- Home

- »

- Medical Devices

- »

-

U.S. Breath Analyzers Market Size, Industry Report, 2030GVR Report cover

![U.S. Breath Analyzers Market Size, Share & Trends Report]()

U.S. Breath Analyzers Market (2025 - 2030) Size, Share & Trends Analysis Report By Technology (Fuel Cell, Semiconductor Sensor, Infrared Spectroscopy), By Application, By End Use, And Segment Forecasts

- Report ID: GVR-4-68039-915-7

- Number of Report Pages: 110

- Format: PDF

- Historical Range: 2018 - 2024

- Forecast Period: 2025 - 2030

- Industry: Healthcare

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

U.S. Breath Analyzers Market Size & Trends

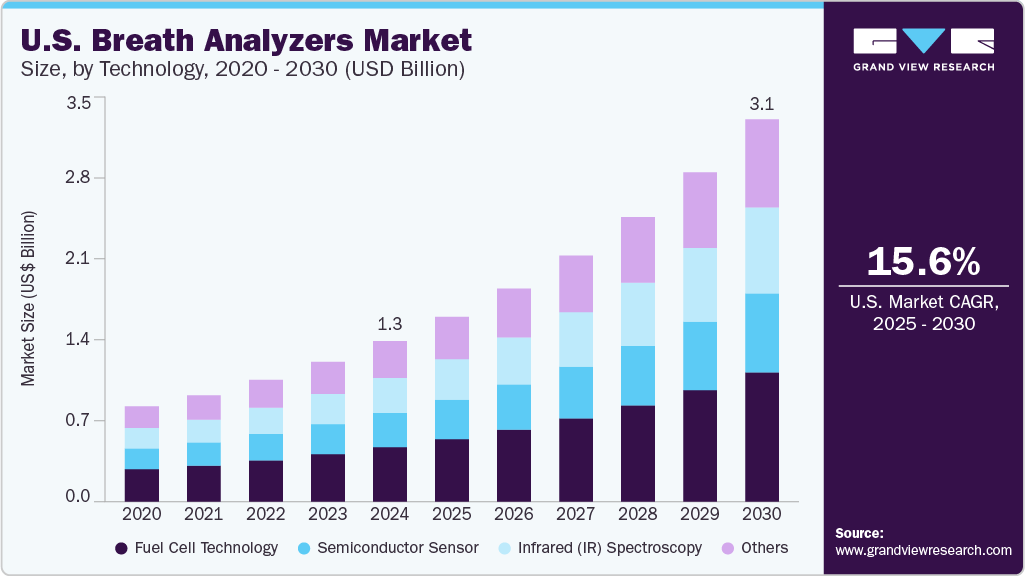

The U.S. breath analyzers market size was estimated at USD 1.32 billion in 2024 and is expected to grow at a CAGR of 15.64% from 2025 to 2030. Factors include increasing awareness of impaired driving, the growing adoption of breath analyzers in medical applications, technological advancements, and increasing alcohol consumption. The growing demand for breath analyzers from law enforcement agencies and other institutions, such as schools, sports, and offices, to minimize alcohol abuse is a major market driver.

Breath analyzers are quick and user-friendly and offer a correct way of determining blood alcohol concentration. The factor boosting sales of these devices is the growing, stringent regulations nationwide for alcohol breath testing while driving. Along with alcohol detection, breath analyzers are also utilized to diagnose tuberculosis, asthma, and various infections. Consequently, breath analyzers observe a proliferated implementation rate in medical settings and diagnostic centers.

Technological advancements in devices are one of the significant drivers. Newer models offer enhanced accuracy, quicker results, and portability, making them more appealing for law enforcement and medical use. Innovations include more compact designs, improved sensors for detecting specific biomarkers, and integration with mobile apps for data analysis. These technological improvements increased the efficiency and versatility of breath analyzers, leading to broader adoption across various industries and contributing to market expansion.

In April 2022, the U.S. Food and Drug Administration (FDA) approved the first breathalyzer test for COVID-19, created by Inspect IR Systems, LLC. This innovative test delivers results in just three minutes and identifies five volatile organic compounds (VOCs) linked to COVID-19. The pandemic increased the need for non-invasive testing options that facilitated social distancing, making breathalyzers an effective method for detecting COVID-19 and other health issues without the risk of spreading the virus.

The healthcare sector has emerged as a significant end user of breath analyzers, utilizing them for non-invasive diagnostics of various conditions, including asthma, diabetes, and gastrointestinal disorders. For instance, in June 2024, the National Institute of Standards and Technology (NIST) announced a partnership with the Bill & Melinda Gates Foundation to develop breathalyzers for malaria and tuberculosis diagnosis, aiming to establish precise testing standards and instruments for affordable and dependable breath-based diagnostics. This expanding application in healthcare is expected to drive demand for breath analyzers, particularly in regions with limited access to traditional diagnostic tools.

Personalized healthcare is growing, focusing more on customizing medical treatments and monitoring according to individual health data. Breath analyzers play a key role in this shift by offering a non-invasive way to track biomarkers associated with various conditions. For instance, wearable breath analyzers are utilized for personalized health monitoring, providing valuable insights into asthma, diabetes, and metabolic disorders. This increasing demand for tailored health management drives innovation and adoption in the market, benefiting consumer wellness and healthcare monitoring sectors.

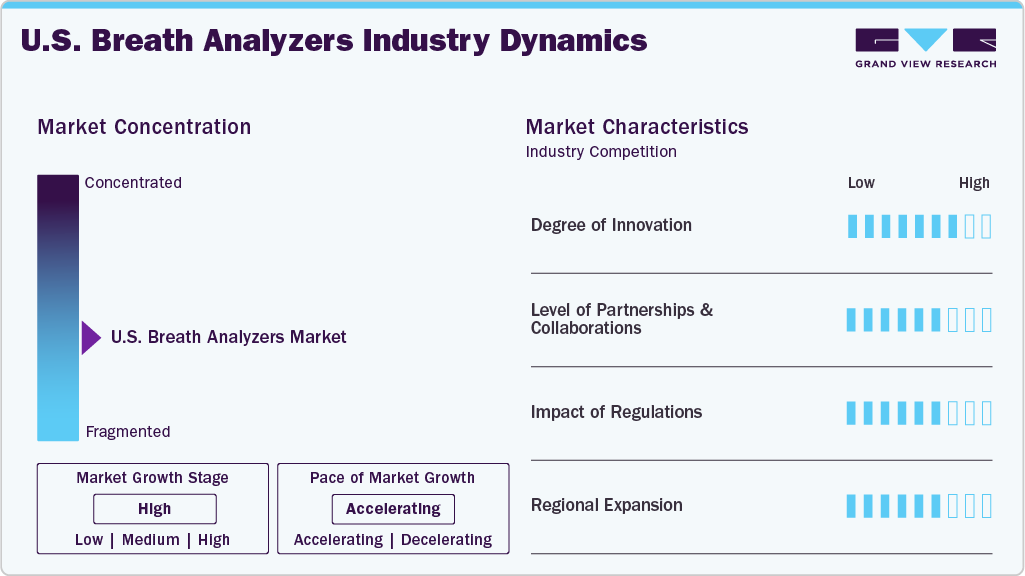

Market Concentration & Characteristics

The U.S. market is marked by high innovation, driven by advancements in sensor technologies, miniaturization, and the development of non-invasive medical diagnostics. For instance, in November 2024, Avalon GloboCare introduced the "BrAce for Impact" affiliate marketing program to promote the KetoAir Breathalyzer device. These innovations enhance accuracy, reliability, and ease of use, contributing to market growth.

M&A activities are medium, with companies seeking to expand their technological capabilities and market share. Companies acquire smaller players to enhance their technological capabilities and expand their product portfolios. These activities allow firms to access new markets, improve R&D, and gain a competitive edge. M&A is not too frequent, and it plays a significant role in facilitating growth and innovation in the market.

Regulatory frameworks significantly impact diagnostic device safety, effectiveness, and quality, particularly in medicine. Agencies such as the U.S. FDA and the EU Medical Device Regulation (MDR) enforce strict standards that manufacturers must adhere to. Before entering the market, companies must pass extensive testing and certification processes to ensure their products meet the required regulatory criteria. This protects patient safety and ensures that devices deliver reliable, consistent results. As regulations evolve, companies remain agile, adapting to new requirements that promote innovation while maintaining compliance and minimizing risks associated with non-compliant products.

Regional expansion is a key growth driver in the U.S. market, with stricter DUI laws in states such as California and New York. Companies expand their reach to these high-regulation areas to meet the increased demand for alcohol detection devices. The rising healthcare awareness and breath analyzers are being adopted in hospitals nationwide, pushing for wider regional adoption, especially in metropolitan regions.

Technology Insights

The fuel cell technology segment held the largest revenue share of 33.89% in 2024. Its high accuracy, stability, and sensitivity in detecting specific biomarkers such as ethanol and acetone in breath drive this growth. This technology offers rapid results and is widely used in alcohol detection, medical diagnostics, and wellness monitoring. Fuel cell-based breath analyzers are preferred for their durability and low maintenance requirements. The technology’s effectiveness in non-invasive testing continues to drive its market.

Infrared (IR) spectroscopy is anticipated to witness the fastest CAGR of 16.24% over the forecast period. The growth is attributed to its precision in detecting specific gases and compounds in exhaled breath. IR spectroscopy is non-invasive, quick, and provides real-time results, making it highly suitable for diagnosing respiratory diseases and diabetes and monitoring overall health. The technology’s growth is driven by advancements in sensor accuracy, improved portability, and the increasing demand for rapid, on-site diagnostics. Its ability to identify multiple biomarkers while offering minimal maintenance makes it a preferred choice for clinical and personal health monitoring applications.

Application Insights

The alcohol detection segment dominated the U.S. market due to increasing efforts in law enforcement to deny drunk driving and enhance public safety. High-profile incidents, stricter regulations, and increased impaired driving arrests increased demand for breath analyzers. Police officers widely use these devices during roadside checks, workplace testing, and personal use. Technological advancements, including accurate and portable devices, contribute to the segment's growth. The increasing prevalence of alcohol-related accidents and legal mandates for alcohol testing in various sectors drive the demand for reliable, quick alcohol detection solutions.

The medical applications segment is the fastest-growing U.S. market due to the rising demand for noninvasive diagnostic tools. These analyzers detect diseases such as diabetes, lung cancer, and infections, offering quick, accurate, and painless results. Growing awareness of preventive healthcare and the need for routine monitoring of conditions such as diabetes drive adoption. Instances of breath analyzers being integrated into healthcare settings, hospitals, and clinics reflect their potential to revolutionize patient care and disease management.

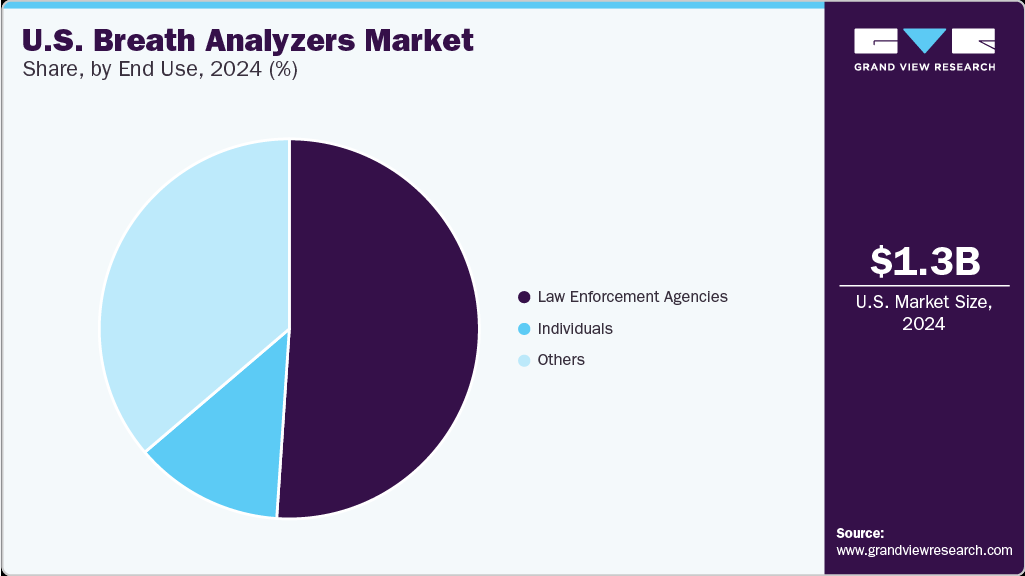

End Use Insights

The law enforcement agencies segment held the largest revenue share in the market, driven by stringent regulations against driving under the influence (DUI). Factors such as increased screening and testing and the need for accurate and reliable devices drive demand. Companies such as Lifeloc Technologies provide trusted handheld evidential breath testing instruments, supporting the segment's growth by offering high-accuracy solutions for effectively enforcing DUI laws.

The other segment is expected to exhibit lucrative growth in the market for breath analyzers during the forecast period. High crime rates in specific parts and strict drug testing regulations implemented by governments in the nation are factors expected to support segment growth. Lifeloc Technologies, Inc. is among the American manufacturers of handheld evidential breath testing instruments for screening and confirmation testing of workforces in both nonregulated and DOT-regulated industries. The firm manufactures professional breath alcohol testers that are trusted countrywide by school resource officers and school administrators in middle schools, high schools, and colleges.

Key U.S. Breath Analyzer Company Insights

Companies entering with innovative products have great scope for growth, as the demand for innovative products is high. The key players are involved in new product launches, acquisitions, and partnerships to gain a competitive edge. For instance, in February 2022, FoodMarble Digestive Health Ltd. introduced the AIRE 2, a personal digestive breath tester.

Key U.S. Breath Analyzer Companies:

- Drägerwerk AG & Co. KGaA

- Lifeloc Technologies, Inc.

- Quest Products, LLC.

- Intoximeters

- Alcohol Countermeasure Systems Corp.

- AK GlobalTech Corp.

- PAS Systems International, Inc

- BACtrack

- Lion Laboratories

- Advanced Safety Devices

- MPD, Inc.

- Abbott Rapid Diagnostics (formerly known as Alere)

- AlcoPro

- GenWorks Health Pvt. Ltd.

Recent Developments

-

In January 2025, Relias acquired Feedtrail to improve its workforce solutions by integrating patient feedback capabilities.

“Feedtrail is incredibly excited to join Relias and extend the impact of our patient experience solutions to the entire continuum of care. Relias’ expertise and offerings in post-acute, behavioral, and community health sectors accelerate our ability to also serve those markets and, together, to improve healthcare quality and outcomes.”

- Stephanie Alexander, Chair and CEO at Feedtrail.

-

In May 2023, GenWorks Health Pvt. Ltd. introduced FenomPro, a portable breath analyzer designed to measure Fractional exhaled Nitric Oxide (FeNO) levels, enabling more accurate detection and management of asthma. FenomPro streamlines the process of asthma diagnosis, screening, and ongoing monitoring, offering a reliable and user-friendly solution for clinical settings. Its compact design and rechargeable battery enhance portability, making it ideal for point-of-care use. The device features an intuitive interface and delivers precise test results in just 28 seconds, allowing healthcare professionals to make informed decisions quickly. By accurately measuring FeNO levels, FenomPro aids in determining whether a patient requires inhaler therapy, supporting more personalized and timely treatment plans.

-

In November 2020, MyMD Pharmaceuticals, a clinical-stage pharmaceutical company, and Akers Biosciences entered into a merger agreement. After closing the transaction, the new company was renamed MyMD Pharmaceuticals, Inc.

-

In July 2020, Lifeloc Technologies introduced two breath alcohol testers-LX9 and LT7. These testers are USA DOT/NHTSA-approved breathalyzers for workplace and law enforcement markets, with greater features that make them user-friendly, while helping make roadways and communities safer.

U.S. Breath Analyzers Market Report Scope

Report Attribute

Details

Revenue Forecast in 2025

USD 1.52 billion

Revenue Forecast in 2030

USD 3.13 billion

Growth rate

CAGR of 15.64% from 2025 to 2030

Actual data

2018 - 2024

Forecast data

2025 - 2030

Quantitative units

Revenue in USD million/billion and CAGR from 2025 to 2030

Report Coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments Covered

Technology, application, end use

Key companies profiled

Drägerwerk AG & Co. KGaA; Lifeloc Technologies, Inc.; Quest Products, LLC; Intoximeters; Alcohol Countermeasure Systems Corp.; AK GlobalTech Corp.; PAS Systems International, Inc.; BACtrack; Lion Laboratories; Advanced Safety Devices; MPD, Inc.; Abbott Rapid Diagnostics (formerly known as Alere); AlcoPro; GenWorks Health Pvt. Ltd.

Customization scope

Free report customization (equivalent to up to 8 analyst’s working days) with purchase. Addition or alteration to country & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

U.S. Breath Analyzers Market Report Segmentation

This report forecasts revenue growth at the country level and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the U.S. breath analyzers market report based on technology, application, and end use:

-

Technology Outlook (Revenue, USD Million, 2018 - 2030)

-

Fuel Cell Technology

-

Semiconductor Sensor

-

Infrared (IR) Spectroscopy

-

Others

-

-

Application Outlook (Revenue, USD Million, 2018 - 2030)

-

Drug Abuse Detection

-

Alcohol Detection

-

Medical Applications

-

-

End Use Outlook (Revenue, USD Million, 2018 - 2030)

-

Law Enforcement Agencies

-

Individuals

-

Others

-

Frequently Asked Questions About This Report

b. The global U.S. breath analyzers market size was estimated at USD 1.32 billion in 2024 and is expected to reach USD 1.52 billion in 2025.

b. The global U.S. breath analyzers market is expected to grow at a compound annual growth rate of 15.64% from 2025 to 2030 to reach USD 3.13 billion by 2030.

b. The fuel cell technology segment held the largest revenue share, 33.89%, in 2024. Its high accuracy, stability, and sensitivity in detecting specific biomarkers such as ethanol and acetone in breath drive this growth.

b. Some key players operating in the U.S. breath analyzers market include Drägerwerk AG & Co. KGaA, Lifeloc Technologies, Inc., Quest Products, LLC, Intoximeters, Alcohol Countermeasure Systems Corp., AK GlobalTech Corp., PAS Systems International, Inc, BACtrack, Lion Laboratories, Advanced Safety Devices, MPD, Inc., Abbott Rapid Diagnostics (Formally known as Alere), AlcoPro, GenWorks Health Pvt. Ltd.

b. Key factors that are driving the U.S. breath analyzers market growth include increasing alcohol and drug abuse, technological advancement, use of breathalyzers in the detection of chronic and infectious diseases across the world.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.