- Home

- »

- Medical Devices

- »

-

U.S. Biopharmaceutical Third-party Logistics Market, Report 2030GVR Report cover

![U.S. Biopharmaceutical Third-party Logistics Market Size, Share & Trends Report]()

U.S. Biopharmaceutical Third-party Logistics Market (2025 - 2030) Size, Share & Trends Analysis Report By Supply Chain (Cold Chain, Non-cold Chain), By Service (Transportation, Warehousing & Storage), By Product (Specialty Drugs, Plasma Derived Products), And Segment Forecasts

- Report ID: GVR-4-68038-381-2

- Number of Report Pages: 120

- Format: PDF

- Historical Range: 2018 - 2024

- Forecast Period: 2025 - 2030

- Industry: Healthcare

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Market Size & Trends

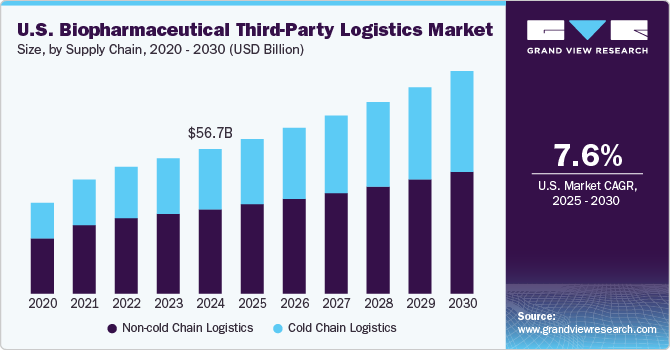

The U.S. biopharmaceutical third-party logistics market size was estimated at USD 56.73 billion in 2024 and is projected to grow at a CAGR of 7.56% from 2025 to 2030. The market is experiencing lucrative growth due to the increasing trend of outsourcing logistics, pharmaceutical companies' importance for strong distribution networks owing to strong sales numbers, and a surge in the number of biosimilar launches. Further, the growing demand for biologics and specialty drugs, which require stringent temperature control, has significantly boosted the need for advanced cold-chain logistics solutions. Increasing regulatory requirements for storing and transporting biopharmaceutical products, particularly with the rise of precision medicine, are likely to contribute to market growth. The COVID-19 pandemic highlighted the importance of efficient supply chain solutions, further accelerating investments in 3PL services to ensure the timely delivery of vaccines and critical medicines.

Moreover, biopharmaceutical companies are increasingly outsourcing logistics functions to 3PL providers to focus on core activities such as drug development to limit operational costs and enhance efficiency, thereby accelerating market demand. The rapid advancement of technology, including real-time monitoring systems and IoT-enabled devices used to enhance the visibility and safety of pharmaceutical products in transit and improve supply chain management, positively influence the market growth potential in the near future. These advanced technologies reduce human errors and safeguard product integrity by ensuring precise temperature management throughout the supply chain. By integrating advanced systems, 3PL providers automate operations and ensure compliance with strict pharmaceutical regulations, further driving market demand. Additionally, the rise in personalized medicine and direct-to-patient distribution models is prompting a shift towards more specialized and flexible logistics services, propelling the growth of the U.S. biopharmaceutical third-party logistics market.

The COVID-19 pandemic acted as a major catalyst in driving the U.S. market, particularly in the cold chain sector. The development and distribution of COVID-19 vaccines, especially those requiring ultra-low temperatures, highlighted the need for innovative temperature-controlled packaging and logistics solutions. During the pandemic, the sudden surge in demand for cold chain logistics accelerated the adoption of advanced technologies and practices, expanding the market's capacity to handle biologics and other temperature-sensitive drugs. The market is expected to boost with enhanced capabilities in managing cold chain logistics with the growing adoption of vaccines and other biologics.

The growing need for reverse logistics in biopharmaceuticals owing to increased product recalls and shorter product life cycles creates ample market growth opportunities. Reverse logistics, especially in drug returns and recalls, is essential for efficiently managing unused or expired medications. Environmental concerns and cost optimization fuel demand for reverse logistics, ensuring safe disposal or redistribution of pharmaceutical products. As service management activities increase, 3PL providers enhance their reverse logistics services, making it a critical factor in market revenue growth.

The demand for outsourcing transportation services has grown significantly over the last few years. Outsourcing transportation services for distributing pharmaceutical drugs has reduced the overheads of large biopharmaceutical companies. Furthermore, the big biopharma companies outsource to 3PL service providers to reduce the overall operating cost, promote lean management, and apply Six Sigma in their business operations. This, in turn, is expected to lower the prices of pharmaceutical products, positively propelling market demand.

Supply Chain Insights

The non-cold chain logistics segment accounted for the largest revenue share of 58.39% in 2024. The segment is primarily driven by the distribution of standard biopharmaceutical products that do not require stringent temperature control, allowing for a broader range of transportation and storage options. This segment benefits from the rise of e-commerce and direct-to-consumer models, which increase the demand for efficient, cost-effective supply chains capable of delivering non-perishable biotechnology products to hospitals, pharmacies, and consumers. Furthermore, advancements in packaging and tracking technologies have enhanced the safety and efficiency of non-cold logistics, ensuring product integrity while in transit, thereby accelerating segmental demand. Outsourcing logistics for these products enables biotechnology companies to focus on research and development while 3PL providers manage warehousing, distribution, and last-mile delivery. The scalability and flexibility offered by non-cold logistics services are critical as biotechnology companies continue to expand their product portfolios and geographic reach.

On the other hand, the cold chain segment is projected to register the fastest CAGR from 2025 to 2030. This is mainly due to the increasing need for cold chain logistics services to handle temperature-sensitive products such as biologics, gene therapies, vaccines, and other high-value treatments. These products require stringent temperature control throughout the supply chain, often involving specialized cold chain solutions such as refrigerated trucks, temperature-controlled packaging, and advanced monitoring systems. Thus, rising demand for biologics and cell and gene therapies, which are highly sensitive to temperature fluctuations, propelling segment revenue growth.

Further, compliance with stringent regulatory norms imposed by the U.S. FDA regarding precise temperature management is necessary to maintain product efficacy. Additionally, with the growing emphasis on personalized medicine and complex biological therapies, the cold logistics segment is expanding to meet the needs of more specialized and direct-to-patient distribution models. The ongoing investment in cold storage infrastructure, along with innovations in packaging and transportation, are some key aspects accelerating the segment growth in the U.S.

Service Insights

The warehousing and storage segment dominated the market in 2024. This segment provides specialized storage solutions for both temperature-sensitive and non-sensitive products, integrating high-tech systems such as automated warehouses and real-time inventory management. With rising demand for biologics and complex therapies, there is increased investment in advanced storage facilities, including cold and ambient warehouses. Additionally, regulatory requirements necessitate strict adherence to Good Distribution Practices (GDP), driving biotech companies to rely on 3PL providers for efficient, compliant warehousing. Thus, the aforementioned factors are anticipated to propel segment growth in the forthcoming years.

On the other hand, transportation services segment is expected to grow at a significant CAGR from 2025 to 2030. This segment features timely and secure delivery, employing specialized vehicles equipped for both cold and ambient temperature management to assist diverse product needs. With advancements in logistics technology, such as GPS tracking and route optimization software, transportation providers enhance visibility and efficiency throughout the supply chain. Additionally, the demand for direct-to-patient delivery models has increased, prompting 3PL companies to adopt flexible transportation solutions that cater to personalized medicine. Thus, transportation service is critical to maintain the integrity and compliance of biotech products during transit, supporting the overall market growth.

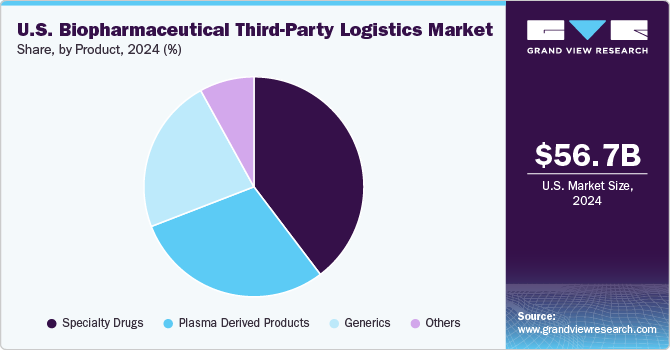

Product Insights

The specialty drugs segment accounted for the largest revenue share in the market in 2024 and is expected to witness the highest CAGR over the estimated timeline. This is attributed to the unique handling requirements of these high-value, often temperature-sensitive medications. Specialty drugs typically require specialized storage, distribution, and monitoring to ensure their efficacy and safety.

As the demand for these medications grows, 3PL providers are enhancing their capabilities to include customized solutions such as patient-centric distribution models, inventory management, and comprehensive compliance with regulatory standards to gain a competitive edge in the market. In addition, the integration of advanced tracking technologies and personalized services assists in improved visibility throughout the supply chain. The growing trend toward personalized medicine and the need for efficient logistics in delivering specialty therapies to patients is likely to boost market growth.

On the other hand, plasma derived products is expected to grow at a notable CAGR from 2025 to 2030. As growing demand for plasma-derived therapies including immunoglobulins, clotting factors, and albumin, 3PL providers are adapting their services to include advanced cold chain solutions, secure transportation, and comprehensive compliance with regulatory requirements. In addition, the emphasis on patient-centric distribution models enhances accessibility for patients requiring these life-saving therapies. The increasing importance of specialized logistics in delivering critical plasma-derived treatments accelerates the overall industry growth.

Key U.S. Biopharmaceutical Third-party Logistics Company Insights

The market is characterized by the presence of several key players that significantly influence market dynamics. Major 3PL companies such as UPS Healthcare, Cardinal Health, Thermo Fisher Scientific, DHL International GmbH, XPO Logistics, AmerisourceBergen, and others, utilize their extensive networks and advanced logistics solutions to cater to the unique needs of the biopharmaceutical sector. These companies are increasingly investing in technology and infrastructure to enhance their service offerings, including cold chain management and specialized distribution channels.

The competitive landscape is further shaped by collaborations and partnerships aimed at expanding capabilities and market reach. As demand for biopharmaceuticals continues to rise, these key players are well-positioned to capture a significant share of the growing market. For instance, in May 2023, DHL introduced a temperature-controlled air freight service to help transport medications in Indianapolis, U.S. With the USD 1.5 million initiative, the company aimed to extend its specialized life sciences and healthcare logistics network throughout the entire continental US and Puerto Rico. The company’s expansion in central Indiana enhanced the development, production, and transportation services for life sciences, healthcare, and pharmaceutical firms and gained a significant market share.

Key U.S. Biopharmaceutical Third-party Logistics Companies:

The following are the leading companies in the U.S. biopharmaceutical third-party logistics market. These companies collectively hold the largest market share and dictate industry trends.

- UPS Healthcare

- Cardinal Health

- KUEHNE + NAGEL

- AmerisourceBergen Corp.

- McKesson Corporation

- Thermo Fisher Scientific

- DHL International GmbH

- DB Schenker

- Kerry Logistics Network Ltd.

- CEVA Logistics

- Agility Logistics

- SF Express

- XPO Logistics

- Cencora, Inc.

- EVERSANA

Recent Developments

-

In February 2024, DHL Supply Chain, part of Deutsche Post DHL Group, announced a significant USD 200 million investment aimed at expanding its life sciences and healthcare logistics capabilities. This initiative includes the construction of advanced warehouse facilities in Pennsylvania and North Carolina, increasing their operational footprint to over 13 million square feet. This strategic move positioned DHL Supply Chain to cater the growing demands of the healthcare sector while strengthening its competitive advantage in the U.S.

-

In November 2023, UPS Healthcare acquired MNX Global Logistics, a prominent player operating in time-critical logistics services. Through this acquisition, UPS broadened its healthcare service offerings and geographical reach in the U.S., Europe and Asia.

U.S. Biopharmaceutical Third-party Logistics Market Report Scope

Report Attribute

Details

Market Size Value in 2025

USD 60.75 billion

Revenue forecast in 2030

USD 87.44 billion

Growth rate

CAGR of 7.56% from 2025 to 2030

Actual data

2018 - 2024

Forecast period

2025 - 2030

Quantitative units

Revenue in USD billion and CAGR from 2025 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Supply chain, service, product, country

Country scope

U.S.

Key companies profiled

UPS Healthcare; Cardinal Health; KUEHNE + NAGEL; AmerisourceBergen Corp.; McKesson Corporation; Thermo Fisher Scientific; DHL International GmbH; DB Schenker; Kerry Logistics Network Ltd.; CEVA Logistics; Agility Logistics; SF Express; XPO Logistics; Cencora, Inc.; EVERSANA

Customization scope

Freereport customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, and segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

U.S. Biopharmaceutical Third-party Logistics Market Report Segmentation

This report forecasts revenue growth at the country level and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the U.S. biopharmaceutical third-party logistics market report based on the supply chain, service, and product:

-

Supply Chain Outlook (Revenue, USD Billion, 2018 - 2030)

-

Cold Chain

-

Non-cold Chain

-

-

Service Outlook (Revenue, USD Billion, 2018 - 2030)

-

Transportation

-

Air Freight

-

Sea Freight

-

Overland

-

-

Warehousing & Storage

-

Other Services

-

-

Product Outlook (Revenue, USD Billion, 2018 - 2030)

-

Specialty Drugs

-

Generics

-

Plasma Derived Products

-

Others

-

Frequently Asked Questions About This Report

b. The U.S. biopharmaceutical third-party logistics market size was estimated at USD 56.73 billion in 2024 and is expected to reach USD 60.75 billion in 2025.

b. The U.S. biopharmaceutical third-party logistics market is expected to grow at a compound annual growth rate of 7.56% from 2025 to 2030 to reach USD 87.44 billion by 2030.

b. Non-cold chain logistics dominated the U.S. biopharmaceutical third-party logistics market with a share of 58.39% in 2024. This is largely attributed to the fact that the majority of pharmaceutical drugs do not need temperature control and are shipped as general cargo.

b. Some of the players operating in the U.S. biopharmaceutical 3PL market include DUPS Healthcare; Cardinal Health; KUEHNE + NAGEL; AmerisourceBergen Corp.; McKesson Corporation; Thermo Fisher Scientific; DHL International GmbH; DB Schenker; Kerry Logistics Network Ltd.; CEVA Logistics; Agility Logistics; SF Express; XPO Logistics; Cencora, Inc.; EVERSANA .

b. The U.S. biopharmaceutical 3PL market is majorly driven by the launch of innovative biopharmaceutical products, including cell & gene therapies that are creating more demand for cold chain storage, transport & distribution solutions. Besides, third-party logistics providers are also investing in advanced technology due to fluctuating demand and capacity problems.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.