- Home

- »

- Medical Devices

- »

-

U.S. Care Services Market Size & Analysis Report, 2030GVR Report cover

![U.S. Care Services Market Size, Share & Trends Report]()

U.S. Care Services Market (2022 - 2030) Size, Share & Trends Analysis Report By Service (Skilled Nursing Facility, Post-Acute Care, Assisted Living Facility, Hospice And Palliative Care, Remote Patient Monitoring), And Segment Forecasts

- Report ID: GVR-4-68038-203-7

- Number of Report Pages: 74

- Format: PDF

- Historical Range: 2017 - 2020

- Forecast Period: 2022 - 2030

- Industry: Healthcare

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Report Overview

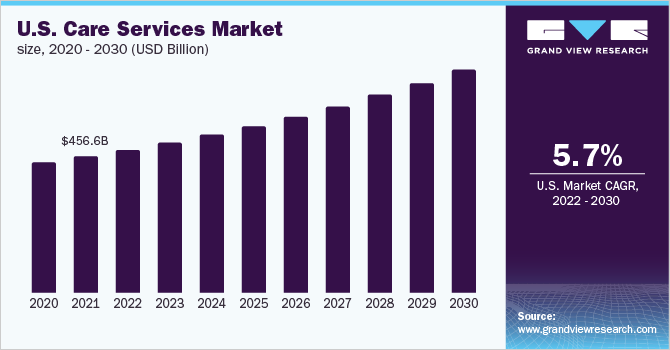

The U.S. care services market size was valued at USD 456.6 billion in 2021 and is expected to exhibit a CAGR of 5.76% during the forecast period. The growing prevalence of chronic diseases, government initiatives, the increasing requirement for nursing homes among the younger population, and the rising elder population are some of the key factors driving the U.S. care services market growth over the years. Moreover, rapid advancement and use of technology-based care services such as app-based teleconsultation, remote patient monitoring, and AI-based therapeutic & monitoring devices are further driving the service demand.

According to the Department of Health & Human Services, 14% of the residents at nursing homes are between the ages of 31 and 64. Around 40% of the adolescents in the U.S. suffer from a chronic disease and are expected to require care services at a younger age. The younger population in the U.S. with disabilities is constantly rising. According to CDC, one in seven young adults suffers from a chronic disorder.

Unnecessary hospitalization often results in higher expenditure and degrades the quality of life. Thus, increasing preference for care settings such as home care, nursing homes, hospice, and assisted living facilities among baby boomers in the U.S. is driving the industry size.

The increasing geriatric population, rising prevalence of chronic conditions, cost-effective treatment, and rising need for wireless and portable systems are some of the major factors driving the remote patient monitoring market growth. The growing incidence of chronic diseases demands disease management and continuous patient monitoring tools are boosting the need for connected care devices. These devices are connected to electronic patient health records and provide access to the required health information during the course of treatment.

Government programs, such as Medicare and Medicaid, along with private health insurance companies and managed care organizations have a significant impact on the care services industry.

COVID-19 U.S. Care Services Market Impact: 1% growth from 2019 to 2020

Pandemic Impact

Post COVID Outlook

The initial phases of the pandemic witnessed complete restrictions on operations for care services leading to a huge financial crisis for care services providers.

Vaccination, lockdown upliftment, and relaxations in restrictions are expected to allow care services in the U.S. to resume the services at the facilities at full scale.

The COVID-19 pandemic has positively impacted home healthcare services & the growth of technology in care services. Service providers are investing in the latest technology for providing top-quality services. Telehealth services at home & house calls have been the main option for residents, with inpatient hospital facilities being busy with handling COVID-19 cases.

The telehealth services & other technologies adopted during the pandemic for care services are expected to have great significance post-COVID due to the convenience & wide array of options available with the help of technology. The government is also taking initiatives for supporting the use of the services resulting in growth.

The federal and state governments in the U.S. are undertaking initiatives for enhancing the reach & quality of care services across the country. The federal government-initiated training & development programs for the workforce at care facilities, ensuring that the best services were provided at the facilities during the pandemic and in the future as well.State governments are also actively undertaking initiatives for care services. For Instance, Washington State Legislature established a public insurance program, providing coverage for SNF, assisted living, hospice, and other care services, which would be applicable from 2025.

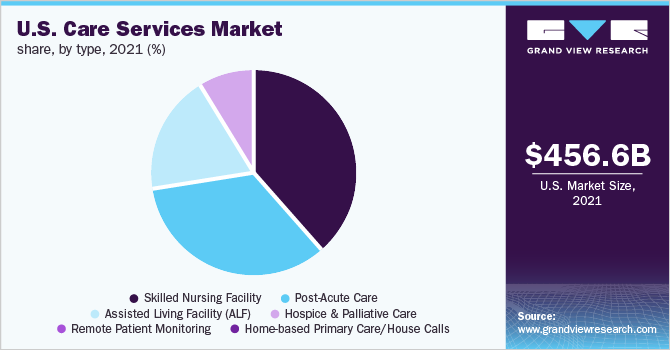

Type Insights

Based on type, the U.S. care services market is categorized into skilled nursing, facility, post-acute care, assisted living facility, hospice, and palliative care, remote patient monitoring, home-based primary care/house calls. In 2021, skilled nursing facilities accounted for the largest share of the market due to the increasing demand for nursing care services owing to the high prevalence of chronic diseases among the U.S. population.

The increasing number of patients of all ages suffering from chronic diseases in the U.S. is a major factor driving the growth of skilled nursing facilities. According to CDC, more than 50% of the adults in the U.S. had a chronic condition. Moreover, initiatives being undertaken by the federal government are contributing to the growth of the industry. For instance, the skilled nursing facility value-based purchasing program by the government is seeking to offer incentives to providers based on patient outcomes, encouraging providers to deliver quality services to patients.

Remote patient monitoring is expected to be the fastest-growing segment during the forecast period. This is attributed to the growing incidence of chronic diseases that demands disease management & continuous patient monitoring tools, thereby boosting the need for connected care devices.

Remote patient monitoring systems enable timely intervention, which reduces hospital admission expenses, frequency of re-hospitalizations, and traveling cost of patients & related expenses. The COVID-19 pandemic further propelled the advancement & adoption of remote patient monitoring due to the increase in demand for home healthcare during the pandemic.

Key Companies & Market Share Insights

The U.S. care services market is highly competitive. The top players are adopting various strategies, such as market expansion, mergers & acquisitions, and partnerships to strengthen their presence in the market. For Instance, in November 2021, LHC Group acquired home health, hospice, & therapy assets from HCA healthcare. In August 2021, Humana acquired Kindred at Home, which includes services such as personal care, hospice, and home health.

Some of the prominent players in the U.S. care services market include:

-

Kindred Healthcare, LLC

-

Amedisys, Inc

-

Sunrise Senior Living, LLC

-

National Healthcare Corporation

-

Brookdale Senior Living, Inc

-

Capital Senior Living Corporation

-

Home Instead, Inc

-

Genesis Healthcare, Inc

-

Diversicare Healthcare Services, Inc

-

LHC Group, Inc

U.S. Care Services Market Report Scope

Report Attribute

Details

Market size value in 2022

USD 478.1 billion

Revenue forecast in 2030

USD 748.5 billion

Growth rate

CAGR of 5.76 % from 2022 to 2030

Base year for estimation

2021

Historical data

2017 - 2020

Forecast period

2022 - 2030

Quantitative units

Revenue in USD billion and CAGR from 2022 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Type

Country scope

U.S.

Key companies profiled

Kindred Healthcare, LLC; Amedisys, Inc ; Sunrise Senior Living, LLC; National Healthcare Corporation; Brookdale Senior Living, Inc; Capital Senior Living Corporation; Home Instead; Inc Genesis Healthcare, Inc; Diversicare Healthcare Services, Inc; LHC Group, Inc.

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Segments Covered in the Report

This report forecasts revenue growth at country level and provides an analysis on the latest industry trends and opportunities in each of the sub-segments from 2017 to 2030. For this study, Grand View Research has segmented the U.S. care services market report based on type:

-

Type Outlook (Revenue, USD Billion, 2017 - 2030)

-

Skilled Nursing Facility

-

Assisted Living Facility

-

Hospice and Palliative Care

-

Post-Acute Care

-

Remote Patient Monitoring

-

Home-based Primary Care/House Calls

-

Frequently Asked Questions About This Report

b. The U.S. care services market size was estimated at USD 456.6 billion in 2021 and is expected to reach USD 478.1 billion in 2022.

b. The U.S. care services market is expected to grow at a compound annual growth rate of 5.76% from 2022 to 2030 to reach USD 748.5 billion by 2030.

b. Skilled nursing facilities dominated the U.S. care services market with a share of 39% in 2021. This is attributable to the availability of high-quality care services at a much lower cost as compared to hospitals, generating tremendous demand among investors.

b. Some key players operating in the U.S. care services market include Kindred Healthcare, LLC.; National HealthCare Corporation (NHC); Amedisys, Inc.; Brookdale Senior Living Inc.; Capital Senior Living; Home Instead, Inc.; Diversicare, Genesis Healthcare, Inc.; LHC Group, Inc.; Sunrise Senior Living; and Senior Care Center (Active Day Health Centers).

b. Key factors that are driving the U.S. care services market growth include the growing incidence of chronic diseases, the presence of a large aging population base, and increasing preference for care settings such as home care, nursing homes, hospice, and assisted living facilities.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.