- Home

- »

- Consumer F&B

- »

-

U.S. Bubble Tea Market Size & Share, Industry Report, 2030GVR Report cover

![U.S. Bubble Tea Market Size, Share & Trends Report]()

U.S. Bubble Tea Market (2024 - 2030) Size, Share & Trends Analysis Report By Type (Black Tea, Green Tea, Oolong Tea), By Flavour (Fruit, Taro, Strawberry, Classic, Coffee), And Segment Forecasts

- Report ID: GVR-4-68040-214-8

- Number of Report Pages: 80

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2024 - 2030

- Industry: Consumer Goods

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

U.S. Bubble Tea Market Size & Trends

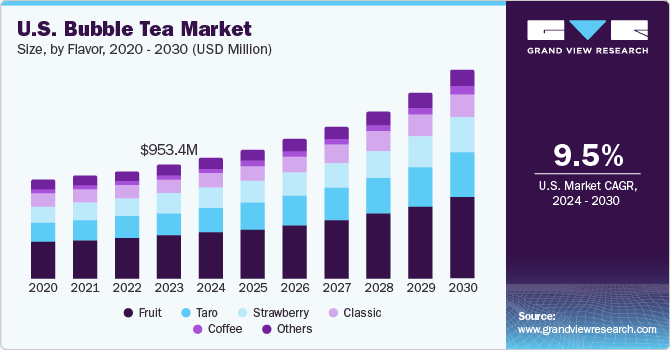

The U.S. bubble tea market size was estimated at USD 953.36 million in 2023 and is expected to grow at a compound annual growth rate (CAGR) of 9.5% from 2024 to 2030. Expected growth can be attributed to unceasing demand for tea and coffee-based drinks nootropics in the working population of the country, the availability of various flavors invented according to changing consumer preferences and likings, overall low-calorie contents of the product and zero-fat versions of it offered by innovative manufacturers. The drink was originated in Taiwan in 1980s, which was brought into the United States around 1990s. Since then, the bubble tea has gained popularity in different local markets of the country.

The U.S. bubble tea market accounted for 32.75% of the global bubble tea market in 2023. Bubble tea has become favourite of many consumers who are part millennials and Gen Z population. The drink is distributed by variety of sellers in different tastes and flavors, which lures consumers with diverse likings. Often, those who like beverages are constantly looking for novelty in terms of flavors and types of drinks. This factor plays a vital role in popularity of the bubble tea in the United States.

In addition, due to increasing awareness about the role of food in overall health of human being, large number of consumers in the U.S. prefer drinks that are less in calorie content and has less to zero sugar and fats in it. Bubble tea is one of such drinks with frothy texture, which is served cold with addition of chewy tapioca balls in it. The bubble tea is also known as Boba tea, bubble milk tea and Boba juice in different parts of the market.

Presence of diverse population in the United States has resulted in bringing variety of cuisines, foods and beverages to the local market, which belong to different countries or originated in other parts of the world. Consumers with origins from countries such as India, China, Malaysia, Indonesia, South Korea and Japan are also driving this market in the U.S. owing to the widespread tea culture in those parts.

Consumption of tapioca pearls is considered a health practice as they are naturally gluten-free and perceived as a great value addition by groups of health-conscious customers. This leads to the growing consumption of bubble tea as well. The market is witnessing several consumers changing their preferences from carbonated soft drinks to tea or coffee owing to increased awareness about possible side effects they might have on one’s health.

Market Concentration & Characteristics

The U.S. bubble tea industry is growing at an accelerating pace, and the growth stage is identified as high. The industry is characterized by the presence of many participants, out of which a few are well-established brands that have been in the business for a long time now, and some are recently established companies that have been generating a significant amount of sales to align themselves with the competitive market.

The degree of innovation is moderate in the industry. The innovation generally takes place in terms of flavors, as the invention of novel flavors attracts more consumers constantly. Consumers keep asking for different types of flavors, which might not be in line with traditional taste inclinations, but they match the modern consumer’s preferences and tastes.

The mergers & acquisitions in the U.S. bubble tea industry are at a moderate level. The industry is more comprised of partnerships and collaborations, which are developed with an intent to enhance the market penetration and generate more revenue thorough improved presence across various locations and segments of the industry as well.

The impact of regulation in this market is fairly low as these products are generally made and served on demand, only use of ingredients and quality of material used in the making is regularised by food and drug authorities. Packaged versions of bubble tea are still becoming a thing. The key regulations that have impact on this industry are organic certifications, foreign supplier verifications, and food safety compliances.

The threat of substitutes is at a moderate level for the U.S. bubble tea industry. This drink is generally preferred by young consumers who are always looking for alternatives when it comes to beverages. In addition, changing trends, reported incidences regarding the consumption of bubble tea, changing flavors, and social media influence are some of the factors that constantly influence the demand for bubble tea. This scenario is subjected to the entry and popularity of substitute drinks.

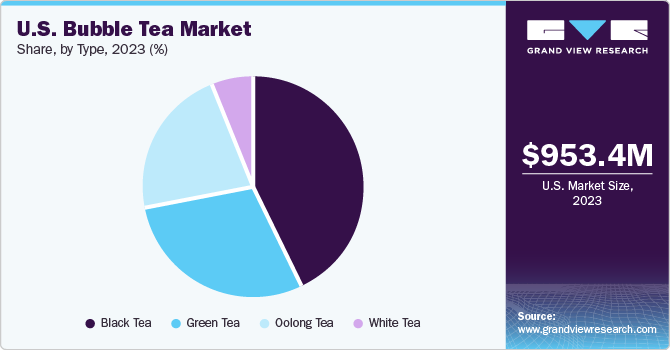

Type Insights

Black tea-based bubble tea market in the United States accounted for a share of 43.15% in 2023. The black tea type of bubble tea is widely popular owing to its authentic and natural flavour. In addition, the drink is believed to be helpful in reducing blood sugar levels and bad cholesterol while improving health of gut. It is an extraordinary source of antioxidants as well. These factors are contributing to the increasing demand for the product across the United States. The classic Taiwanese bubble tea is made out of black tea, milk, tapioca pearls, and syrups. This is one of the key reasons why most of the bubble teashops feature black tea with milk and sweetener. Black tea’s strong taste and sense of authenticity helps to maintain the taste factor of the drink even after addition of other flavouring ingredients and agents.

In the U.S., the green tea-based bubble tea market is expected to grow at a CAGR of 9.3% from 2024 to 2030. The expected growth can be attributed to the strong flavour that green tea has, which tends to blend well with milk. The most commonly used type of this is jasmine green tea. It is believed to be helpful in improving focus and metabolism, strengthening immune systems, and supporting body detox as well.

Flavour Insights

Fruit flavored bubble tea market accounted for a share of 38.2% in 2023. The growing response for fruit flavors in bubble tea is mainly due to the variety it offers. Consumers prefer this type of flavour as it offers nutrition and novelty as well. Health-conscious consumers tend to buy these drinks on a regular basis owing to the several vitamins and minerals they offer. The fruit-flavoured bubble tea is considered healthier than other varieties of it as they have less to no levels of caffeine content. Commonly used fruit flavors in bubble tea variants are lychee, passion fruit, green apple, pineapple, honeydew, coconut, grape, lemon and kiwi.

The taro flavors bubble tea market in the United States is expected to grow at a CAGR of 10.6% from 2024 to 2030. Taro is a root vegetable known for its toasty sweet flavor and starchy structure. The taro tea has gained a lot of popularity in U.S. market. Manufacturers use this ingredient mainly because of the purple colour element it adds and the incredible taste it offers.

Key U.S. Bubble Tea Company Insights

The U.S. bubble tea market is fragmented owing to the presence of several market participants who belong to large-scale as well as medium and small scale of operations. The market is moderately brand-driven; however, people like their bubble teas made according to their choice and taste inclination and worry less about the brands.

-

Kung Fu Tea, one of the many sought-after bubble tea makers in the U.S., was founded Queens, New York in 2010. Over period, the company has opened stores in more than 300 locations in the United States.

-

Shareeta, one among the global key companies for bubble tea, was founded in Taipai in 1992, which now has presence in 15 different countries and more than 500 locations.

Key U.S. Bubble Tea Companies:

- Kung Fu Tea

- Gong cha

- TIGER SUGAR

- Quickly Boba Tea

- ShareTea

- Boba Guys

- Tapioca Express

- Bubbles Tea & Juice Company

- Happy Lemon

- Chatime

Recent Developments

-

In December 2023, Chinese bubble tea company Heytea entered United States market by opening their first store in the country. In this newly opened store, they have sixteen different beverages available for buyers, including fruit-made tea and milk tea.

-

In December 2023, The Coffee Bean & Tea Leaf added Ceylon Milk Tea with Brown Sugar Boba to its menu in nine different stores on trial basis across Southern California and Arizona to address the growing demand for the product.

U.S. Bubble Tea Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 1,012.8 million

Revenue Forecast in 2030

USD 1.74 billion

Growth Rate

CAGR of 9.5% from 2024 to 2030

Actuals

2018 - 2023

Forecasts

2024 - 2030

Quantitative units

Revenue in USD Million/Billion and CAGR from 2024 to 2030

Report Coverage

Revenue forecast; company ranking; competitive landscape; growth factors; and trends

Segments Covered

Product, flavor

Key companies profiled

Kung Fu Tea; Gong cha; TIGER SUGAR; Quickly Boba Tea; ShareTea; Boba Guys; Tapioca Express; Bubbles Tea & Juice Company; Happy Lemon; Chatime

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

U.S. Bubble Tea Market Report Segmentation

This report forecasts revenue growth and provides an analysis of the latest industry trends in each of the sub-segment from 2018 to 2030. For the purpose of this study, Grand View Research has segmented the U.S. bubble tea market on the basis of type and flavours:

-

Type Outlook (Revenue, USD Billion, 2018 - 2030)

-

Black Tea

-

Green Tea

-

Oolong Tea

-

White Tea

-

-

Flavour Outlook (Revenue, USD Billion, 2018 - 2030)

-

Fruit

-

Taro

-

Strawberry

-

Classic

-

Coffee

-

Other

-

Frequently Asked Questions About This Report

b. The U.S. bubble tea market size was estimated at USD 953.36 million in 2023 and is expected to reach USD 1,012.8 million in 2024.

b. The U.S. bubble tea market is expected to grow at a compounded growth rate of 9.5% from 2024 to 2030 to reach USD 1.74 billion by 2030.

b. Black tea-based bubble tea market in the United States accounted for a share of 43.15% in 2023. The black tea type of bubble tea is widely popular owing to its authentic and natural flavour. In addition, the drink is believed to be helpful in reducing blood sugar levels and bad cholesterol while improving health of gut. It is an extraordinary source of antioxidants as well.

b. Some key players operating in the market include Kung Fu Tea; Gong cha; TIGER SUGAR; Quickly Boba Tea; ShareTea; Boba Guys; Tapioca Express; Bubbles Tea & Juice Company; Happy Lemon; Chatime

b. Key factors that are driving the market growth include the unceasing demand for tea and coffee-based drinks nootropics in the working population of the country, the availability of various flavors invented according to changing consumer preferences and likings, overall low-calorie contents of the product and zero-fat versions of it offered by innovative manufacturers.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.