- Home

- »

- Homecare & Decor

- »

-

U.S. Car Wash Services Market Size, Industry Report, 2033GVR Report cover

![U.S. Car Wash Services Market Size, Share & Trends Report]()

U.S. Car Wash Services Market (2026 - 2033) Size, Share & Trends Analysis Report By Mode Of Washing (Tunnels, Roll-over/In-bay, Self-service), By Mode Of Payment (Cash Payment, Cashless Payment), And Segment Forecasts

- Report ID: GVR-4-68039-355-9

- Number of Report Pages: 110

- Format: PDF

- Historical Range: 2021 - 2025

- Forecast Period: 2026 - 2033

- Industry: Consumer Goods

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

U.S. Car Wash Services Market Summary

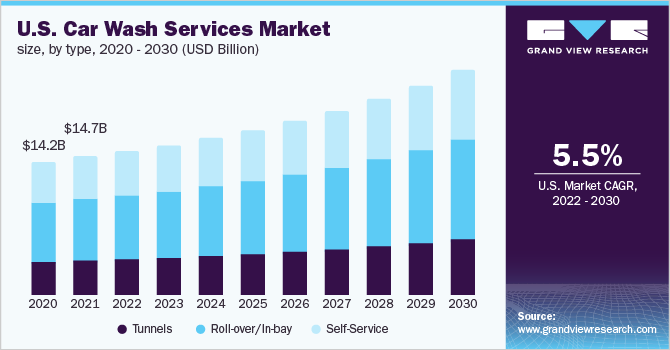

The U.S. car wash services market size was estimated at USD 15.28 billion in 2025 and is expected to reach USD 17.01 billion by 2033, growing at a CAGR of 1.1% from 2026 to 2033. The growing consumer focus on vehicle maintenance, as well as damage caused to the car body due to bird droppings, dirt, acid raindrops, particulate matter, and salt deposits during the winter months, has increased the demand for car wash services in the U.S.

Key Market Trends & Insights

- By mode of washing, roll-over/in-bay car wash services led the market, accounting for a share of 43.10% in 2025.

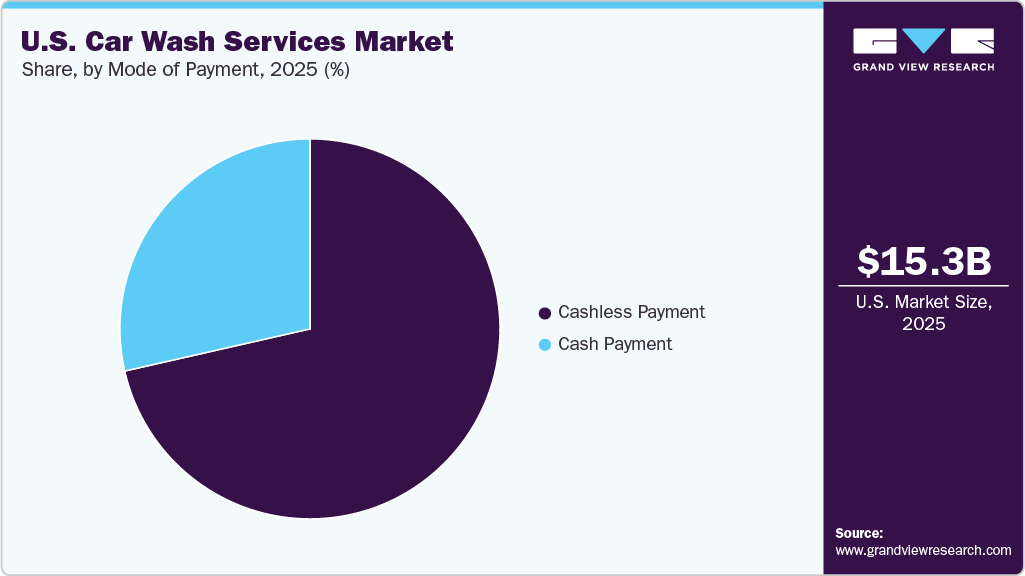

- By mode of payment, the cashless payment segment led the U.S. car wash services industry, accounting for a share of 71.44% in 2025.

Market Size & Forecast

- 2025 Market Size: USD 15.28 Billion

- 2033 Projected Market Size: USD 17.01 Billion

- CAGR (2026-2033): 1.1%

The rising number of vehicles in the U.S. highlights the expanding opportunities for the car wash services market. With over 283 million registered vehicles, a 2.5% increase over three years, vehicle dependency is steadily climbing. According to a 2025 blog by MoneyGeek, U.S. households averaged 1.8 cars, with metro areas like Provo-Orem, Utah, showing higher reliance on personal vehicles. As car ownership grows, the need for maintenance services such as car washes becomes increasingly crucial, driving demand for convenient, efficient cleaning solutions.

Car ownership rates vary significantly between urban and rural regions, further shaping car wash service needs. While urban areas like New York see lower ownership rates due to better public transit, rural regions like Daphne-Fairhope-Foley in Alabama have some of the highest car ownership rates. These disparities highlight opportunities for tailored car wash services. Areas with higher vehicle dependency often require accessible and reliable car care services, creating steady demand in the U.S. car wash services industry.

Electric vehicle ownership is surging, with nearly 3.3 million EVs registered nationwide. This shift signifies a new subset of car owners concerned with eco-friendly and specialized cleaning methods for EVs. Car wash services can capitalize on this trend by offering EV-specific cleaning options that cater to this growing demographic. The rise in EVs underscores an evolving market, pushing car wash services to innovate and align with modern consumer needs, further driving the growth of the U.S. car wash services market.

The growing emphasis on vehicle care among Americans, as highlighted by a 2024 blog by NBC Right Now, signals promising prospects for the U.S. car wash services industry. With 73% of respondents aiming to better maintain their vehicles amid economic concerns, professional car care services, including car washes, are becoming a priority. The survey also revealed that 80% of vehicle owners rely on others for maintenance, with half hiring professionals. This trend underscores strong demand for convenient, expert services, positioning car washes as an essential part of routine vehicle upkeep.

The increasing awareness of vehicle maintenance among U.S. car owners is driving a significant shift toward professional car wash services. While 96% of owners washed their vehicles at least once, according to The Consumer Pulse, preference for car washes has surged, with 79% choosing professional services over home washing, a 60% decline in home washing since 1996. This trend underscores growing consumer recognition of the convenience and quality offered by professional car wash providers.

Consumer demand for value-added car wash services further highlights the industry’s growth potential. According to recent studies, 62% of consumers value such offerings, with branded services such as rain-repellent headlights standing out. Additionally, the willingness to pay a premium for trusted car wash brands has risen by 43%, emphasizing the importance of professional expertise and brand reputation in vehicle maintenance. This awareness drives sustained growth for the U.S. car wash market.

U.S. Car Wash Services Market Trends

Digital platforms are central to the success of these subscription services. Advanced algorithms and customer insights enable precise site placement and marketing efforts, ensuring maximum efficiency in attracting and retaining customers. Automated tools allow for seamless membership management, personalized marketing campaigns, and the creation of a tailored customer experience. These platforms also support AI-powered systems such as license plate recognition, further enhancing the ease and convenience of services for subscribers.

Subscription-based revenue models offer scalability and high margins, with some locations reporting earnings before interest, taxes, depreciation, and amortization (EBITDA) margins of up to 50%. Operators leveraging digital solutions to expand their subscription offerings are poised to capture a larger market share, particularly as membership growth is projected to increase the total number of U.S. car washes from 2 billion to 3 billion annually.

This potential for exponential growth underscores the critical role of digital and subscription-based innovations in shaping the industry's future. Moreover, the combination of digital platforms and subscriptions aligns with evolving consumer preferences for convenience and customization. By offering members unlimited washes and personalized perks, operators can foster long-term customer relationships, ensuring consistent engagement in a competitive market. This strategy positions the U.S. car wash services industry as a model for how traditional services can adapt to modern consumer trends.

Technological innovations in the U.S. car wash services industry have opened up significant growth opportunities by revolutionizing processes, customer interactions, and operational efficiencies. Advancements like AI-powered license plate recognition (LPR) systems are transforming customer service by enabling seamless identification and personalized experiences. These systems allow operators to recognize all visitors, including non-members, and tailor services based on customer segmentation. This not only enhances customer satisfaction but also boosts throughput by streamlining interactions at the point of sale with modern, intuitive interfaces.

Automation is becoming a necessity as operators face rising labor costs and increasing customer demand for faster, more consistent service. Tools such as vehicle-scanning sensors and automated chemical-mixing systems optimize the wash process with precision. Vehicle scanning sensors use advanced technologies such as infrared and lasers to assess each vehicle's specific needs, ensuring the optimal application of water, chemicals, and drying techniques. Automated chemical mixing systems further enhance efficiency by delivering precise cleaning agent concentrations, reducing waste and operational costs while maintaining superior wash quality.

Consumer Insights

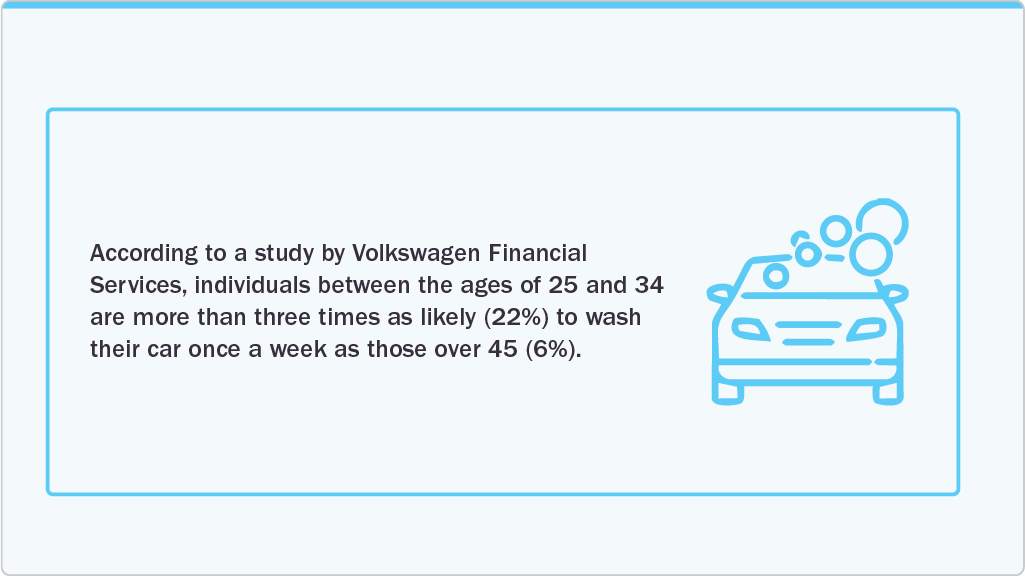

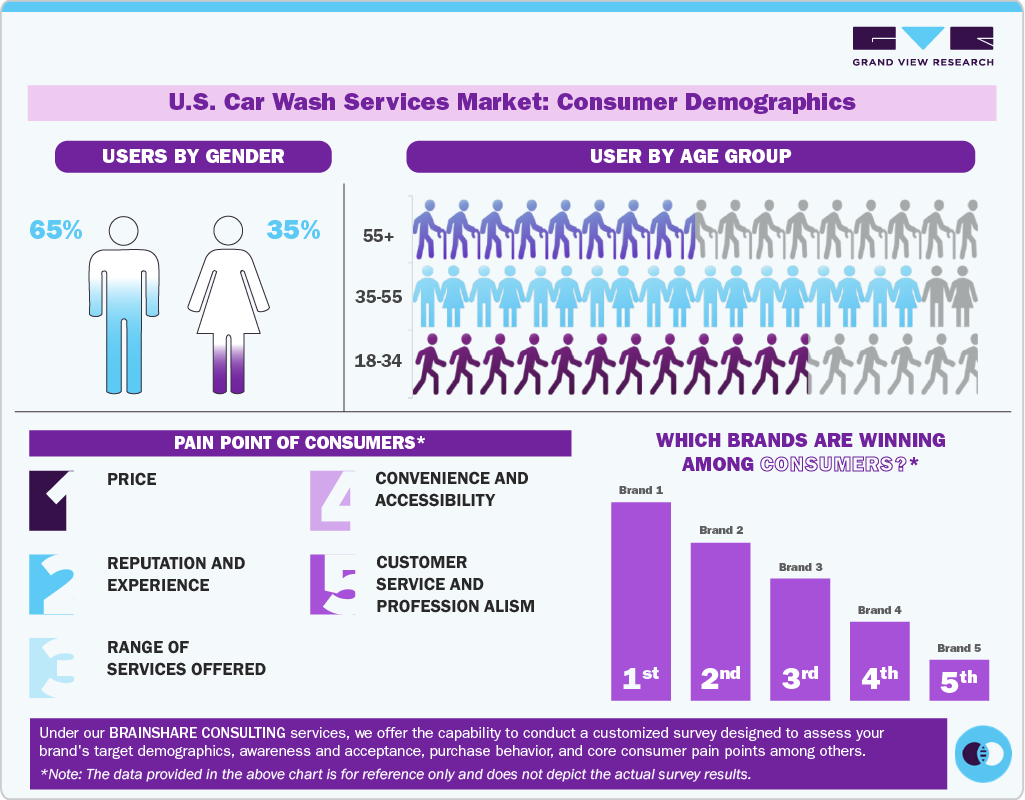

Generational differences in car care habits significantly influence the U.S. car wash services industry. Millennials present a significant growth opportunity for subscription-based car wash services, with data indicating they are three times more likely than Baby Boomers to be active subscription members. Additionally, non-member Millennials are over twice as likely to consider joining in the future. At the same time, lapsed members from this demographic are 50% more likely to re-subscribe compared to their Boomer counterparts. Combined with their lower price sensitivity, Millennials represent a highly valuable and receptive market segment, offering substantial potential for sustained revenue growth in the subscription U.S. car wash services industry.

Table 1 How well do you think you take care of your car?

Gen Z

Millennials

Gen X

Baby Boomers

I care for my car and maintain it to the best of my abilities

50.6%

56.1%

54.9%

59.3%

I am mostly very responsible for car care and maintenance

39.5%

36.7%

32.4%

32.6%

I do not care for my car as well as I should

7.1%

5.6%

9.0%

1.7%

I do not care for or maintain my car with any regularity

2.9%

1.6%

3.7%

6.4%

Consumers in the U.S. are increasingly drawn to eco-friendly car wash services, prioritizing businesses that align with their environmental values. With growing awareness of sustainability, many prefer options that conserve water, use biodegradable products, and reduce chemical runoff, minimizing environmental harm. Waterless car washing solutions offer convenience, especially in urban settings, while sustainable practices resonate with eco-conscious customers.

In January 2025, Autobell Car Wash unveiled a redesigned website, enhancing the customer experience with seamless technology integration. The update unifies the Autobell app, website, and advanced point-of-sale (POS) system, offering a consistent experience across all platforms. Features include single sign-on for effortless account access and real-time syncing of purchases between the app and website. The advanced POS system personalizes service by displaying customer details upon arrival, enabling a warm, efficient greeting and instant receipt delivery.

Mode of Washing Insights

Roll-over/in-bay car wash services market accounted for a revenue share of over 43.10% in 2025. Roll-overs/in-bay are among the most widespread types of express car washes. Roll-over or in-bay structures keep the vehicles stationary during the wash process while the machinery or washer moves around the vehicle, unlike in the tunnel car wash system. Wash styles offered by in-bay automatic systems are touch-free, where high-pressure water is used to clean the vehicle and offer friction, and soft-cloth brushes are used to clean and spread the detergent and polish on the vehicle before they are rinsed off. These in-bay/roll-over automatic car wash services offer various benefits, such as simpler customer interaction and impulse-driven purchases, and are ideal for smaller spaces.

The self-service car wash market segment is projected to grow at a CAGR of 1.1% from 2026 to 2033. The increasing preference for self-service car washing systems across the globe is a trend driven by several factors, including convenience, cost-effectiveness, and environmental concerns. Self-service car washes allow customers to wash their vehicles at their own pace, using automated equipment and high-pressure washing systems. This model eliminates the need for extensive labor costs, making it a more affordable alternative to traditional hand-washing services. As a result, many car owners are opting for self-service options due to their ability to control the washing process, the flexibility to wash at any time, and the savings over paying for a professional wash.

Mode of Payment Insights

Cashless payments accounted for over 71.44% of the revenue share in 2025.Given the widespread adoption of online payments among consumers, car wash service owners have increasingly begun installing integrated payment solutions across pay stations. In addition to boosting sales, these payment systems also provide detailed insights into their clientele. Millennial consumers especially expect the availability of convenient methods, including tokens, debit cards, loyalty cards, EMV-enabled credit card payments, or mobile payment options.

Cash payments offer immediacy and simplicity. Many car wash services, especially those operating independently or in smaller towns, may not have access to digital payment infrastructure. For them, cash is straightforward-no need for card machines, internet connectivity, or digital platforms. Customers, especially older individuals or those not comfortable with digital transactions, also find cash more convenient. They can see and control how much they’re spending, which adds a level of transparency and security.

Key U.S. Car Wash Services Company Insights

The presence of significant domestic service providers characterizes the U.S. car wash services market. Large players are acquiring local establishments to reach a wider audience across the country. To expand the consumer base, U.S. car wash market players have recognized the importance and dominance of regional players.

Players operating in this U.S. car wash services industry are focusing on service differentiation owing to the growing competition and the varying needs of clients, fueling the U.S. car wash market growth in the western part of the U.S. Subscription-based car wash facilities are an exciting new opportunity for new players to enter the U.S. car wash market. For instance, California Hand Wash, a car wash facility based in California, offers customers monthly membership subscription-based plans. The full-service wash options offered by the company are California Dream Plus+, California Dream, California Gold, California Exterior, and other unlimited monthly membership packages.

Key U.S. Car Wash Services Companies:

- Driven Brands, Inc.

- Tommy’s Express

- Splash Car Wash

- Zips Carwash

- Autobell Car Wash, Inc.

- Quick Quack Car Wash

- True Blue Car Wash

- Magic Hands Car Wash

- Wash Depot

- SSCW Enterprises (Super Star Car Wash)

Recent Developments

-

In June 2025, Tommy’s Express Car Wash launched its first location in Norfolk, Virginia, at 450 N. Military Hwy. The grand opening, held from June 19-21, featured free washes, raffles, food trucks, and music. The event marked the brand’s expansion in the region and strong community engagement.

-

In April 2025, Splash Car Wash announced a strategic majority investment from AEA Investors’ Small Business Private Equity strategy, which acquired the stake from Palladin Consumer Retail Partners. This partnership is expected to accelerate Splash’s expansion plans while preserving its commitment to quality customer service. The involved parties did not disclose the financial terms of the transaction.

-

In February 2025, Super Star Car Wash opened its 20th location in Texas, specifically in Mesquite, bringing its total number of sites across the country to 109. To celebrate, the company is offering free car washes for a limited time and a promotional deal on its unlimited wash membership. This new facility offers a range of express car wash services, including advanced treatments like Graphene and Ceramic Sealants, Carnauba Hot Wax, and high-gloss Tire Shine.

-

In February 2025, Driven Brands Holdings, Inc. announced to enter into a definitive agreement to sell its U.S. car wash business to Express Wash Operations, LLC dba Whistle Express Car Wash for USD 385 million.

U.S. Car Wash Services Market Report Scope

Report Attribute

Details

Market size value in 2026

USD 15.75 billion

Revenue forecast in 2033

USD 17.01 billion

Growth rate

CAGR of 1.1% from 2026 to 2033

Actuals

2021 - 2025

Forecast period

2026 - 2033

Quantitative units

Volume in million transactions, revenue in USD billion, and CAGR from 2026 to 2033

Report coverage

Revenue forecast, volume forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Mode of washing and mode of payment

Country scope

U.S.

Key companies profiled

Driven Brands, Inc.; Tommy’s Express; Splash Car Wash; Zips Carwash; Autobell Car Wash, Inc.; Quick Quack Car Wash; True Blue Car Wash; Magic Hands Car Wash; Wash Depot; SSCW Enterprises (Super Star Car Wash)

Customization

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional and segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

U.S. Car Wash Services Market Report Segmentation

This report forecasts revenue and volume growth at the country level and provides an analysis of the latest industry trends and opportunities in each of the sub-segments from 2021 to 2033. For this study, Grand View Research has segmented the U.S. car wash services market report based on mode of washing and mode of payment:

-

Mode of Washing Outlook (Volume, Million Transactions; Revenue, USD Billion, 2021 - 2033)

-

Tunnels

-

Roll-over/In-Bay

-

Self-Service

-

-

Mode of Payment Outlook (Volume, Million Transactions; Revenue, USD Billion, 2021 - 2033)

-

Cash Payment

-

Cashless Payment

-

Frequently Asked Questions About This Report

b. The U.S. car wash services market was valued at USD 15.28 billion in 2025 and is expected to reach USD 15.75 billion by 2026.

b. The U.S. car wash services market is expected to reach USD 17.01 billion by 2033 and is expected to grow at a compound annual growth rate (CAGR) of 1.1% from 2026 to 2033.

b. Roll-over/in-bay car wash services accounted for a revenue share of over 43.10% in 2025, driven by Roll-overs/in-bay are one of the most widespread express car wash types.

b. Some key players operating in the U.S. car wash services market include Driven Brands, Inc., Tummy’s Express, Splash Car Wash, Zips Carwash, Autobell Car Wash, Inc., Quick Quack Car Wash, True Blue Car Wash, Magic Hands Car Wash, Wash Depot, Mister Car Wash, SSCW Enterprises (Super Star Car Wash)

b. The demand for car wash services in the U.S. has been rising over the past decade due to their increased convenience and a greater array of budget and luxury options. The increasing environmental regulations prohibiting residential car washing practices are anticipated to expand the customer base for professional car washes, thereby driving the demand for the services.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.