- Home

- »

- Plastics, Polymers & Resins

- »

-

U.S. Bottled Water Packaging Market Size Report, 2033GVR Report cover

![U.S. Bottled Water Packaging Market Size, Share & Trends Report]()

U.S. Bottled Water Packaging Market (2025 - 2033) Size, Share & Trends Analysis Report By Material (Plastic, Glass, Metal), By Distribution Channel (Retail Stores, Ecommerce, Supermarkets), By Application, And Segment Forecasts

- Report ID: GVR-4-68040-663-2

- Number of Report Pages: 100

- Format: PDF

- Historical Range: 2021 - 2023

- Forecast Period: 2025 - 2033

- Industry: Bulk Chemicals

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

U.S. Bottled Water Packaging Market Trends

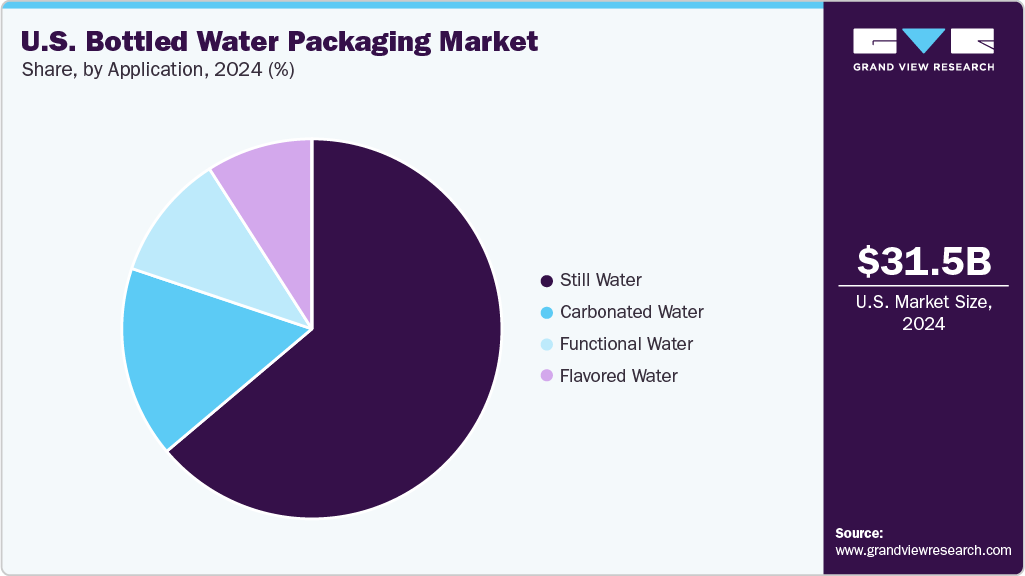

The U.S. bottled water packaging market size was valued at USD 31.54 billion in 2024 and is expected to expand at a CAGR of 6.6% from 2025 to 2033. Rising health consciousness and increasing demand for convenient, on-the-go hydration drive the U.S. bottled water packaging industry.

Key Market Trends & Insights

- By material, the metal segment is expected to grow at a considerable CAGR of 7.0% from 2025 to 2033 in terms of revenue.

- By distribution channel, the e-commerce segment is expected to grow at a considerable CAGR of 7.2% from 2025 to 2033 in terms of revenue.

- By application, the functional water segment is expected to grow in revenue at a considerable CAGR of 9.0% from 2025 to 2033.

Market Size & Forecast

- 2024 Market Size: USD 31.54 Billion

- 2033 Projected Market Size: USD 56.06 Billion

- CAGR (2025-2033): 6.6%

Additionally, innovations in sustainable and recyclable packaging solutions are fueling market growth. The U.S. bottled water packaging industry is primarily driven by shifting consumer preferences toward healthier lifestyles, spurring a steady decline in sugary beverage consumption and a corresponding rise in bottled water demand. According to the International Bottled Water Association (IBWA), bottled water has overtaken carbonated soft drinks as the most consumed beverage in the U.S. Consumers increasingly view bottled water as a cleaner, healthier, and more convenient hydration option, especially as awareness grows around the health risks of obesity, diabetes, and word other sugar-related diseases. Functional water varieties such as electrolyte-infused, alkaline, and vitamin-enriched options are also gaining traction, particularly among fitness-conscious and younger demographics.Additionally, the expansion of on-the-go consumption and urban mobility, particularly in metropolitan areas with high commuting and outdoor activity, is driving the country's market growth. The convenience of single-serve PET bottles has made them a staple in daily routines-from gyms and offices to public events and travel hubs. Companies such as Nestlé, Coca-Cola (Dasani), and PepsiCo (Aquafina) continue to invest in diverse bottle sizes and portable formats to cater to mobile consumers. Innovations such as lightweight bottles, easy-grip designs, and resealable caps also enhance consumer convenience and drive repeat purchases.

Moreover, sustainability-driven packaging innovation is emerging as both a challenge and an opportunity in the U.S. market. Amid rising consumer and regulatory pressure to reduce plastic waste, manufacturers invest heavily in recycled PET (rPET), biodegradable materials, and refillable systems. For example, The Coca-Cola Company has committed to using 50% recycled content in its bottles by 2030 under its “World Without Waste” initiative. Similarly, startups like JUST Water offer paper-based bottles with sugarcane caps, tapping into the eco-conscious consumer segment. These sustainable packaging solutions help brands meet regulatory compliance (such as California’s recycled content laws) and serve as a powerful marketing differentiator in a highly competitive market.

Market Concentration & Characteristics

This industry operates on large-scale volumes with relatively thin profit margins, particularly in the commoditized still-water segment. Economies of scale are critical for profitability, making efficient logistics, lightweight packaging, and essential automation. Cost control in materials (especially PET resin), transportation, and production directly impacts competitiveness. Premium bottled waters and functional water products offer slightly higher margins but lower volumes.

There is a growing emphasis on eco-friendly packaging, including recycled PET (rPET), biodegradable plastics, and reusable bottles. Regulatory mandates, such as California’s requirement for minimum recycled content in plastic bottles (50% by 2030), are shaping packaging strategies. Brands that balance sustainability goals with product performance and cost-efficiency are gaining a competitive edge. This makes R&D in packaging materials and circular economy practices a defining industry characteristic.

Material Insights

The plastic segment recorded the largest market revenue share of over 77.0% in 2024. Plastic is the most widely used material, with PET being the most common resin due to its lightweight, durability, and cost-effectiveness. Plastic bottles dominate the market, especially in single-use, small-sized formats for convenience and on-the-go consumption. The material offers excellent barrier properties against moisture and gases and is widely accepted in recycling systems. The growth of plastic packaging is driven by its affordability, mass production scalability, and light shipping weight, which reduces transportation costs and carbon footprint.

The metal segment is expected to grow at the fastest CAGR of 7.0% during the forecast period. Aluminum and steel bottles are a niche but growing segment in the market. They are valued for their durability, recyclability, and ability to protect the product from light and oxygen. Brands leveraging metal packaging often target sustainability-conscious consumers and active lifestyle markets. The growth of metal packaging is driven by increasing demand for sustainable and reusable options. Aluminum has one of the highest recycling rates among packaging materials, and its lightweight, shatterproof properties make it attractive for outdoor and travel uses.

Distribution Channel Insights

The retail stores segment recorded the largest market revenue share of over 37.0% in 2024. Retail stores remain a significant distribution channel, especially in urban and semi-urban areas. These outlets typically include small neighborhood shops, convenience stores, and independent grocers that stock bottled water from both global and local brands. They provide easy accessibility, allowing consumers to purchase bottled water in single units or small quantities as needed. Retail stores thrive on their proximity to consumers, impulse buying behavior, and the need for on-the-go hydration.

The e-commerce segment is expected to grow at the fastest CAGR of 7.2% during the forecast period. E-commerce has emerged as a fast-growing distribution channel for bottled water, particularly in urbanized and digitally connected regions. Through online platforms such as Amazon, Walmart, and others, consumers can purchase various bottled water products in bulk or as subscription services, with home delivery convenience.

Application Insights

The still water segment recorded the largest market share of over 63.0% in 2024. Still water, or non-carbonated water, is the most consumed form of bottled water globally. It includes spring , purified and mineral water, and is typically sold in plastic (PET), glass, or carton-based packaging. This segment holds the largest market share due to its wide consumer base and low price point. The growth of still water packaging is primarily driven by increasing health consciousness among consumers who are shifting away from sugary and carbonated beverages. Urbanization, tourism, and the availability of small and large-size packaging options further boost its demand.

The functional water segment is projected to grow at the fastest CAGR of 9.0% during the forecast period. Functional water includes water enhanced with ingredients such as vitamins, minerals, electrolytes, amino acids, or antioxidants. It is marketed for its health benefits and performance, enhancing properties, making it popular among athletes and fitness-conscious individuals. Rising awareness around fitness, immunity, and holistic wellness has led to increasing consumption of functional water. The packaging market benefits from this trend as brands innovate with clear labeling, sustainable bottles, and convenient formats. Growth in the sports and wellness sectors, andendorsements from health influencers,further ddrivedemand.

Key U.S. Bottled Water Packaging Company Insights

The competitive environment of the bottled water packaging market in the U.S. is highly dynamic and fragmented, driven by a mix of global packaging giants, regional players, and private-label brands. Key players such as Amcor plc, Berry Global Inc., and Ball Corporation dominate the market with advanced manufacturing capabilities, sustainable packaging innovations, and strong partnerships with major beverage companies. Competition is intensified by the growing consumer demand for eco-friendly and convenient packaging solutions, prompting players to invest heavily in recyclability, design differentiation, and digital labeling. Price sensitivity, regulatory pressure around plastic usage, and the rise of local bottled water brands with unique value propositions amplify market rivalry.

-

In December 2023, Cove, a California-based material innovation company, launched a 100% biodegradable water bottle, partnering with Los Angeles premium organic grocer Erewhon for its initial retail debut. The bottles and caps are made from polyhydroxyalkanoate (PHA), a biopolymer produced by microorganisms certified to biodegrade in marine, soil, and freshwater environments and in industrial and home composting. The bottles are plastic-free, renewable, non-toxic, and compostable, breaking down in industrial composting conditions within 90 days and in natural environments in less than five years. This launch is significant in addressing single-use plastic pollution by offering a direct, sustainable alternative to conventional plastic bottles.

Key U.S. Bottled Water Packaging Companies:

- Amcor plc

- Ball Corporation

- Owens-Illinois (O-I)

- Carow Packaging

- Ardagh Group

- Berry Global Inc.

- ALPLA

- Silgan Plastics

- Graham Packaging

- Plastipak Holdings, Inc.

- Apex Plastics

U.S. Bottled Water Packaging Market Report Scope

Report Attribute

Details

Revenue forecast in 2033

USD 56.06 billion

Growth rate

CAGR of 6.6% from 2025 to 2033

Historical data

2021 - 2023

Forecast period

2025 - 2033

Quantitative units

Revenue in USD million, and CAGR from 2025 to 2033

Report coverage

Revenue forecast, competitive landscape, growth factors, and trends

Segments covered

Material, distribution channel, application

States scope

North America, Europe, Asia Pacific, Latin America, and the Middle East & Africa

Key companies profiled

Amcor plc; Ball Corporation; Owens-Illinois (O-I); Carow Packaging; Ardagh Group; Berry Global Inc.; ALPLA; Silgan Plastics; Graham Packaging; Plastipak Holdings, Inc.; Apex Plastics

Customization scope

Free report customization (equivalent up to 8 analyst’s working days) with purchase. Addition or alteration to country, and segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

U.S. Bottled Water Packaging Market Report Segmentation

This report forecasts revenue growth at a country level and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2033. For this study, Grand View Research has segmented the U.S. bottled water packaging market report based on material, distribution channel, and application:

-

Material Outlook (Revenue, USD Million, 2021 - 2033)

-

Plastic

-

Glass

-

Metal

-

Others

-

-

Distribution Channel Outlook (Revenue, USD Million, 2021 - 2033)

-

Retail Stores

-

Ecommerce

-

Supermarkets

-

Hypermarkets

-

-

Application Outlook (Revenue, USD Million, 2021 - 2033)

-

Still Water

-

Flavored Water

-

Carbonated Water

-

Functional Water

-

Frequently Asked Questions About This Report

b. The U.S. bottled water packaging market was estimated at around USD 31.54 billion in the year 2024 and is expected to reach around USD 33.50 billion in 2025.

b. The U.S. bottled water packaging market is expected to grow at a compound annual growth rate of 6.6% from 2025 to 2033 to reach around USD 56.06 billion by 2033.

b. Still water segment emerged as the dominating application segment in the U.S. bottled water packaging market due to its widespread daily consumption, perceived health benefits, and affordability.

b. The key players in the bottled water packaging market include Amcor plc; Ball Corporation; Owens-Illinois (O-I); Carow Packaging; Ardagh Group; Berry Global Inc.; ALPLA; Silgan Plastics; Graham Packaging; Plastipak Holdings, Inc.; and Apex Plastics

b. The U.S. bottled water packaging market is driven by rising health consciousness, convenience, urbanization, and stringent safety regulations, along with increasing demand for sustainable and lightweight packaging solutions.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.