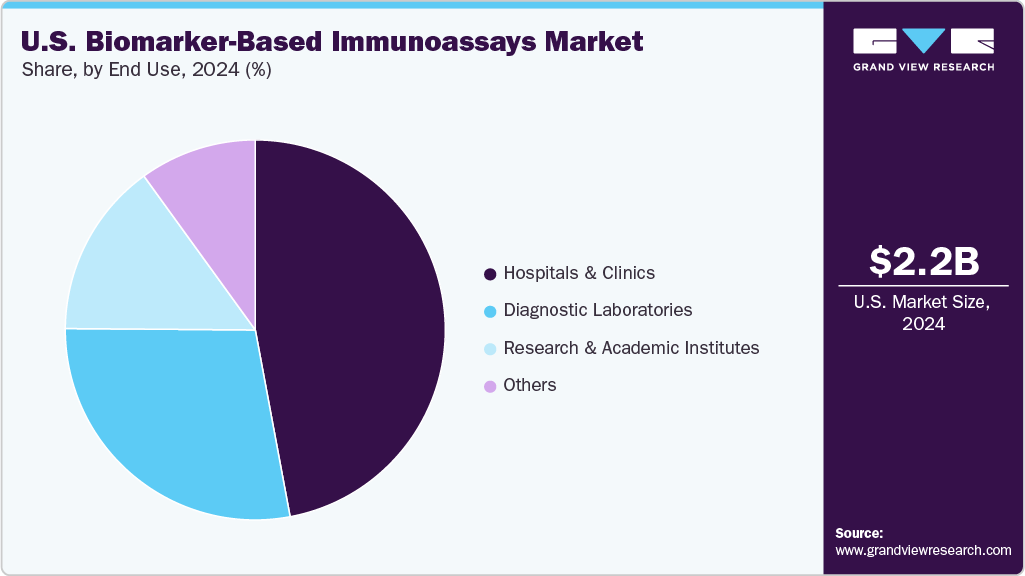

End Use Insights

Based on end use, the hospitals & clinics segment led the market with the largest revenue share of 47.06% in 2024. Hospitals rely on immunoassays for emergency testing, oncology diagnostics, and chronic disease management. The integration of new assays into hospital laboratories reflects their critical role. For instance, in April 2024, the FDA cleared Abbott’s whole-blood traumatic brain injury test, designed for rapid use in emergency departments, while in January 2025, Abbott’s NT-proBNP assay received clearance for heart failure assessment in hospital settings.

The diagnostic laboratories segment is projected to grow at the fastest CAGR of 5.3% during the forecast period. Unlike hospitals and clinics, which focus on point-of-care testing, diagnostic laboratories are equipped with high-throughput automated analyzers capable of processing thousands of biomarker samples daily. This makes them key players in cancer screening, infectious disease monitoring, and chronic disease management. Several leading reference laboratories in the U.S., such as Labcorp and Quest Diagnostics, have expanded their biomarker immunoassay offerings in recent years. For example, in March 2024, Labcorp announced the launch of a new Alzheimer’s blood biomarker test designed for routine clinical use, indicating the growing adoption of advanced biomarker testing in mainstream diagnostic labs.

Key U.S. Biomarker-Based Immunoassays Company Insights

Key participants in the biomarker-based immunoassays market are focusing on developing innovative testing solutions and securing necessary certifications to broaden their offerings. In addition, companies are entering into partnerships, collaborations, mergers, and acquisitions to strengthen their presence in the sector. These players are heavily investing in advanced technology and infrastructure, allowing them to efficiently process & analyze a large volume of samples. Moreover, companies undertake various strategic initiatives with other companies and distributors to strengthen their market presence.

Key U.S. Biomarker-Based Immunoassays Companies:

- F. Hoffmann-La Roche AG

- Abbott

- Thermo Fisher Scientific Inc

- Erofins Scientific

- QIAGEN

- Bio-Rad Laboratories, Inc.

- Siemens Healthineers AG

- Merck KGaA

- PerkinElmer Inc.

- Agilent Technologies, Inc.

Recent Developments

-

In January 2025, Quanterix Corporation announced a merger agreement to acquire Akoya Biosciences, combining their expertise to create the first integrated solution for ultra-sensitive detection of blood- and tissue-based protein biomarkers. The merger will accelerate biomarker translation, expand customer relationships, and deliver significant cost synergies.

-

In April 2024 Roche's Elecsys pTau217 plasma biomarker test, developed in collaboration with Eli Lilly, received Breakthrough Device Designation from the U.S. FDA, highlighting its potential to revolutionize Alzheimer’s diagnosis. This test aids healthcare providers in identifying amyloid pathology, a key feature of Alzheimer's disease, which can lead to earlier, more accurate diagnoses.

U.S. Biomarker-Based Immunoassays Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 2.32 billion

Revenue forecast in 2033

USD 4.28 billion

Growth Rate

CAGR of 7.95% from 2025 to 2033

Base year for estimation

2024

Historical data

2021 - 2023

Forecast period

2025 - 2033

Quantitative units

Revenue in USD billion/million and CAGR from 2025 to 2033

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Sample, product, biomarkers, diseases, end use, region

Key companies profiled

F. Hoffmann-La Roche AG.; Abbott.; Thermo Fisher Scientific Inc.; Bio-Rad Laboratories, Inc.; Siemens Healthineers AG; QIAGEN; Merck KGaA; PerkinElmer Inc.; Agilent Technologies, Inc.; Eurofins Scientific

Customization scope

Free report customization (equivalent up to 8 analysts’ working days) with purchase. Addition or alteration to country, regional & segment scope

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

U.S. Biomarker-Based Immunoassays Market Report Segmentation

This report forecasts revenue growth and provides an analysis on the latest trends in each of the sub-segments from 2021 to 2033. For the purpose of this report, Grand View Research has segmented the U.S biomarker-based immunoassays market on the basis sample, product, biomarkers, diseases, end use and region.

-

Sample Outlook (Revenue, USD Million, 2021 - 2033)

-

Blood

-

Tissue

-

Urine

-

Saliva

-

-

Product Outlook (Revenue, USD Million, 2021 - 2033)

-

Consumables

-

Instruments/Analyzers

-

Reagent & Kits

-

Services

-

-

Biomarker Outlook (Revenue, USD Million, 2021 - 2033)

-

Safety & toxicity biomarkers

-

Efficacy & Pharmacodynamic Biomarkers

-

Predictive & Prognostic Biomarkers

-

Surrogate/Exploratory Biomarkers

-

-

Diseases Outlook (Revenue, USD Million, 2021 - 2033)

-

Cancer

-

Cardiovascular Diseases

-

Neurological Diseases

-

Immunological Diseases

-

Others

-

-

End Use Outlook (Revenue, USD Million, 2021 - 2033)

-

Hospitals & Clinics

-

Diagnostic Laboratories

-

Research & Academic Institutes

-

Others

-

Frequently Asked Questions About This Report

b. The U.S. biomarker-based immunoassays market size was estimated at USD 2.17 billion in 2024 and is expected to reach USD 2.32 billion in 2025.

b. The U.S. biomarker-based immunoassays market is expected to grow at a compound annual growth rate of 7.95% from 2025 to 2033 to reach USD 4.28 billion by 2033.

b. The blood segment led the biomarker-based immunoassays market in 2024 with a share of 60.39%. Blood has long been considered the gold standard for biomarker-based immunoassays because it offers direct access to systemic biomarkers that reflect disease progression and therapeutic response

b. Some key players operating in the market include F. Hoffmann-La Roche AG.; Abbott.; Thermo Fisher Scientific Inc.; Bio-Rad Laboratories, Inc.; Siemens Healthineers AG; QIAGEN; Merck KGaA; PerkinElmer Inc.; Agilent Technologies, Inc.; Eurofins Scientific

b. Key factors that are driving the U.S. biomarker-based immunoassays market growth include the rising global burden of chronic diseases such as cancer, cardiovascular disorders, and neurological conditions, which require precise and early diagnostic tools

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.