- Home

- »

- Clinical Diagnostics

- »

-

U.S. Cancer Biopsy Market Size, Industry Report, 2030GVR Report cover

![U.S. Cancer Biopsy Market Size, Share & Trends Report]()

U.S. Cancer Biopsy Market (2025 - 2030) Size, Share & Trends Analysis Report By Type (Fine-needle Aspiration, Core Biopsy, Surgical Biopsy, Skin Biopsy/Punch Biopsy, Others), By Cause (Application), By Site (Organ), And Segment Forecasts

- Report ID: GVR-4-68039-467-3

- Number of Report Pages: 80

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2025 - 2030

- Industry: Healthcare

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

U.S. Cancer Biopsy Market Size & Trends

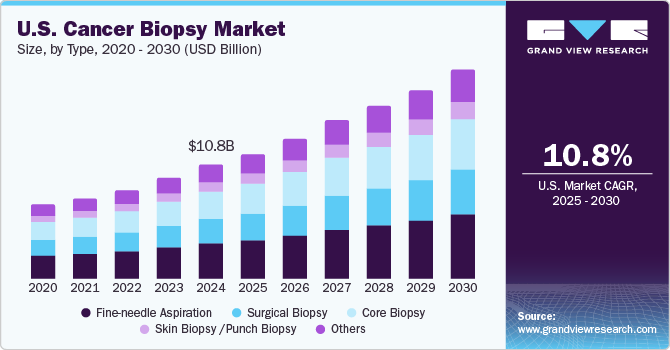

The U.S. cancer biopsy market size was estimated at USD 10.83 billion in 2024 and is forecasted to grow at a CAGR of 10.8% from 2025 to 2030. The increasing number of cancer cases in the U.S. is a significant factor driving the demand for cancer biopsies. As the population ages, more people are at risk of developing cancer, which contributes to the rising incidence of the disease. In addition, lifestyle factors such as smoking, poor diet, and lack of physical activity have also led to an increase in cancer rates. With more people being diagnosed with cancer, there is a greater need for diagnostic procedures such as biopsies to detect the disease at an early stage. Early detection through biopsies is crucial for effective treatment, driving the demand for these procedures.

Advancements in biopsy techniques have made cancer biopsies more accessible and less invasive. For example, a recent study published in Nature reported in September 2023 that a new spectroscopic liquid biopsy could detect 99% of stage I cancers with high specificity, demonstrating the potential of liquid biopsies to improve early detection rates across multiple cancer types. Methods such as liquid biopsies, Fine Needle Aspiration (FNA), and core needle biopsies reduce recovery time and the risk of complications. Imaging technologies such as ultrasound, CT scans, and MRI have improved the accuracy and precision of biopsies, allowing for earlier cancer detection. In addition, digital pathology and Artificial Intelligence (AI) are now being used to analyze biopsy samples, making diagnoses faster and more accurate. These advancements have significantly improved the effectiveness and appeal of cancer biopsy procedures in the U.S. cancer biopsy industry.

In addition, with growing public awareness about cancer and the importance of early detection, more people are seeking biopsy procedures. Health campaigns and increased focus on screening programs have encouraged individuals to detect cancer at earlier stages and take preventive measures. Screening tests, such as mammograms for breast cancer and colonoscopies for colorectal cancer, often lead to the need for biopsies to confirm diagnoses. These programs help identify cancer early, improving treatment outcomes and survival rates. Hence, the demand for biopsies has increased due to these awareness and detection efforts in the U.S. cancer biopsy industry.

Type Insights

The fine-needle aspiration segment dominated the market with the largest revenue share of 32.2% in 2024, driven by the increasing prevalence of cancer and a growing preference for minimally invasive procedures. Fine-needle aspiration is favored for its ability to provide rapid and accurate diagnostic results with minimal patient discomfort. The rise in awareness about cancer detection and the importance of early diagnosis has led to higher utilization of fine-needle aspiration techniques in clinical settings. Moreover, advancements in needle technology have improved the efficacy and safety of these procedures, further supporting their adoption among healthcare providers in the U.S. cancer biopsy industry.

The skin biopsy/punch biopsy segment is expected to experience significant growth during the forecast period due to the rising incidence of skin cancer. This increase has created a greater need for effective diagnostic tools, with punch biopsies emerging as a preferred option due to their accuracy and minimal invasiveness. Technological advancements in biopsy instruments have also played a crucial role, as new devices are designed to enhance diagnostic precision while simplifying the procedure for healthcare providers. In addition, expanding healthcare services and heightened public awareness regarding skin health contribute to the growing adoption of punch biopsies, reinforcing their importance in early cancer detection and management strategies.

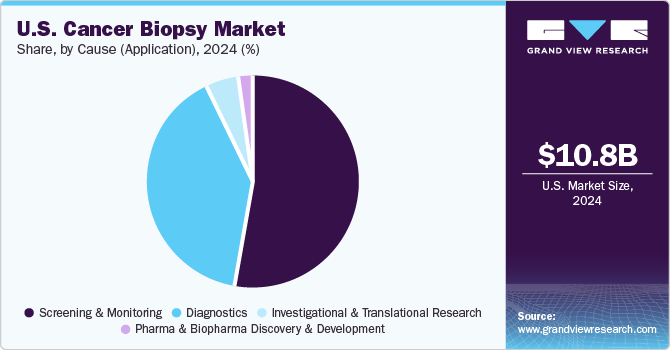

Cause (Application) Insights

The screening & monitoring segment dominated the market with the largest revenue share in 2024, attributable to the rising demand for regular health check-ups and early cancer detection. Increased awareness about cancer risks and the benefits of timely intervention have led to more patients seeking screening services. Furthermore, healthcare providers emphasize preventive care strategies, including routine biopsies, for monitoring potential malignancies. The integration of advanced imaging technologies has also enhanced the accuracy of these procedures, making them more appealing to patients and clinicians in the U.S. cancer biopsy industry.

The pharma & biopharma discovery & development segment is estimated to grow at the highest CAGR over the forecast period due to increasing investments in research and development. Pharmaceutical companies are increasingly focusing on developing targeted therapies that require precise molecular characterization through biopsy samples. This trend is driven by the growing emphasis on precision medicine, which requires detailed genetic profiling of tumors for treatment planning. As a result, there is an increased demand for innovative biopsy techniques that can provide comprehensive insights into tumor biology.

Site (Organ) Insights

The breast segment held a significant share of the market in 2024, driven by the rising incidence of breast cancer. As one of the most diagnosed cancers among women, breast cancer needs frequent diagnostic assessment, including biopsies, to determine the presence and stage of the disease. The increasing number of recommendations for needle biopsies, particularly image-guided techniques, has made these procedures safer and more accurate. In addition, advancements in diagnostic methods have improved the ability to characterize tumors effectively, which is essential for developing tailored treatment plans. This combination of factors has solidified the breast segment’s leading position within the U.S. cancer biopsy market.

The thyroid segment is projected to grow at the highest CAGR over the forecast period, which can be attributed to rising awareness of thyroid disorders and advancements in fine-needle aspiration techniques tailored explicitly for thyroid nodules. The effectiveness of fine-needle aspiration biopsies in diagnosing thyroid cancer has made them standard practice in evaluating suspicious nodules. In addition, ongoing research into thyroid cancer management and treatment options will likely drive the demand for these procedures as healthcare providers seek accurate diagnostic methods to guide patient care decisions.

Key U.S. Cancer Biopsy Company Insights

Some key companies operating in the market are Becton, Dickinson and Company (BD); IZI Medical Products; Johnson & Johnson Services, Inc.; Argon Medical Devices; and SPECTRA MEDICAL DEVICES, LLC. Companies are undertaking various strategic initiatives, such as mergers, acquisitions, and product launches, to expand their market presence and address the evolving healthcare demands in U.S. cancer biopsy market.

-

BD provides many products and solutions to improve cancer biopsy procedures and diagnosis. Its offerings include core biopsy systems such as the Marquee, Mission, Max-Core, and Magnum, which cater to different tissue types and biopsy techniques. The EleVation Breast Biopsy System facilitates efficient sampling through Single Insertion Multiple Sample (SIMS) technology, while the Trek Powered Bone Biopsy System allows for controlled access during bone marrow aspirations.

-

Johnson & Johnson Services, Inc. offers a range of innovative products and solutions for cancer biopsy. Its key offerings include the CellSearch Liquid Biopsy System, which detects Circulating Tumor Cells (CTCs) in blood samples to aid in early cancer diagnosis and monitoring. The company also provides advanced surgical instruments designed for precise tissue sampling and minimally invasive procedures across various cancer types, such as breast, lung, and gastrointestinal cancers.

Key U.S. Cancer Biopsy Companies:

The following are the leading companies in the U.S. cancer biopsy market. These companies collectively hold the largest market share and dictate industry trends.- BD

- IZI Medical Products

- Johnson & Johnson Services, Inc.

- Argon Medical Devices

- SPECTRA MEDICAL DEVICES, LLC

- Medtronic

- Boston Scientific Corporation

- CONMED Corporation

- INRAD, Inc.

- Thermo Fisher Scientific Inc.

Recent Developments

-

In May 2024, BD announced its partnership with Healthians, a leading health technology company, to enhance cancer screening and diagnostics in India. This collaboration aimed to leverage BD's innovative biopsy technologies alongside Healthians' extensive network for improved access to diagnostic services. By integrating their resources, the companies sought to streamline the cancer detection process and provide patients with timely and accurate results. The partnership reflected BD's commitment to advancing healthcare solutions and addressing the growing need for effective cancer diagnostics in the region.

-

In March 2021, Izi Medical Products launched a fully automatic Quick Core Auto Biopsy System. This innovative system is designed to enhance the efficiency and accuracy of tissue sampling procedures. By automating the biopsy process, the company aims to improve patient outcomes and streamline workflows for healthcare providers.

U.S. Cancer Biopsy Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 12.08 billion

Revenue forecast in 2030

USD 20.18 billion

Growth rate

CAGR of 10.8% from 2025 to 2030

Base year for estimation

2024

Historical data

2018 - 2023

Forecast period

2025 - 2030

Quantitative units

Revenue in USD billion and CAGR from 2025 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, trends

Segments covered

Type, cause (application), site (organ)

Key companies profiled

BD.; IZI Medical Products; Johnson & Johnson Services, Inc.; Argon Medical Devices; SPECTRA MEDICAL DEVICES, LLC; Medtronic; Boston Scientific Corporation; CONMED Corporation; INRAD, Inc.; Thermo Fisher Scientific Inc.

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

U.S. Cancer Biopsy Market Report Segmentation

This report forecasts country revenue growth and analyzes the latest industry trends in each sub-segment from 2018 to 2030. For this study, Grand View Research has segmented the U.S. cancer biopsy market report based on type, cause (application), site (organ):

-

Type Outlook (Revenue, USD Billion, 2018 - 2030)

-

Fine-needle Aspiration

-

Pharma-use

-

Clinical

-

-

Core Biopsy

-

Pharma-use

-

Clinical

-

-

Surgical Biopsy

-

Pharma-use

-

Clinical

-

-

Skin Biopsy /Punch Biopsy

-

Pharma-use

-

Clinical

-

-

Others

-

Pharma-use

-

Clinical

-

-

-

Cause (Application) Outlook (Revenue, USD Billion, 2018 - 2030)

-

Screening & Monitoring

-

Diagnostics

-

Investigational & Translational Research

-

Pharma & Biopharma Discovery & Development

-

-

Site (Organ) Outlook (Revenue, USD Billion, 2018 - 2030)

-

Liver

-

Breast

-

Thyroid

-

Prostate Gland

-

Uterus & Cervix

-

Kidney

-

Bladder

-

Lungs

-

Pancreas

-

Others

-

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.